Has a recent car accident left you wondering if your vehicle will be repaired or declared a total loss? Insurance companies make this decision by calculating whether the cost of repairs is greater than your car’s value right before the crash. Understanding this process is the first step toward ensuring you receive a fair insurance total loss payout.

Is Your Car a Total Loss or Repairable?

When an insurance adjuster inspects your damaged car, they are making a purely financial decision. The outcome depends on a few key terms, and knowing them is the best way to protect your interests and understand the car value after an accident.

Think of it like a balancing act. On one side, you have the estimated cost to fix your car. On the other, you have its value right before the accident. If the repair costs get too high, the scale tips, and the insurance company will declare it a total loss.

The Core Components of the Calculation

Every total loss evaluation boils down to three key numbers. Insurers use these figures to determine what makes the most financial sense for their business. Here’s a quick breakdown of the terms you’ll hear and what they mean for your claim.

Key Terms in a Total Loss Calculation

Understanding the core components an insurer uses to determine if your vehicle is a total loss.

| Term | Simple Definition | Why It Matters |

|---|---|---|

| Actual Cash Value (ACV) | What your car was worth moments before the accident. | This is the starting point for your settlement. A low ACV from the insurer means you get a smaller payout. |

| Cost of Repairs | The estimated total for parts and labor to fix the car. | If this number gets too high relative to the ACV, it can trigger a total loss declaration. |

| Salvage Value | The amount the insurer can get by selling your wrecked car. | This is factored into the insurer’s decision, as it helps them recover some of their costs. |

| Total Loss Threshold (TLT) | A percentage set by state law (e.g., 75%). | If repair costs exceed this percentage of the ACV, the insurer must legally declare it a total loss. |

Let’s dig deeper. The Actual Cash Value (ACV) isn’t what you paid for the car; it’s the fair market value considering its age, mileage, condition, and options. Insurers often use third-party vendors to generate this number, and their initial figure is frequently too low.

The Cost of Repairs is the estimate from a body shop to return the car to its pre-accident state. The Salvage Value is what they can sell the wrecked vehicle for at auction.

A critical factor is the Total Loss Threshold (TLT). This is a percentage set by your state’s law. If repair costs pass a certain percentage of the car’s ACV (like 75%), the insurer is legally required to declare it a total loss.

You can find the rules for your area on our state-specific law pages. Understanding these terms is crucial when you’re calculating total loss vehicle value.

How Insurers Calculate if a Vehicle is a Total Loss

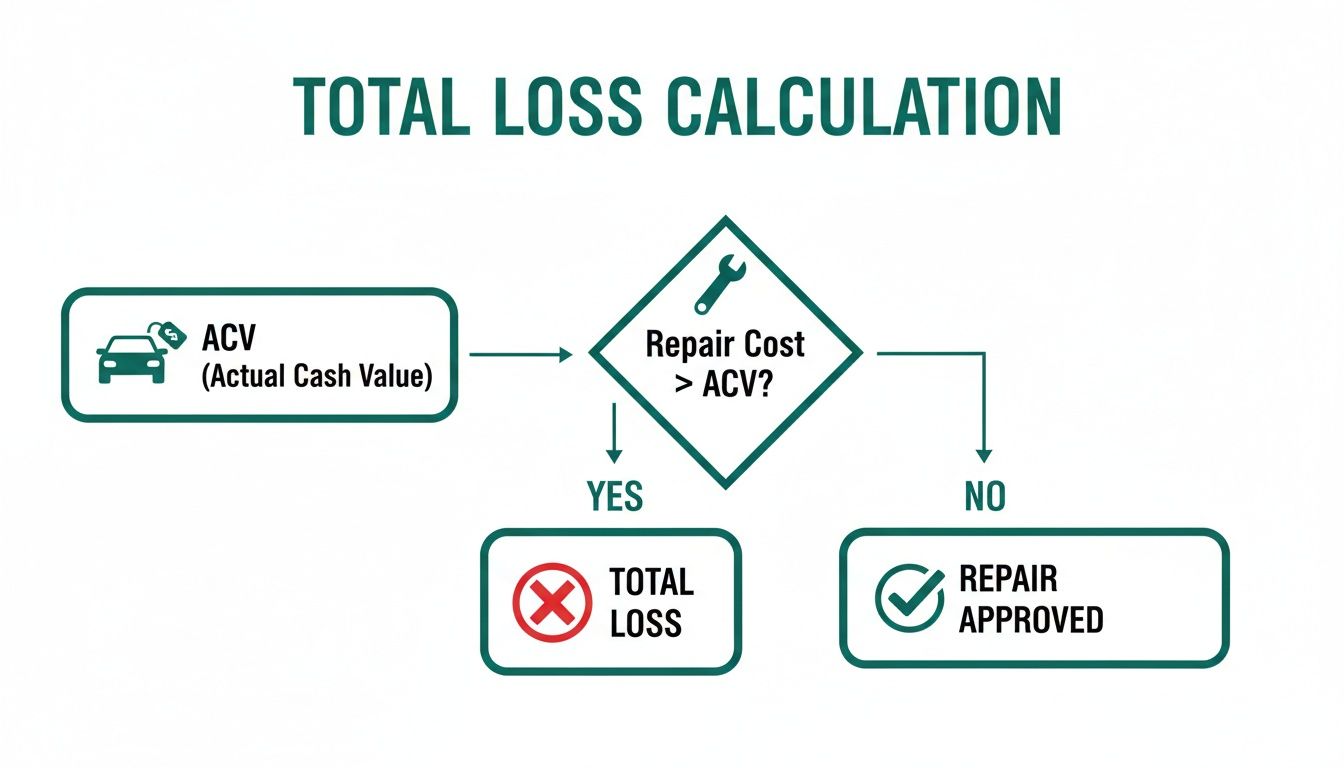

Insurance adjusters follow a strict, numbers-driven process to determine if your vehicle is a total loss. It all comes down to a purely financial decision based on the Total Loss Formula (TLF).

The formula is: (Cost of Repairs + Salvage Value) ≥ Actual Cash Value

If the cost to fix your car plus what the insurer can get for the wreck at auction is greater than or equal to its pre-accident value, it’s cheaper for them to write you a check.

A Real-World Example

Let’s see this in action. Imagine your sedan had a pre-accident Actual Cash Value (ACV) of $15,000. After a collision, the body shop estimates repairs at $12,000. The insurer determines its salvage value is $4,000.

Here’s the math:

- Cost of Repairs: $12,000

- Salvage Value: $4,000

- Total: $16,000

Since $16,000 is higher than the car’s $15,000 ACV, the insurance company will declare it a total loss.

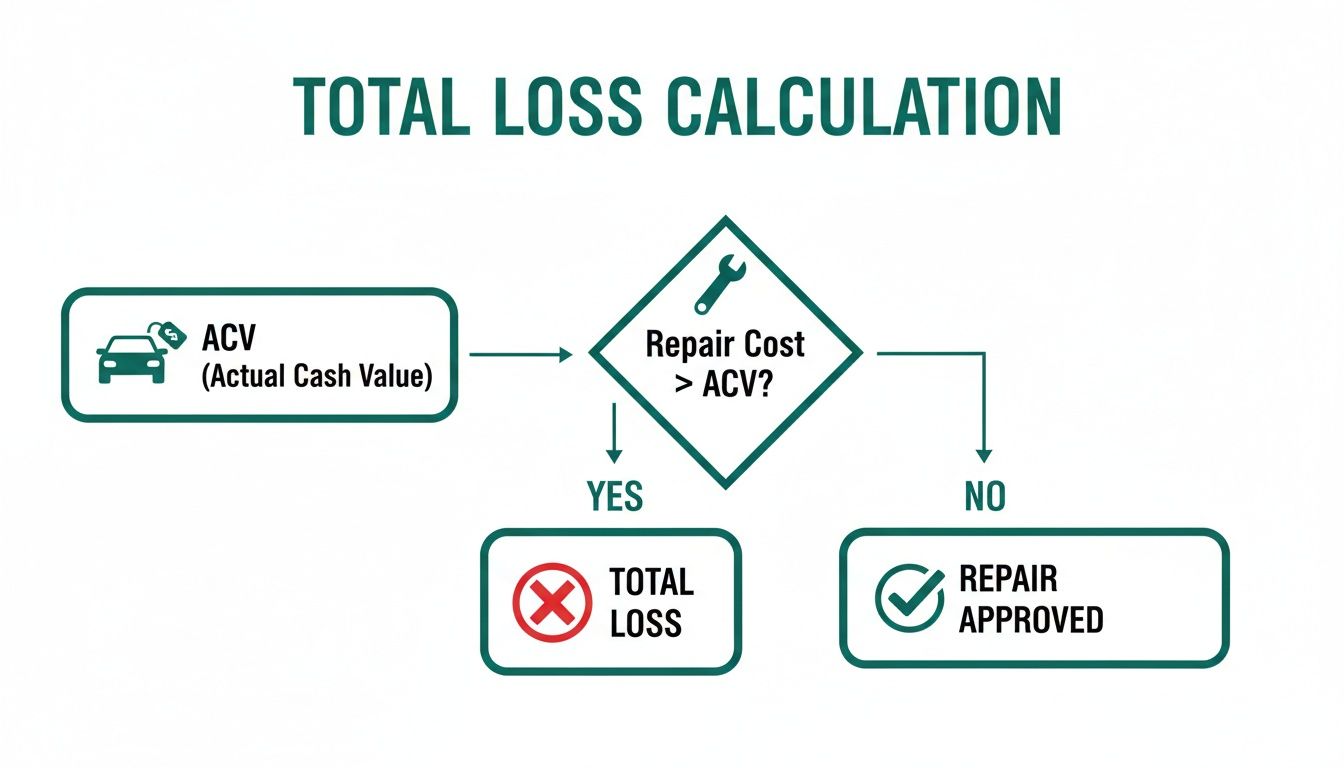

This flowchart lays out the basic decision tree an adjuster follows.

As you can see, the process hinges on one key comparison: the repair estimate versus your car’s pre-accident worth.

The State Law Override

While the TLF is a common industry standard, state laws often have the final say. Many states enforce a mandatory Total Loss Threshold (TLT), which is a specific percentage of the car’s ACV.

For example, if your state has a 75% TLT, any vehicle with repair costs exceeding 75% of its ACV must be totaled. Using our example above, 75% of $15,000 is $11,250. Since the $12,000 repair cost is over that threshold, the car would be totaled by law, regardless of its salvage value.

Finding Your Car’s True Value

The most important—and most disputed—number in this equation is the Actual Cash Value. Your insurer will use valuation reports to arrive at this figure, but you should not take their first offer at face value.

Do your own homework. Reputable sources like Kelley Blue Book (KBB) are a great place to start building your case for a higher value.

Using tools like KBB helps you ground the conversation in real market data. If you want to dig deeper, you can learn how to accurately determine your vehicle’s Actual Cash Value in our detailed guide. An informed owner is always in a better position to get a fair insurance payout.

Why Insurance Company Valuations Are Often Too Low

When you get a settlement offer for your totaled car, it often feels like a take-it-or-leave-it number. But that first offer is almost always just a starting point, and it’s frequently lower than what your vehicle was actually worth.

Most insurers don’t do their own market research. They outsource the job to large third-party vendors like CCC Intelligent Solutions, who generate valuation reports for them. These reports look official but can be seriously misleading.

How Valuation Reports Get It Wrong

The biggest problem is often the “comparable” vehicles used to set your car’s price. These reports may pull comps from hundreds of miles away in different markets where cars are cheaper. They might even use vehicles sold at wholesale auctions, which have no bearing on the retail price you would pay to replace your car.

Here are common red flags in these reports:

- Distant Comps: Using cars for sale in another city or state to lower your local market value.

- Ignoring Condition: Failing to give proper credit for a vehicle kept in pristine, above-average shape.

- Missing Features: Overlooking thousands of dollars in options, a premium trim package, or recent upgrades like new tires.

- Unjustified Adjustments: Applying negative adjustments for mileage or condition without real justification.

The Problem with Automated Systems

Systems like CCC ONE are built for the insurance industry, not for you. Their goal is efficiency, which means their automated process often misses the unique details that made your car more valuable. You can see a full breakdown of the flaws in a CCC ONE market valuation report and learn what to look for.

The insurer’s initial offer is based on data that protects their bottom line. It’s calculated to be defensible, but that doesn’t make it right. This is why you must challenge their low settlement with your own proof when calculating total loss vehicle value.

Gathering Evidence to Challenge a Low Settlement

If the insurer’s settlement offer feels too low, don’t accept it. That first number is a starting point for negotiation, not the final word. To successfully challenge their valuation, you need to build a counter-offer supported by solid, real-world evidence.

Your goal is to prove your vehicle’s true Actual Cash Value (ACV) right before the accident. This takes more than a generic printout from an online calculator.

Finding Truly Comparable Vehicles

The most powerful evidence is a list of comparable vehicles for sale in your area. The key is finding cars that are a true apples-to-apples match.

Focus on listings that match your car in these areas:

- Trim Level and Options: A base model is worth less than a fully loaded one. Match the exact trim and any high-value features like a sunroof or premium audio.

- Mileage: Find comps with mileage within 5-10% of your car’s. A big mileage difference significantly impacts value.

- Condition: Look for vehicles described as being in a similar pre-accident condition.

- Location: Stick to dealerships in your local market—usually within a 50-75 mile radius.

Documenting Your Car’s Unique Value

Next, gather proof of everything that made your car worth more than average. Meticulous maintenance and recent upgrades directly boost its fair market value.

Pull together receipts and records for things like:

- New Tires: A new set of quality tires can add hundreds of dollars to a car’s value.

- Recent Major Service: A recent timing belt replacement or major tune-up is valuable.

- Aftermarket Upgrades: Custom wheels or an upgraded stereo have value. You’ll need receipts to prove it.

This documentation is more critical than ever. Recent market volatility has changed how depreciation works. For instance, CarGurus reported that used car prices recently dropped 7.25% year-over-year, which changes how insurers must calculate ACV. This is why proving your specific car’s condition matters so much.

While this evidence strengthens your position, the ultimate tool for fighting an unfair offer is a certified appraisal. A professional total loss appraisal from SnapClaim delivers a data-backed, unbiased report that serves as expert proof of your car’s true value.

Using a Certified Appraisal to Maximize Your Payout

When you and the insurance adjuster are at a standstill, a certified, independent appraisal becomes your most powerful tool. It’s how you get things moving again and accurately start calculating total loss vehicle value to defend your claim. The conversation instantly shifts from your opinion versus theirs to a discussion based on hard, verifiable evidence.

An independent appraisal is a world away from the generic, automated reports insurers use. A real appraiser digs into your specific local market, resulting in a fair and realistic picture of your car’s replacement cost.

What a Professional Report Delivers

A certified appraisal is a defensible document built to stand up to scrutiny. It levels the playing field by bringing professional-grade evidence to the table.

This report will highlight key factors the insurer’s low offer probably ignored:

- Precise Condition Adjustments: It documents your vehicle’s specific pre-accident condition, giving you credit for keeping it in exceptional shape.

- Valuable Options and Upgrades: Every feature, from a premium sound system to new tires, is properly valued.

- Real Local Market Data: The appraisal uses hyper-local, retail-based comparable vehicles to reflect the true replacement cost.

This detailed approach gives the adjuster a clear, logical reason to increase their offer. It’s no longer your word against their system; it’s a professional report they must take seriously.

A Risk-Free Step Toward Fair Compensation

Submitting a professional appraisal provides the concrete proof needed to reopen negotiations and secure a fair settlement. At SnapClaim, we’ve made this step completely risk-free. If your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee — guaranteed.

This Money-Back Guarantee means you can challenge a lowball offer with total confidence. By investing in a professional total loss car appraisal, you’re arming yourself with the documentation needed to get the full compensation you rightfully deserve.

Navigating State Laws and Total Loss Rules

When facing a potential total loss, it’s easy to think the insurance company holds all the cards. But they don’t set all the rules. The final decision often comes down to your state’s specific laws, which are critical to calculating a total loss vehicle outcome.

These state-level regulations spell out exactly when an insurer is legally required to declare a car a total loss. Without this knowledge, you’re negotiating in the dark.

Total Loss Threshold vs. Total Loss Formula

Generally, states fall into one of two camps.

Many use a Total Loss Threshold (TLT), a specific percentage set by law. If repair costs exceed this percentage of the car’s Actual Cash Value (ACV)—say, 75%—the vehicle must be totaled. The adjuster has no choice.

Other states rely on the Total Loss Formula (TLF), which gives the insurance company more flexibility. In these states, a car is totaled if the (Cost of Repairs + Salvage Value) is greater than the ACV. The TLF is an economic calculation for the insurer, while the TLT is a legal mandate.

It’s also worth noting that outside factors can affect these calculations. For instance, major automotive recalls can create parts shortages and back up repair shops. This makes it even more important to know your state’s rules. You can read more about how recalls impact the auto market on bizzycar.com.

To give you an idea of how much these rules differ, here’s a quick look at a few key states.

Total Loss Rules: A State-by-State Snapshot

This table shows a few examples of how different states handle total loss declarations, illustrating how varied the laws can be.

| State | Rule Type | Threshold Example |

|---|---|---|

| Texas | Total Loss Threshold (TLT) | 100% of ACV. Repairs must equal or exceed the car’s full value. |

| Florida | Total Loss Threshold (TLT) | 80% of ACV. A lower threshold means more cars are totaled. |

| California | Total Loss Formula (TLF) | (Repairs + Salvage) ≥ ACV. Insurers have more discretion here. |

| New York | Total Loss Threshold (TLT) | 75% of ACV. This is one of the more common thresholds nationwide. |

As you can see, where your car is registered makes a massive difference. For a complete rundown of the laws where you live, you can always find more details on our state-specific law pages.

Frequently Asked Questions About Total Loss Claims

Dealing with a total loss claim can be frustrating, but you don’t have to go through it alone. Here are straightforward answers to common questions about the total loss process.

Can I keep my car if it’s declared a total loss?

Yes, in most states, you can choose to keep your vehicle through a process called owner-retained salvage. The insurer pays you the Actual Cash Value (ACV) minus the car’s salvage value. However, your car will receive a “salvage” title, which makes it difficult to insure or register until it passes a state inspection and is re-titled as “rebuilt.”

Will the insurance payout cover my entire car loan?

Not always. The insurance company is only responsible for the car’s ACV, which might be less than your loan balance. The insurance check goes to your lender first, and you are responsible for paying any remaining difference. GAP (Guaranteed Asset Protection) insurance is designed to cover this financial “gap.”

Can I claim diminished value if the accident wasn’t my fault?

A diminished value claim applies when your car is repaired, not totaled. It compensates you for the loss in resale value your car suffers simply because it now has an accident history. If your vehicle is declared a total loss, you receive an ACV settlement instead of a diminished value payment. Learn more in our Diminished Value and Total Loss guides.

How long does a total loss claim usually take?

A typical total loss claim takes about 30 days from start to finish. This includes the inspection, valuation, negotiations, and final payout. Delays are often caused by disagreements over the ACV or missing paperwork. Staying organized can help speed up the process.

Get the Fair Payout You Deserve

Navigating the aftermath of an accident is stressful enough without having to fight for a fair settlement. By understanding the basics of calculating total loss vehicle value and knowing your rights, you can confidently challenge an insurer’s low offer. A certified appraisal from SnapClaim provides the data-backed proof you need to negotiate effectively and recover the full amount you are rightfully owed.

Get your free estimate today or order a certified appraisal report to strengthen your insurance claim.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This guide was reviewed and verified by SnapClaim’s auto appraisers, who specialize in diminished value and total loss disputes.

Our team continually updates every article to reflect current insurer guidelines, valuation standards, and court-accepted appraisal practices, ensuring that you’re relying on information trusted by professionals nationwide.

Get Started Today

Whether you’re challenging a low total loss settlement or proving your vehicle’s post-repair loss in value, SnapClaim makes it simple to take the next step.

Generate a free diminished value or total loss estimate in minutes and see how much compensation you may be owed.

👉 Order your total loss appraisal today