After an accident, the last thing you want is another confusing expense. So, how much should a professional auto appraisal cost? While the price typically ranges from $250 to over $750, the real question is what you get for that investment.

The final cost depends on the depth of analysis your claim needs, whether it’s for diminished value or a total loss settlement. Understanding this helps you see an appraisal not as a cost, but as a crucial tool for securing a fair insurance payout. You can also learn more about diminished value state law.

Why the Auto Appraisal Cost Is a Smart Investment

It’s easy to view an appraisal as just another bill, but a certified report is an investment in getting the compensation you rightfully deserve. Insurance companies often use their own valuation methods, which can undervalue your vehicle to protect their bottom line. An independent, professional appraisal provides the real-world market data you need to challenge a lowball offer.

Think of it like getting a second opinion from a medical specialist. While a quick online search might give you an idea, an expert diagnosis provides the accuracy you need when the stakes are high. A certified appraiser delivers a detailed, defensible report that holds up under scrutiny from adjusters.

The Power of a Certified Report

An appraisal is more than a quick price lookup; it’s a thorough analysis that documents your vehicle’s true worth. This is essential in two common post-accident situations:

- Diminished Value Claims: This calculates how much your car’s resale value has dropped, even after perfect repairs. A certified report from a provider like SnapClaim is what proves this financial loss to the insurer.

- Total Loss Payouts: If your vehicle is totaled, the report establishes its fair market value before the accident, ensuring the insurance payout is accurate and fair.

Without this expert validation, you’re left arguing against the insurer’s numbers, putting you at a significant disadvantage. The right appraisal gives you the leverage needed to negotiate for the compensation you are owed.

For a detailed breakdown of how pricing aligns with report depth, explore our guide on diminished value appraisal costs.

Quick Guide to Auto Appraisal Costs

To help you identify which appraisal fits your needs, here’s a summary of common types and their typical costs.

| Appraisal Type | Typical Cost Range | Best For |

|---|---|---|

| Diminished Value Appraisal | $250 – $500 | Proving the lost resale value of your car after accident repairs. |

| Total Loss/Fair Market Value | $300 – $600 | Disputing an insurer’s low payout offer for a totaled vehicle. |

| Classic or Custom Car Appraisal | $400 – $750+ | Valuing unique, modified, or vintage vehicles with non-standard worth. |

Each report serves a specific purpose, and choosing the right one provides the exact evidence needed for your claim. Ultimately, a fair auto appraisal cost is a small price to pay to potentially recover thousands more in your settlement.

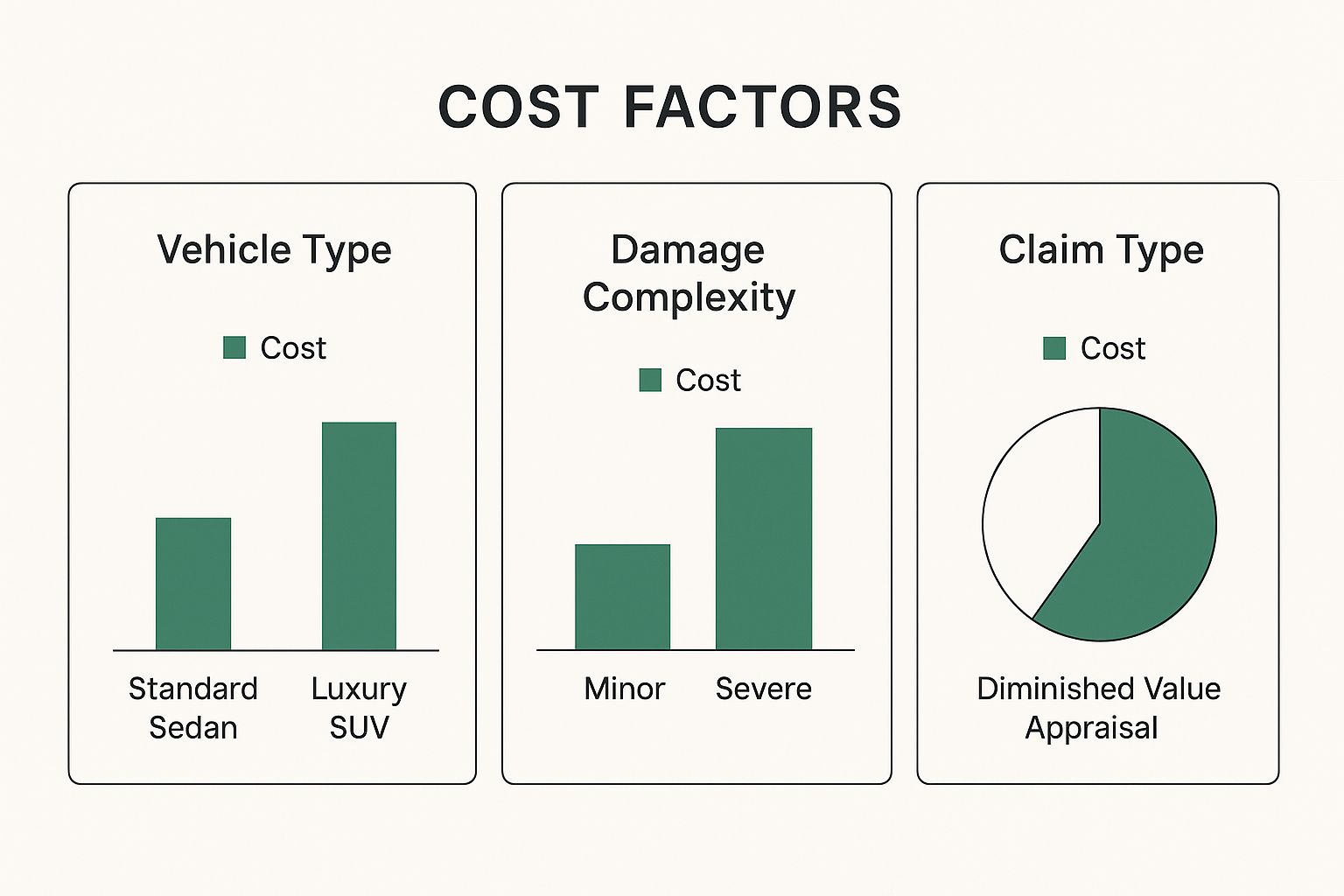

Key Factors That Influence the Auto Appraisal Cost

Ever wonder why there isn’t one flat price for every auto appraisal? It’s because every car and every accident is unique. The auto appraisal cost varies because numerous factors go into building a detailed, solid report that an insurance company can’t simply dismiss.

When you understand these factors, you see the true value behind the price. You’re not just paying for a number; you’re investing in the expertise required to prove your financial loss, dollar for dollar.

The Vehicle’s Profile

The first major driver of cost is the car itself. Appraising a common sedan is relatively straightforward, but things get more complex with high-end or specialized vehicles.

- Luxury and Exotic Cars: Valuing a late-model luxury SUV or a rare sports car requires deep market research and specialized knowledge of their unique features, which increases the appraisal cost.

- Classic or Custom Vehicles: For a vintage muscle car or a truck with custom modifications, standard market data is insufficient. An appraiser with specific expertise is needed to determine its true worth.

- Electric Vehicles (EVs): Appraising an EV means understanding factors like battery health and software versions—tech that doesn’t exist in gas-powered cars.

The infographic below shows how these different factors—from car type to claim complexity—shape the scope and cost of an appraisal.

As you can see, the more complex the vehicle or claim, the more work is required, and the appraisal fee reflects that extra effort.

Claim Type and Damage Severity

The type of insurance claim you’re filing and the extent of the damage also play a huge role in the final auto appraisal cost. Minor cosmetic scratches require a less intensive analysis than a vehicle with frame damage or one declared a total loss.

A diminished value claim calculates the loss in resale value after repairs, while a total loss appraisal establishes the vehicle’s fair market value right before the accident. Each uses a completely different methodology.

This is a critical distinction. If you’re fighting an insurer’s lowball insurance total loss payout, you need a robust, evidence-packed document to prove your car’s true pre-accident value.

This accuracy is more important than ever. With vehicle prices steadily rising, a poor valuation can easily cost you thousands. You can read more about rising vehicle costs from reputable sources like ABC News. A certified SnapClaim report provides the data you need to secure a fair settlement that reflects your vehicle’s actual market value.

Comparing Different Types of Appraisals

Not all appraisals are created equal, and choosing the right one is critical for your insurance claim. An incorrect choice can mean wasting time and money on a report an insurance adjuster will quickly dismiss.

Options range from online tools to in-person inspections. If you just need a ballpark estimate of your car’s value, a free tool is fine. But to prove a financial loss to an insurer, you need something far more substantial.

Free Online Estimators vs. Certified Appraisals

Free valuation tools from sites like Kelley Blue Book are great for a quick snapshot of your vehicle’s market value. They use broad algorithms based on make, model, and mileage to generate a general price range.

However, these tools are not formal appraisals. They cannot account for your vehicle’s specific condition, accident history, or local market demand. An insurance company will never accept a KBB printout as proof for a diminished value claim because it lacks professional validation.

Desk Appraisals vs. In-Person Appraisals

For a certified report that holds up under scrutiny, you have two main options: a desk appraisal or an in-person appraisal. Each approach impacts the overall auto appraisal cost and turnaround time.

A desk appraisal is a remote valuation conducted by a certified professional. They analyze documents you provide, such as:

- Photos and videos of your vehicle

- The official repair estimate

- Vehicle history reports (e.g., CarFax)

This method is faster and more affordable because it eliminates travel time. For most diminished value and total loss claims, a well-documented desk appraisal from a provider like SnapClaim provides all the evidence needed for a strong, defensible case.

An in-person appraisal involves an appraiser physically inspecting your vehicle. This is more expensive and takes longer to schedule. It’s typically reserved for complex situations, like claims involving rare classic cars, extensive custom modifications, or legal disputes.

For the vast majority of post-accident claims, a certified desk appraisal delivers the same level of authority and accuracy as an in-person inspection, but with greater speed and affordability.

To help you decide, here’s a straightforward comparison of the two professional methods.

Desk Appraisal vs. In-Person Appraisal Comparison

| Feature | Desk Appraisal | In-Person Appraisal |

|---|---|---|

| Methodology | Remote analysis of photos and documents | Physical, hands-on vehicle inspection |

| Typical Cost | Lower ($250 – $500) | Higher ($400 – $750+) |

| Turnaround Time | Fast (1-3 business days) | Slower (Requires scheduling) |

| Best For | Most diminished value and total loss claims | Classic cars, custom vehicles, legal disputes |

Ultimately, selecting the right type of appraisal is about matching the report’s credibility to what your specific insurance claim demands.

Why a Cheap Appraisal Can Cost You Thousands

When facing repair bills and insurance paperwork, opting for the cheapest appraisal seems like a smart move. However, saving a few dollars upfront can end up costing you thousands in the long run.

An uncertified, bargain-bin report is a major red flag for an insurance adjuster, giving them an easy excuse to dismiss your claim and stick to their lowball offer.

The logic is simple: if you were in a serious legal battle, you wouldn’t hire the cheapest lawyer. You’d want an expert with a proven track record. The same principle applies to your auto appraisal cost.

An Investment in Your Financial Recovery

A high-quality, certified appraisal isn’t just an expense—it’s an investment in getting the money you’re owed. A cheap report provides a number, but it lacks the detailed market analysis and certified methodology needed to be taken seriously by an insurer.

This is where a SnapClaim report makes a difference. Our appraisals are built to be defensible, providing the hard, data-backed proof you need to establish your car value after accident. It transforms your request into a professional, evidence-based demand they cannot ignore.

A proper auto appraisal provides the factual basis needed to challenge low initial offers. The first offer is rarely the best, a key principle when negotiating with insurance companies.

The High Cost of a Weak Claim

An insurance adjuster’s primary role is to resolve claims for the lowest possible amount. A flimsy, poorly documented appraisal gives them permission to stick to their initial low offer.

Here’s what’s at stake with a weak appraisal:

- Dismissed Evidence: Adjusters are trained to find flaws in reports that lack certified data or a credible methodology.

- Lost Leverage: Without solid proof of value, you have no ground to stand on when arguing for a fair payout.

- Thousands Left Behind: The gap between the insurer’s low offer and your vehicle’s actual lost value can easily be thousands of dollars—far more than the cost of a legitimate appraisal.

Paying a fair auto appraisal cost for a certified report from an expert like SnapClaim is one of the most powerful moves you can make. It arms you with the proof needed to negotiate from a position of strength for your total loss or diminished value claim.

How Technology Shapes Appraisal Accuracy and Cost

The auto appraisal industry has evolved significantly with technology, boosting accuracy and influencing valuation costs. Modern tools have replaced outdated methods, delivering a level of precision that was previously impossible. This ensures your report is built on solid, current data—not guesswork.

This shift is most evident in how fair market value is determined. Instead of relying on static guidebooks, top appraisers now use sophisticated software for real-time market analysis. This technology scans thousands of current vehicle listings to pinpoint your car’s true value with incredible accuracy.

Valuing Today’s Complex Vehicles

Modern cars are packed with advanced technology, adding new layers of complexity to any appraisal. Accurately valuing these features requires specialized knowledge beyond a standard mechanical check.

Two critical areas include:

- Advanced Driver-Assistance Systems (ADAS): Features like adaptive cruise control rely on sensitive cameras and sensors that often require costly recalibration after a collision, which must be factored into the valuation.

- Electric Vehicles (EVs): Appraising an EV requires understanding its battery health, a major component of its overall value. This specialized knowledge affects the appraiser’s time and, consequently, the final auto appraisal cost.

Technology ensures an appraisal report is a data-driven conclusion, not just an opinion. By analyzing live market data and accounting for complex systems, a modern appraisal provides the defensible proof needed for a fair insurance claim.

The automotive world is evolving fast. As cars become more sophisticated, appraisal methods must keep pace. Using advanced data is now a necessity for a credible report, which is why a SnapClaim appraisal gives you the hard evidence to negotiate confidently.

Want a preliminary idea of what your claim might be worth? Use our free diminished value claim calculator to get an instant estimate.

Get the Compensation You Deserve

Knowing the auto appraisal cost is the first step. The ultimate goal is to secure a fair settlement, and that requires the right appraisal—one that provides undeniable, data-backed proof of your vehicle’s value. Don’t let an insurer’s lowball offer be the final word.

At SnapClaim, our entire focus is on building a strong, evidence-based case for you. Our certified reports are accurate, defensible, and designed to withstand adjuster scrutiny. We provide the leverage you need to stop asking and start demanding fair compensation.

Your Financial Recovery Is Our Priority

We are so confident in our reports that we stand behind them with a straightforward promise, removing the financial risk from your decision.

SnapClaim’s Money-Back Guarantee: If your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee — guaranteed.

This guarantee makes investing in a professional appraisal a strategic, risk-free move. Armed with our report, you are presenting a data-driven demand for what’s fair. Understanding terms like actual cash value (ACV) is helpful, but a certified appraisal that proves it makes all the difference.

A proper car appraisal after an accident is the most effective tool for ensuring you receive the payment you are truly owed. You can find a diminished value appraiser near me.

Frequently Asked Questions (FAQs)

What does a typical auto appraisal cost?

A professional auto appraisal cost generally ranges from $250 to $750. The price depends on the type of claim (diminished value vs. total loss), the vehicle’s complexity (e.g., luxury, classic, or EV), and the level of detail required to create a defensible report for your insurance company.

Can I claim diminished value if the accident wasn’t my fault?

Yes, in most states, you are entitled to file a diminished value claim against the at-fault driver’s insurance policy. A certified appraisal is the primary evidence you need to prove the amount of value your vehicle lost due to the accident history, even after it was properly repaired. Be sure to check your specific state laws to understand your rights.

Is an auto appraisal worth the cost?

For most vehicle owners, a certified appraisal is a worthwhile investment. Insurance companies’ initial settlement offers are often low. A professional appraisal provides the leverage needed to negotiate a higher payout, and the increase in your settlement can be thousands of dollars—far exceeding the initial auto appraisal cost.

Can the at-fault insurance company be required to pay for the appraisal?

In many jurisdictions, the at-fault party’s insurer is responsible for all reasonable costs associated with making you whole after an accident. This can include the cost of an independent appraisal needed to prove your financial damages. You can typically include the appraisal fee in your total demand for settlement.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This article was reviewed by SnapClaim’s team of certified auto appraisers and claim specialists with years of experience preparing court-ready reports for attorneys and accident victims. Our content is regularly updated to reflect the latest industry practices and insurer guidelines.

Get Started Today

Ready to prove your claim? Get your free estimate today or order a certified appraisal report to strengthen your insurance claim.

👉 Get your free diminished value estimate today