Diminished Value Appraisal in

Arizona

Get Your Free Estimate in a Minute!

Recover the lost value of your car after an accident with a certified Arizona diminished value appraisal. Our reports are fast, accurate, and court-ready—trusted by insurers and attorneys across Georgia.

No credit card required [Takes less than 30 second]

Filing a Diminished Value Claim in Arizona: What You Need to Know

Arizona Diminished Value Appraisal — Get the True Value of Your Car After an Accident

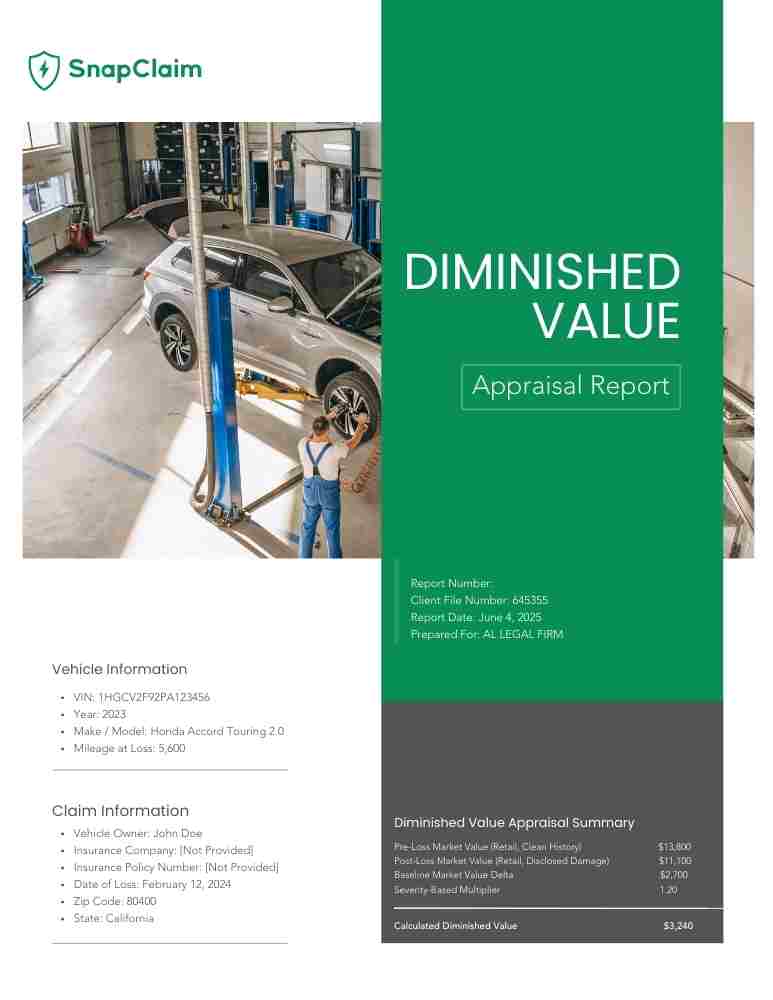

Even after quality repairs, your vehicle can lose resale value once its accident history appears on Carfax or AutoCheck. If your accident happened anywhere in Arizona—including Phoenix, Tucson, Mesa, Chandler, Scottsdale—an Arizona diminished value appraisal helps document that loss, often worth thousands depending on vehicle type and damage severity. SnapClaim delivers data-driven, court-ready appraisal reports used by Arizona insurers, attorneys, and small-claims courts.Why Diminished Value Matters in Arizona

Arizona law recognizes recovery for diminished value when you’re not at fault. Courts have confirmed you may recover proven loss in market value without needing to sell the vehicle (see Oliver v. Henry (Ariz. Ct. App. 2011); Farmers Ins. Co. of Arizona v. R.B.L. Inv. Co. (Ariz. Ct. App. 1983)).What Your Arizona Diminished Value Appraisal Report Includes

- Vehicle details (year, make, model, trim, mileage, options)

- Comparable listings filtered to Arizona ZIP codes (Phoenix, Tucson, Mesa, etc.)

- Pre- and post-accident market value estimates using verified market data

- DV calculation incorporating repair severity and dealer feedback

- Transparent methodology aligned with appraisal best practices (USPAP-aware)

- Optional expert-witness support for court or arbitration

Arizona Areas We Serve

We provide DV and Total Loss appraisals statewide across Arizona, including:- Phoenix

- Tucson

- Mesa

- Chandler

- Scottsdale

- Glendale

- Gilbert

- Tempe

- Peoria

- Surprise

- Yuma

- Avondale

- Goodyear

- Flagstaff

- Prescott

How to File a Diminished Value Claim in Arizona

- Order your appraisal to document the loss with clear market evidence.

- Submit a DV demand letter to the at-fault driver’s insurer.

- Negotiate or escalate — our reports are formatted for attorney and arbitration review.

- Recover compensation — many Arizona clients recover several thousand dollars depending on severity and market.

Arizona Insurance Practices to Know

Insurers such as State Farm, Allstate, GEICO, and Progressive may cite simplified formulas (e.g., “17c”) that can understate Arizona resale values. SnapClaim counters with:- Real-world listings from AutoTrader, CarGurus, and Cars.com filtered to Arizona markets

- Dealer quotes within ~50 miles of the owner’s ZIP

- Localized adjustments for mileage, color, options, and trim demand

Example Arizona Case Study

Vehicle: 2021 Toyota 4Runner TRD Off-RoadRepair Cost: $7,900 (front-end)

Initial Insurer Offer: $1,100 (formula-based)

SnapClaim DV Result: $5,300

Final Settlement: $4,900 after submitting our report and demand letter

Helpful Arizona Resources

- Arizona Department of Insurance & Financial Institutions (DIFI) — file an insurance complaint

- Arizona Attorney General — Consumer Complaint — report unfair or deceptive practices

- Arizona Courts — Small Claims — filing information and self-help

Ready to Get Your Arizona Diminished Value Appraisal?

Start now — fast turnaround, clear evidence, and strong market comparables tailored to Arizona.- No credit card required

- Delivery in about 1 hour

- Includes appraisal and demand-letter template

Related Arizona Locations

Click a pin to open the city’s diminished value page.

Find your Arizona city or metro area below to see local examples and order your Diminished Value Appraisal report.

Order Your Diminished Value Appraisal

Get Your Appraisal Report and Demand Letter Now!

Free Estimate, no credit card required.

Recover Diminished Value After an Accident in Arizona

Even after professional repairs, your vehicle can lose thousands in resale value following an accident. This loss is known as diminished value. With a certified Arizona diminished value appraisal, you can prove that loss and demand fair compensation from the at-fault driver’s insurance company.

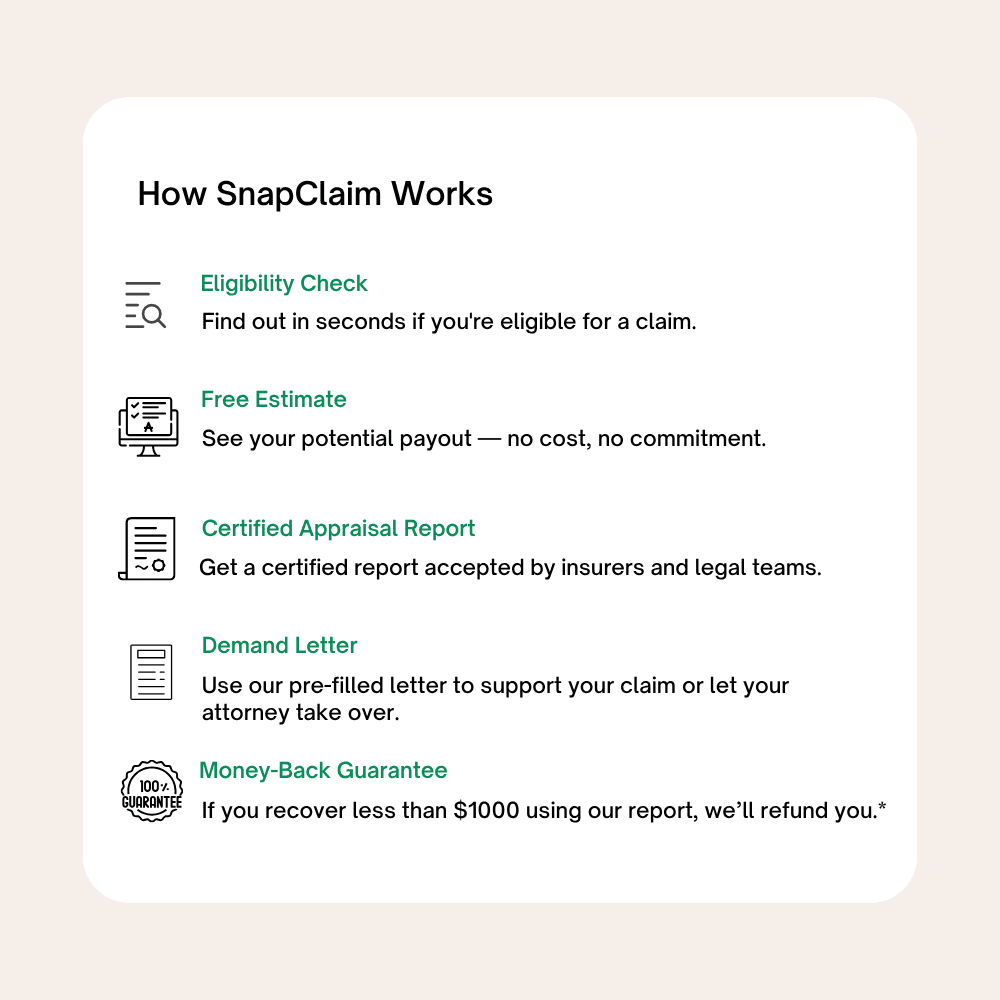

At SnapClaim, we make the process simple and fast. Get a free diminished value estimate, receive a court-ready appraisal report, and access an insurer-ready demand letter—all within hours. No confusion, no waiting. Just accurate documentation trusted by attorneys and insurance professionals throughout Arizona.

Partnering with an experienced diminished value lawyer can help you maximize your claim and ensure the insurer pays what your vehicle truly lost in value. Learn more about Arizona diminished value lawyers .

"After a driver hit my sedan in Tucson, the repairs looked perfect—but dealerships still offered me less because of the accident record. I ordered an Arizona diminished value appraisal from SnapClaim, and within a day, I had a detailed report showing exactly how much value I lost. My attorney used it to negotiate with the insurer, and they paid nearly $4,000 more than their first offer. SnapClaim made the whole process simple and professional."

Nelson R.

Tempe, AZ

Frequently Asked Questions:

- Does Arizona allow diminished value claims?

Yes. Arizona allows recovery for diminished value if another driver caused the accident. Courts have upheld the right of vehicle owners to recover proven loss in market value even without selling the vehicle — see Oliver v. Henry (2011).

- Why do I need a diminished value appraisal in Arizona?

An Arizona diminished value appraisal gives you the documentation insurers and attorneys require to validate the loss in market value after repairs. Without an independent appraisal, insurers often rely on generic formulas that undervalue your claim.

- How much does an Arizona diminished value appraisal cost?

Most Arizona diminished value reports cost $350. For details, visit our SnapClaim Pricing page. You can also get a free estimate before ordering your full report.

- Will insurance companies accept a SnapClaim appraisal in Arizona?

Yes. SnapClaim’s Arizona appraisal reports follow recognized industry standards and are accepted by major insurers such as State Farm, Allstate, GEICO, and Progressive. Our reports include verified market comparables and USPAP-aligned methodology.

- How fast can I get my Arizona diminished value report?

Most reports are completed within about 1 hour after your vehicle information and repair documents are submitted. You’ll receive an appraisal report ready for insurer or attorney submission.

- Can I claim diminished value if I caused the accident?

No. Under Arizona law, diminished value recovery is only available if you were not at fault in the accident. If you were responsible, your own insurance typically does not pay diminished value unless you have special coverage.

- What documents should I collect for an Arizona diminished value claim?

Before ordering your report, gather your repair estimate, final invoice, photos of damage (if available), and the accident or police report. These documents help ensure your SnapClaim appraisal reflects accurate damage severity and market loss.

- What are the deadlines for an Arizona diminished value claim?

Arizona generally allows up to 2 years from the date of the accident to file a property damage claim, including diminished value. However, starting early improves your chances of a smooth settlement. Consult your local SnapClaim appraiser or attorney for guidance.

- Where can I order an Arizona diminished value appraisal?

You can order online through SnapClaim’s free estimate tool. Choose your Arizona city — such as Phoenix, Tucson, or Scottsdale — and get your certified appraisal report today.

Diminished Value & Total Loss Appraisal Reports

Instant Free Estimate

Instant diminished value and total loss appraisals — no guesswork, no delays, backed by a 100% money-back guarantee.

Free Estimate, no credit card required.