Getting your car repaired after a collision is only half the battle. Your vehicle now has a permanent accident record that drags down its resale value—no matter how perfect the repairs look. This drop in your car’s value is called “diminished value,” and you have the right to file an Allstate diminished value claim to recover that loss.

Why Your Car Is Worth Less After an Accident

Let’s be honest. Even with flawless repairs, a car with an accident history is a tough sell. Imagine you’re buying a used car and see two identical models, but one has a reported collision. Which one would you choose? You’d either pick the one with a clean history or demand a steep discount for the repaired vehicle.

This “stigma” isn’t just a feeling; it’s a real, measurable financial loss. The accident gets logged on vehicle history reports like CARFAX, making it impossible to hide from future buyers. As a result, your car’s fair market value takes a nosedive.

Understanding the Financial Impact

Diminished value claims are about recovering that lost market value. For example, a three-year-old SUV worth $32,000 before a crash might only sell for $28,400 afterward, even with top-notch repairs. That $3,600 gap is your diminished value—a loss you can and should claim from the at-fault driver’s insurer, like Allstate. You can see more real-world examples of Allstate’s claim process on https://www.allstate.com/claims

Learn more denied Allstate diminished value claims.

This is precisely why filing an Allstate diminished value claim is so critical. It’s not about getting a bonus payout; it’s about being made financially whole after someone else’s mistake. The goal is to receive fair compensation so that your repaired car, plus the diminished value check, equals what your vehicle was worth moments before the accident.

To achieve that, you need solid proof. A certified appraisal from a service like SnapClaim provides the hard data you need to challenge lowball offers and recover what you’re rightfully owed.

Confirming Your Claim Is Eligible

Before diving into the paperwork for an Allstate diminished value claim, you need to ensure you have a valid case. Not every accident qualifies, and insurance adjusters have a checklist they follow. The three main factors are fault, location, and your vehicle’s details.

Generally, you can only file for diminished value if the other driver was at fault. This is known as a third-party claim—you’re claiming against the at-fault driver’s Allstate policy. Trying to claim this from your own insurance (first-party claim) is almost always a non-starter, with Georgia being the rare exception.

Key Eligibility Factors Allstate Will Review

Allstate has an initial screening process, and your claim must tick these boxes to be considered.

Think of it this way:

- Clear Fault: The other driver must be 100% at fault. If you share any of the blame, your claim is likely to be denied.

- Significant Damage: A minor paint scratch won’t qualify. The damage must be substantial enough to leave a permanent mark on your vehicle’s history report, like a CARFAX or AutoCheck record.

- Vehicle Age and Mileage: Newer cars with lower mileage typically suffer the biggest drop in value after an accident. An older, high-mileage car may have already lost so much value that an insurer will argue the accident didn’t make a meaningful difference.

- No Total Loss: This is critical. Diminished value is for cars that have been repaired, not declared a total loss. A total loss payout is a completely different process meant to cover the car’s entire pre-accident value.

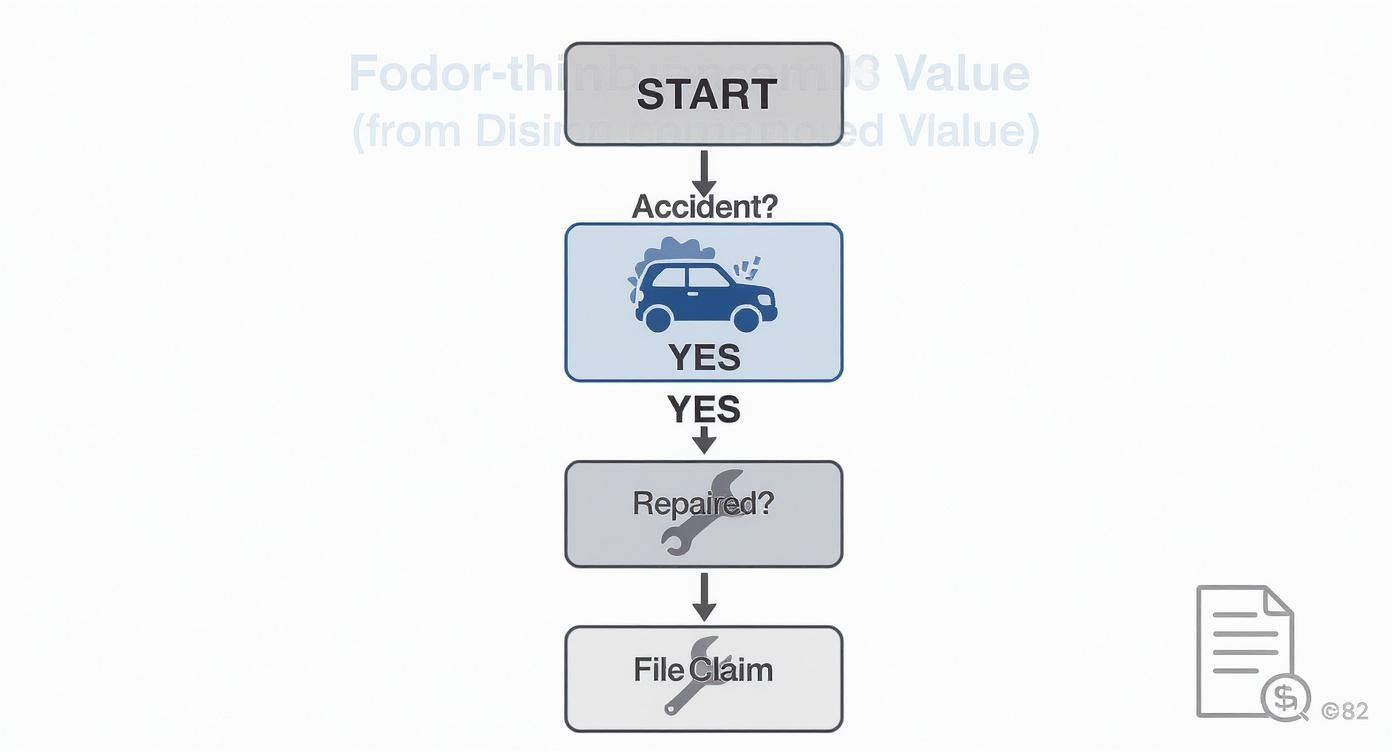

This decision tree gives you a quick visual of the path for a diminished value claim.

As you can see, a successful claim depends on your car being repaired after an accident caused by someone else. Only then can you start pursuing fair compensation for your vehicle’s lost value.

State Laws Are the Deciding Factor

Your location is one of the most important factors. Diminished value laws vary widely across the country, and each state has its own rules.

While courts in many states recognize third-party claims for diminished value, the specific regulations can create roadblocks. To see exactly what rules apply to you, it’s worth checking out SnapClaim’s detailed state-specific law pages.

Key Takeaway: The success of your Allstate diminished value claim boils down to your state’s laws, who was at fault, and the severity of the damage. You can get a solid legal overview by reviewing this guide to diminished value laws in all 50 states. Confirm your eligibility on these points before investing more time into building your case.

Gathering the Right Evidence to Prove Your Loss

When you file an Allstate diminished value claim, you are entering a negotiation. In any negotiation, hard facts beat opinions every time. The adjuster’s job is to minimize the payout, and they are trained to challenge any claim not backed by undeniable proof.

Your mission is to build a case so thorough that it leaves no room for them to argue. Think of it as preparing for court—every document and report adds another layer of evidence that strengthens your position.

Your Essential Evidence Checklist

To build a compelling claim, you need specific documents that tell the complete story of your vehicle’s value before the accident and after the repairs. This paperwork is the foundation of your entire demand.

Here is a checklist of the core documents you will need to get Allstate to take your claim seriously.

| Document Type | Why You Need It | Where to Get It |

|---|---|---|

| Official Police Report | Establishes who was at fault, which is critical for a third-party claim. No fault, no claim. | The responding police department’s records office. |

| Itemized Repair Invoices | Shows the severity of the damage in black and white—every part replaced and every hour of labor. | The body shop that completed the repairs. |

| Pre- & Post-Repair Photos | Photos of the damage before repairs prove the impact’s severity. Photos after repairs show the work was done but don’t erase the history. | Your phone, the body shop, or the insurer’s appraiser. |

| Vehicle History Report | A fresh CARFAX or AutoCheck report showing the new accident record is concrete proof of the stigma now attached to your car. | CarFax.com or AutoCheck.com. |

Putting this file together shows the adjuster you are serious, prepared, and will not accept a lowball offer without a fight.

Key Takeaway: The single most powerful piece of evidence you can have is a certified, independent appraisal. While online calculators are a fine starting point, they provide a generic estimate that holds no weight in a real negotiation.

The Power of a Certified Appraisal

Free online diminished value calculators are convenient, but they won’t stand up to scrutiny from an Allstate adjuster. They simply can’t provide the specific market data needed to prove your car’s unique loss. This is where a professional report from a certified appraiser changes the game.

A SnapClaim appraisal provides objective, data-backed proof using a court-accepted methodology. It analyzes your specific vehicle, the local market, and the exact nature of the damages to determine the true loss in value. This isn’t just an opinion; it’s a professional valuation that an adjuster must take seriously.

Investing in a professional appraisal equips you with the single best tool to negotiate effectively and recover the full amount you are owed. Finding a qualified expert is simple—you can easily find a certified diminished value appraiser near you to get started.

Crafting a Demand Letter That Gets Results

Your demand letter is your formal opening move. It’s your chance to state the facts, present your evidence, and put a firm number on the table for your car’s lost value. This isn’t the time for an angry letter—it’s about presenting a professional, evidence-backed case that an adjuster can’t ignore.

A well-crafted demand letter signals that you have done your homework, understand your rights, and will not be brushed off with a low offer. It sets the stage for the entire negotiation and puts you in control from the start.

Structuring Your Letter for Maximum Impact

Keep your letter clean, concise, and logical. Allstate adjusters handle many files, so a rambling, disorganized letter will likely be ignored. A professional format that gets straight to the point is your best bet.

Every solid demand letter for an Allstate diminished value claim should include these key sections:

- The Introduction: State your name, the Allstate claim number, and the at-fault driver’s information. Make it clear this is a formal demand for diminished value compensation.

- The Accident Summary: Briefly recap the accident, highlighting the other driver’s fault. Mention the extent of the damage and the total repair cost to establish the incident’s significance.

- The Demand: This is the core of your letter. State the precise amount of diminished value you are claiming and reference the attached certified appraisal report that proves this number.

- The Deadline: End with a clear call to action. Request payment for the specified amount within a reasonable timeframe, like 15 or 30 days, and provide your contact information.

This structure frames your claim as a straightforward matter supported by expert, undeniable analysis.

Sample Language to Get You Started

You don’t need to sound like a lawyer. Simple, direct language is often more powerful. When stating your diminished value figure, try something like this:

“As documented in the attached certified appraisal report from SnapClaim, my vehicle has suffered an inherent loss of value totaling $4,250. This figure is based on a comprehensive market analysis and reflects the permanent stigma associated with its new accident history.”

This statement is professional, confident, and immediately points the adjuster to your strongest piece of evidence. Send your letter via certified mail to get a delivery receipt, so there’s no question that Allstate received your demand.

Handling Allstate’s Negotiation Tactics

Once you send your demand letter, the real work begins. Allstate adjusters are skilled professionals trained to protect the company’s bottom line by minimizing payouts on every Allstate diminished value claim. They use a playbook of common arguments to challenge your claim.

Your job is to stay calm, stick to the facts, and not get flustered. By knowing their arguments ahead of time, you can prepare solid, evidence-based responses and keep the negotiation focused on your actual financial loss.

Common Allstate Arguments and How to Respond

The adjuster will likely use one or more of these arguments to deny or reduce your claim. Don’t get caught off guard.

Argument: “Our high-quality repairs restored the car to its pre-accident condition, so there’s no lost value.”

- Your Response: “While I appreciate the quality of the repairs, the permanent accident history is now attached to my vehicle’s VIN. An informed buyer will not pay the same price for a car with a documented collision, regardless of repair quality. My certified appraisal proves this with real market data.”

Argument: “We don’t pay for diminished value.”

- Your Response: “State law requires the at-fault party to make the claimant whole for all property damages, which includes the inherent loss of market value caused by the accident. This isn’t an optional coverage—it’s a direct damage your insured is responsible for.”

Argument: “We use the 17c formula, and it shows you’re owed a much smaller amount.”

- Your Response: “The 17c formula is an arbitrary, internal calculation created by an insurance company to serve its own interests. It does not reflect actual market data for my specific vehicle. My claim is based on a certified appraisal that uses real-world sales analysis, which is the only accurate way to determine the loss.”

You can see for yourself why the 17c formula is flawed and how it consistently undervalues claims like yours.

Sticking to Your Evidence

Throughout every conversation, your certified appraisal is your anchor and most powerful tool.

Constantly bring the conversation back to the appraisal as the source of your demand. This shifts the negotiation from a frustrating battle of opinions (“I think…”) to a review of credible evidence (“My expert report shows…”). An adjuster can argue with you, but it’s much harder for them to argue with a data-driven report from a certified expert.

To succeed, you need to use powerful negotiation strategies. Document every phone call, and stick to email whenever possible to create a written record. This paper trail is invaluable if you need to escalate your claim.

What to Do When Allstate Won’t Budge

So, you’ve presented a solid case, but the adjuster on your Allstate diminished value claim is either stonewalling or countering with a laughably low offer. This is a classic tactic designed to wear you down until you give up.

Don’t fall for it. When the conversation hits a wall, you have several powerful options to escalate the claim and force a fair negotiation. Your first move should be to check the at-fault driver’s Allstate policy for an “appraisal clause.”

The Appraisal Clause: Your Secret Weapon

The appraisal clause is a contractual right in the insurance policy that can break a negotiation stalemate. It bypasses the adjuster and puts the valuation dispute into the hands of neutral, third-party experts.

Here’s a quick rundown of how it typically works:

- You hire your appraiser: This is where having a certified report from SnapClaim gives you a huge advantage.

- Allstate hires their appraiser: They will select their own appraiser to represent their side.

- The appraisers negotiate: If they can agree on a value, that amount becomes binding. If not, they bring in a neutral “umpire” to make the final decision.

This process forces Allstate to stop playing games and engage with your evidence on a professional level, often leading to a much fairer outcome.

Other Escalation Paths

If the appraisal clause doesn’t resolve the issue, you can still turn up the heat.

Filing a formal complaint with your state’s Department of Insurance (DOI) is a serious step. The DOI will launch an investigation and require Allstate to provide a formal, written response. This regulatory oversight is often enough to make an insurer rethink a lowball offer.

When an insurer refuses to negotiate in good faith, it could be a violation of their legal duties. This is precisely when escalating the matter starts to produce real results.

For the toughest cases, you may need to consider small claims court or consult an attorney. If Allstate simply won’t be reasonable, getting professional legal assistance for insurance disputes might be your best move. It sends a clear signal that you’re serious about getting the compensation you deserve.

Frequently Asked Questions (FAQ)

Can I claim diminished value if I was at fault?

Almost never. Diminished value is a third-party claim, meaning you file against the other driver’s policy. Your own policy covers repairs, not the drop in your car’s resale value. The one major exception is Georgia, where you can file a first-party diminished value claim under your own collision coverage.

How long do I have to file my claim with Allstate?

Every state has a deadline, known as the statute of limitations for property damage, which can range from two to six years. However, you should always file your claim as soon as your vehicle repairs are finished. The evidence is fresh, and you eliminate the risk of missing the legal cutoff.

Will filing a diminished value claim make my insurance rates go up?

No. When you file a third-party claim against the at-fault driver’s Allstate policy, the claim goes on their record, not yours. Your insurance rates are not affected by claims made against another driver who damaged your property.

Does Allstate have to accept my appraisal report?

Allstate does not have to automatically pay the amount listed, but they are legally required to consider credible evidence. A certified, independent appraisal provides data-driven proof of your loss that is difficult for an adjuster to ignore and serves as the foundation for your negotiation.

A SnapClaim report gives you the concrete proof you need to negotiate from a position of strength. And if your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee — guaranteed.

Get your free estimate today or order a certified appraisal report to strengthen your insurance claim.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This guide was reviewed and verified by SnapClaim’s auto appraisers, who specialize in diminished value and total loss disputes. Our team continually updates every article to reflect current insurer guidelines, valuation standards, and court-accepted appraisal practices, ensuring that you’re relying on information trusted by professionals nationwide.

Get Started Today

Whether you’re challenging a low total loss settlement or proving your vehicle’s post-repair loss in value, SnapClaim makes it simple to take the next step. Generate a free diminished value or total loss estimate in minutes and see how much compensation you may be owed.