After a car accident, the official police report is a critical piece of evidence for your insurance claim. It provides an unbiased, third-party account that helps insurance adjusters determine who was at fault and begin processing your claim. Understanding how to use the accident report for insurance is your first step toward getting the fair compensation you deserve.

How to Use an Accident Report for Insurance Claims Effectively

Let’s be honest—the moments after a crash are chaotic and stressful. Memories get fuzzy, and emotions run high. The police report serves as the authoritative record, detailing everything from road conditions to driver statements. Insurance adjusters lean heavily on this document to make their initial liability decisions, which directly impacts who pays for damages.

Without a formal report, your claim can quickly turn into a messy “he said, she said” situation, leading to delays and frustration. The report provides a factual foundation that backs up your side of the story and gives your claim serious weight. For example, if the other driver received a ticket for running a red light, that detail in the report makes it very difficult for them to argue you were at fault.

The Report Sets the Stage for Your Claim

This document is more than just a summary; it’s the starting point for all financial negotiations that follow. The details inside influence everything.

- Establishes Initial Fault: The officer’s notes, diagrams, and any citations issued paint a clear picture of who likely caused the accident.

- Verifies Key Information: It confirms names, contact information, vehicle details, and insurance policy numbers, preventing disputes over basic facts.

- Documents Conditions: The report notes factors like weather, road hazards, and visibility at the time of the crash, all of which can be crucial in determining liability.

Your accident report for insurance claim is the cornerstone of your claim. It provides the unbiased evidence needed to validate your account and begin the process of recovering your losses. It’s often the first piece of proof an adjuster will ask for.

Ultimately, this report gives you leverage. It’s an official document that’s tough for an insurer to ignore. While adjusters conduct their own investigations, a detailed and accurate police report makes it much harder for them to unfairly deny your claim or offer a low settlement. Knowing how to navigate that conversation is crucial, which is why we created a guide on how to deal with insurance adjusters.

How to Get a Copy of Your Police Report

After a collision, the official police report isn’t just a piece of paper—it’s essential for your insurance claim. The first thing to do is identify which law enforcement agency responded to the scene. Was it the local city police, the county sheriff, or the state highway patrol? Knowing this is your first step.

These days, most departments have online portals where you can request your accident report for insurance, which is almost always the fastest method. To find your file, you’ll typically need basic information like the date and location of the crash and the names of the drivers involved. If the officer gave you a report number at the scene, that will speed things up significantly.

Requesting Your Report

What if there’s no online option? Don’t worry, you still have a couple of solid methods. Many agencies let you request a copy by mail or by visiting their records department in person.

- Online Portals: The most convenient option. You can often get a digital copy within a few days.

- Mail-in Requests: This usually involves downloading a form, filling it out, and mailing it with a check to cover the fee.

- In-Person Visits: Sometimes you can walk out with the report the same day. Just be sure to check their public hours before you go.

Expect to pay a small administrative fee, usually between $5 and $25, depending on the department. The time it takes to receive the report can range from a few days to a couple of weeks, so it’s best to submit your request as soon as possible. Delays on your end will only slow down your claim.

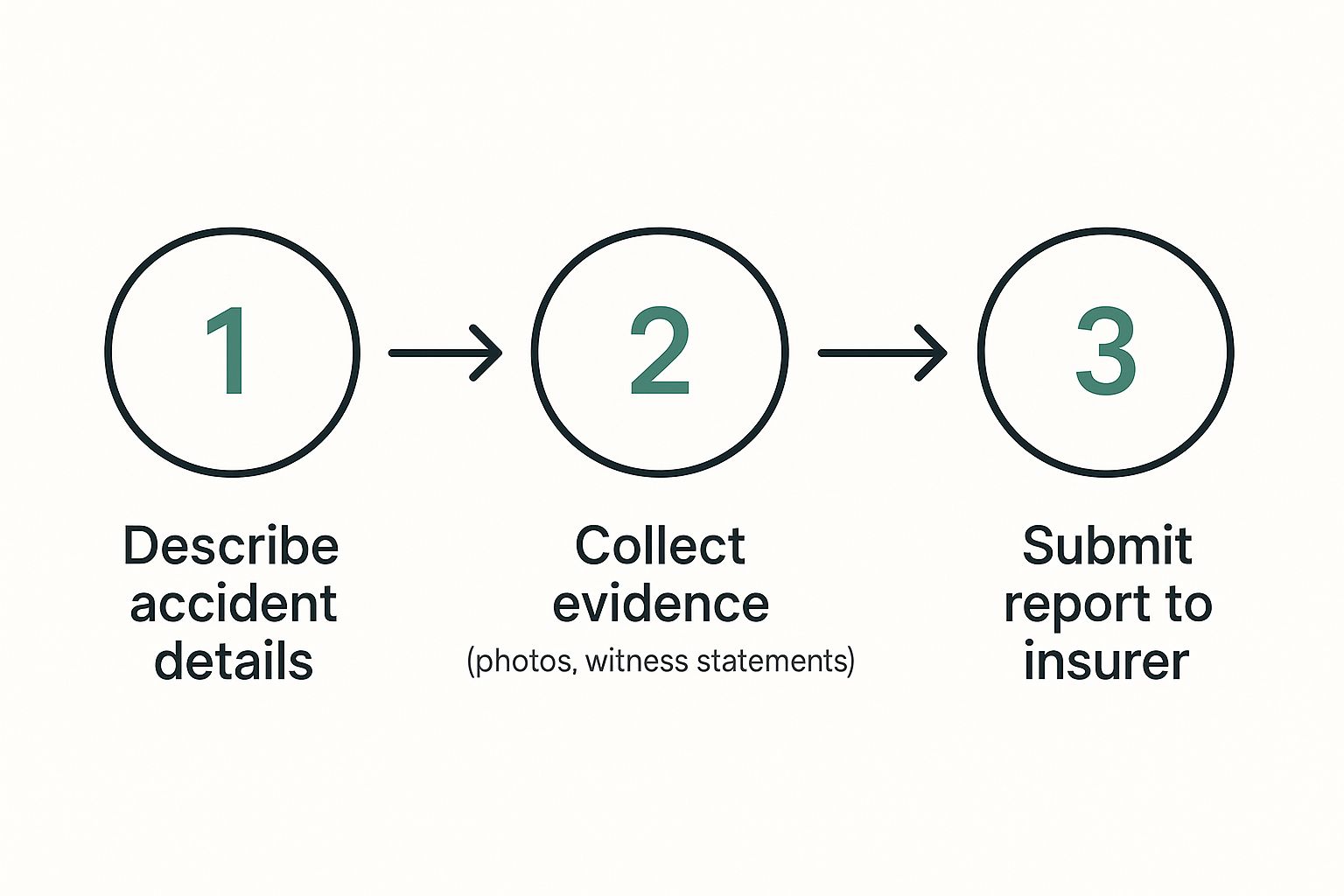

A police report provides a structured, unbiased account of the accident, which is why insurers rely on it. The process of describing the incident, collecting evidence, and submitting the report forms the backbone of your claim.

Each step builds on the last, creating a solid package for your insurance company and putting you in a much stronger position for a fair settlement. If you’re looking for state-specific resources or traffic safety information, the NHTSA’s state directory is a great place to start.

Reading and Verifying Your Accident Report for insurance

An accident report for insurance is the official record of what happened, and even a small mistake can turn into a big headache later. These reports are often filled with codes and jargon, but don’t get overwhelmed. Your job is to confirm that the facts are 100% correct. A simple typo in a license plate can delay your claim, but a major error in the accident description could hurt your settlement.

What to Look for Section by Section

The best way to review the report is to break it down piece by piece. Think of it as a pre-flight checklist for your claim.

- Personal and Vehicle Information: Go through every name, address, driver’s license number, and insurance policy detail. Are they all correct? Make sure your vehicle’s make, model, year, and VIN are listed accurately.

- Date, Time, and Location: Double-check that the report has the exact date, time, and specific location of the crash.

- Officer’s Narrative and Diagram: This is the heart of the report. Read the officer’s written summary and study the crash diagram. Does it match what you remember? Are the vehicle positions and points of impact drawn correctly?

- Citations and Violations: Look to see if any tickets were issued. If the other driver received a citation, it significantly strengthens your case for proving fault.

An error on the police report isn’t just a typo; it’s a potential weakness in your claim. An insurance adjuster may use any inconsistency, no matter how small, to question your version of events or reduce your payout.

Correcting Errors on Your Report

So, what do you do if you find a mistake? Don’t panic. For straightforward factual errors—like a misspelled street name or an incorrect license plate number—you can usually get it fixed by contacting the records division of the law enforcement agency that filed the report. You might need to provide proof, like your vehicle registration, to get an amendment added.

Changing an officer’s opinion or narrative about who was at fault is much more difficult. However, you can still submit your own written statement to the insurance adjuster to clarify your perspective. This is where having solid proof becomes essential. Our certified auto appraisal guide explains how independent reports provide the hard evidence needed to support your side of the story.

Using the Report to Push Your Insurance Claim Forward

Once you have the official police report in hand, it’s time to put it to work. Sending this document to your insurance company is what moves your claim from “pending” to “in process.”

Most insurers make it simple—you can usually upload the PDF directly to their online portal or email it to your assigned adjuster. Whichever method you choose, always keep a copy for your own records.

Think of the report as the objective, third-party proof that insurers need before moving forward. It’s the official story of what happened, and it gets the process started.

But while the accident report for insurance claim is great for establishing who was at fault, its purpose largely stops there. It doesn’t tell the whole story of your financial loss.

Where the Police Report’s Usefulness Ends

The report is powerful for proving liability, but it won’t say anything about the biggest hidden cost of an accident: the permanent drop in your car’s resale value. This is called diminished value.

Insurance companies use their own formulas to decide what your car is worth, but they almost always fail to account for this significant loss in value, leaving you undercompensated.

The accident report for insurance is crucial for proving fault, but it does absolutely nothing to calculate the real financial damage to your vehicle’s market value. That part is on you.

This is the gap you must fill yourself. The police report opens the door, but you need to walk through it with your own evidence to show what your car was worth before the crash and how much value it has lost since.

This is exactly why learning how to file a diminished value claim is so important if you want to get the full amount you’re owed. An independent appraisal report from SnapClaim gives you the hard data needed to back up your claim and negotiate from a position of strength.

When the Police Report Isn’t Enough

Insurers have their own formulas for calculating what your car is worth. The problem is, these valuations almost always ignore critical details like your car’s pre-accident condition, any recent upgrades you’ve made, and the diminished value it now has on the open market. This is exactly why you need more than just the police report to get a fair settlement.

Bridging the Evidence Gap

Think of it this way: the police report proves what happened, but an appraisal proves what your loss is worth. To get a fair settlement that covers your actual financial loss, you have to bring proof that challenges the insurer’s lowball offer. An independent, certified appraisal report is the tool that fills this crucial evidence gap.

A professional appraisal from SnapClaim provides a data-driven valuation reflecting your car’s true market value before the crash and quantifies the loss afterward. It’s the kind of concrete evidence that supports your claim and strengthens your negotiating position. When you need to bring stronger proof, it’s essential to understand your rights; our guide on what a car appraisal after an accident involves can give you critical insights.

An insurer’s primary goal is to close claims for the lowest possible amount. A certified appraisal shifts the negotiation in your favor by replacing their opinion with market-based facts.

Proving Your Claim Beyond the Basics

Without solid proof of loss, vehicle owners often receive less than they are owed. When the police report isn’t cutting it and you find yourself facing legal action, using tools like a comprehensive deposition preparation checklist can be a lifesaver for organizing all your evidence.

With SnapClaim, you get a court-ready appraisal that serves as undeniable proof of your car’s value. We’re so confident in our reports that we offer a money-back guarantee: if the insurance recovery from the claim is less than $1,000, the appraisal fee is fully refunded. This gives you the peace of mind to fight for the fair settlement you deserve.

Frequently Asked Questions About Accident Reports

What if the police didn’t come to the scene of the accident?

This happens often with minor accidents. If police don’t respond, your own documentation becomes the most important evidence. Take clear photos of both cars from every angle, exchange insurance and contact information with the other driver, and get contact details for any witnesses. Some states also allow you to file a self-report with the DMV. In these situations, a professional appraisal is even more vital to prove the full extent of the damage to your insurer.

How quickly do I need to send the report to my insurance company?

Insurance policies often use vague terms like “promptly” or “as soon as practicable.” While there’s no universal deadline for the police report itself, it’s always best to send it to your adjuster the moment you get it. This shows you are proactive and helps get the claims process moving faster, from determining fault to issuing payment.

What if I disagree with the officer’s conclusion in the report?

This is a common concern. Factual mistakes, like a misspelled name, are usually easy to correct by contacting the police department. Changing the officer’s opinion on who was at fault is much harder. Your best move is to write a clear, concise statement explaining your side of the story and submit it to the adjuster along with any supporting evidence you have, like photos, dashcam footage, or witness statements.

Can an insurance company ignore what the police report says?

While insurers are required to consider the report, they are not legally bound by the officer’s conclusion on fault. They conduct their own internal investigation, and the police report is just one piece of evidence—though it is a very influential one. If the insurance company’s finding on fault differs from the report, you’ll need to push back with strong evidence of your own to fight for a fair outcome. For more answers, check out our blog.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This article was reviewed by SnapClaim’s team of certified auto appraisers and claim specialists with years of experience preparing court-ready reports for attorneys and accident victims. Our content is regularly updated to reflect the latest industry practices and insurer guidelines.

Get Started Today

Ready to prove your claim? Generate a free diminished value estimate in minutes and see how much you may be owed.

Get your free estimate today