It is very important to know the total loss vehicle value after an accident. When your insurance company declares your vehicle a “total loss,” it can be confusing. This doesn’t mean your car is worthless; it’s a financial decision that means the cost to repair it is more than the car was worth right before the accident. This pre-accident value, known as the Actual Cash Value (ACV), is the most important number in your claim, as it determines the size of your settlement check.

Understanding Your Vehicle’s Actual Cash Value (total loss vehicle value)

Hearing your car is totaled can be a shock, but the logic is straightforward. Your insurer has decided it makes more financial sense to pay you for the car’s value rather than sink that money into extensive repairs.

The heart of their calculation is the Actual Cash Value (ACV). In simple terms, this is what a buyer would have likely paid for your car moments before the crash. It is not the price you paid for it new, nor is it what it will cost to buy a brand-new replacement.

The Key Difference: ACV vs. Replacement Cost

It’s crucial to understand that ACV and replacement cost are two different concepts.

- Actual Cash Value (ACV): This is what your specific car was worth, with its exact mileage, condition, and options.

- Replacement Cost: This is what you would need to go out and buy a similar car today from a dealer.

Insurers are only required to pay the ACV, which is almost always lower than the retail prices you see on car lots. This gap is why their first settlement offer for your total loss vehicle value can feel disappointingly low.

What Determines Your Car’s Value?

So, how do insurers arrive at that ACV number? It’s a mix of several key data points that paint a full picture of your vehicle’s worth. Here’s a quick breakdown of what they look at.

| Factor | What It Means | Why It Matters for Your Claim |

|---|---|---|

| Make, Model, & Year | The basics of your car’s identity. | This is the starting point for any valuation. A 2022 Honda CR-V has a much different base value than a 2012 Ford Focus. |

| Mileage | How many miles are on the odometer. | More miles mean more wear and tear, which almost always lowers the value. It’s a primary indicator of the car’s remaining lifespan. |

| Overall Condition | The state of the interior, exterior, and mechanics. | Any pre-existing damage—dents, scratches, stained upholstery—will be deducted from the final value. |

| Trim & Options | Factory-installed features and packages. | A sunroof, leather seats, or an advanced tech package add real dollars to your car’s ACV. A base model is worth less. |

| Local Market | The supply and demand for your car in your area. | If your specific model is popular and hard to find locally, its value could be higher. If lots are full of them, it might be lower. |

Understanding these elements is the first step toward making sure you get a fair settlement. Knowing these details is critical when you’re figuring out how much an accident can devalue a car and fighting for what you’re owed.

How Insurers Calculate Your Vehicle’s Worth

When an insurance adjuster makes a settlement offer, it can feel like they pulled a number out of thin air. In reality, it’s a standardized process built for speed, but that efficiency often comes at the cost of accuracy, leaving your car’s unique value behind. Understanding their method is the first step toward getting a fair total loss vehicle value.

Most large insurance companies outsource valuations to third-party data providers like CCC Intelligent Solutions. These companies use massive databases of vehicle sales data to generate a value. The adjuster plugs in your car’s basic info, and the system provides a baseline value. It’s fast, but it treats your car like just another statistic.

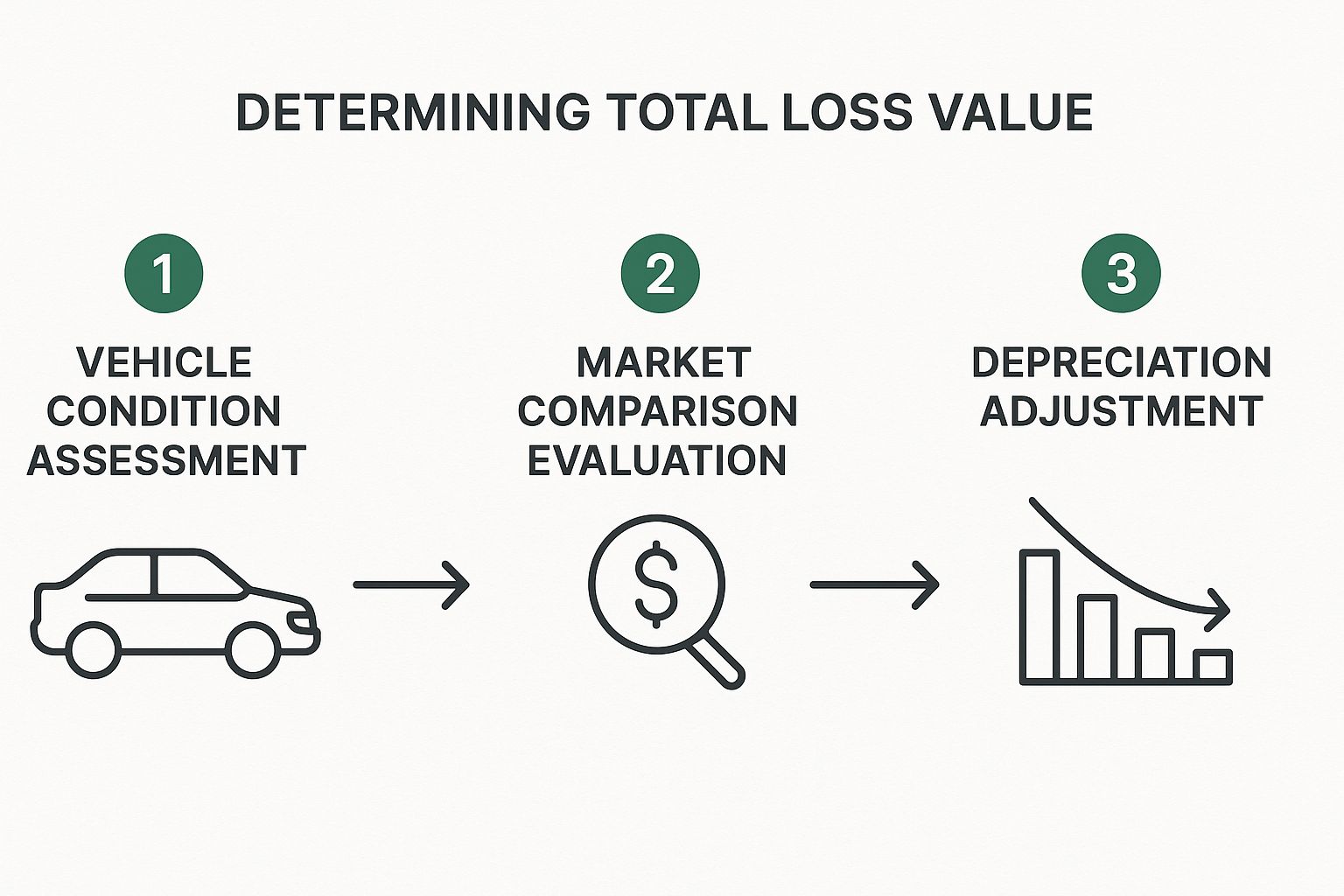

The Standard Valuation Process

At its core, the insurer’s calculation hinges on a few simple data points:

- Vehicle Identification Number (VIN): This tells them the exact year, make, model, and factory-installed options.

- Mileage: The number on the odometer is one of the biggest factors they use to calculate depreciation.

- Geographic Location: The system pulls recent sales data from your specific area to account for local market demand.

- Pre-Accident Condition: The adjuster assigns a rating like “poor,” “average,” or “excellent.” This is one of the most subjective parts of the process.

This infographic breaks down the general workflow insurers use.

The problem is, the most important details about your specific car often get lost in this automated process.

What Insurers Often Overlook

The automated systems that generate these initial offers are built on averages. They aren’t designed to pick up on the specific details that can add hundreds, or even thousands, of dollars to your car’s actual market value.

The insurance company’s valuation is not the final word—it’s the opening bid in a negotiation. Your job is to provide the proof they missed to justify a higher, more accurate settlement.

They routinely miss or undervalue critical elements that contribute to a higher total loss vehicle value. These omissions are incredibly common and can make a huge difference in your payout.

Key areas where insurers fall short:

- Premium Packages: Did your car have the upgraded tech package, a sport-tuned suspension, or a premium sound system? These options often get buried under a generic “trim level” and aren’t valued correctly.

- Recent Major Upgrades: That brand-new set of tires you put on last month? Or the recent brake job? Without receipts, that real, tangible value is invisible to their system.

- Exceptional Condition: If you were meticulous about maintenance and kept your car in pristine, garage-kept condition, it’s worth more than the “average” car they’re comparing it to. Your photos and service records are the proof.

- High Local Demand: Their systems try to track local demand, but they often fail to capture the full premium that private sellers are actually getting.

The insurer’s first number is just their opening play. It’s on you to bring the evidence that tells the full story of your vehicle. If you’re concerned about value loss even if your car is repaired, our diminished value claim calculator can help.

Always demand a copy of their valuation report—it’s your roadmap for finding the errors that will lead you to a fair settlement.

How to Fight a CCC Total Loss Vehicle Value

If your insurer uses a CCC report to calculate your total loss vehicle value, don’t assume their number is final. CCC’s valuation software often undervalues cars by comparing them to cheaper or mismatched vehicles in your area. You have the right to challenge their report by requesting the comparable vehicles used, reviewing their condition and options line by line, and providing your own evidence—such as listings from local dealers, repair receipts, or an independent appraisal. Submitting this documentation can help you prove your car’s true market worth and negotiate a higher settlement.

Uncovering the Hidden Details That Boost Your Car’s Value

It’s a frustrating truth: many car owners leave money on the table because they accept a low total loss vehicle value. They overlook the high-value details that really drive up a car’s price. The insurance company’s software isn’t designed to hunt for these nuances. It’s up to you to document every single thing that makes your car better than average.

Beyond the Basics: Your Trim and Optional Packages

The gap in value between a base model and a fully loaded one can be massive. Insurance valuation tools often gloss over factory-installed packages that add thousands in real-world value. It’s your job to point them out.

Think back to when you bought the car or find the original window sticker. Did your vehicle have any of these?

- Technology or Infotainment Packages: Premium sound systems, oversized touchscreens, built-in navigation, or head-up displays.

- Safety and Driver-Assist Packages: Adaptive cruise control, blind-spot monitoring, 360-degree cameras, and automatic emergency braking.

- Performance or Sport Packages: An upgraded engine, a sport-tuned suspension, bigger wheels, or enhanced brakes.

- Luxury or Comfort Packages: Sunroofs, real leather upholstery, heated and ventilated seats, and premium interior trim.

Without your proof, the adjuster will likely value your car as a base model, a mistake that could cost you dearly.

Documenting Recent Improvements and Maintenance

Have you invested money in your vehicle recently? New parts and major services add tangible value that an insurer’s report will almost certainly miss. These are investments that directly improved your car’s pre-accident condition.

Think of your service records as more than just receipts. They are proof of your vehicle’s superior condition and a powerful tool for justifying a higher valuation.

Compile receipts and invoices for any significant work done in the last year or two:

- New Tires: A full set of new, high-quality tires can easily add hundreds of dollars to the value.

- Major Mechanical Work: Did you recently replace the transmission, timing belt, or major engine components?

- Brakes and Suspension: New brake pads, rotors, or suspension components improve safety and performance.

The Power of Comparable Vehicles (“Comps”)

One of the most effective ways to challenge a low offer is by finding “comparable vehicles,” or “comps.” These are listings for cars that are the same make, model, year, and trim as yours that are for sale in your local area. This gives you real-world evidence of what it would actually cost to replace your car.

A certified car appraisal after an accident from a service like SnapClaim does this heavy lifting for you, delivering an unbiased, data-backed report that puts you in a much stronger negotiating position.

Common Mistakes That Lower Your Settlement

Dealing with a total loss claim is stressful, the first step is knowing the total loss vehicle value and it’s easy to make a wrong move that costs you thousands. The biggest mistake? Blindly accepting the insurance company’s first offer. Treat that initial number as a starting point for negotiations, not the final word on your total loss vehicle value.

Failing to Provide Complete Documentation

A huge error is not giving the adjuster thorough evidence of your car’s true condition. They have no way of knowing you just spent $1,200 on new premium tires or that your vehicle had the top-of-the-line tech package.

It’s up to you to supply the proof. Start gathering this documentation immediately:

- Receipts for recent major repairs (tires, brakes, engine service).

- The original window sticker to prove optional packages.

- Detailed service records to show your car was well-cared-for.

Overlooking Pre-Accident Condition Details

Insurance companies may try to lower your car’s value by pointing out minor pre-existing wear and tear. They might downgrade its condition from “excellent” to “average” because of a few small door dings, which can knock a surprising amount off the final settlement. Be honest but precise about your car’s condition before the accident happened. If your car was in pristine shape, find recent photos to prove it.

Cashing the Settlement Check Too Soon

This is the most final—and costly—mistake you can make. Cashing the settlement check is legally seen as an acceptance of the offer in most states. It slams the door on your claim and ends any chance you have to negotiate for more money.

Never cash the check until you have a final, written agreement that you believe represents the fair market value of your vehicle. Cashing it prematurely signals “case closed” to the insurer.

If you believe the offer is too low, it’s time to push back. Our guide offers a step-by-step process for disputing a total loss offer and shows you how to build a strong case.

Using an Independent Appraisal to Prove Your Car’s Value

You’ve gathered your evidence, but the insurance company’s offer for your total loss vehicle value is still too low. When your own research isn’t enough, an independent appraisal becomes your most powerful tool. Think of it this way: the adjuster is the insurer’s expert. An independent appraiser is your expert, hired to find the true, unbiased market value of your car.

How an Appraisal Levels the Playing Field

An independent appraisal provides the hard proof you need to successfully challenge a low valuation. Unlike the automated software insurers use, a certified appraiser digs deep into your car and your local market.

SnapClaim’s certified reports are built to do just that, focusing on details insurers miss:

- Deep Local Market Analysis: We hunt down current listings and recent sales for your exact make and model in your area to find its true, market-correct value.

- Unique Feature Valuation: Our experts properly credit high-value options like premium tech packages and luxury trims that generic systems undervalue.

- Condition and Maintenance Proof: We factor in your service records and exceptional pre-accident condition to justify a higher value.

A professional appraisal shows the insurer that your counter-offer isn’t just a number you picked. It’s a figure grounded in meticulous research.

The Impact of Depreciation on Your Claim

Understanding depreciation is crucial, as it directly impacts your vehicle’s value. While a car might lose around 12.5% of its value per year on average, this figure varies widely. For example, recent industry reports on vehicle value trends on CCCIS.com show that some vehicle types hold their value much better than others. A proper independent appraisal accounts for these specific depreciation factors, ensuring the valuation reflects where your car truly stood in the market.

An independent appraisal report is the ultimate proof to back up your claim. It transforms a frustrating argument into a straightforward, fact-based discussion.

Removing the Financial Risk with a Guarantee

We understand that paying for an appraisal during a stressful time can feel like a big ask. That’s why SnapClaim removes the risk with our money-back guarantee. If our report doesn’t help you recover at least $1,000 more from the insurance company, we will refund your appraisal fee in full. No questions asked. This guarantee gives you the power to challenge a lowball offer with total confidence. A SnapClaim total loss appraisal is your risk-free path to a fair settlement.

Negotiating a Fair Total Loss Settlement

Once you have your research and an independent appraisal, you’re in a much stronger position. The goal is to build a clear, evidence-based case for a higher total loss vehicle value. Keep the conversation calm and professional, and let the facts do the talking.

Presenting Your Counter-Offer

When you speak with the adjuster, frame the conversation as a collaborative effort. You can say, “I’ve reviewed the offer, and based on my research and a professional appraisal, I believe the actual market value is higher.”

Then, lay out your evidence:

- Lead with the Independent Appraisal: Start with your SnapClaim report. It’s prepared by a certified expert and immediately elevates the conversation.

- Provide Your Comparable Vehicles: Share your list of local “comps” for cars just like yours. It’s hard to argue with what it actually costs to replace your car in your neighborhood.

- Show Your Receipts: Present the paperwork for any recent upgrades like new tires or a major service.

Tips for Effective Communication

How you say it is just as important as what you say.

Always remember: The adjuster is a person doing their job. A calm, respectful, and fact-driven negotiation is far more effective than an emotional one.

Follow these simple rules:

- Keep a Detailed Log: Write down every call and email, noting the date, time, and who you spoke with.

- Confirm Everything in Writing: After a phone call, send a follow-up email summarizing the conversation. This creates a paper trail.

- Stay Focused on the Facts: Stick to the numbers in your appraisal and the evidence you’ve gathered.

If you decide to keep your car, knowing some strategies for selling a salvage car successfully can make a big difference. By building an undeniable case, you give yourself the power to get the fair market value you’re owed. And with SnapClaim’s money-back guarantee, there’s no financial risk.

FAQs About Total Loss Vehicle Value

What happens if I still owe money on my car?

If the insurance payout for your car’s total loss value is less than your outstanding loan balance, you are responsible for covering the shortfall. This situation is referred to as “negative equity.” If you have GAP insurance, it is intended to cover this shortfall, helping you avoid a significant out-of-pocket cost.

What happens if I still owe money on my car?

If the insurance payout for your car’s total loss value is less than your outstanding loan balance, you are responsible for covering the shortfall. This situation is referred to as “negative equity.” If you have GAP insurance, it is intended to cover this shortfall, helping you avoid a significant out-of-pocket cost.

How long does a total loss claim take?

A total loss claim generally takes several weeks to process. This includes the initial evaluation, the insurer’s estimation, a negotiation phase if there’s a disagreement over the offer, and finally, the settlement and payment. Staying organized and proactive can help ensure the process proceeds smoothly.

What is Total Loss Value?

Total loss value is the amount your insurer determines your car was worth prior to the accident, also known as the Actual Cash Value (ACV).

How is Total Loss Value Calculated?

Insurers calculate total loss value based on the car’s condition before the accident, its mileage, and the market value of similar vehicles.

Can I Negotiate the Total Loss Payout?

Yes, you can negotiate the total loss payout. If you believe your insurer has undervalued your car, you can request a review or provide an independent appraisal.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This article was reviewed by SnapClaim’s team of certified auto appraisers and claim specialists with years of experience preparing court-ready reports for attorneys and accident victims. Our content is regularly updated to reflect the latest industry practices and insurer guidelines.

Get Started Today

Ready to prove your claim? Generate a free diminished value estimate in minutes and see how much you may be owed.

Get your free estimate today