After a car accident, it’s important to know how to determine if a car is totaled so you can understand your insurance settlement and next steps with confidence. Understanding how to determine if a car is totaled is the first step toward ensuring you receive a fair settlement. This guide explains the process in clear, simple terms so you can navigate your claim with confidence.

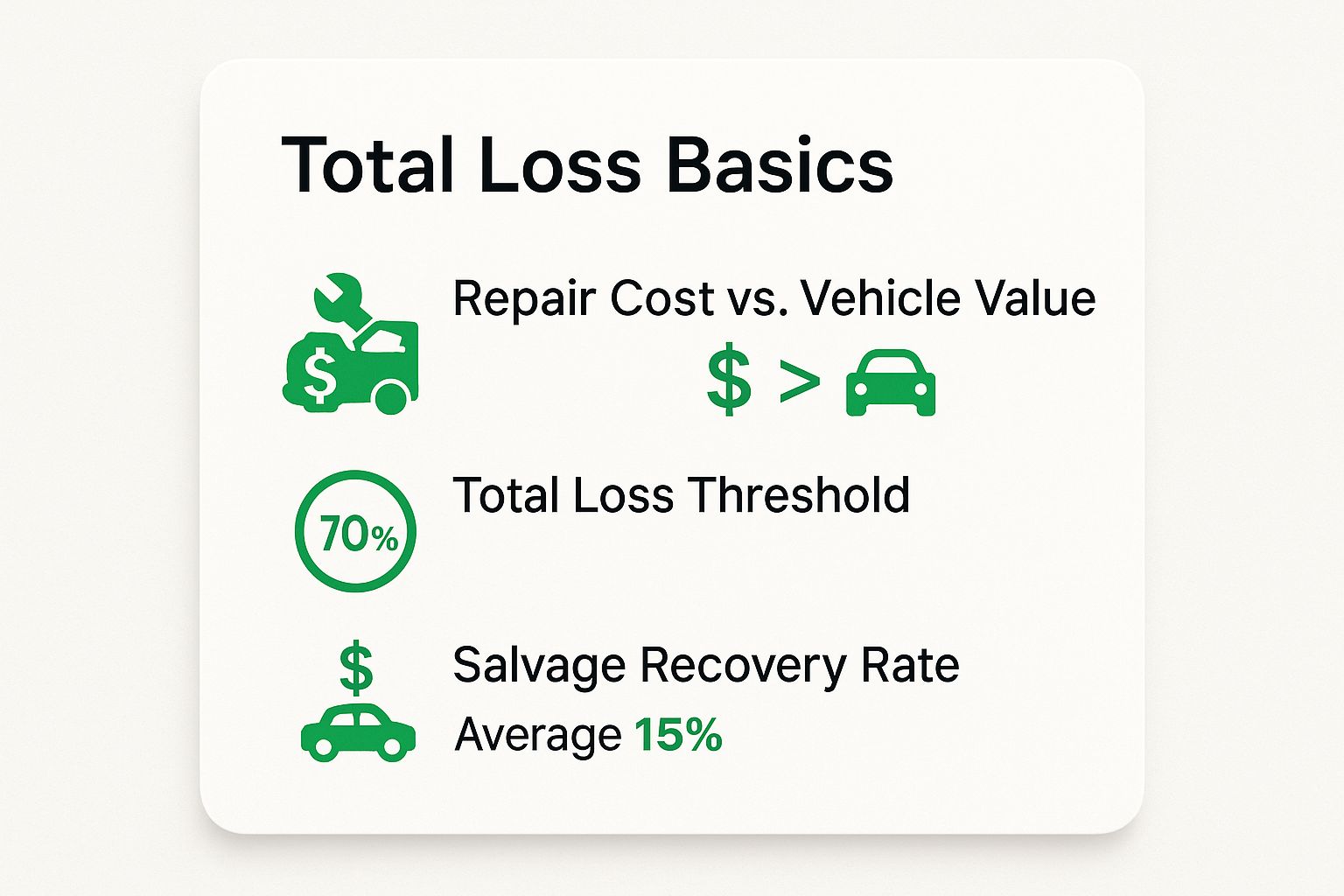

An insurance company declares a car a total loss when the cost of repairs plus its remaining salvage value is greater than its Actual Cash Value (ACV) before the accident. The basic formula is Cost of Repairs + Salvage Value ≥ Actual Cash Value. If the numbers on the left side of that equation are higher, the insurer will almost always deem the car totaled because it’s the most economical decision for them.

The Core Factors to Learn How to Determine if a Car is Totaled

When an adjuster evaluates your vehicle to determine if your car is totaled, their decision isn’t based on visible damage alone. It’s a financial calculation based on three key components that you need to understand to protect your interests.

- Actual Cash Value (ACV): This is the single most important factor. ACV is the fair market value of your car the moment before the collision occurred. It accounts for your vehicle’s year, make, model, mileage, overall condition, and any recent upgrades.

- Cost of Repairs: This is the complete, itemized estimate to restore your car to its pre-accident condition. It includes all necessary parts, labor, and the complex recalibration of modern safety sensors.

- Salvage Value: This is the amount the insurance company can recover by selling your damaged vehicle to a salvage yard or parts reseller through an auction.

The insurer weighs these numbers to make a business decision. Understanding this calculation is crucial for you to determine if their assessment is accurate and fair. You can read about none signs that your car is a total loss after an accident.

The Total Loss Equation at a Glance

To make it even clearer, here’s a quick breakdown of the components an insurance adjuster weighs when looking at your claim.

| Component | What It Means | Why It’s Critical for Your Claim |

|---|---|---|

| Actual Cash Value (ACV) | The fair market value of your vehicle before the accident. | This forms the basis of your settlement offer. An undervalued ACV makes a total loss more likely and reduces your final payout. |

| Repair Estimate | The total projected cost for parts, labor, and paint to fix the car. | High repair costs, especially with advanced vehicle technology, can quickly push a car past the total loss threshold. |

| Salvage Value | The amount the insurer can recover by selling the damaged car for scrap. | The insurer subtracts this from their potential payout. A higher salvage value makes it more financially sensible for them to total the car. |

Understanding the Total Loss Threshold (TLT)

Most states simplify this process with a Total Loss Threshold (TLT). This is a specific percentage of the car’s ACV set by state law. If the estimated repair costs exceed this percentage, the insurer is legally required to declare the vehicle a total loss.

This threshold typically falls between 70% and 80% of the vehicle’s pre-accident value. Once repair costs approach that limit, it becomes impractical for the insurer to approve the repairs.

An insurer’s goal is to close a claim at the lowest possible cost. If paying you the ACV and selling the salvage is cheaper than funding extensive repairs, they will declare it a total loss.

This is why your car’s true ACV is so critical. The entire settlement depends on it. If the insurer undervalues your car, it not only increases the chance of a total loss but also reduces the settlement check they write to you. An independent total loss appraisal provides the proof needed to challenge a low valuation and support negotiations for what your car was truly worth. Kyder law group explains more about how insurance companies determine if a car is totaled in their recent article about total loss cars.

Why Modern Cars Are Totaled So Easily

Have you ever been surprised that a seemingly minor accident resulted in a total loss declaration? The reason often lies hidden within your car’s bumpers and dashboard.

Today’s vehicles are packed with Advanced Driver-Assistance Systems (ADAS) like cameras, radar sensors, and onboard computers designed to improve safety. While effective, these systems have also made repairs incredibly expensive. Even a low-speed impact can damage a network of sensitive electronics that are costly to replace and require precise recalibration.

The Soaring Cost of High-Tech Repairs

A simple bumper replacement is no longer a straightforward job. What once cost a few hundred dollars can now easily exceed several thousand. This is because modern bumpers house critical sensors for systems such as:

- Automatic Emergency Braking

- Blind-Spot Monitoring

- Parking Assist and Rear Cross-Traffic Alerts

After a collision, these systems require more than just new parts. They must be perfectly recalibrated by a trained technician using specialized equipment. This process alone can add hundreds or even thousands of dollars to the repair bill, often pushing the total cost past the car’s total loss threshold.

A car is increasingly declared a total loss due to the high cost of repairing its complex electronics. In 2023, 27% of vehicles in collisions were totaled, a sharp rise from 19% in 2018, largely because recalibrating safety systems after minor impacts dramatically inflates repair estimates. You can discover more insights on this trend at Axios.

This means a car that looks repairable may have extensive, hidden electronic damage. These inflated repair costs can also significantly impact your vehicle’s resale value, making a history of high repair costs a major red flag for any potential buyer.

How to Calculate Your Car’s Actual Cash Value

When an insurance adjuster presents their initial offer for your car’s value, it’s important to view it as a starting point for negotiation. Insurers calculate the Actual Cash Value (ACV)—what your vehicle was worth the moment before the crash—to determine if it’s a total loss. Accepting their first number without verification could mean leaving thousands of dollars on the table.

The good news is that you can research this value yourself. The ACV is based on real-world market data that you can use to build your case for a fair settlement.

Once Determined if a car is Totaled , Key Factors That Determine Your Car’s Value

An insurer’s valuation report often relies on a generic database that may not account for your car’s specific details. To negotiate effectively, you need to gather your own evidence based on what truly determines its value.

- Make, Model, Year, and Trim Level: A higher-end trim package is worth more than a base model—a detail adjusters sometimes overlook.

- Mileage: Lower mileage almost always corresponds to a higher value.

- Overall Condition: This is where you can make a significant impact. Was your car garage-kept with a spotless interior? Photos and service records provide powerful proof.

- Recent Upgrades: Did you recently buy new tires for $1,000 or install a premium audio system? Receipts for these enhancements add real value.

Your car’s true ACV is based on its specific condition and features right before the collision. A generic valuation from an insurer’s system may overlook details that significantly increase what you’re owed.

Finding Comparable Vehicles (“Comps”)

The most effective tool for negotiation is proof of what similar cars are selling for in your local market. You need to find “comps”—vehicles that are the same make, model, year, and trim, with similar mileage and in a similar pre-accident condition.

Search local dealership websites and online marketplaces to establish a realistic price range. If the insurer’s offer is significantly lower than what these comps are selling for, you have concrete data to challenge their valuation. A certified car appraisal after an accident from SnapClaim performs this comprehensive research for you, compiling the market data into a professional report that provides the proof needed for negotiations.

Understanding Your State’s Total Loss Rules

The process to determine if a car is totaled is not the same everywhere. The rules can change significantly from one state to another, as each state sets its own laws dictating when an insurance company must declare a vehicle a total loss.

Most states use a Total Loss Threshold (TLT), which is a specific percentage of the car’s ACV. If the repair estimate exceeds that percentage, the insurer must classify the car as a total loss. A few states use a more flexible Total Loss Formula (TLF), which gives the insurer more discretion.

How State Thresholds Impact Your Claim

The difference in these rules can be substantial. A car might be considered repairable in one state but an automatic total loss in another, even with identical damage and value. Familiarizing yourself with your local regulations is a critical step in any claim.

For example, a state with a high 100% TLT will see more cars repaired compared to a state with a strict 50% TLT. Knowing this number helps you anticipate the insurer’s likely decision.

Example Total Loss Thresholds by State

To illustrate how much these thresholds can vary, consider these examples. A vehicle with damage costing 60% of its value would be repaired in Texas but would be an automatic total loss in Iowa.

| State | Total Loss Threshold | What This Means for Your Claim |

|---|---|---|

| Texas | 100% of ACV | Insurers can repair cars with very high damage before a total loss is required. |

| Colorado | 100% of ACV | The repair cost must meet or exceed the car’s full pre-accident value to be totaled. |

| New York | 75% of ACV | If repairs cost more than 75% of the car’s value, it must be declared a total loss. |

| Iowa | 50% of ACV | This is one of the strictest thresholds, leading to more cars being totaled for less damage. |

Because these laws are location-specific, it is wise to check the current rules for your state. Your local Department of Motor Vehicles (DMV) website is an excellent resource for this information. Regardless of your state’s rules, an independent appraisal from SnapClaim gives you leverage by providing undeniable proof of your car’s true value.

What to Do When You Disagree With the Insurer

Receiving a low settlement offer or disagreeing with a total loss decision can be frustrating. However, you are not required to accept an insurer’s first offer. You have the right to negotiate a fair outcome, provided you come prepared with factual evidence.

Your first step should be to request the insurer’s complete valuation report. This document details how they calculated your car’s Actual Cash Value (ACV), including the comparable vehicles they used. Review this report carefully for errors, such as an incorrect trim level, missing features, or comps from distant markets with lower vehicle values.

Gather Your Own Evidence

To effectively counter the insurer’s report, you need to build a strong, evidence-based case for a higher valuation. Collect all documents that prove your car’s pre-accident condition and value:

- Maintenance Records: Proof of regular servicing demonstrates that your car was well-maintained.

- Receipts for Recent Upgrades: Documentation for new tires, brakes, or other enhancements adds tangible value.

- Pre-Accident Photos: Clear photos showing your car in excellent cosmetic condition can be very persuasive.

Your insurance policy is a contract, and understanding its terms is your best defense. When disputes arise, knowing your rights is critical. With motor vehicle crashes costing an estimated $513.8 billion annually according to the National Safety Council, it’s understandable that insurers manage claim payouts carefully.

The most powerful tool in your negotiation toolkit is an independent appraisal. An insurer’s valuation serves their interests; a certified appraisal serves yours.

A SnapClaim report provides the unbiased, data-driven proof needed to effectively push back against a lowball offer. It presents a comprehensive market analysis that helps strengthen your position for a fair negotiation. For a detailed guide, see our article on how to dispute a total loss offer.

We also offer a money-back guarantee: if your insurance recovery from the claim is less than $1,000, we will fully refund your appraisal fee. It’s a risk-free way to ensure you are treated fairly.

Secure the Fair Settlement You Deserve

Navigating a total loss claim can feel overwhelming, but being informed is your greatest advantage. The insurance company’s initial settlement is just that—an offer. It is a starting point for negotiation, not the final word.

To secure a fair outcome, you must understand the total loss formula, recognize how modern technology inflates repair costs, and, most importantly, research your car’s true pre-accident value. When you present factual evidence, you create a more level playing field.

The insurance company’s goal is to settle claims for the lowest possible cost, which can result in undervalued offers. Your goal is to recover the full amount you are rightfully owed.

A SnapClaim report provides the expert, data-driven documentation needed to advocate for yourself with confidence. It delivers the proof you need to challenge an undervalued offer and helps strengthen your negotiating position.

Even if your vehicle is repaired, you may still be entitled to additional compensation for its loss in resale value. Our guide explains how to file a diminished value claim for repaired vehicles. Don’t leave money on the table. Protect your investment with a certified, independent appraisal to ensure you receive the fair compensation you deserve.

Frequently Asked Questions About Total Loss Claims

Can I keep my car if it’s declared a total loss?

Yes, in most states, you have the right to keep your vehicle through a process called “owner retention.” The insurance company will pay you the car’s Actual Cash Value (ACV) minus its salvage value. However, the vehicle will be issued a “salvage title,” which makes it very difficult to insure or sell in the future, and you will be responsible for all repair costs.

Does my auto loan go away if my car is totaled?

No, you are still responsible for the entire remaining balance of your auto loan. The insurance company will typically send the settlement check directly to your lender to pay off as much of the loan as possible. If the settlement is less than what you owe, you are responsible for paying the difference. This is why GAP (Guaranteed Asset Protection) insurance is valuable, as it is designed to cover this “gap.”

What if the repair estimate is just below the total loss threshold?

This situation requires caution. It is common for additional “hidden” damage to be discovered once a mechanic begins disassembling the vehicle. This supplemental damage can easily push the final repair cost over the total loss threshold, resulting in a delayed total loss declaration. Obtaining an independent appraisal upfront establishes your car’s true value, helping you make an informed financial decision from the beginning.

How can I prove my car was in excellent condition before the accident?

Documentation is key. Provide the insurer with recent photos of your vehicle, complete service and maintenance records, and receipts for any recent upgrades or new parts (like tires or brakes). This evidence helps justify a higher Actual Cash Value by proving your car was well-maintained and in better-than-average condition for its age and mileage.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This article was reviewed by SnapClaim’s team of certified auto appraisers and claim specialists with years of experience preparing court-ready reports for attorneys and accident victims. Our content is regularly updated to reflect the latest industry practices and insurer guidelines.

Get Started Today

Ready to prove your claim? Generate a free diminished value estimate in minutes and see how much you may be owed.

Get your free estimate today