That gut-wrenching moment after a collision is confusing enough. When you see deployed airbags, one question immediately jumps to mind: if airbags deploy is the car totaled?

While airbag deployment is a serious indicator of a major accident, it doesn’t automatically mean your car is a total loss. The final decision is a purely financial one made by your insurance company. This guide will walk you through how insurers make that call and how you can ensure you receive fair compensation.

A Major Sign, but Not an Automatic Total Loss

Insurance companies use a straightforward formula to decide your car’s fate. If the cost to safely repair your vehicle exceeds a certain percentage of its pre-accident value—known as its Actual Cash Value (ACV)—they’ll declare it a total loss.

Airbags are lifesavers, designed to deploy only in moderate to severe crashes. Frontal airbags have saved over 50,000 lives in the U.S. alone, according to the Insurance Institute for Highway Safety. Deployment thresholds vary by manufacturer, but they typically activate in impacts equivalent to hitting a solid barrier at 8-12 mph. This means the crash had significant force.

Why Deployment Signals a Potential Total Loss

A deployed airbag instantly tells an insurance adjuster two critical things:

- The Impact Was Significant: Airbags don’t deploy in minor fender benders. The crash had enough force to trigger the vehicle’s core safety systems, which strongly suggests deeper, more expensive structural damage is likely.

- The Repair Bill Will Be High: Replacing an airbag system is incredibly expensive. The repair involves replacing sensors, the control module, and often big-ticket items like the dashboard or steering wheel—all before bodywork even begins.

An adjuster sees a deployed airbag and immediately knows the repair estimate will start in the thousands. This puts the car much closer to the total loss threshold right from the start. Ultimately, the decision comes down to that financial formula, not just a single part.

You can get a deeper dive into the numbers by checking out our guide on how to tell if your car is totaled. The key is always comparing the professional repair estimate against your car’s true pre-accident market value.

How Insurers Calculate a Total Loss Settlement

To understand why airbag deployment often leads to a total loss, you need to see the situation through an insurer’s eyes. They use a specific financial formula that boils down to two key numbers: the car’s value and the cost to repair it.

The first, and most important, number is your car’s Actual Cash Value (ACV). This is not what you paid for the car or what you owe on it. ACV is what your vehicle was worth on the open market in the moments right before the accident.

To determine ACV, insurers look at:

- Age and Mileage: An older car with more miles is naturally worth less.

- Condition: Pre-existing dings, scratches, or mechanical issues lower the value.

- Trim Level and Options: A fully loaded model has a higher ACV than a base model.

- Recent Sales Data: They check what similar cars have recently sold for in your local area.

The Repair Cost vs. Value Equation

The second number is the total estimated cost to repair the vehicle. This covers everything—parts, labor, paint, and the recalibration of advanced safety systems.

Once the adjuster has the ACV and the repair estimate, they compare them. This simple math problem decides whether your car is officially a total loss.

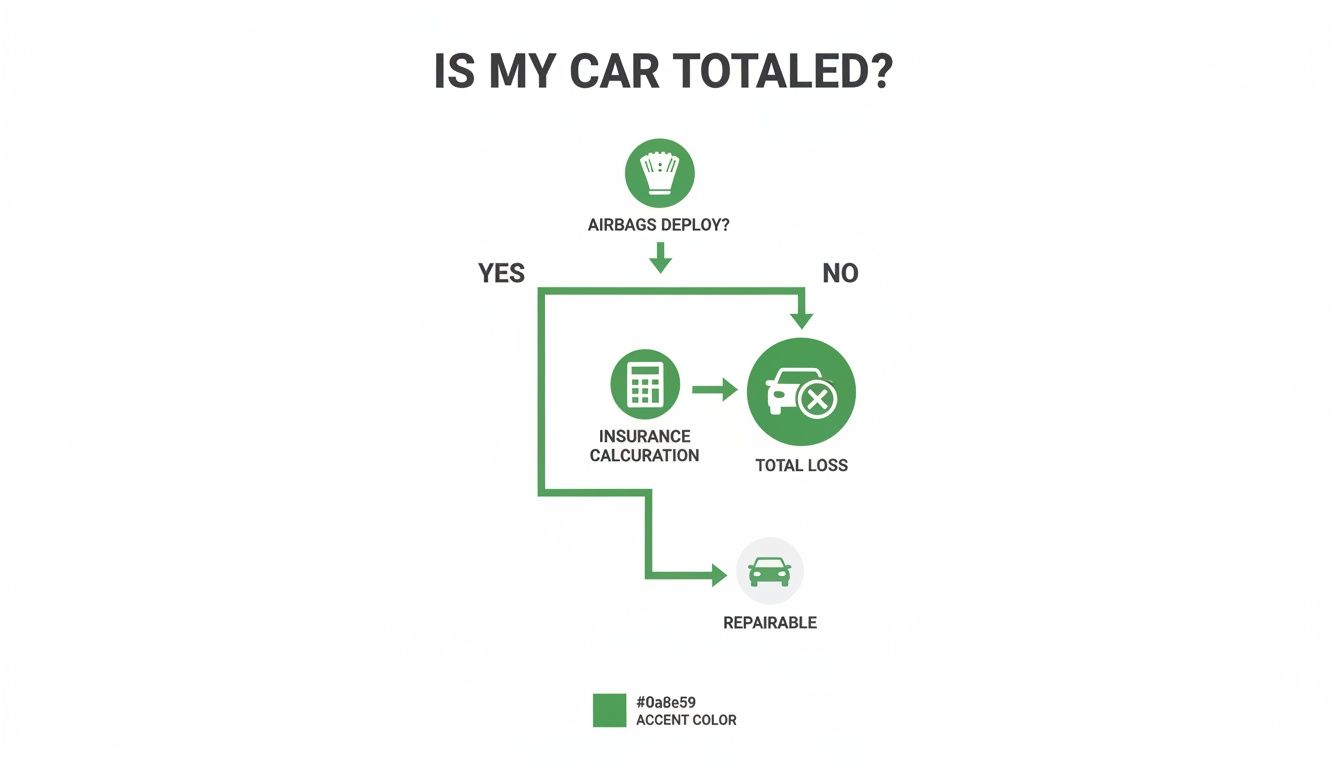

This flowchart breaks down the logic insurers use after airbags go off.

As you can see, the airbag deployment kicks off the financial calculation. It’s that calculation, not the deployment itself, that makes the final call.

Understanding the Total Loss Threshold

Every state has a rule dictating when an insurer must declare a vehicle a total loss. This is the Total Loss Threshold (TLT), a set percentage of the car’s ACV.

For example, if your car’s ACV is $10,000 and your state has a 75% TLT, a repair estimate over $7,500 requires the insurer to total it.

Some states use a “Total Loss Formula” where repair costs plus the car’s remaining salvage value must exceed its ACV. It’s smart to know the general law about car accidents in Ontario or similar rules in your area.

Insurers often present a low initial ACV offer by using outdated data or poor “comparable” vehicles. Our guide explains how a fair total loss calculation should be done. A data-backed appraisal from SnapClaim provides the proof you need to negotiate fairly and challenge an undervalued claim.

Unpacking the High Cost of Airbag System Repairs

Many drivers are blindsided when a seemingly repairable crash leads to a shocking five-figure estimate. More often than not, the airbag system is the culprit. Fixing it is far more complex than just replacing the bag; a deployment sets off an expensive chain reaction.

When an airbag deploys, it’s a one-time event. The entire system is engineered to work together, but once used, a host of components must be replaced to ensure future safety. This is exactly why a deployed airbag is such a strong indicator your car might be totaled.

Beyond the Bag: The Cascade of Component Replacements

The true cost of an airbag repair is hidden in the interconnected parts that activate simultaneously. The explosive force of the deployment also causes collateral damage to expensive interior pieces.

Here’s a look at what usually needs to be replaced:

- The Airbags Themselves: Every deployed airbag module—driver, passenger, side-curtain, knee, or seat-mounted—must be replaced. Each one can cost hundreds or even thousands of dollars.

- The Airbag Control Module (ACM): This is the system’s brain. Once it logs a deployment, it must be replaced to guarantee it will work correctly in a future crash.

- Impact and Weight Sensors: These delicate sensors around the vehicle detect a crash and tell the ACM when to fire the bags. They are often replaced to prevent malfunctions.

- Seatbelt Pre-Tensioners: During a collision, a small explosive charge pulls the seatbelt tight. These fire with the airbags and are a mandatory replacement.

A single driver-side airbag can easily cost $1,000 – $2,000 for the part and labor. Add multiple bags, the control module, sensors, and seatbelts, and the bill climbs sky-high before any bodywork begins.

The Hidden Costs of Cosmetic Repairs

After the safety system is addressed, the body shop must fix the visible damage caused by the airbags bursting through interior panels.

These necessary cosmetic repairs add significantly to the total cost:

- Dashboard and Steering Wheel: The driver’s airbag destroys the center of the steering wheel, while the passenger airbag often shatters the dashboard. Replacing these large, molded parts can cost $2,000 to $4,000 or more.

- Headliner and Interior Trim: Side-curtain airbags deploy from the roofline, usually requiring replacement of the entire fabric headliner and damaged plastic pillar trim.

- Windshield: The force of a passenger airbag can be enough to crack the windshield, adding another major expense.

Modern airbag systems are highly sophisticated. As Consumer Reports highlights, technological leaps have made today’s systems far safer than early designs. You can read the full history of airbag safety challenges to appreciate their complexity.

How Costs Add Up: A Real-World Scenario

Let’s use a real-world example. Imagine a five-year-old sedan with a pre-accident value of $16,000. In a state with a 75% total loss threshold, any repair estimate over $12,000 will total the car.

Here’s how quickly those costs can accumulate from a moderate front-end collision.

Estimated Costs for Common Airbag System Components

The table below breaks down potential costs for parts and labor in a typical airbag system repair. These are estimates—luxury vehicles can be significantly more expensive.

| Component | Estimated Part Cost | Estimated Labor Cost | What It Does |

|---|---|---|---|

| Driver Airbag Module | $400 – $1,000 | $100 – $200 | Protects the driver in a frontal collision. |

| Passenger Airbag Module | $500 – $1,500 | $200 – $400 | Protects the front passenger. |

| Side-Curtain Airbags (Pair) | $600 – $1,200 | $300 – $500 | Deploys from the roofline to protect from side impacts. |

| Airbag Control Module (ACM) | $500 – $1,000 | $150 – $300 | The "brain" that controls airbag deployment. |

| Seatbelt Pre-Tensioner (Each) | $250 – $500 | $100 – $200 | Tightens the seatbelt an instant before impact. |

| Dashboard Assembly | $1,500 – $3,000+ | $500 – $1,000 | The cosmetic panel the passenger airbag bursts through. |

Plugging these numbers into our scenario:

- Driver & Passenger Airbags: $3,000

- Airbag Control Module: $800

- Seatbelt Pre-Tensioners (x2): $1,000

- New Dashboard Assembly: $2,500

- Labor for All System Components: $2,000

Just for the airbag system and interior work, the bill is already $9,300. This leaves only $2,700 for all external bodywork—the bumper, fenders, headlights, paint, and potential frame alignment. It’s easy to see how a crash that looks manageable can quickly cross the total loss threshold.

Looking Beyond Airbags for Hidden Structural Damage

A deployed airbag is a huge red flag for an insurance adjuster. It’s a clear sign that the impact was severe enough to trigger the car’s last line of defense, meaning expensive problems are likely hiding out of sight.

Think of your car’s frame or unibody as its skeleton. If that skeleton is bent, twisted, or cracked, the vehicle’s integrity is compromised, making any future collision far more dangerous. An adjuster isn’t just thinking about a new fender; they’re worried about the car’s fundamental safety.

This is why they perform detailed inspections, like those recommended by the National Highway Traffic Safety Administration (NHTSA). Adjusters use specialized tools to find frame damage an untrained eye would miss, which is a big reason why getting an independent appraisal is so important.

The Ripple Effect of a Major Impact

When a car takes a hard hit, the force travels through the entire vehicle. These hidden issues are what drive repair costs through the roof and push a car into total loss territory.

Adjusters hunt for these common, but often hidden, problems:

- Bent or Cracked Frame: This is the big one. Fixing a compromised frame requires specialized equipment and is incredibly labor-intensive. It’s often the final nail in the coffin.

- Damaged Unibody Structure: Most modern cars are built with a unibody. If key structural points like crumple zones, pillars, or the firewall are damaged, a proper repair can be next to impossible.

- Fried Electronics and Wiring: A violent impact can shred wiring harnesses or short-circuit control units (ECUs). Replacing these systems is incredibly expensive.

- Compromised Suspension and Alignment: The collision’s force can wreck control arms, struts, and other critical suspension parts, making the car unsafe to drive.

Recalls and Pre-Existing Defects Matter

The condition of the airbag system itself can sway an insurer’s decision. For example, defective airbags have led to the largest auto recall in U.S. history, impacting 42 million vehicles.

A vehicle with an open recall may have a lower fair market value, making it easier for an insurer to declare it a total loss. You can learn more about how defective airbags impact personal injury cases to understand the full scope.

An insurance company weighs all factors contributing to a vehicle’s value and repair cost. When they see a deployed airbag, they launch a deep dive into the car’s structural integrity because that’s where budget-busting problems usually live. This is why you should never accept an initial offer without an independent appraisal from a service like SnapClaim.

What Happens When Your Car Is Repaired but Loses Value

So, the repair bill came in just under the total loss threshold, and you have your car back. It might look as good as new, but a permanent black mark now exists on its vehicle history report. This loss in resale value is called diminished value.

Diminished value is the real-world difference between what your car was worth moments before the crash and what it’s worth now with a major collision on its permanent record.

Understanding the Impact of Diminished Value

Imagine you’re buying a used car. You find two identical models, but one has a documented major accident with airbag deployment. Which one would you pay top dollar for? The answer is obvious. The repaired car is now worth significantly less—a real financial hit to you.

Even with perfect repairs, a vehicle with a serious accident history is less desirable to any informed buyer. This is the market reality that justifies a diminished value claim, especially if the accident wasn’t your fault.

How to Recover Your Car’s Lost Value

To recover this loss, you must file a diminished value claim against the at-fault driver’s insurance. However, insurance companies rarely volunteer to pay. They often argue that their repairs restored the car to its pre-accident condition.

This is where you need proof. A strong diminished value claim is built on:

- Proof of the Accident’s Severity: The fact that the airbags deployed is powerful evidence.

- Detailed Repair Invoices: These documents show how extensive the damage was.

- A Certified Appraisal Report: This is your key tool. A professional appraisal from SnapClaim provides an unbiased, market-backed calculation of your car’s true diminished value.

Our guide on how to claim diminished value breaks down the entire process. Even if your vehicle isn’t totaled, its value can decrease significantly, making it possible to file a diminished value claim. A SnapClaim report provides the certified data you need to negotiate a fair settlement.

Securing Fair Compensation for Your Vehicle

After a crash, it’s easy to feel powerless against a massive insurance company whose goal is to close your claim for the least amount of money possible. This often leads to a lowball offer that doesn’t cover your actual financial loss.

You don’t have to accept their first offer. Protecting your financial interests starts with a clear plan. Remember, their initial settlement figure is just an opening bid.

Your Action Plan for a Fair Settlement

When an insurer gives you their initial Actual Cash Value (ACV) for your car, they are starting a negotiation. You can take back control with these steps:

- Question the Initial Offer: Politely ask for the full valuation report. Scrutinize the “comparable” vehicles they used. Are they truly similar to your car in trim, mileage, and condition?

- Get an Independent Repair Estimate: Get a second or third estimate from a repair shop you trust. This provides a clearer picture of the real repair costs.

- Challenge a Low ACV Assessment: If their valuation feels low, it probably is. This is the most important part of the negotiation, and having your own evidence is your most powerful tool.

The Power of a Certified Appraisal

Arguing with an insurer without your own data is an uphill battle. A SnapClaim Total Loss appraisal is critical. Our reports are data-backed valuations based on a real-time analysis of what cars just like yours are actually selling for.

When you present a certified appraisal, the conversation immediately changes from opinion to fact. You are no longer just another claimant; you are an informed owner with proof to back up your demand for a higher payout. Our certified reports provide the market-verified evidence needed to prove your vehicle’s true pre-accident car value and helps strengthen your claim.

We are so confident in our methodology that we offer a Money-Back Guarantee. If your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee—guaranteed.

Common Questions About Total Loss and Airbag Deployment

Here are answers to common questions vehicle owners have after an accident involving airbag deployment.

Can I Keep My Car if It Is Declared a Total Loss?

Yes, in most states, you can “owner-retain” your vehicle. The insurer will pay you the car’s Actual Cash Value (ACV), minus its salvage value and your deductible. However, the vehicle will be issued a salvage title, which makes it very difficult to insure, register, or sell. You will also be responsible for all repairs.

Is a Car with a Salvage Title Unsafe to Drive?

Not necessarily, but extreme caution is required. A salvage title means an insurer decided the car wasn’t worth fixing. To be driven legally again, it must be professionally repaired and pass a strict state inspection to receive a “rebuilt” title. While a rebuilt car can be safe, there’s always a risk of hidden structural or electronic issues.

Can I Claim Diminished Value if the Accident Was Not My Fault?

Absolutely. If the other driver was at fault, you are entitled to file a third-party diminished value claim against their insurance. This claim is designed to compensate you for the drop in your car’s resale value caused by the accident. To succeed, you need objective proof, which is why a certified appraisal from a service like SnapClaim is essential.

Will My Insurance Rates Go Up if My Airbags Deployed?

The airbag deployment itself doesn’t cause a rate hike. Your rates are more likely to increase based on who was at fault for the accident and the total claim payout. An accident severe enough to deploy airbags is always considered major, so if you are found at fault, you should expect your rates to increase at renewal.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This guide was reviewed and verified by SnapClaim’s auto appraisers, who specialize in diminished value and total loss disputes. Our team continually updates every article to reflect current insurer guidelines, valuation standards, and court-accepted appraisal practices, ensuring that you’re relying on information trusted by professionals nationwide.

Get Started Today

Whether you’re challenging a low total loss settlement or proving your vehicle’s post-repair loss in value, SnapClaim makes it simple to take the next step. Generate a free diminished value or total loss estimate in minutes and see how much compensation you may be owed.

👉 Get your free estimate today or order a certified appraisal report!