Negotiating a total loss settlement is your chance to challenge an insurance company’s lowball offer for your vehicle. It’s the process of using solid evidence to prove what your car was really worth right before the accident—its Actual Cash Value (ACV)—to get the fair payout you deserve. Don’t just accept the first offer; it’s almost always a starting point, and taking it could leave thousands of dollars behind.

Your Car Is Totaled—Now What Happens?

Hearing an insurance adjuster say your car is a “total loss” is a frustrating experience. It kicks off a confusing financial process that leaves most drivers unprepared and stressed. This declaration isn’t just about the damage; it’s a cold, hard economic calculation.

A vehicle is declared a total loss when the cost to repair it is more than it was worth before the crash. Insurers use a specific formula to decide it’s cheaper to pay you out than to fix the car.

The key phrase here is their valuation. The initial insurance total loss payout they offer is based on their own assessment of your car’s ACV. The first 48 hours after they make that call are critical. This is your window to protect your rights and set the stage for a successful negotiation.

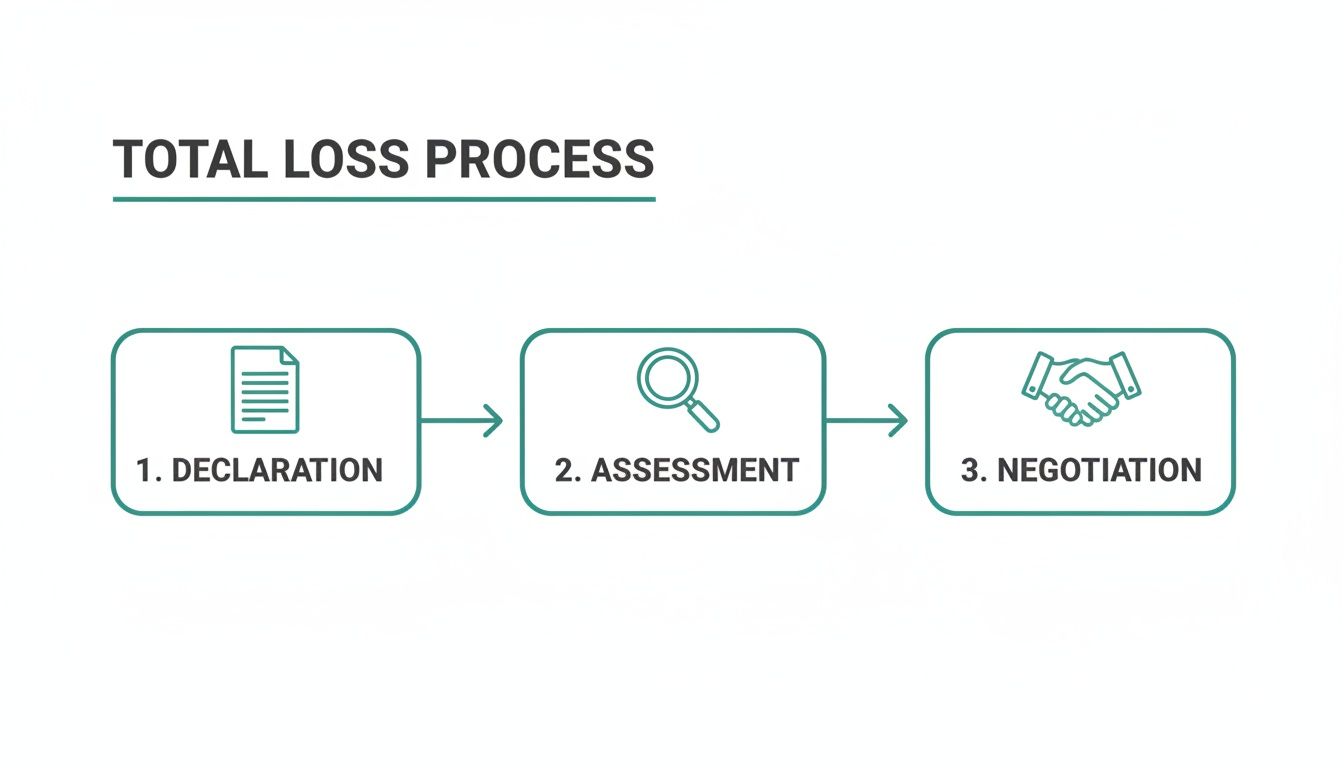

The Total Loss Journey Explained

The path from the crash to the final check usually follows three main stages: the declaration, the assessment, and the negotiation.

Seeing it laid out like this makes one thing clear: negotiation isn’t an unexpected conflict. It’s a built-in part of the system that you can prepare for.

Immediate Steps After a Total Loss Declaration

What you do right after the insurer declares your car a total loss matters. Don’t let them rush you into a quick decision. Instead, take these measured steps to prepare for what comes next.

This table breaks down the essential first moves that will protect your claim from the very beginning.

| Action Item | Why It's Critical | Expert Tip |

|---|---|---|

| Do Not Sign Anything | Signing a release or the vehicle title too soon can permanently waive your right to negotiate for a higher amount. | Politely tell the adjuster, "I need some time to review the offer and my documentation before I can sign anything." |

| Request the Valuation Report | This is the insurer's playbook. It shows exactly how they came up with their number, including the "comps" (comparable vehicles) they used. | Email the adjuster: "Please send me a complete copy of the valuation report used to determine the ACV for my vehicle." |

| Gather Your Records | This is your evidence. Maintenance receipts, records for new tires or brakes, and the original window sticker prove your car's superior condition and features. | Create a digital folder and scan everything. Having it all organized and ready to send makes you look professional and serious. |

Taking control early flips the script. You go from being a passive recipient of an offer to an active, informed participant in the process.

For a deeper dive into the immediate aftermath, you can learn more about what to expect when your car is totaled in our detailed guide. This initial prep work is the foundation for successfully negotiating your total loss settlement.

Why Insurance Companies Get Actual Cash Value Wrong

The entire process of negotiating a total loss settlement comes down to three words: Actual Cash Value (ACV). This isn’t just jargon; it’s the amount your insurance company is legally required to pay you.

Simply put, ACV is what your car was worth on the open market a moment before it was wrecked. It’s what someone would have paid to buy your car in its pre-accident condition. The problem is that an insurer’s first calculation often misses the mark, sometimes by thousands of dollars.

Their first offer is almost never their best. It’s an opening bid based on valuation models that can easily work against you. Knowing how they come up with that number is the key to getting a fair insurance total loss payout.

Common Tactics Used to Undervalue Your Car

Insurance companies are businesses trying to control their costs. They rely on standardized third-party valuation services that are notorious for producing lowball offers.

Here are the most common ways they get it wrong:

- Cherry-Picking “Comps”: The valuation report will list comparable vehicles (“comps”) recently sold near you. Insurers often pick the ones that drag your value down—base models, cars in worse condition, or those with higher mileage.

- Applying Unfair Condition Adjustments: An adjuster might deduct money for tiny pre-existing scratches or normal tire wear. These deductions are often subjective and exaggerated, chipping away at your car’s real value.

- Using Outdated or Flawed Reports: The tools they use can rely on old data or miss high-value options and packages that made your car worth more.

The insurer’s valuation is just an opinion backed by their preferred data. Your job is to counter with a better opinion backed by better evidence.

How State Laws Influence the Total Loss Threshold

What qualifies as a “total loss” also changes from state to state. Most states declare a car totaled when repair costs hit 70-75% of the vehicle’s ACV. Some states, like Texas, use a 100% threshold, meaning repairs must exceed the car’s entire value.

This can lead to insurers pushing for repairs when they shouldn’t, leaving you with a poorly fixed car. Understanding your state-specific laws is crucial for protecting your rights.

The Real-World Impact of a Bad ACV

Imagine you had a well-maintained SUV with a premium trim package and recently spent $1,000 on new tires.

The insurer’s report might pull comps for a basic model with worn tires, instantly ignoring the extra value you had. They might also apply a “fair” condition rating, docking you $500 for minor dings. These “small” deductions add up fast, leaving you with an offer that won’t come close to buying a similar replacement vehicle.

This is exactly why you have to get involved. You know your car better than anyone, and SnapClaim can help you build a powerful, data-backed counteroffer.

Building a Counteroffer with Rock-Solid Evidence

An insurance adjuster’s job is to close claims quickly and within budget. Your opinion of what your car was worth won’t move them, but cold, hard data will. Building a strong counteroffer means replacing their questionable evidence with your own undeniable proof.

The initial offer is based on their version of the facts. Now, it’s your turn to paint a more accurate picture. This is where you shift the conversation from a subjective disagreement to an objective, fact-based discussion—a critical step in negotiating a total loss settlement.

Find Your Own Comparable Vehicles

The most powerful tool in your arsenal is a solid list of comparable vehicles (“comps”) for sale in your local area. The insurer did this, but they often cherry-pick examples that support their low number. Your job is to find the comps that truly match your car’s pre-accident condition and features.

Search online marketplaces like Kelley Blue Book, AutoTrader, or local dealership websites. Here’s what to look for:

- Keep It Local: The vehicles must be for sale within a reasonable distance—think a 50 to 100-mile radius. This proves the fair market value in your market.

- Match the Specs: Match the year, make, and model. Pay close attention to the trim level (e.g., a premium EX-L versus a base LX).

- Mind the Mileage: Find cars with mileage similar to yours. A car with 50,000 miles is valued differently than one with 90,000.

- Don’t Forget the Extras: Did your car have a sunroof, premium sound system, or advanced safety package? Find listings that include those same valuable options.

Take screenshots of at least three to five strong comps. Make sure the listing price, VIN, mileage, and features are clearly visible. This simple step creates a data-backed average that’s much harder for an adjuster to argue with.

Document Every Last Added-Value Item

Next, you need to prove your vehicle was in better-than-average shape. Adjusters almost always apply generic deductions for “wear and tear.” Show them precisely why your car deserves more.

Pull together a simple file with every receipt and record for anything that added value.

Make sure you gather documentation for:

- New Tires: A quality set of tires can easily add hundreds of dollars to a car’s value.

- Recent Major Maintenance: Did you just sink money into replacing the brakes or timing belt? Show them the invoice.

- Upgrades: This covers everything from a new stereo to a remote starter or high-end floor mats.

- Exceptional Condition: If you kept your car spotless and have photos from before the accident to prove it, use them to counter any unfair “condition adjustments.”

This evidence directly challenges any unfair deductions the insurer used to lower your car value after accident.

Evidence Checklist for Your Total Loss Counteroffer

Use this table to gather every piece of documentation you need. The more complete your file, the stronger your negotiating position will be.

| Evidence Type | What to Collect | Where to Find It |

|---|---|---|

| Comparable Vehicles | Screenshots of 3-5 local listings with VIN, mileage, price, and options visible. | AutoTrader, Cars.com, KBB.com, local dealership websites. |

| Recent Maintenance | Invoices or receipts for major services (brakes, timing belt, tires, etc.). | Your mechanic, dealership service department, personal files. |

| Aftermarket Upgrades | Receipts for any non-factory additions (stereo, remote start, wheels, etc.). | Audio/accessory shops, online purchase history, personal files. |

| Vehicle Records | Original window sticker (if you have it) showing all factory options. | Glove box, dealership records, online VIN decoders. |

| Condition Proof | Pre-accident photos showing the vehicle's excellent interior and exterior condition. | Your phone's camera roll, social media posts, family photos. |

| Independent Appraisal | A certified, USPAP-compliant report from a third-party appraiser. | Professional appraisal services like SnapClaim. |

Having these documents organized shows the insurance company that you’ve done your homework and are prepared to stand your ground.

The Power of an Independent Appraisal

Gathering comps and receipts is a fantastic start, but the ultimate tool for negotiating a total loss settlement is a certified, independent appraisal. While your own research is compelling, an adjuster can still try to poke holes in it. What they can’t easily dismiss is a formal report from a qualified expert.

An appraisal from SnapClaim delivers a comprehensive, data-backed valuation prepared according to strict industry standards. It isn’t just an opinion—it’s a defensible document that carries serious weight in a negotiation.

Here’s why it’s so effective:

- It Shows You’re Serious: It signals to the adjuster that you have professionally proven your claim’s value.

- It’s Built on Certified Data: SnapClaim reports analyze real-time local market data and vehicle-specific features to generate an accurate fair market value.

- It’s Unbiased Proof: The report comes from a neutral third party, which removes any hint of personal bias from your counteroffer.

When you present a certified appraisal, the dynamic of the negotiation shifts. The burden of proof is now on them to explain why their valuation is more accurate than an expert’s report. This single move can level the playing field and give you the leverage you need to secure a fair insurance total loss payout.

Communicating Effectively with the Adjuster

You’ve gathered your evidence. Now it’s time to communicate professionally with the insurance adjuster and start negotiating a total loss settlement. Your goal is to be firm, organized, and clear. Your preparation allows you to drive the conversation instead of just reacting to their lowball offer.

Treat every interaction as part of the official negotiation. Keep phone calls short and follow up with an email summarizing what was discussed. This creates a paper trail that is invaluable if things get complicated.

Drafting Your Demand Letter

Your first move is sending a formal demand letter. This is a structured document that lays out your counteroffer and the evidence that backs it up. A strong demand letter signals to the adjuster that you’re serious and have done your homework, which often encourages them to return with a more reasonable insurance total loss payout.

Keep the letter concise and professional. It should clearly state:

- Your Claim Information: Your full name, policy number, and claim number.

- Rejection of Their Offer: A polite but firm statement rejecting their settlement offer because it doesn’t reflect your vehicle’s true ACV.

- Your Counteroffer: The specific ACV you calculated based on your market research.

- Attached Evidence: A list of every document you’re including, from your comparable vehicle listings to your certified SnapClaim appraisal report.

This letter is your opening move, and it sets a professional tone for everything that follows.

Key Phrases to Use in Your Communications

The words you choose matter. Using confident language changes how the adjuster sees your claim. You want to sound like an informed owner, not an emotional one.

Try using phrases like these:

- “The comparable vehicles in your report don’t accurately match my car’s trim level and condition.”

- “Based on my local market research, replacement vehicles are selling for closer to [Your Counteroffer Amount].”

- “I’ve attached a certified, independent appraisal that establishes the fair market value.”

- “I look forward to reviewing a revised offer that accounts for this new evidence.”

These phrases are not aggressive. They simply make it clear that you won’t accept a number that isn’t supported by real-world data.

Handling Common Pushback Tactics

Insurance adjusters are trained negotiators. Knowing their tactics keeps you from feeling pressured. Never let an adjuster rush you with phrases like “this offer is only good for 24 hours.” Take the time you need.

Here’s how you can counter their most common objections:

- If they say, “This is our final offer”: Respond calmly, “I understand that’s the current number, but it doesn’t align with the market evidence I’ve provided. Can you show me where my data is incorrect?”

- If they dismiss your comps: Ask them to provide their own comps that are a better match for your vehicle’s exact trim, mileage, and condition in your local area.

- If they ignore your independent appraisal: Remind them the report was done by a certified professional. Ask for a written rebuttal explaining why their valuation is more accurate.

By staying firm and consistently pointing back to your evidence, you force the adjuster to negotiate on your terms, not theirs.

What to Do When the Insurer Won’t Budge: Using the Appraisal Clause

You’ve presented solid evidence, but the adjuster is stuck on a lowball number. This frustrating stalemate is common, but it’s not the end of the line. Buried in your auto policy is a powerful tool: the Appraisal Clause. This is your next move when you and the insurer can’t agree on your car’s ACV.

How Does the Appraisal Clause Work?

Think of it as a binding mediation focused entirely on your car’s value. When you trigger the appraisal clause, you are telling the insurance company that neutral experts should resolve the dispute.

It’s a structured process that follows a few key steps:

- You Hire Your Appraiser: You choose an independent appraiser to determine your vehicle’s fair market value.

- The Insurer Hires Theirs: The insurance company hires its own appraiser.

- The Experts Negotiate: The two appraisers review the evidence and work to agree on a final value.

- The Umpire Decides (If Needed): If they can’t agree, they select a neutral third-party expert (an umpire) who makes a final, binding decision.

This process removes emotion and focuses the dispute on data and evidence between qualified professionals.

When Other Escalation Paths Make Sense

The appraisal clause is a fantastic tool, but it’s not your only option. Filing a complaint with your state’s Department of Insurance (DOI) is another serious step. The DOI regulates insurers and protects consumers.

A formal complaint can trigger an official review of your claim. This often puts enough pressure on the insurer to handle your case fairly, especially if they have been unresponsive or using delay tactics.

Why You Need a Formal Dispute Process

Insurers are getting tougher on total loss payouts. A staggering 27% of all collision claims were declared total losses in late 2022—a huge jump from previous years.

This spike, detailed in a report from Insurance Journal, means insurance companies are more motivated than ever to keep settlement costs down. A certified appraisal report from a service like SnapClaim is your single best asset, providing unbiased, data-backed proof to anchor your negotiation and show the insurer you’re serious.

Finalizing Your Settlement and Getting Paid

You’ve made it through the toughest part—standing your ground and negotiating a total loss settlement. Once you and the insurer agree on a fair number, there are just a few loose ends to tie up to get paid.

The adjuster will send a settlement agreement and a release form. It is critical to read every word before you sign. The release form is a legally binding contract stating you accept their offer as final payment.

Reviewing the Paperwork

Slow down and check the details. Make sure the settlement amount on the agreement is the exact number you agreed to. Look for any strange deductions or confusing language. If something looks off, ask the adjuster to explain it in writing before you sign.

How the Payout Process Works

After you’ve triple-checked everything, you’ll sign the forms and send them back along with your vehicle’s title. This kicks off the payment process.

Here’s how it typically plays out:

- If you have a loan: The insurance company will pay your lender directly first. If the settlement is higher than your loan balance, you will receive a check for the difference.

- If you own the car outright: The full check comes directly to you.

Don’t be afraid to follow up if things are taking too long. A polite email is often all it takes to get things moving again.

At SnapClaim, we stand by our valuations with a Money-Back Guarantee. If your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee—guaranteed. It ensures you have the expert evidence you need without the financial risk.

Frequently Asked Questions About Total Loss Settlements

Can I keep my car if it’s a total loss?

Yes, in most states, you can choose “owner retention.” The insurance company will pay you the car’s actual cash value (ACV) minus its salvage value. However, your car will receive a salvage title, which makes it much harder to insure or sell later. You’ll also need to repair it and pass a state inspection before it can be legally driven again.

How long does a total loss negotiation usually take?

It varies. If you accept the first offer, it may be over in a week or two. But if you are negotiating a total loss settlement to get a fair payout, expect the process to last anywhere from a few weeks to a couple of months. The timeline depends on how organized your evidence is and how responsive the adjuster is.

What if the insurer uses comps from hundreds of miles away?

This is a classic lowball tactic. A car’s value is based on its local market, so prices from a city 300 miles away are irrelevant. Respond with your own list of comparable cars for sale at dealerships within a 50-100 mile radius. A certified appraisal from SnapClaim uses geographically accurate data to prove your car’s true local market value.

Is an independent appraisal worth the money?

Think of it as an investment. A professional appraisal can help you recover thousands more than the insurer’s initial offer. The report provides unbiased, data-backed proof of your vehicle’s value, which is far more powerful than your opinion alone. SnapClaim’s Money-Back Guarantee removes the financial risk, ensuring you can fight for a fair settlement with confidence.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This guide was reviewed and verified by SnapClaim’s auto appraisers, who specialize in diminished value and total loss disputes.

Our team continually updates every article to reflect current insurer guidelines, valuation standards, and court-accepted appraisal practices, ensuring that you’re relying on information trusted by professionals nationwide.

Get Started Today

Whether you’re challenging a low total loss settlement or proving your vehicle’s post-repair loss in value, SnapClaim makes it simple to take the next step. Get your free estimate today or order a certified appraisal report to strengthen your insurance claim.

👉 Get your diminished value appraisal today