Has your car been in an accident? Even after perfect repairs, its resale value takes a permanent hit simply because it now has an accident history. To determine the diminished value of your car after an accident, you must calculate the difference between its fair market value before the crash and its new, lower value after repairs.

This guide will walk you through exactly how to prove this financial loss and strengthen your diminished value claim with the at-fault driver’s insurance company.

What Is Diminished Value and Why Does It Matter?

After an accident, the focus is usually on fixing visible damage like dents and scratches. But even after flawless repairs, your vehicle has an invisible scar: a permanent accident record. This is the heart of diminished value—the drop in your car’s market price simply because it now has a documented accident history.

Imagine your pristine 2022 Honda Civic was worth $25,000 before someone rear-ended you. The body shop does an amazing job, and it looks brand new. However, that car now has an accident flagged on its vehicle history report. According to reputable sources like Kelley Blue Book, that history alone could slash its car value after an accident by thousands of dollars.

This financial loss is exactly what you can—and should—claim from the at-fault driver’s insurance. Of course, knowing what to do in the chaotic moments after a crash is just as important. For a solid overview, check out this guide on What to Do After a Motor Vehicle Accident.

The Three Types of Diminished Value

Diminished value isn’t a single concept; it breaks down into three types. Understanding which one applies to your situation is the first step in building a strong diminished value claim.

Here’s a simple breakdown of what each one means for you.

| Type of Diminished Value | What It Means for You | When It Applies |

|---|---|---|

| Immediate Diminished Value | This is the loss in value right after the crash, before any repairs. Think of it as the "as-is" damaged condition value versus its pre-accident value. | Immediately following the accident. |

| Inherent Diminished Value | This is the most common and crucial type. It’s the permanent loss of value that remains even after perfect, high-quality repairs are complete. | After your vehicle has been fully and properly repaired. |

| Repair-Related Diminished Value | This is an additional loss in value caused by shoddy or incomplete repairs, like mismatched paint or cheap aftermarket parts. | When the quality of the repair work is subpar and further damages the car's value. |

For most vehicle owners, inherent diminished value is what matters most. It acknowledges that a smart buyer will always choose a similar car with a clean history over one that’s been in a wreck. A certified appraisal from SnapClaim provides the data-backed proof you need to establish this loss and negotiate fairly.

How Insurance Companies Undervalue Diminished Value Claims

After an accident, you expect the at-fault driver’s insurance company to make things right. But their primary goal is to protect their bottom line, which means minimizing every payout, including your diminished value claim.

When their first offer seems shockingly low, don’t be surprised. Insurers often use a controversial, in-house calculation known as the “17c formula.” This tool originated from a Georgia court case and became popular with adjusters because it is engineered to produce the lowest possible diminished value figure.

The Problem with the 17c Formula

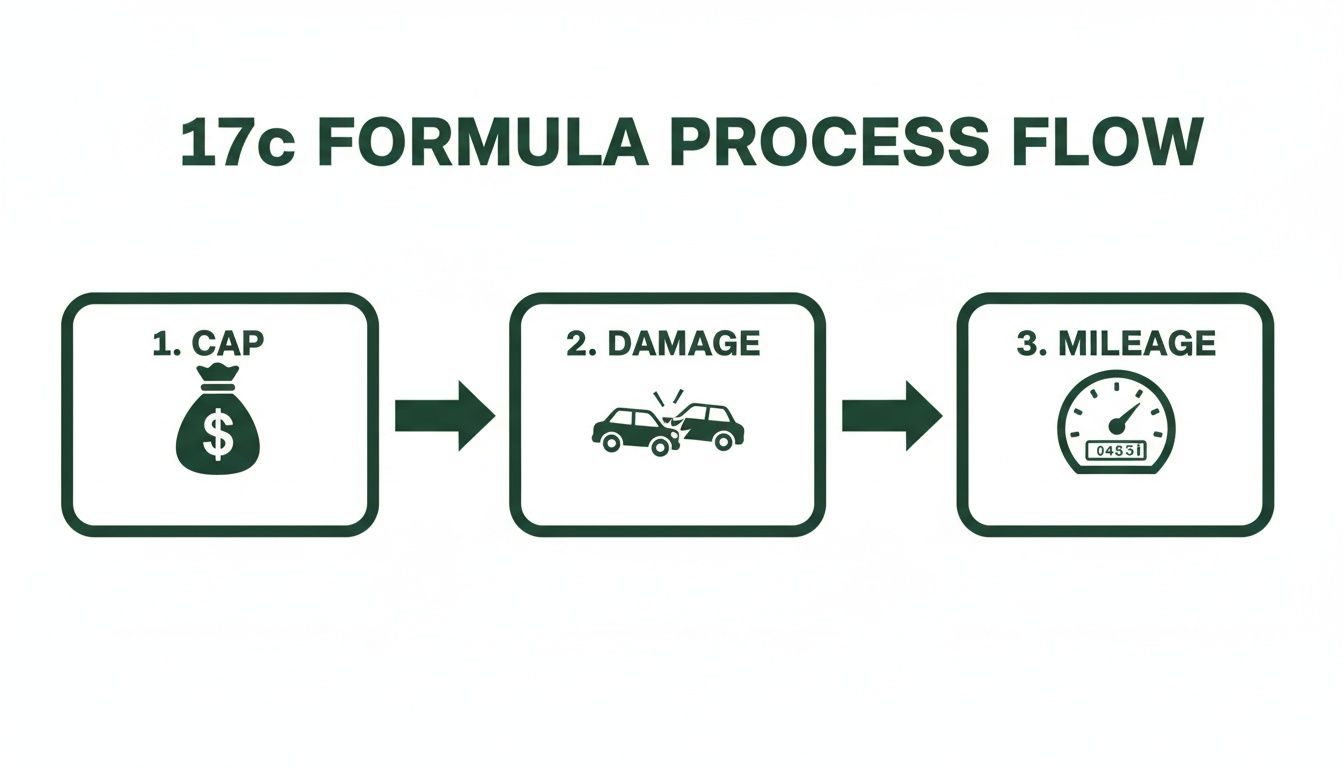

The 17c formula is not a real-world market assessment. It’s a rigid calculation that systematically chips away at your claim with arbitrary caps and penalties. The first step to fighting back is understanding how they stack the deck against you.

The formula starts by capping the maximum potential diminished value at just 10% of your car’s pre-accident value. From there, it gets worse with two more deductions.

- Damage Multiplier: This penalty is based on the so-called severity of the damage. Severe structural damage might get a multiplier of 1.00 (no reduction), but moderate cosmetic damage could be hit with a 0.50 multiplier, instantly slashing the already-capped value.

- Mileage Penalty: Another multiplier is applied based on your car’s odometer reading. The higher the mileage, the bigger the penalty, further eroding your final payout.

This triple-reduction process is precisely why their first offer is almost always a lowball. It’s math that serves their interests, not your financial recovery.

A Real-World Example of the 17c Formula

Let’s see how this formula crushes a real claim. Imagine your sedan was worth $30,000 before it was hit. It sustained moderate damage and has 45,000 miles on it.

Here’s the insurance adjuster’s math:

- Start with the 10% Cap: 10% of $30,000 is $3,000. This is now the absolute most you can get, according to them.

- Apply the Damage Multiplier: The adjuster deems the damage “moderate” and applies a 0.50 multiplier. The value plummets: $3,000 x 0.50 = $1,500.

- Apply the Mileage Penalty: For a car with 45,000 miles, the adjuster uses a mileage factor of 0.75. The final calculation is $1,500 x 0.75 = $1,125.

Just like that, a real-world loss of thousands of dollars is manipulated down to $1,125. It’s common for adjusters to offer a settlement that doesn’t cover your actual losses. If your insurance check is less than you need for repairs, that’s a huge red flag that you’re being undervalued.

Key Takeaway: The insurer’s first offer isn’t the final word. It’s just their opening move, based on a formula designed to benefit them. You have every right to challenge it with your own independent, data-backed evidence.

This process is separate from, but just as critical as, figuring out an insurance total loss payout. To learn more about that, see our guide on calculating total loss for a vehicle. The only way to counter their rigged formula is with a certified appraisal that reflects true market reality.

How to Gather Evidence and Prove Your Diminished Value Loss

To get paid what you’re owed, you need more than just an opinion—you need solid proof. An adjuster’s first question will always be, “Where’s your evidence?” Vague statements won’t get you anywhere. You need an organized file of documents that tells the complete story of your vehicle’s value.

Your Essential Document Checklist

Putting together the right paperwork is the foundation of a strong diminished value claim. Each document serves a specific purpose, from proving fault to detailing the repairs.

Start by gathering these key items:

- The Official Police Report: This establishes the who, what, when, and where of the accident, including the at-fault party.

- Repair Invoices and Estimates: You need the final, itemized repair bill showing a line-by-line accounting of every part and hour of labor.

- Pre-Accident Value Documentation: Establish a starting point by printing a value report from a trusted source like Kelley Blue Book showing what your car was worth the day before the accident.

- Photographic Evidence: Pictures are powerful. Gather photos from the accident scene, close-ups of the damage before repairs, and pictures of the finished work.

The flowchart above illustrates the flawed 17c formula insurers use. They start with an arbitrary cap, then apply deductions for damage and mileage. Your detailed evidence is critical to pushing back against this unfair method.

The Power of an Independent Appraisal

While your own documents are a great start, the single most effective tool you can have is a professional, independent appraisal. An adjuster can easily dismiss a DIY calculation, but they must consider credible third-party evidence.

Crucial Insight: An independent appraisal changes the conversation. It’s no longer your opinion versus theirs; it’s an expert’s documented, data-driven findings that an insurer is legally obligated to consider.

A certified report from SnapClaim isn’t just an estimate; it’s a full market analysis. Our appraisers dig into real-time sales data for vehicles just like yours in your local area to pinpoint your exact financial loss. We even review the insurer’s own valuation reports, like the CCC ONE Market Valuation Report, to find and challenge their errors.

Using a Certified Appraisal to Negotiate Effectively

Think of an independent appraisal as your ace in the hole. It’s the most powerful tool for negotiating with an insurance adjuster because it replaces opinion with fact. When you present a certified report, you shift the discussion from their internal formula to real-world market data.

This shift is critical. According to a Boston University Law Review analysis, up to 40% of the millions of used cars sold each year have an accident history. This record directly translates to a financial loss that insurers’ initial offers rarely account for.

What Makes an Appraisal Defensible

Not all appraisals are created equal. To be taken seriously, your report must be “certified” and “defensible,” meaning it’s built on a solid foundation of real-world market data and industry-standard methodology.

A SnapClaim report is defensible because it always includes:

- Comprehensive Market Analysis: We analyze real-time sales data for comparable vehicles in your geographic area.

- Like-for-Like Comparisons: Our appraisers compare vehicles of the same make, model, year, and condition—contrasting those with clean histories to those with accident records.

- Verifiable Data Sources: We cite industry-recognized valuation guides and actual market listings that the adjuster can verify.

- Certified Methodology: The entire process follows court-accepted appraisal practices used nationwide.

This provides a clear, evidence-based calculation of your loss that an adjuster can’t easily dismiss.

How to Present Your Evidence for Maximum Impact

Once you have your certified appraisal, present it to the insurance adjuster professionally and directly. You aren’t asking for a favor; you’re providing documented proof of a financial loss.

The best approach is to send a formal demand letter via email or certified mail. Attach the full appraisal report and other supporting documents.

Simple, direct language works best:

“My diminished value claim is supported by the attached independent appraisal report from a certified expert. The report uses current market data to establish my vehicle’s inherent diminished value at $X,XXX. Please review the attached documentation and remit payment for this amount.”

This approach sticks to the facts and gives the adjuster everything they need to justify approving a fair claim.

Confidently Countering the Lowball Offer

The adjuster will likely come back with a lower number or try to find holes in your appraisal. This is a standard negotiation tactic, so don’t get discouraged. Stand firm and keep pointing back to your report as the objective, third-party evidence.

When they push back, respond with calm confidence:

- If they claim your report is too high: “My appraisal is based on verifiable market data for comparable vehicles in our area. Can you please provide the specific data you are using to justify your lower offer?”

- If they try to dismiss the report: “This is a certified report from an independent appraiser using industry-standard methodologies. It is credible evidence, and I expect it to be given fair consideration.”

The same principles apply when a car is totaled; learn more in our guide on total loss vehicle appraisals. By staying professional and letting your report do the heavy lifting, you dramatically boost your chances of getting a fair settlement.

FAQ: Common Questions About Diminished Value Claims

Here are answers to some of the most frequently asked questions to help you determine the diminished value of your car after an accident.

Can I claim diminished value if the accident wasn’t my fault?

Yes. Diminished value is a third-party liability claim, meaning you file it against the at-fault driver’s insurance policy. If the other driver was at fault, you have the right to claim this loss in nearly every U.S. state. You generally cannot file a diminished value claim against your own policy if you caused the accident.

Is my car too old to have a diminished value claim?

Not necessarily. While newer, low-mileage vehicles typically suffer the largest drop in value, there is no universal age or mileage cutoff. The key factor is your car’s pre-accident market value. A well-maintained classic car, a rare model, or a luxury vehicle can still have a significant diminished value claim regardless of age.

Can I claim diminished value if my car is leased?

Yes, you can. The lease agreement holds you responsible for the vehicle’s condition, and an accident history reduces its value upon return. This loss is your responsibility, so you have the right to recover that diminished value from the at-fault party’s insurer to avoid being charged by the leasing company later.

Can I claim diminished value if my car is leased?

Yes, you can. The lease agreement holds you responsible for the vehicle’s condition, and an accident history reduces its value upon return. This loss is your responsibility, so you have the right to recover that diminished value from the at-fault party’s insurer to avoid being charged by the leasing company later.

What if the insurer rejects my appraisal report?

This is a common negotiation tactic. First, ask for their reason for the rejection in writing. A legitimate, defensible report is difficult for an insurer to dismiss without a specific, data-backed rebuttal. If they continue to stonewall, you can escalate the issue to a supervisor or file a complaint with your state’s Department of Insurance.

Ready to stop guessing and start proving your vehicle’s true loss? A SnapClaim report provides the certified, data-driven evidence you need to negotiate effectively and recover the money you rightfully deserve. If your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee — guaranteed.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This guide was reviewed and verified by SnapClaim’s auto appraisers, who specialize in diminished value and total loss disputes.

Our team continually updates every article to reflect current insurer guidelines, valuation standards, and court-accepted appraisal practices, ensuring that you’re relying on information trusted by professionals nationwide.

Get Started Today

Whether you’re challenging a low total loss settlement or proving your vehicle’s post-repair loss in value, SnapClaim makes it simple to take the next step.

Generate a free diminished value or total loss estimate in minutes and see how much compensation you may be owed.

👉 Get your diminished value appraisal today