When your insurance company drops the “T” word—”totaled”—it’s easy to picture a twisted wreck. But a totaled car isn’t defined by how it looks; it’s a purely financial decision. Understanding this is the first step to taking control of your car insurance for totaled car claim and ensuring you get a fair payout.

In simple terms, your car is declared a total loss when the cost to repair it is higher than its actual cash value right before the accident.

What It Means When Your Car Is Totaled

Hearing your car is a “total loss” is jarring, especially if the damage doesn’t seem catastrophic. A car with what looks like moderate body damage can easily be totaled if fixing hidden structural issues and electronics is expensive enough.

On the other hand, a vehicle that looks like a complete mess might be repairable if its pre-accident value was very high. The entire decision comes down to the numbers and a formula the insurer uses.

The Total Loss Formula

At its core, the total loss decision boils down to one simple comparison: Repair Cost vs. Car’s Value.

If the price to fix your car gets too close to what it was worth before the crash, your insurer will declare it a total loss. Instead of paying a body shop, they will pay you the car’s Actual Cash Value (ACV), minus your deductible.

Think of it like this: you wouldn’t spend $20,000 fixing a house that’s only worth $15,000. Insurers apply that exact same logic to vehicles.

Key Terms You Need to Know

To handle your claim with confidence, you need to understand the adjuster’s language. Two critical terms drive this entire process:

- Actual Cash Value (ACV): This is what your car was worth on the open market a moment before the crash. It is not what you paid for it or what a new one costs. ACV is based on your vehicle’s age, mileage, overall condition, and what similar cars are selling for in your local area.

- Total Loss Threshold: This is a percentage set by either state law or your insurance company. If repair costs exceed this percentage of your car’s ACV, it’s automatically a total loss. For example, if your state has a 75% threshold and your car is valued at $10,000, it will be totaled if repairs cost $7,500 or more. State laws vary, so it’s wise to check the rules where you live.

Key Takeaway: A totaled car is an economic calculation, not a visual one. The insurer has decided it’s cheaper to pay you than to pay for repairs.

Understanding these basics is critical because the insurer’s ACV calculation is the foundation for your settlement offer. If they undervalue that number, your entire insurance total loss payout suffers. A low ACV can also trigger a premature total loss decision, robbing you of the chance to repair a car you love. This is why you must verify the insurer’s valuation from the start.

How Insurers Calculate Your Car Insurance for a Totaled Car Payout

The settlement offer you receive for a totaled car isn’t a number pulled from thin air. It comes from a specific formula that all boils down to one critical figure: your vehicle’s Actual Cash Value (ACV). This number is the entire foundation of your total loss payout.

It’s crucial to understand that ACV is not what you paid for the car, nor is it what a brand-new replacement costs. Think of ACV as the fair market value of your vehicle one moment before the accident—what a buyer would have realistically paid for it in its pre-accident condition.

To figure this out, an insurance adjuster will look at several key factors.

Breaking Down the ACV Calculation

Insurance companies use valuation reports from third-party data providers to determine a vehicle’s ACV. These reports crunch a ton of data to set a base value, which is then fine-tuned for your specific car.

Here are the factors that matter most:

- Year, Make, and Model: This is the starting point. The basic identity of your car sets the stage, as some models hold their value better than others.

- Mileage: This is simple: lower mileage almost always means a higher value because it suggests less wear and tear.

- Overall Condition: This is where things get subjective. The adjuster assigns your car a pre-accident condition rating (like excellent, good, or fair) based on its interior, exterior, and mechanical shape.

- Recent Upgrades: Did you recently spend money on new tires or a premium sound system? If you have receipts, these can add to the value.

- Local Market Comparables: The insurer looks for similar vehicles (“comps”) that have recently sold in your area to establish the going rate.

The adjuster combines this information to arrive at an initial ACV, which becomes the basis for their settlement offer.

What Is the Total Loss Threshold?

Once the ACV is estimated, the insurer compares it to the repair estimate. This is where another key term comes into play: the Total Loss Threshold. It’s a specific percentage set by your state’s law or your insurance policy. If the cost to fix your car exceeds this percentage of its ACV, it’s automatically a total loss.

For example, if your state has a 75% threshold and your car’s ACV is pegged at $20,000, it will be totaled if the repair estimate is $15,000 or more. It’s vital to see how these numbers connect, and you can dive deeper into how to accurately determine a total loss vehicle’s value.

A vehicle is declared a total loss when Repair Costs > (ACV x Total Loss Threshold). The fairness of the entire process depends on an accurate ACV.

This cold, hard math happens more and more often. Modern cars are packed with expensive sensors and high-tech parts, so repair bills can skyrocket quickly. In fact, many U.S. auto insurance claims now end in a total loss—not always because of a catastrophic wreck, but because fixing it just doesn’t make economic sense.

Insurer Valuations vs. Comprehensive Appraisals

The real problem for vehicle owners is that the insurer’s process can easily miss the details that add value. Their data might be based on wholesale auction prices, or they might use “comparable” cars that were in worse shape or lacked the premium features your car had.

This is where a professional, independent appraisal completely changes the game. It goes far beyond the standard insurer checklist to build a detailed, evidence-backed case for your car’s true market value.

An insurer’s standard valuation often comes up short when compared to a detailed appraisal report that fights for every dollar you’re owed.

Insurer’s ACV Calculation vs. Comprehensive Appraisal

| Valuation Factor | Typical Insurer Approach | SnapClaim Comprehensive Approach |

|---|---|---|

| Comparable Vehicles | Often uses outdated listings or cars from wholesale auctions that don’t reflect retail value. | Pulls real-time, local dealer listings for vehicles that are true “apples-to-apples” matches. |

| Condition Adjustments | Relies on a brief, subjective assessment, often undervaluing a well-maintained vehicle. | Analyzes your photos and records to document and prove a higher-than-average pre-accident condition. |

| Optional Features | May overlook non-standard options or packages, leaving value on the table. | Identifies and quantifies the market value of every factory option and recent upgrade. |

| Market Analysis | Uses a broad, automated valuation model that may not reflect specific local demand. | Provides a localized, market-driven analysis that proves what your exact vehicle was worth in your area. |

At the end of the day, an insurer’s goal is to close the claim efficiently using their standard process. Your goal is to get fair compensation for what you actually lost. A certified appraisal report from SnapClaim delivers the specific, undeniable proof you need to close that gap and make a strong case for a higher car insurance total loss payout.

Your Action Plan After a Total Loss

Hearing your car is a “total loss” can feel like a gut punch. It’s easy to feel overwhelmed, but what you do in the next few days is critical to protecting your finances. This is the moment to get proactive and take control of the claims process.

First thing’s first: pause before you sign anything. The insurance adjuster might seem friendly, but their goal is to close the claim quickly. They may push you to accept an offer or sign over your title on the spot. Politely state that you need time to review everything. This simple move keeps all your negotiation options on the table.

Gather Your Evidence

Your main job is to prove your vehicle’s car value after accident was higher than the insurer claims. The insurance company has its own data, but it’s often generic and might not reflect your car’s true condition or the upgrades you’ve made. It’s up to you to paint the full picture with solid proof.

Start digging up every document related to your car’s history. This paper trail is your best tool for building a case for a higher Actual Cash Value (ACV).

Here’s your checklist:

- Maintenance Records: Proof of regular oil changes, tire rotations, and other services shows you kept the car in top shape.

- Repair and Upgrade Receipts: Did you recently spring for new tires, brakes, or a battery? Install a better stereo or a roof rack? Every receipt adds value.

- Original Window Sticker: If you have it, this is gold. It provides ultimate proof of all the factory-installed options and packages your car came with.

- Pre-Accident Photos: Have any pictures or videos of your car looking great before the crash? Use them to push back if the adjuster gives your car a low condition rating.

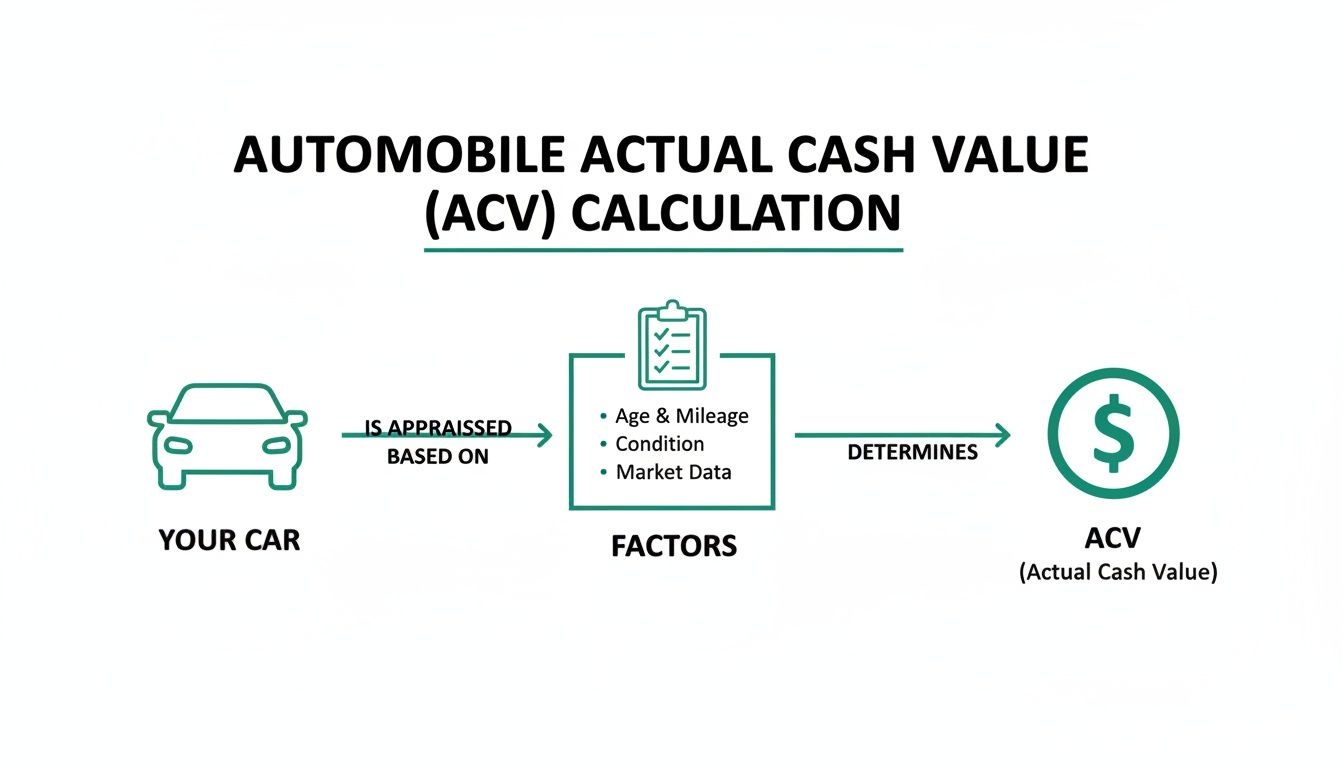

This diagram breaks down how different factors come together to determine your car’s ACV.

As you can see, the final number is a mix of its basic stats, its condition, and its features—and good documentation helps you prove every one of them.

Review Your Insurance Policy

Next, pull up your auto insurance policy. You’re looking for the section that covers total loss claims, which is usually under “Collision Coverage” or “Comprehensive Coverage.” Think of this as the rulebook; it spells out the insurer’s duties and your rights.

Pay close attention to the “appraisal clause” or “right to appraisal.” This is a powerful tool. It gives you the right to hire your own independent appraiser if you and the insurance company can’t agree on a value. Knowing this clause exists gives you serious leverage from the start.

It’s also a good time to understand the payout logistics and find out more about who gets the insurance check when a car is totaled, especially if you still have a loan.

Conduct Your Own Market Research

Never take the insurance company’s valuation report at face value. Their number is just their opinion of what your car was worth—and it’s often a lowball one. You need to do your own homework to form an educated opinion.

An insurer’s initial offer is often a starting point for negotiation, not the final word. Arming yourself with independent market data is the first step toward a fairer settlement.

Start with online tools like Kelley Blue Book or Edmunds to get a general idea of the retail value. But the most important step is to search for comparable vehicles for sale at dealerships in your local area. A “comp” needs to be the same year, make, and model, with similar mileage, options, and overall condition.

Save screenshots of these listings. They are your best ammunition when you go back to the adjuster with a counteroffer.

If your research shows a big gap between the real-world market value and the insurer’s offer, you’ll know it’s time to dispute it. By taking these steps, you build a solid foundation of proof that’s tough for any adjuster to ignore. You’re no longer just accepting what they tell you; you’re prepared to fight for the full and fair value you’re owed.

How to Negotiate a Fairer Total Loss Settlement

That first settlement number you get from the insurance company? It’s just an offer. It’s their opening bid, not the final word. You absolutely do not have to accept a lowball valuation, but you’ll need solid evidence to challenge it effectively. This is where the real work on your car insurance for totaled car claim begins.

An adjuster’s job is to close your claim quickly and within their company’s guidelines. That often means finding ways to justify the lowest possible payout. A classic tactic is picking “comparable” vehicles that aren’t truly comparable—think base models, cars with more miles, or vehicles in rough shape—just to drag down the average market value.

While doing your own homework is a good start, insurers almost always trust their data over yours. To win this negotiation, you must shift the conversation from your opinion to undeniable proof.

Deconstructing the Insurer’s Offer

When the adjuster sends their valuation report, don’t just glance at the final number. Pull it apart, piece by piece. The report will list the comparable vehicles they used to arrive at your car’s Actual Cash Value (ACV).

For every “comp” they list, ask yourself these questions:

- Is it a true match? Does it have the same trim, engine, and transmission? A base-model sedan isn’t a fair comparison to your fully loaded sport edition.

- What’s the mileage? A significant gap in mileage can change a vehicle’s value by thousands of dollars.

- How accurate is the condition rating? They might have rated your meticulously maintained car as just “average.” Your maintenance records and pre-accident photos are your proof.

- Did they miss any options? Factory upgrades like a sunroof, a premium sound system, or advanced safety features all add value that adjusters frequently overlook.

Pinpointing these weak spots lets you build a logical, fact-based case. You can then go back to them and say, “Your report is based on cars that don’t have the premium tech package and have 20,000 more miles than mine did. My vehicle’s true market value is higher.”

The Power of an Independent Appraisal

Showing the adjuster a few online listings you found is one thing. Presenting them with irrefutable, third-party proof is the real game-changer. This is where a certified, data-driven Fair Market Value report from a company like SnapClaim completely transforms the dynamic. It’s no longer your word against theirs; it’s your certified expert’s analysis against their initial lowball estimate.

An independent appraisal isn’t just a second opinion—it’s a comprehensive market analysis that levels the playing field, forcing the insurer to justify their low offer against objective data.

A professional appraisal gives you the specific, defensible evidence you need to make them listen. Our SnapClaim reports provide data-backed proof that methodically documents your car’s true pre-accident worth, using real-time market data from your local area. This court-ready documentation gives the adjuster the validation they often need to approve a higher settlement.

The Financial Stakes of a Fair Settlement

Pushing back isn’t just about being right; it’s about your financial reality. With rising repair costs and inflation, getting a fair payout is more important than ever. According to recent industry analysis, claim costs are expected to continue rising due to supply chain issues and technology advancements in vehicles. You can get more insights on these insurance market trends on ey.com.

This economic pressure is why so many vehicle owners turn to independent appraisals. It’s the most reliable way to ensure your payout accurately reflects your vehicle’s true replacement cost in today’s market.

Your Negotiation Script

When you get back in touch with the adjuster, your approach should be professional, organized, and firm.

- State your position clearly: “I’ve reviewed your valuation report and found several discrepancies. I am formally disputing the proposed Actual Cash Value.”

- Present your evidence: “The comparable vehicles you used don’t accurately reflect my car’s premium trim level and excellent pre-accident condition. I am providing a certified appraisal report that uses more accurate local market data to support my claim.”

- Make your counteroffer: “Based on this certified analysis, the fair market value of my vehicle is $X, and I am requesting a revised settlement for that amount.”

When you arm yourself with professional documentation, you stop being a passive recipient of a low offer. You become an empowered, informed participant equipped with the proof you need to get the money you rightfully deserve.

Your Rights When You Disagree with the Insurer

Getting a lowball settlement offer for your totaled car can feel like adding insult to injury. It’s a frustrating moment, but it’s not the final word. You have specific rights and powerful options when you and your insurer can’t agree on your claim.

You are never forced to accept an offer that doesn’t reflect your car’s true pre-accident value. In fact, most auto insurance policies have a built-in process for resolving these exact disputes. Knowing how to use it can make all the difference.

Invoking the Appraisal Clause

Tucked away in the fine print of most auto policies is a powerful tool called the appraisal clause. Think of it as a contractually agreed-upon tie-breaker. It lays out a formal path forward when you and the insurance adjuster are at a standstill over the Actual Cash Value (ACV) of your vehicle.

Invoking this clause kicks off a clear procedure:

- You hire an independent appraiser: You find and pay for your own certified appraiser to value your car.

- The insurer hires one, too: Your insurance company will do the same, hiring their own independent appraiser.

- The two appraisers negotiate: These two unbiased professionals will review the evidence and try to agree on a fair value.

- An umpire steps in if needed: If the two appraisers can’t agree, they select a neutral third party, called an umpire, to make the final, binding decision.

This process takes the negotiation out of the adjuster’s hands and puts it into the hands of qualified experts whose only job is to determine a fair, unbiased value.

Keeping Your Totaled Car

Another right you have is the option to keep your vehicle even after it’s been declared a total loss. This is often called “owner retention.” If you choose this route, the insurance company will pay you the vehicle’s ACV minus its salvage value.

The salvage value is what the insurer would have gotten by selling your wrecked car to a salvage yard. By keeping the car, you’re essentially “buying” it back from them for that amount.

Be warned: keeping your car comes with serious responsibilities. You’ll be on the hook for arranging and paying for all repairs yourself. After it’s fixed, you must apply for a salvage title from your state’s DMV, which permanently brands the vehicle as totaled. This makes it harder to insure and tanks its future resale value. To learn more about your rights, you can check your state-specific law pages or learn how to conduct legal research.

Which Path Is Right for You?

So, should you invoke the appraisal clause or keep the car? The right answer depends entirely on your goals.

- Choose the appraisal clause if: Your main goal is to get the highest possible cash settlement. If you’re sure the insurer’s offer is thousands too low and you have solid proof (like a SnapClaim report), this is your best move.

- Consider keeping your car if: It has sentimental value, the damage is mostly cosmetic, or you’re a mechanic who can handle the repairs cheaply. Just be sure to weigh the costs against the permanent hit of a salvage title.

No matter which path you take, remember that the insurer’s first offer is just that—an offer. Knowing your rights is the first step toward pushing back on a low settlement and ensuring you’re treated fairly.

Why a Certified Appraisal Is Your Strongest Evidence

Simply telling an adjuster their offer is too low won’t get you far. You need to show them. This is where a certified appraisal becomes your most powerful tool in your car insurance for totaled car claim, turning your opinion into a fact-based, professional position they can’t ignore.

Think of it this way: an independent appraisal report is objective, third-party proof. It levels the playing field and forces the insurance company to respond to hard data, not just dismiss your feelings.

Moving from Opinion to Evidence

Adjusters live and breathe data. When you counter their offer with a few online price guides or random dealership listings, it’s easy for them to poke holes in your argument. A professional appraisal is a completely different ballgame.

SnapClaim’s reports are built on a solid, data-driven methodology designed to stand up to insurer scrutiny. Our analysis digs deep into:

- Real-Time Market Data: We pull current, local dealer listings for true “apples-to-apples” comparisons of cars just like yours—not stale auction results.

- Condition Adjustments: We professionally document your vehicle’s excellent pre-accident condition, putting a real dollar value on how well you maintained it.

- Complete Feature Valuation: Every single factory option, package, and recent upgrade is identified and assigned its specific market value.

This level of detail actually helps the adjuster. It provides the concrete documentation they often need to justify a higher payout to their managers, creating a clear, logical path to increasing your settlement.

A certified appraisal isn’t just a second opinion—it’s a comprehensive market analysis that provides the proof you need to negotiate fairly and forces the insurer to justify their lowball offer against objective, court-accepted data.

Risk-Free Proof with a Guarantee

We’re so confident in the accuracy and power of our reports that we stand behind them 100%. An appraisal gives you the undeniable proof needed to negotiate a fair settlement. The SnapClaim total loss car appraisal process is built from the ground up to arm you with certified, credible data that helps strengthen your claim.

And to make the decision to fight back even easier, we offer a risk-free guarantee. If your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee—guaranteed. You have nothing to lose and a fair settlement to gain.

Frequently Asked Questions

What happens if I disagree with the insurance company’s valuation?

You have the right to dispute the insurer’s offer. Start by gathering your own evidence, such as maintenance records and listings for comparable local vehicles. For the strongest case, invoke the appraisal clause in your policy and hire an independent appraiser to provide a certified, data-backed valuation report that supports your claim for fair compensation.

Can I keep my car if it is totaled?

Yes, in most states, you have the right to keep your vehicle. This is called “owner retention.” If you choose this option, the insurance company will pay you the car’s Actual Cash Value (ACV)minus its salvage value (what they would have received from a salvage yard). Be aware that you will be responsible for all repairs and will receive a salvage title, which can impact future insurance and resale value.

What if I owe more on my car loan than the settlement offer?

This situation is known as being “upside down” on your loan. The insurance payout is based on the car’s market value (ACV), not your loan balance. If the settlement is less than what you owe, you are responsible for paying the difference. This is where Guaranteed Asset Protection (GAP) insurance helps; if you have it, it covers the “gap” between the ACV payout and your remaining loan.

Will a total loss claim increase my insurance premium?

It depends on who was at fault. If another driver was 100% at fault, their insurance pays the claim, and your rates should not increase. However, if the accident was your fault, you can expect your premium to go up at your next renewal.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This guide was reviewed and verified by SnapClaim’s auto appraisers, who specialize in diminished value and total loss disputes.

Our team continually updates every article to reflect current insurer guidelines, valuation standards, and court-accepted appraisal practices, ensuring that you’re relying on information trusted by professionals nationwide.

Get Started Today

Whether you’re challenging a low total loss settlement or proving your vehicle’s post-repair loss in value, SnapClaim makes it simple to take the next step.

Generate a free diminished value or total loss estimate in minutes and see how much compensation you may be owed.

👉Get your fair market value (total loss) appraisal