Has your insurance company declared your car a total loss and made an offer that feels far too low? A total loss vehicle appraisal is an independent, expert valuation that determines your car’s true market value right before it was damaged. It’s your most powerful tool to challenge a lowball settlement and get the fair compensation you deserve.

Their first offer isn’t the final number—it’s just the opening bid in a negotiation.

Why Your Insurer’s First Offer Is Just a Starting Point

When your insurance company declares your car a total loss, the settlement offer they slide across the table can be a real shock. It almost always feels like it’s thousands less than what your car was actually worth just moments before the crash.

This isn’t an accident. It’s a calculated part of their business model, designed to minimize what they pay out on claims. You have every right to dispute their number, and that’s where a total loss vehicle appraisal becomes essential. An independent appraisal isn’t just a second opinion; it’s a detailed, evidence-backed report that counters the insurer’s flawed valuation with real-world data.

The Reality of Total Loss Payouts

If you feel shortchanged by an insurer, you’re not alone. A recent study from J.D. Power found that customer satisfaction with total loss claims is dropping fast. In fact, only 58% of people felt their insurer’s valuation was fair.

That means more than four out of every ten drivers believe their insurance total loss payout was simply not enough. An independent appraisal gives you the power to close that gap by focusing on what actually matters: your specific vehicle’s value in your local market.

What an Independent Appraisal Uncovers

So, what makes an independent report so different from the insurer’s number? While insurance companies rely on automated systems and generic averages, a certified appraiser digs into the details that give your car its true value.

Here’s a quick look at how the two approaches stack up.

| Valuation Factor | Typical Insurer Offer | Independent Total Loss Appraisal |

|---|---|---|

| Market Data | National or regional averages | Hyper-local, recent comparable sales |

| Vehicle Condition | Generic rating (e.g., “average”) | Based on actual pre-loss condition |

| Options & Upgrades | Often overlooked or undervalued | Every feature and upgrade is documented |

| Mileage Adjustment | Standardized formula | Custom adjustment for your market |

| Report Type | Internal, often undisclosed | Certified, defensible, and transparent |

An independent appraisal from SnapClaim provides a much clearer, fact-based picture of your vehicle’s worth.

With a SnapClaim report, you get:

- Accurate Local Market Data: We pinpoint the value based on recent sales of cars just like yours, right in your area—not using national averages that drag the price down.

- Detailed Condition Assessment: We consider your car’s actual pre-accident condition, maintenance records, and overall care, instead of letting the insurer slap a generic and unfair rating on it.

- Credit for Options and Upgrades: That premium sound system or those brand-new tires you just bought? We account for every factory option, package, and recent upgrade that adds to your car’s value.

- A Defensible Report: You receive a certified, USPAP-compliant document that holds up under scrutiny, giving your negotiation a strong, evidence-based foundation.

Getting a total loss vehicle appraisal means you’re no longer just arguing over a number. You’re presenting a fact-based case for the compensation you are rightfully owed.

Understanding Why Your Vehicle Is a Total Loss

When an insurance adjuster tells you your car is a “total loss,” it can be a real shock. You might be looking at a crumpled fender and a broken headlight, thinking, “This is fixable, right?”

But for an insurance company, the decision isn’t about whether the car can be repaired. It’s a cold, hard economic calculation. An insurer totals a vehicle when the cost to repair it plus its remaining salvage value adds up to more than its Actual Cash Value (ACV) right before the accident. ACV is just industry-speak for the fair market value of your vehicle.

If it costs more to fix than it’s worth, the insurance company will simply cut a check and write it off. This is exactly why getting an accurate total loss vehicle appraisal is so critical. The insurance company controls the two most important numbers in that equation: the repair estimate and their valuation of your car’s ACV. If they undervalue your car, it becomes much easier for them to declare it a total loss and hand you a lowball settlement.

To learn more about this process, you can explore our detailed guide on what to do when your car is totaled.

The Total Loss Threshold Explained

Every state has its own rule, called a Total Loss Threshold (TLT). This is a set percentage that tells an insurer when they must declare a car a total loss. Typically, this threshold ranges from 70% to 100% of the vehicle’s ACV.

Let’s say your car’s ACV is $20,000 and your state has a 75% threshold. The moment repair costs hit $15,000, the car is officially totaled. However, don’t be surprised if the insurer totals it even sooner—many use their own internal, lower thresholds if it saves them money.

Why Are So Many Cars Being Totaled These Days?

It’s not just you. Total losses are happening more often than ever before. Modern vehicles are technological marvels, packed with advanced driver-assistance systems (ADAS), cameras, and sensors hidden in bumpers, mirrors, and windshields. This tech makes cars safer, but it also makes them incredibly expensive to fix.

Here are the main reasons for the spike:

- Complex Technology: A minor parking lot bump can easily damage sensitive electronics. Replacing and recalibrating these systems can turn what looks like a simple repair into a multi-thousand-dollar job.

- Rising Labor Costs: The demand for highly skilled technicians who can work on today’s complex cars has driven labor rates through the roof.

- High Parts Prices: Between supply chain hiccups and the sheer complexity of modern components, the cost for everything from a headlight assembly to a bumper cover has soared.

When you start wondering what your car is worth, online tools like Kelley Blue Book (KBB) are a decent first step. They can give you a ballpark figure to start with. But these tools just scratch the surface. They can’t account for the unique details an independent appraiser would—things like high local market demand for your specific model, recent upgrades you made, or its exceptional pre-accident condition. Those are the details that are essential for a truly fair valuation.

How Insurers Calculate Value and Where They Go Wrong

When an insurance company declares your car a total loss, they don’t just pull a settlement number out of thin air. Instead, they lean on third-party valuation systems—complex software platforms designed to quickly calculate your vehicle’s Actual Cash Value (ACV).

You’ll almost always see reports from companies like CCC, Mitchell, or Audatex. On the surface, these reports look official and data-driven. The problem is, they are often built to serve the insurer’s interests, not yours. These systems scrape data from various sources to generate a market valuation, but the whole process is riddled with flaws. The result? A settlement offer that looks legitimate but might be thousands of dollars short of what you’re truly owed.

The Big Three Valuation Systems

Insurance carriers love these platforms because they’re fast, standardized, and churn out reports that justify their offers. While their exact formulas differ, they all follow the same basic playbook: find a few “comparable” vehicles and then apply a series of adjustments.

- CCC ONE (Certified Collateral Corporation): This is the undisputed giant in the industry. The “Market Valuation Report” it produces is what insurers will wave in your face as the definitive proof of your car’s value.

- Mitchell International: Another major player, Mitchell supplies valuation data that, like its competitors, tries to find an average price for similar cars in your region.

- Audatex (a Solera company): While heavily used for repair estimates, Audatex also provides valuation services that insurers use to figure out total loss payouts.

These systems are powerful tools for the insurance industry, but they are far from perfect. The data they choose and the adjustments they make are precisely where the errors creep in, leading to a lower insurance total loss payout for you.

Common Flaws in Insurer Valuation Reports

That valuation report from your insurer might look intimidating, but the mistakes are often hiding in plain sight once you know where to look. An unfairly low offer is rarely the result of one giant error. It’s usually a series of small, negative adjustments that stack up against you.

To help you scrutinize your insurer’s report, here’s a quick guide to the most frequent mistakes that can drain value from your vehicle.

Common Errors in Insurance Valuation Reports

| Error Type | What to Look For | Potential Impact on Value |

|---|---|---|

| Incorrect “Comps” | Vehicles listed are a lower trim, missing key options, or are from a different geographic market. | Can undervalue your car by hundreds or thousands of dollars right from the start. |

| Unfair Condition Adjustments | Negative deductions for “prior damage” or “wear and tear” that is normal for the vehicle’s age. | Small deductions of $100-$500 each can quickly add up to a significant loss. |

| Outdated Market Data | The sales data used for comps is more than 90 days old and doesn’t reflect current market demand. | Fails to capture recent price increases, leaving money on the table. |

| Overlooked Options & Packages | The report credits you for a single feature (like a sunroof) but misses the $3,000+ package it came with. | You don’t get full credit for valuable factory upgrades. |

| Geographic Inaccuracy | Using comps from dealers 100+ miles away where market values are lower than in your local area. | Your settlement won’t reflect what it would actually cost you to replace the car locally. |

Let’s break down these common tricks and traps in more detail.

1. Using Incorrect Comparable Vehicles (“Comps”)

The entire valuation rests on the “comps” it uses—supposedly similar vehicles that have recently sold. This is where things go wrong right from the start. The insurer’s system might pull comps that are a lower trim level, from a different market, or missing key options.

2. Applying Unfair Condition Adjustments

Insurers will grade your car’s pre-accident condition, often slapping it with a generic “average” rating without real proof. They’ll then pile on negative adjustments for minor wear and tear that is completely normal for a vehicle of its age and mileage. These small deductions quickly add up, chipping away at your final settlement.

3. Ignoring Recent Market Shifts

The used car market is anything but static. A valuation system pulling sales data that’s even 90 days old might completely miss a recent spike in demand for your make and model. Independent appraisers use the latest, real-time data to make sure the value reflects what your car was worth the day before the accident.

4. Overlooking Packages and Options

Automated systems are notoriously bad at telling the difference between a standalone option and a factory package that bundles multiple features together. The report might give you credit for having a sunroof but completely ignore the $3,000 “Technology Package” it was a part of.

To see a real-world analysis of these problems, you can dive deeper into the common flaws in CCC ONE market valuation reports and learn how to spot them.

Using a Certified Appraisal to Prove Your Car’s True Worth

When your insurance company comes back with a lowball offer, you need credible, data-driven proof to change their mind. A certified total loss vehicle appraisal is the single most powerful tool you have to provide that proof and flip the negotiation dynamic back in your favor.

Unlike the automated, one-size-fits-all report from the insurer, a certified appraisal is a meticulously researched document put together by an expert. It’s built to be defensible, transparent, and in line with valuation standards that hold up in court. This isn’t just getting a second opinion; it’s building a comprehensive case for your vehicle’s true fair market value.

A Modern Approach to Fair Valuation

SnapClaim has completely changed the game. Our online platform delivers a certified, data-backed appraisal report right to your inbox, often in less than an hour. We build a powerful, defensible report by zeroing in on the very details that insurance valuation systems are notorious for getting wrong.

- Real-Time Local Market Data: We dig into current, local listings and recent sales of vehicles that are true “apples-to-apples” matches for yours. This makes sure the value is based on what it would actually cost to replace your car, in your specific area, right now.

- Precise Option and Package Adjustments: Our system identifies and properly values every single factory option and high-value package, from advanced safety features to premium interior upgrades that insurers often ignore.

- Accurate Condition and Mileage Analysis: We assess your vehicle’s pre-accident condition and mileage against the standards of your local market, applying adjustments that are both fair and accurate.

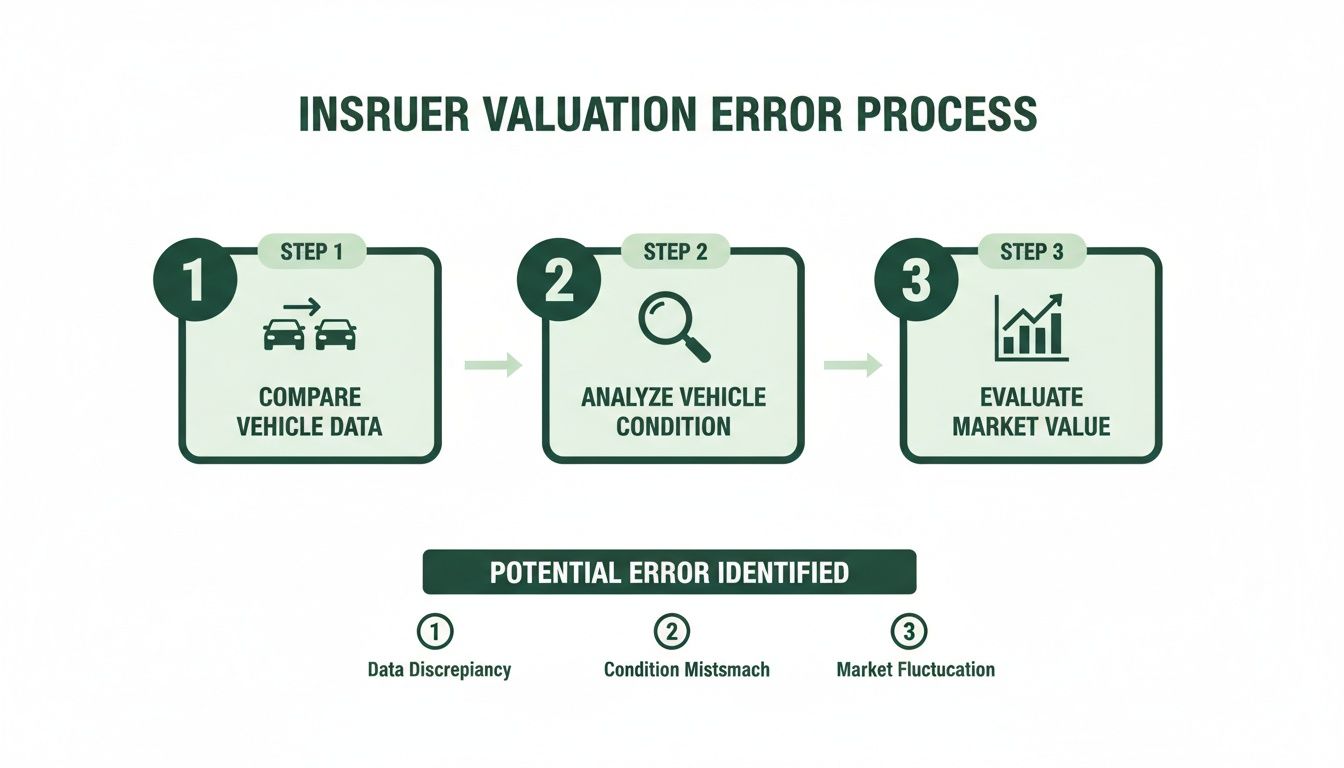

This flowchart shows how our process is designed to directly counter the most common insurer valuation errors by focusing on accurate comparisons, fair condition ratings, and current market data.

By prioritizing these key areas, a certified appraisal builds a valuation from the ground up—one based on facts, not flawed assumptions.

Why Speed and Accuracy Matter More Than Ever

The used car market is anything but static. While vehicle prices are starting to normalize, industry analysis in Claims Journal shows total loss market values are still higher than historical averages. At the same time, the cost of repairs has shot up significantly, pushing more borderline damage claims over the total loss threshold. This perfect storm makes an up-to-the-minute, market-verified total loss vehicle appraisal absolutely essential.

The Power of a Defensible Report

The moment you present your insurance adjuster with a SnapClaim report, the entire conversation changes. You’re no longer just another customer complaining about a number. You’re now a policyholder armed with a certified document that methodically breaks down your car’s true value.

A certified appraisal report shifts the burden of proof. The insurer must now justify why their valuation is more accurate than a detailed, market-verified analysis from a qualified third party. This evidence-based approach forces the adjuster to deal with specific data points, paving a much clearer path toward a fair settlement.

Negotiating a Fair Settlement with Your Appraisal

Holding a certified total loss vehicle appraisal is a game-changer, but just having the report isn’t enough. Now it’s time to put that data to work and negotiate the settlement you actually deserve.

This isn’t about picking a fight. It’s about presenting a clear, fact-based case that an insurance adjuster can’t just brush aside. Your appraisal report transforms the conversation into a professional negotiation grounded in solid market evidence.

Presenting Your Case to the Adjuster

With your certified appraisal in hand, the next move is to formally submit it to your insurance adjuster. The key here is to be professional, firm, and clear. Skip the angry phone calls—you want a paper trail.

Start by drafting a straightforward email or letter. This document will state your position and have the full appraisal report attached as proof. A simple, effective demand letter should follow this structure:

- A Clear Opening: State you are formally disputing their valuation and are providing an independent, certified appraisal.

- Reference the Appraisal: Point out that the attached SnapClaim report breaks down the specific market data used to arrive at the correct value.

- State Your Demand: Clearly state the new settlement amount you’re requesting, which should be the value from your appraisal.

- A Professional Closing: End by asking them to review the documents and reply with a revised offer.

This approach flips the script. The burden of proof is now back on the insurer to explain why their data is better than your detailed, market-verified report.

Invoking the Appraisal Clause

What if your adjuster digs in their heels and refuses to budge? Your auto insurance policy has a powerful, often overlooked tool for this exact situation: the Appraisal Clause.

This clause outlines a formal process for resolving valuation disputes. It allows both you and the insurance company to hire your own independent appraisers. Those two appraisers then work to agree on the vehicle’s value. If they can’t reach an agreement, they select a neutral third appraiser (called an umpire) to make the final call. Invoking the Appraisal Clause is a serious step that often gets the insurer to come back with a more reasonable offer.

A certified report from SnapClaim gives your chosen appraiser all the evidence needed to argue your case effectively. For a full breakdown of this strategy, check out our guide on how to dispute a total loss offer step-by-step.

A Risk-Free Path to Fair Compensation

Taking on a huge insurance company can feel overwhelming. That’s why we stand behind every report with a guarantee that makes the decision to fight back completely risk-free.

SnapClaim’s Money-Back Guarantee: “If your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee — guaranteed.”

This guarantee removes all the financial risk. You can get your total loss vehicle appraisal knowing your investment is protected. It’s our way of making sure you have the best possible shot at securing a fair insurance total loss payout with zero downside.

Frequently Asked Questions About Total Loss Vehicle Appraisal

Can I keep my car if it is a total loss?

Yes, in most states, you can choose “owner retention.” The insurance company will pay you the car’s actual cash value (ACV) minus its salvage value (what they would have received at auction). However, your car will be given a “salvage” title, which means it must be repaired and pass a rigorous state inspection before it can be legally driven again.

How long does a total loss claim take?

A total loss claim can take anywhere from a few weeks to over a month. The timeline depends on your insurer, the complexity of the accident, and how long it takes to agree on your car’s value. The negotiation phase is often the longest, but providing a certified total loss vehicle appraisal upfront can help speed up the process by presenting clear, undeniable evidence of value.

What if the payout is less than my car loan?

If the settlement is less than what you owe, you are responsible for paying the difference. This is why Guaranteed Asset Protection (GAP) insurance is so valuable. If you have GAP coverage, it will pay the “gap” between the insurance payout and your remaining loan balance. A fair total loss vehicle appraisal can help shrink this gap by ensuring you receive the highest possible settlement.

Is a total loss vehicle appraisal worth the cost?

For most vehicle owners, yes. The cost of a certified appraisal is a small fraction of the additional settlement money it can help you recover. SnapClaim makes this decision completely risk-free with our Money-Back Guarantee: if our certified appraisal doesn’t help you recover at least $1,000 more than the insurer’s final written offer, we refund the entire fee.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This guide was reviewed and verified by SnapClaim’s auto appraisers, who specialize in diminished value and total loss disputes. Our team continually updates every article to reflect current insurer guidelines, valuation standards, and court-accepted appraisal practices, ensuring that you’re relying on information trusted by professionals nationwide.

Get Started Today

Whether you’re challenging a low total loss settlement or proving your vehicle’s post-repair loss in value, SnapClaim makes it simple to take the next step. Generate a free diminished value or total loss estimate in minutes and see how much compensation you may be owed.