Hearing an insurance adjuster say your car is “totaled” can be a gut punch. It’s a stressful, confusing moment that leaves most people wondering what happens next and if they’ll get a fair payout.

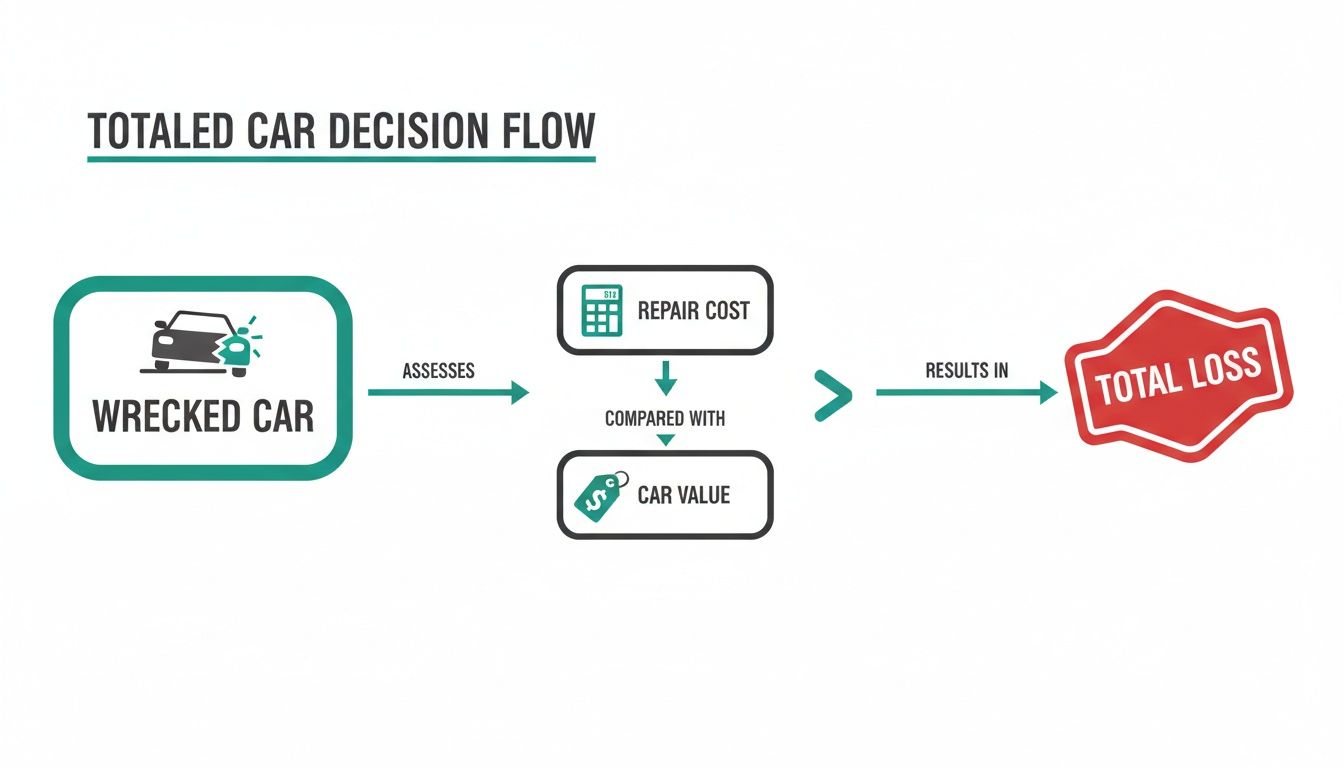

Simply put, an insurance company declares a car a “total loss” when the cost to repair it is more than the car’s value. It’s a financial decision. Instead of paying a body shop, the insurer pays you for your car’s pre-accident value and takes the damaged vehicle.

What It Means When an Insurer Totals Your Car

Seeing your damaged car is bad enough, but hearing it’s a “total loss” can feel even worse. This isn’t the end of the road, however—it’s the start of a specific insurance process that you can navigate with the right information.

Think of it like a broken appliance. If a repair costs $500 but a similar new one is $600, fixing it makes sense. But if that same repair is $700, you’re better off replacing it. Insurers apply the same logic to your vehicle, just with much larger numbers.

The Total Loss Threshold

The official tipping point for this decision is the Total Loss Threshold (TLT). This is a percentage of a car’s value set by each state’s law. If repair costs meet or exceed that percentage, the car is automatically declared a total loss.

This threshold varies. For example, a state might have a TLT of 75%. If your car was worth $10,000 before the crash, any repair estimate over $7,500 means it’s totaled. You can find your state’s specific rules on your local DMV’s website. Some states use a “Total Loss Formula,” where the cost of repairs plus the car’s scrap value must exceed its pre-accident value.

To get through this process, you need to know the terms the insurance company will use.

Key Terms in Your Total Loss Claim

Here’s a simple guide to the essential terms you’ll encounter during the totaled car insurance process.

| Term | What It Really Means |

|---|---|

| Actual Cash Value (ACV) | This is what your car was worth the moment before the accident. It’s based on its age, mileage, and condition, and it’s the number your payout is based on. |

| Total Loss Threshold (TLT) | A state-mandated percentage. If repair costs exceed this percentage of your car’s ACV, your insurer must declare it a total loss. |

| Salvage Value | The amount the insurer can get by selling your wrecked car for parts or scrap. If you decide to keep the car, they’ll subtract this from your final payout. |

The most important thing to remember is this: an insurer’s decision is a cold, hard calculation. Once you understand the jargon, you can navigate your totaled car insurance claim with much more confidence.

How Insurers Calculate Your Car’s Value

The most confusing part of a totaled car insurance claim is often the settlement offer. That number can feel like it came out of nowhere, leaving you wondering how the adjuster reached that figure. Understanding their math is the first step toward getting a fair deal.

It all comes down to one critical term: Actual Cash Value (ACV). This isn’t what you paid for the car or the sticker price of a new one.

Actual Cash Value (ACV) is what your vehicle was worth on the open market the moment before the accident. Think of it as the price a real person would have paid for your car in its pre-crash condition.

This simple flow chart breaks down the core decision insurers make.

As you can see, once repair estimates climb higher than the car’s pre-accident value, declaring it a total loss becomes the only logical move for the insurance company.

The Ingredients of Actual Cash Value

Insurance companies use valuation software that pulls data from multiple sources to determine your car’s ACV. Here are the main ingredients in that calculation:

- Vehicle Basics: The year, make, and model create the baseline value.

- Mileage: More miles on the odometer usually means less value.

- Overall Condition: This is a big one. They assess the interior, exterior, and mechanical state of your vehicle before the wreck.

- Features and Upgrades: That premium sound system, sunroof, or special trim package can add value, but you’ll need to prove you had them.

- Local Market Data: The insurer looks at what similar cars—known as “comparables”—have recently sold for in your area.

That last point is where most disputes begin. Insurers often use comps that are base models or have more miles, leading to a lowball offer. To see how these factors are weighed, you can get a closer look at the complete total loss calculation for your vehicle.

Salvage Value and Your Final Payout

Another key piece is the salvage value. This is the amount the insurer believes it can get by selling your wrecked car at auction for parts.

If you choose to keep your totaled car (an option called “owner retention”), the insurer will subtract this salvage value from your ACV payout. For instance, if your car’s ACV is $15,000 and its salvage value is $2,000, your check will only be for $13,000.

What About Your Car Loan?

This is a critical point: the insurance payout is based on the car’s value, not what you owe on your loan. If your ACV settlement is $15,000 but you still owe $17,000, you are responsible for that $2,000 difference.

This is why Guaranteed Asset Protection (GAP) insurance exists. It’s designed to cover that “gap” between the ACV payout and your loan balance. Without it, you could end up making payments on a car that’s already in a salvage yard.

Why Are So Many Cars Being Totaled These Days?

If it feels like you’re hearing about cars being “totaled” more often, you’re not wrong. A minor fender-bender that was a straightforward repair a decade ago can now easily be declared a total loss. This isn’t because accidents are worse—it’s because car repair economics have completely changed.

The hard truth is that even moderate damage can now trigger a totaled car insurance claim. Insurers make these decisions based on skyrocketing repair costs, and modern vehicle technology is the main culprit.

It’s All About the Tech (and How Much It Costs)

Today’s cars are essentially computers on wheels, packed with technology to keep us safe. But when that tech gets damaged, the repair bills become astronomical.

Think about what’s hiding in common impact zones:

- Bumpers: They used to be simple plastic. Now, they’re loaded with sensors for parking assist and emergency braking. A small bump can wreck this network, turning a minor fix into a repair bill costing thousands.

- Windshields: What was once simple glass now holds cameras and sensors for lane-keeping assist. A crack means replacing the glass and recalibrating the entire system.

- Headlights: Gone are the days of cheap halogen bulbs. High-tech LED or laser headlights are incredibly expensive, with some units costing over $2,000 each.

Add the specialized labor needed to fix these complex systems, and the total cost soars.

This Isn’t a Fluke—It’s a Trend

This is a documented, industry-wide shift. Total loss claims are climbing not because of more catastrophic crashes, but because the financial tipping point for repairs is lower than ever.

Recent data shows that the total loss frequency in the U.S. has reached unprecedented levels. By October 2023, total loss frequency hit 22.8%, putting the market on pace for another record-breaking year. Learn more about the factors reshaping the global auto insurance market and driving this trend.

That means nearly one in four accident claims ends with the car being written off. Your situation isn’t an isolated incident; it’s part of a larger pattern driven by insurer finances.

What This Means for You

The takeaway is simple: your car has a higher chance of being declared a total loss now than ever before. This makes it critical to be prepared to fight for your car’s actual pre-accident value. Arming yourself with evidence is the key to ensuring their financial strategy doesn’t leave you shortchanged.

Your Step-By-Step Plan After a Total Loss Declaration

Hearing your car is a “total loss” can feel overwhelming. Suddenly, you’re buried in paperwork and confusing insurance terms. But you don’t have to be a passive participant. With a clear plan, you can take control of your claim.

Think of this as your roadmap. Following these steps will keep you organized, protect your rights, and help you build the strongest case for the compensation you deserve.

Step 1: Secure Your Belongings and the Police Report

First things first. Before your car is towed, get all your personal items out of it. Check the glove box, trunk, and under the seats. Once it’s gone, getting your things back can be a nightmare.

Next, get an official copy of the police report. This document establishes the undisputed facts of what happened and is the foundation of your totaled car insurance claim.

Step 2: Review Your Policy and the Insurer’s Offer

Now, it’s time for a little homework. Find your auto insurance policy and read the sections on comprehensive and collision coverage. Get clear on your deductible—the amount you pay out of pocket—and any specific language about total loss claims.

When the insurer sends their settlement offer, don’t just look at the final number. Ask for the detailed valuation report they used. A huge part of this process involves talking and negotiating with insurance agents, so you need to see exactly how they did their math.

Step 3: Gather Your Own Evidence

This is where you shift from defense to offense. The insurance company built a case for what they think your car is worth; now it’s time to build yours. The goal is to prove your vehicle was in better-than-average shape and worth more than their offer.

Your evidence file should include:

- Maintenance Records: Proof of regular oil changes, new brakes, or tire rotations shows you took excellent care of the car.

- Receipts for Upgrades: Did you install a new stereo or add premium tires? Those receipts prove you added real value.

- Pre-Accident Photos: Any pictures showing your car looking clean and well-maintained can be incredibly persuasive.

Never underestimate your paperwork. Every receipt and service record helps paint a picture of a well-cared-for vehicle. This is your best weapon against an insurer trying to lowball you with generic book values.

Step 4: Challenge the Offer and Negotiate

With your evidence organized, you’re ready to push back. If the insurer’s “comps” aren’t truly comparable—maybe they used a base model when you had a fully-loaded one—point it out. Find your own examples from local online listings for the exact same year, make, model, and trim.

Present your maintenance records and upgrade receipts to prove your car’s Actual Cash Value is higher. The key is to be polite but firm. This isn’t about emotion; it’s about presenting facts and data to negotiate a fair settlement.

How to Negotiate a Fairer Insurance Settlement

Getting a lowball settlement offer for your totaled car can feel like adding insult to injury. But the good news is their first offer is just that—an offer. It’s a starting point for negotiation, not the final word.

To negotiate effectively, you have to understand the common tactics insurers use to justify a lower payout. Arming yourself with this knowledge is your first step toward getting the fair compensation you deserve.

Common Insurer Tactics and How to Counter Them

Insurance adjusters are skilled negotiators, and their arguments often rely on data that doesn’t show your car’s true value. By knowing their playbook, you can prepare a fact-based response.

Here are three common tactics and how to counter them:

Using Inaccurate “Comps”: The insurer may value your car using “comparable” vehicles that aren’t comparable at all. They might pull comps for base models, cars with higher mileage, or vehicles in poor condition.

- Your Strategy: Do your own homework. Find online listings in your local area for cars of the exact same year, make, model, and trim with similar mileage. Present these as counter-evidence.

Overlooking Recent Upgrades: Did you just spend $1,000 on new tires or install an upgraded sound system? Insurers often value a car based on its stock condition, ignoring valuable additions.

- Your Strategy: Show them the receipts. Hard proof of recent investments demonstrates added value that must be included in the Actual Cash Value calculation.

Ignoring Meticulous Maintenance: A car with a perfect maintenance history is worth more than a neglected one. But insurers often assume average wear and tear, which can lower their offer if you were a diligent owner.

- Your Strategy: Provide your service records. A complete history of tune-ups and preventative maintenance paints a clear picture of a car in superior condition, justifying a higher valuation.

The Power of an Independent Appraisal

While your research is a good start, the ultimate tool for leveling the playing field is a certified, independent appraisal. An insurer’s valuation is created to serve their financial interests. An independent appraisal is created to determine the objective, data-driven truth of your car’s value.

A professional report from a service like SnapClaim provides the unbiased proof you need. It analyzes real-time market data, accounts for your vehicle’s specific condition, and presents the findings in a format that stands up to scrutiny. This isn’t just an opinion; it’s a defensible, evidence-based valuation. For a deeper dive, our guide on disputing a total loss offer provides a complete roadmap.

Formalizing Your Counter-Offer

Once you have your evidence—market research, maintenance records, and a certified appraisal—it’s time to present your case. Your negotiation should be professional and fact-driven. This often involves sending a well-structured demand. For specific guidance, you can learn about crafting a demand letter to an insurance company for an auto accident.

This formal communication should clearly lay out why you’re disputing their offer and include copies of all your evidence. By backing up your claim with facts, you shift the negotiation from a battle of opinions to a discussion based on evidence.

Strengthening Your Claim with a Certified Appraisal

What’s the real difference between the insurance company’s valuation report and an independent appraisal? Everything.

An insurer’s report is built to justify their settlement offer. An independent appraisal has one job: to determine your vehicle’s true, unbiased Fair Market Value. Getting one is the single most powerful step you can take to level the playing field.

Handing an adjuster a few printouts from online car sites is a decent start. But handing them a certified report from a state-licensed appraiser is a game-changer. The conversation immediately shifts from opinion to a factual debate backed by a professional, evidence-based document.

How a Certified Appraisal Provides Proof

A SnapClaim report doesn’t rely on generic book values or a few cherry-picked “comparable” cars. Our certified methodology uses advanced market analysis and industry standards to establish a precise value.

Here’s what our comprehensive analysis includes:

- Hyper-Local Market Data: We analyze recent sales of the exact same year, make, model, and trim in your specific area.

- Condition Adjustments: We account for your vehicle’s true pre-accident condition, especially if you took meticulous care of it.

- Added Value from Upgrades: We factor receipts for new tires, a premium sound system, or other enhancements into the final value.

This data-driven process eliminates guesswork. A certified total loss car appraisal gives you both the confidence and the hard data needed to prove your car’s true worth.

A Risk-Free Way to Challenge Your Insurer

We understand that pushing back against a large insurance company feels intimidating. That’s why we stand behind every report with a simple, no-nonsense guarantee that removes the financial risk.

SnapClaim’s Money-Back Guarantee: If your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee — guaranteed.

This isn’t just a marketing promise. It’s a reflection of our confidence in our valuation process and our commitment to helping vehicle owners get the compensation they rightfully deserve. When you present a SnapClaim report, you provide certified proof that strengthens your totaled car insurance settlement claim.

FAQs About Your Totaled Car Insurance Claim

Dealing with a totaled car insurance claim is stressful, but you’re not alone. Here are straight answers to the most common questions we hear from vehicle owners.

Can I keep my car if it’s declared a total loss?

Yes, in most states, you can choose to keep your car through a process called “owner retention.” The insurance company will pay you the car’s Actual Cash Value (ACV) minus its determined salvage value. However, the vehicle will be issued a “salvage title,” which makes it very difficult to insure or sell later and requires extensive, certified repairs before it’s legal to drive again.

What happens if I owe more on my car loan than the insurance payout?

If your car loan balance is higher than the insurance settlement, you are responsible for paying the difference. The insurance check goes to your lender first. This financial shortfall is often called being “upside down” on your loan. This is the exact scenario that Guaranteed Asset Protection (GAP) insurance is designed to cover.

How long does a total loss claim usually take?

While every claim is different, most total loss settlements are resolved within about 30 days. This timeline includes the adjuster’s vehicle inspection, valuation research, negotiations, and final paperwork. Delays can occur due to disagreements over the car’s value or communication issues with your lender.

Can I claim diminished value if my car is a total loss?

No, a diminished value claim only applies when a vehicle is repaired after an accident. Diminished value is the loss in resale value your car suffers because it now has an accident history. Since a totaled car is not repaired and resold by you, a diminished value claim is not applicable. For more information, see our Diminished Value Guide.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This guide was reviewed and verified by SnapClaim’s auto appraisers, who specialize in diminished value and total loss disputes.

Our team continually updates every article to reflect current insurer guidelines, valuation standards, and court-accepted appraisal practices, ensuring that you’re relying on information trusted by professionals nationwide.

Get Started Today

Whether you’re challenging a low total loss settlement or proving your vehicle’s post-repair loss in value, SnapClaim makes it simple to take the next step.

Generate a free diminished value or total loss estimate in minutes and see how much compensation you may be owed.

👉 Get your free estimate today or order a certified appraisal report to strengthen your insurance claim.