Your car is back from the shop and looks fantastic, but there’s a problem you can’t see: its accident history. That blemish on its record means it’s now worth less than an identical car that’s never been in a wreck. This frustrating financial loss is called diminished value, and the key to getting that money back is knowing how to file a diminished value claim with State Farm using solid proof.

Your Car Is Repaired, but Its Value Isn’t Restored

When another driver hits you, their insurance company—in this case, State Farm—is supposed to make you whole. That responsibility covers more than just fixing the dents and scratches. While a great body shop can make your car look and drive like new, they can’t erase the accident from its permanent record.

This isn’t just a theoretical problem. It’s a real financial hit you’ll take when you eventually sell or trade in your car.

Today’s buyers are savvy. They pull vehicle history reports from services like CARFAX and will immediately see the collision on your car’s record. No matter how perfect the repairs are, the market automatically views a car with an accident history as less valuable.

The Two Kinds of Value Loss You’re Facing

To build a strong claim, it helps to know exactly what you’re trying to recover. Diminished value usually breaks down into two types:

- Inherent Diminished Value: This is the big one and the most common type of claim. It’s the automatic drop in your car’s market value simply because it now has an accident on its record. Even with flawless, factory-certified repairs, the stigma remains, and a buyer will always pay less for it.

- Repair-Related Diminished Value: This is an additional loss caused by subpar repair work. Think mismatched paint, cheap aftermarket parts instead of OEM, or subtle frame issues that weren’t perfectly corrected. This is damage to the value caused by a bad repair job.

Of course, before you can even think about diminished value, you need to make sure you’ve handled the immediate aftermath of the crash correctly. Knowing What to Do After a Car Accident is the first step in protecting your rights and setting yourself up for a successful claim later on.

A common myth adjusters love to push is that if your car is repaired properly, you haven’t lost anything. But the market tells a different story. If a buyer has a choice between two identical cars at the same price, and one has been in an accident, they will always choose the one with the clean history.

That difference in value is what you’re owed. Filing a diminished value claim with State Farm is your way of proving that loss and demanding fair compensation. If you don’t file, you’re essentially letting the at-fault driver off the hook and paying for their mistake out of your own pocket.

How to Know if Your Diminished Value Claim Qualifies with State Farm

Before you dive into gathering paperwork and building a diminished value claim, let’s make sure your situation actually qualifies. This is a critical first step. Not every accident is eligible, and knowing where you stand with State Farm from the get-go saves a ton of frustration and sets the right expectations.

Nine times out of ten, it all comes down to one thing: who was at fault.

In nearly every state, you can only file a diminished value claim against the at-fault driver’s insurance. This is what we call a third-party claim. So, if a State Farm-insured driver hit you, you’d file your DV claim with State Farm to get back the market value your car has lost.

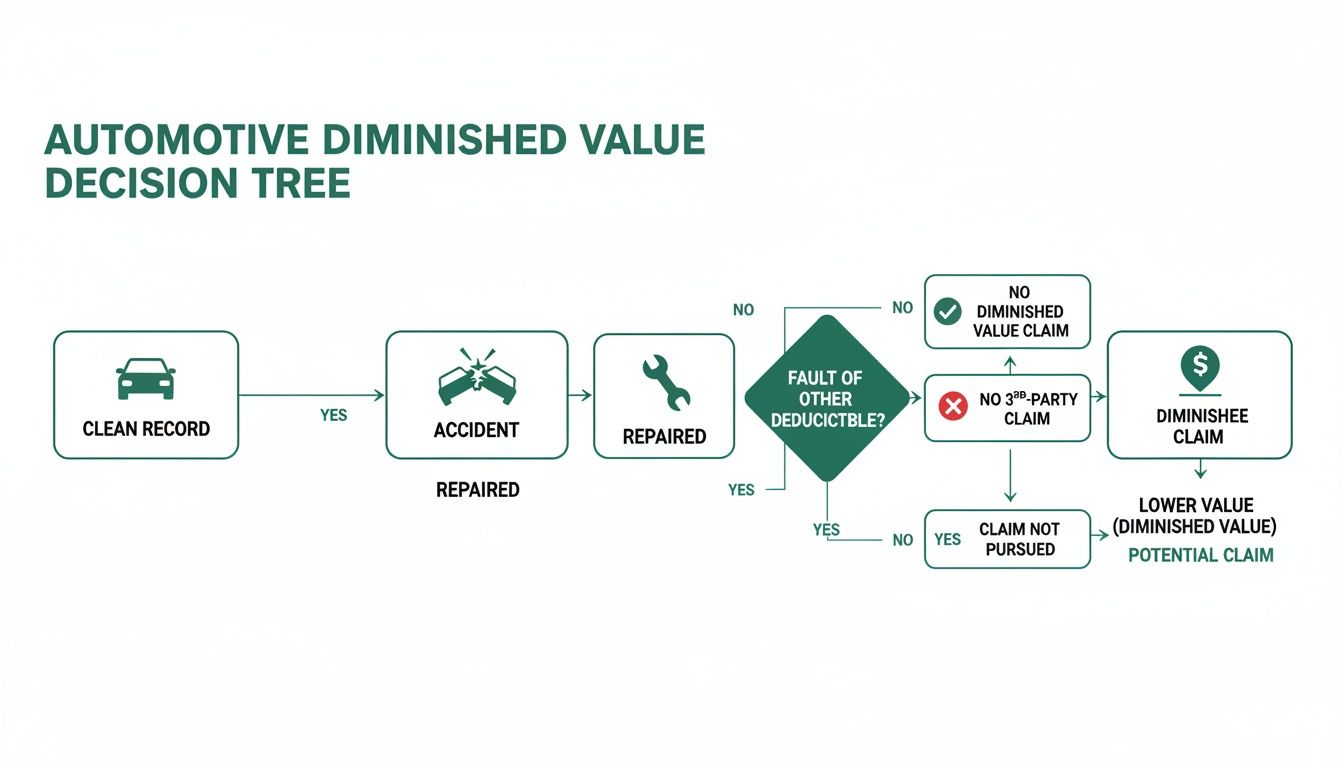

This flowchart breaks down the typical path for a successful diminished value claim.

As you can see, a strong claim begins with a vehicle that had a clean title before it was damaged by someone else. Even with perfect repairs, that accident history now drags down its resale value. That loss is what your claim is for.

First-Party vs. Third-Party Claims

What if you try to file a DV claim with your own insurance? That’s called a first-party claim, and it’s almost always a dead end. Standard auto policies are written to cover the cost of repairs, not the hit your car value takes after the accident. Because of this, insurance companies deny first-party DV claims by default.

But there’s one massive exception: Georgia.

Thanks to a landmark court ruling, Georgia law allows vehicle owners to file first-party diminished value claims under certain conditions. The case, Mabry v. State Farm, was a game-changer. It forced the insurer to pay for inherent diminished value on some first-party claims, a decision that ultimately cost the company an estimated $150 million and reshaped how claims are handled in the state.

Factors That Give Your Claim a Fighting Chance

Beyond just proving fault, a few other elements will make a State Farm adjuster take your claim much more seriously. Your case is strongest if your vehicle:

- Is a newer model, typically less than 7 years old.

- Has relatively low mileage for its age.

- Was in pristine condition before the crash, with no prior accident history.

- Suffered significant damage, especially if it involved the frame or other structural components.

Think about it from an adjuster’s perspective. A minor bumper scuff on a 12-year-old sedan with 150,000 miles on the clock isn’t going to have a strong DV case. But a two-year-old SUV with only 20,000 miles that needed a whole new door and quarter panel? That’s a completely different story—and a much stronger argument for a significant loss in value.

Assembling the Proof for a Winning Claim

A strong diminished value claim is built on undeniable proof. State Farm adjusters are trained to minimize payouts, so your goal is to present a case that’s too solid to ignore. Merely telling them your car is worth less isn’t enough; you must show them with clear, organized documentation.

Think of it like building a legal case. Each piece of evidence you provide closes a potential loophole the adjuster might use to undervalue or deny your claim. Without this proof, you’re just asking for money. With it, you’re demanding fair compensation for a documented loss.

Your Essential Evidence Checklist

Gathering the right documents is the most important step in preparing your claim. Each item tells part of your story, from the moment of the crash to the final, repaired state of your vehicle.

To get started, you’ll need a folder—digital or physical—to collect everything. This isn’t just about being organized; it’s about presenting a professional, irrefutable case to the adjuster.

Here’s a rundown of the non-negotiable documents you need to build a rock-solid diminished value claim with State Farm.

| Essential Documents for Your State Farm Diminished Value Claim | |

|---|---|

| Document | Why You Need It |

| Police Report | This is your foundational document. It officially establishes fault, which is a non-negotiable requirement for any third-party claim. |

| Itemized Final Repair Invoice | A detailed, itemized invoice shows exactly what was fixed, listing every part and labor hour. It proves the severity of the damage, especially if structural or frame components were involved. |

| High-Quality Photos (Before & After) | Visual evidence is powerful. Photos of the initial damage and post-repair photos create a clear narrative of the collision’s impact. |

| Third-Party Diminished Value Appraisal | This is the single most critical document. It’s an independent, data-driven report that calculates the exact dollar amount of your vehicle’s lost market value. It turns your opinion into an expert-backed fact. |

| Vehicle Title or Registration | This confirms you are the legal owner of the vehicle and have the right to file a claim for its loss in value. |

| Proof of Insurance (Yours) | While you’re filing against the at-fault driver’s policy, having your own insurance details handy is always a good practice. |

Having these documents organized and ready to go shows the adjuster you are serious and prepared, setting a completely different tone for your entire claim process.

Pro Tip: When taking post-repair photos, try to capture the exact same angles as your accident photos. A side-by-side comparison makes the extent of the work immediately obvious to the adjuster and leaves no room for interpretation.

The One Document That Seals the Deal

While the items above are crucial, they only prove the accident happened and your car was fixed. They don’t prove how much value it actually lost. For that, you need the single most important piece of evidence: a third-party diminished value appraisal.

An independent appraisal from a certified expert like SnapClaim is the cornerstone of your entire claim. This isn’t just an opinion; it’s an objective, data-backed report that calculates the precise loss in your vehicle’s fair market value using real-world market data and industry-standard methods.

When you present a State Farm adjuster with a certified appraisal, the entire conversation changes. You are no longer just asking for money; you are presenting a documented, expert-backed valuation of your financial loss. Its absence is one of the top reasons insurers deny or lowball these claims.

This report becomes your anchor during negotiations. It stops the adjuster from dismissing your claim with a tiny offer based on a flawed internal formula like the 17c rule. Before you order a full report, you can use a free diminished value calculator to get a quick estimate of what your claim might be worth.

How to File Your Diminished Value Claim with State Farm Professionally

You’ve got all your evidence ready to go. Now it’s time to formally present your case to State Farm. The way you submit your claim package really sets the tone for the entire negotiation, so professionalism is everything.

Your goal is simple: make your request so clear and well-supported that the State Farm adjuster has no choice but to take you seriously.

The centerpiece of your entire submission is the diminished value demand letter. This isn’t an angry email or a frustrated note—it’s a formal, concise business communication. In it, you’ll clearly state your intention to claim compensation for your vehicle’s lost value because of the accident.

Crafting a Powerful Demand Letter

Your letter needs to be brief and straight to the point. This isn’t the place for long, emotional stories about the accident. That kind of thing can actually weaken your position. Stick to the cold, hard facts you’ve gathered.

Your demand letter absolutely must include these key elements:

- Your Claim Number: Put this right at the very top so the adjuster can find it instantly.

- A Clear Statement of Purpose: Use a direct and unambiguous phrase like, “I am writing to formally demand compensation for the inherent diminished value of my vehicle.”

- The Specific Amount: State the exact dollar amount your independent appraisal report calculated. Don’t estimate or round the number. Precision matters.

- A List of Enclosed Documents: Itemize everything you’re including, like the police report, the final repair invoice, and your certified appraisal.

This organized, no-nonsense approach shows the adjuster you’re methodical and serious. It immediately elevates your request from a simple complaint to a formal demand backed by solid proof.

Think of your demand letter as your opening argument. Keep it firm, factual, and professional. Let your certified appraisal report do the heavy lifting by providing the data-driven justification for the amount you’re claiming.

Sending Your Package for Maximum Impact

Once your letter and all your supporting documents are ready, the final step is getting the package to the State Farm adjuster assigned to your claim. While email is quick, it just doesn’t have the formal authority or proof of delivery you need for this kind of communication.

The best way to do this is to send your entire claim package via Certified Mail with a return receipt requested. This gives you a legal, verifiable record proving that State Farm received your demand on a specific date. It’s a small step, but it adds a serious layer of accountability and signals to the insurer that you are handling this matter with precision.

Following a structured process is crucial when you’re dealing with a massive insurer like State Farm. For more details on what to expect, check out our complete guide on how to file a diminished value claim. By presenting your case professionally from the start, you build a strong foundation for the negotiation that comes next.

Negotiating With the State Farm Adjuster

Once your demand letter is sent, the real game begins. This is where the back-and-forth with the State Farm adjuster kicks off, so be ready. It’s almost a guarantee that their first response will be a lowball offer or, in some cases, an outright denial of your claim.

Don’t panic. This is a standard opening move, not the final word. The key is to stay professional, calm, and firmly anchored to the facts and figures in your appraisal report.

It’s a well-known rule in this world that you should never accept the insurance company’s first offer, especially when it comes to diminished value. Think of their first number as a starting point for discussion, nothing more. Your job is to patiently guide the conversation back to the market-based evidence you’ve already provided, making it clear your claim is rooted in data, not just opinion.

Understanding Common Adjuster Tactics

State Farm adjusters are trained negotiators, and their primary goal is to minimize the company’s payouts. They have a playbook of common tactics they use to challenge or shrink your claim.

One of the most frequent is pulling out the 17c formula. This is a controversial, in-house calculation method that is widely criticized for spitting out artificially low numbers. It uses arbitrary multipliers for damage severity and mileage that rarely reflect the true market loss.

Nationally, the average diminished value claim is around $1,500, but a 17c calculation can easily drag a legitimate claim far below that figure. It simply doesn’t compare to an appraisal based on actual market data.

Another tactic you might encounter is a flat-out denial, where the adjuster claims State Farm doesn’t owe for diminished value at all. In a valid third-party claim, this is simply not true.

How to Respond to a Lowball Offer

When that low offer lands in your inbox, take a breath. Don’t get discouraged or angry. Instead, craft a calm, professional written response.

Here’s what your counter-email should do:

- Politely reject their offer. State clearly that the amount they’ve proposed doesn’t cover the documented loss in your vehicle’s value.

- Ask for their math. Request a detailed breakdown of how they arrived at their number. Make them show their work.

- Point back to your evidence. Gently but firmly re-emphasize the findings from your certified SnapClaim appraisal. Highlight that it’s based on real-world market data, not a generic formula.

Your appraisal is your greatest asset in this conversation. Frame every point around it. A good response looks something like this: “Thank you for your offer. However, it is significantly lower than the $4,500 loss identified in my certified appraisal, which is based on an analysis of comparable vehicles in our local market. Can you please explain how your valuation accounts for these market realities?”

This data-driven approach puts the ball back in their court and forces the adjuster to justify their position against hard evidence. If they continue to stonewall or refuse to negotiate in good faith, it might be time to think about escalating.

While most claims get settled without legal action, knowing when you might need a diminished value claim lawyer is a smart next step. Remember, patience and persistence, backed by solid evidence, are your strongest tools.

FAQs About How to File a Diminished Value Claim with State Farm

When you’re trying to figure out how to file a diminished value claim with State Farm, a lot of questions pop up. It can be a confusing process, but these answers to common concerns should help.

Can I file a diminished value claim if the accident wasn’t my fault?

Yes, absolutely. In fact, this is the main requirement. Diminished value claims are filed against the at-fault driver’s insurance policy. If a State Farm-insured driver caused the accident, you are entitled to pursue compensation from them for your car’s loss in value.

Can I file for diminished value if I caused the accident?

Almost certainly not. Think of a diminished value claim as a third-party claim—you file it against the insurance company of the driver who hit you. Your own collision policy is designed to cover the cost of repairs, not to reimburse you for the hit your car value takes after the accident. The only major exception is in Georgia, where state law sometimes allows for first-party claims.

What if State Farm denies my claim or gives me a lowball offer?

Don’t panic. A low offer—or even a flat denial—is a standard negotiation tactic. Your first step is to respond calmly and professionally in writing. Reject their offer and ask for a detailed breakdown of how they calculated their number. This is where your independent SnapClaim appraisal becomes your most powerful tool. Point back to the certified, data-driven evidence in your report and contrast it with their likely formula-based offer.

How much time do I have to file my claim?

This is determined by your state’s laws, not State Farm. Each state has a statute of limitations for property damage, which is a firm deadline for filing a claim. Most states give you two or three years from the date of the accident, but this can vary. It’s critical to look up the specific statute of limitations in your state and start the process long before that window closes.

Conclusion

Successfully learning how to file a diminished value claim with State Farm comes down to one thing: providing undeniable proof of your loss. While adjusters are trained to minimize payouts, a professionally prepared claim supported by a certified, data-driven appraisal from SnapClaim changes the entire dynamic. It provides the proof you need to negotiate fairly and strengthens your claim for the compensation you deserve.

Ready to see what your claim is worth? SnapClaim provides the certified, data-backed evidence you need to strengthen your insurance claim and negotiate for a fair settlement.

Plus, if your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee—guaranteed.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This guide was reviewed and verified by SnapClaim’s auto appraisers, who specialize in diminished value and total loss disputes.

Our team continually updates every article to reflect current insurer guidelines, valuation standards, and court-accepted appraisal practices, ensuring that you’re relying on information trusted by professionals nationwide.

Get Started Today

Whether you’re challenging a low total loss settlement or proving your vehicle’s post-repair loss in value, SnapClaim makes it simple to take the next step.

Generate a free diminished value or total loss estimate in minutes and see how much compensation you may be owed.

👉 Get your free diminished value estimate today