Total Loss Appraisal in Wisconsin

Get Your Free Estimate in minutes.

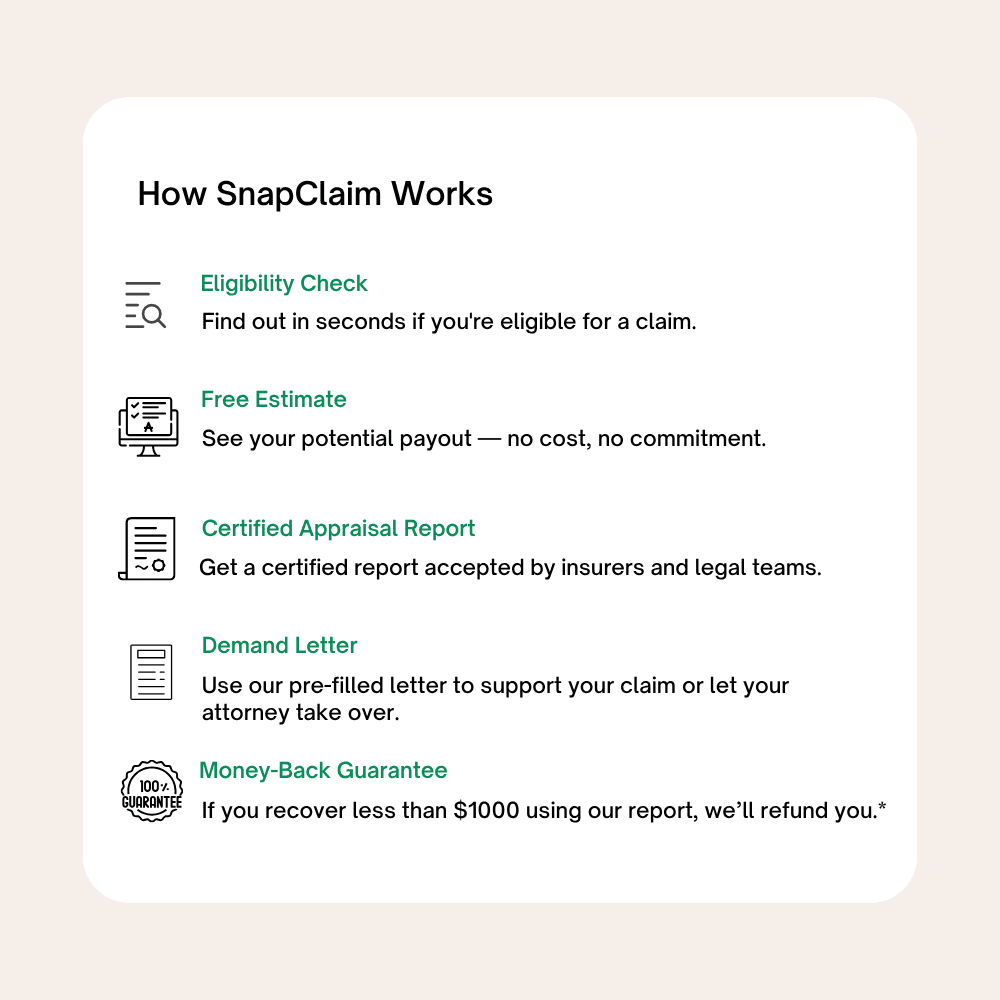

If your car was declared a total loss and you’re not happy with the insurance payout, you have the right to request a Wisconsin total loss appraisal. SnapClaim helps you dispute unfair insurance valuations with certified, data-backed reports that show your vehicle’s true fair market value.

No credit card required [Takes less than 30 second]

Total Loss Appraisal in Wisconsin: What You Need to Know

Wisconsin Total Loss Appraisal — Get a Fair Settlement for Your Totaled Vehicle

If your vehicle was declared a total loss in Wisconsin and the insurance offer feels too low, you have the right to request an independent Wisconsin total loss appraisal to verify your car’s true pre-accident value. From Milwaukee, Madison, Green Bay to Kenosha, Racine, Appleton, Waukesha and communities across the state, SnapClaim helps Wisconsin drivers recover the fair market value (ACV) of their vehicles and challenge low or inaccurate insurance valuations. Our certified total loss appraisal reports are data-driven, USPAP-aware, and insurer-ready — frequently used by adjusters, attorneys, and small-claims courts throughout Wisconsin.Why Get a Total Loss Appraisal in Wisconsin?

Wisconsin’s used-vehicle market varies significantly between major metro areas and rural towns. Insurance valuation tools often fail to capture price differences tied to:- Urban vs. rural demand

- Market premiums for AWD, 4WD, sedans, SUVs, and trucks

- Regional variations in listing supply and pricing

- Winter-driven demand for reliable all-weather vehicles

Common Reasons to Question a Wisconsin Total Loss Offer

- Incorrect trim, package, or drivetrain listed in the insurer’s report

- Comparables pulled from lower-priced regions outside Wisconsin

- Improper deductions for condition or aftermarket equipment

- AWD, 4WD, hybrid, or specialty trims undervalued

- Metro-area pricing (Milwaukee, Madison, Green Bay) not properly reflected

What’s Included in Your Wisconsin Total Loss Appraisal Report

- Full VIN-decoded breakdown confirming trim, drivetrain, and installed features

- Local comparable listings from Milwaukee, Madison, Green Bay, Appleton, Waukesha, and nearby regions

- Accurate pre-loss fair market value based on Wisconsin market conditions

- Adjustments for mileage, features, upgrades, and vehicle condition

- Documentation to invoke the appraisal clause under your Wisconsin auto policy

- Optional expert support if negotiations escalate or if an attorney becomes involved

Wisconsin Total Loss Rules & Appraisal Rights

Wisconsin policyholders may dispute a total loss valuation and request an independent appraisal through the appraisal clause in their policy. If the two appraisers cannot agree, a neutral umpire will decide the final value.- Wisconsin Office of the Commissioner of Insurance

- Wisconsin DOT — Vehicle & Title Services

- Wisconsin Courts — Small Claims Information

How to Dispute a Total Loss Offer in Wisconsin

- Request the insurer’s valuation report (CCC, Mitchell, Audatex) and review for inaccuracies.

- Order a SnapClaim total loss appraisal to determine the correct ACV.

- Invoke the appraisal clause if your valuation differs significantly from theirs.

- Send the independent appraisal to your adjuster or attorney.

- Use documented market evidence — many Wisconsin drivers secure thousands more than the initial offer.

Wisconsin Market Insights

- AWD and SUVs command higher prices due to harsh winter conditions.

- Used-car prices in Milwaukee and Madison often exceed statewide averages.

- Pickup trucks retain strong value across rural and suburban regions.

- Hybrids and EVs may be undervalued by automated valuation tools.

Example Wisconsin Case Study

Vehicle: 2020 Subaru Outback Premium AWDInsurance Offer (CCC): $19,400

SnapClaim Appraisal: $23,100

Final Settlement: $22,800 after submitting our independent report under the appraisal clause

Helpful Wisconsin Resources

- Wisconsin Insurance Consumer Help

- Small Claims & Dispute Resolution

- Wisconsin DOT — Titles & Vehicle Info

- NHTSA — Vehicle History Search

Ready to Get Your Wisconsin Total Loss Appraisal?

- No upfront payment required

- Most reports completed in about 1 hour

- Includes a fair-market-value conclusion with insurer-ready documentation

Related Wisconsin Locations

Click a pin to open the city’s total loss page.

Find your Wisconsin city below to order your Total Loss Appraisal.

Order Your Total Loss Appraisal

Get Your Appraisal Report and Demand Letter Now!

Free Estimate, no credit card required.

Dispute an Unfair Total Loss Offer in Wisconsin

If your car was declared a total loss in Wisconsin but the insurance payout seems too low, you don’t have to accept it. Under your policy’s appraisal clause, you can request an independent Wisconsin total loss appraisal to verify your vehicle’s true fair market value. SnapClaim makes it simple — get a certified total loss report, invoke your appraisal rights, and negotiate a higher settlement — all within minutes.

“After a rear-end accident in Madison left my SUV severely damaged, the insurance company’s total-loss offer came in way below what similar vehicles were selling for across Wisconsin. SnapClaim’s appraisal laid out the true market value using real statewide comps and repair documentation. Once I submitted their report, the insurer increased their offer by nearly $3,100.”

Dana K.,

Madison, WI

Wisconsin Total Loss – Frequently Asked Questions

When is a vehicle considered a total loss in Wisconsin?

Wisconsin uses a 70% total loss threshold for many vehicles. If a vehicle less than seven years old is damaged so that the cost to repair is more than 70% of its fair market value, it generally meets the definition of a salvage vehicle and is treated as a total loss for title-branding purposes. You can see how Wisconsin’s rules compare to other states here: total loss laws by state.

What does Actual Cash Value (ACV) mean on a Wisconsin total loss claim?

ACV is your vehicle’s fair market value just before the crash. Insurers should look at similar vehicles actually selling in Wisconsin markets like Milwaukee, Madison, Green Bay, Kenosha, Racine, Appleton, and nearby areas. It should reflect your vehicle’s year, trim, mileage, options, condition, and local supply. For a deeper explanation, visit: Fair Market Value & ACV.

The total loss valuation seems low for Wisconsin — how can I push back?

Start by requesting the full valuation report from the insurer. Review each comparable vehicle for: incorrect trim, missing options, wrong mileage, or listings pulled from cheaper out-of-area markets. Many Wisconsin drivers and law firms rely on an independent SnapClaim total loss appraisal to show a higher, data-backed ACV: order a Wisconsin total loss appraisal.

How does Wisconsin’s 70% salvage threshold actually work?

For many vehicles under seven model years old, if the estimated or actual cost to repair the collision damage is more than 70% of the vehicle’s fair market value, Wisconsin law treats it as a salvage vehicle. That triggers salvage-title rules even if the insurer technically could repair the vehicle. Older vehicles and certain title brands may be treated differently, so the exact outcome depends on your specific facts and policy language.

What happens to my title if my car is totaled in Wisconsin?

When a vehicle is deemed a total loss under Wisconsin rules, it is typically branded as a salvage vehicle and a salvage title is issued. If the vehicle is later repaired and passes the required Wisconsin salvage inspection, it can receive a rebuilt salvage (or similar) brand before it can be registered and driven again. In some situations, you may also see additional brands such as “claim paid,” “flood damaged,” or “hail damaged” depending on the type and extent of loss.

Can I keep my totaled vehicle in Wisconsin and repair it myself?

Often, yes. If you choose to retain the salvage, your insurer usually reduces your cash settlement by the vehicle’s salvage value. You will hold a salvage title and must complete repairs and a state inspection before the vehicle can be registered and legally driven again. A properly documented ACV and salvage value can help you decide whether keeping the vehicle makes financial sense: talk to our Wisconsin appraisal team.

Will my Wisconsin total loss payout include taxes, title, and registration fees?

Many total loss settlements include applicable sales tax and certain mandatory fees needed to replace your vehicle, but practices vary by insurer and policy. Always ask for an itemized breakdown that separately lists: vehicle ACV, tax, title, registration, and other charges. If something seems missing, you can question it in writing.

What if I owe more on my auto loan than the insurance will pay in Wisconsin?

If your loan payoff is higher than the total loss settlement, you have negative equity. You remain responsible for that balance unless you have GAP coverage or a similar product that covers the shortfall. Because of this, having a well-supported ACV can directly reduce the amount you still owe after the claim.

How long do I have to deal with a Wisconsin property damage or total loss claim?

Wisconsin has specific statutes of limitations that control how long you have to pursue vehicle damage and injury claims after a crash. The deadlines can span years, but they depend on the type of claim and may change if the law is updated. Missing a deadline can impact your rights, so it’s wise to consult a Wisconsin attorney about timing for your situation. SnapClaim’s role is to provide a clear, data-driven valuation that your attorney or adjuster can use in negotiations: see how our Wisconsin reports are used.

Does my Wisconsin auto policy have an appraisal clause, and how does it help?

Many Wisconsin auto policies include an appraisal clause that applies when you and your insurer disagree about your vehicle’s value. Typically, each side hires an appraiser; if they cannot agree, a neutral umpire reviews both positions and helps set the amount. This process usually applies when you’re making a claim under your own policy. A detailed SnapClaim report can support your position in that process: Wisconsin total loss appraisals.

Does SnapClaim work for rural or small-town Wisconsin claims?

Yes. SnapClaim works across all of Wisconsin—from larger cities like Milwaukee and Madison to smaller communities and rural areas. Instead of generic national numbers, we focus on hyper-local comparable listings that match your vehicle’s actual market. You can start from our Wisconsin hub and then select your city: SnapClaim Wisconsin overview.

How fast can I get a Wisconsin total loss appraisal from SnapClaim?

Most Wisconsin total loss appraisals are completed the same business day after we receive your claim information and documents—often within about an hour. That speed helps you respond to a low offer before the claim drags on. Get started here: request a Wisconsin total loss appraisal.

How does a SnapClaim report help Wisconsin drivers and law firms negotiate better payouts?

SnapClaim builds a Wisconsin-specific valuation file using verified comparables, condition adjustments, mileage, options, and market corrections for your area. The report explains how ACV should be calculated and points out where the insurer’s number may fall short. Many clients recover substantially more after presenting a well-supported appraisal: learn how our fair market value reports work.

Diminished Value & Total Loss Appraisal Reports

Instant Free Estimate

Instant diminished value and total loss appraisals — no guesswork, no delays, backed by a 100% money-back guarantee.

Free Estimate, no credit card required.