Delray Beach Total Loss Appraisal

Get Your Free Estimate in a Minute!

If your car was declared a total loss and you’re not happy with the insurance payout, you have the right to request a Delray Beach total loss appraisal. SnapClaim helps you dispute unfair insurance valuations with certified, data-backed reports that show your vehicle’s true fair market value.

No credit card required [Takes less than 30 second]

Delray Beach Total Loss Appraisal — Get What Your Vehicle Is Truly Worth

If your vehicle was declared a total loss in Delray Beach, Miami, or Orlando and the payout seems too low, you don’t have to accept it. Florida drivers have the right under their insurance policy’s appraisal clause to request an independent Delray Beach total loss appraisal that determines the car’s actual cash value (ACV) before the accident. SnapClaim provides USPAP-compliant, data-driven total loss reports trusted by insurers, attorneys, and appraisers throughout Florida to resolve valuation disputes quickly.Why Total Loss Appraisals Matter in Delray Beach

Insurance valuations (CCC or Mitchell) often use data that doesn’t fully reflect the local market trends in Florida. SnapClaim ensures your vehicle’s valuation includes accurate dealer and retail pricing from the Delray Beach metro area.Why Delray Beach Vehicle Owners Often See Undervalued Offers

- Delray Beach’s used car market is consistently strong, especially for hybrids, EVs, trucks, and SUVs like Toyota RAV4, Tesla Model 3, Ford F-150, and Honda CR-V.

- Insurance valuations often rely on comps from cheaper nearby states.

- High demand around Miami, Orlando, Tampa, and Jacksonville results in higher resale pricing.

What Your Delray Beach Total Loss Appraisal Report Includes

- Verified VIN, year, make, model, trim, mileage, and options

- Comparable listings from Delray Beach, Miami, Orlando, Tampa, Jacksonville, and St. Petersburg markets

- Transparent pre-loss fair market value analysis

- Documentation to invoke your appraisal clause or use in small claims court

- Optional expert-witness support within Florida

Delray Beach and Surrounding Areas We Serve

- Miami

- Orlando

- Tampa

- Jacksonville

- St. Petersburg

- Hialeah

- Port St. Lucie

- Cape Coral

- Tallahassee

- Fort Lauderdale

- Pembroke Pines

- Hollywood

- Gainesville

- Miramar

How to Dispute a Delray Beach Total Loss Offer

- Get a copy of your insurer’s CCC or Mitchell valuation report.

- Order your Delray Beach total loss appraisal to verify pre-loss ACV.

- Invoke the appraisal clause in writing if there’s a large difference.

- Use SnapClaim’s report to negotiate or proceed to arbitration.

- Recover your loss — many Florida clients gain $2,000–$6,000+ more with accurate documentation.

Local Insight: Delray Beach Market Trends

- Florida has high demand for EVs, hybrids, trucks, and SUVs.

- Miami and Orlando show higher dealer pricing compared to inland Florida.

- Insurers often use comps from rural areas, lowering payouts unfairly.

Example Delray Beach Case Study

Vehicle: 2018 Honda Accord EXInsurance Offer (CCC): $14,800

SnapClaim Appraisal: $17,900

Final Settlement: $17,700 after invoking the appraisal clause

Helpful Florida Resources

- Florida Department of Financial Services

- Florida Highway Safety & Motor Vehicles

- Florida Courts — Small Claims

Ready to Get Your Delray Beach Total Loss Appraisal?

- Delivered same day — usually within an hour

- Money-back guarantee if your claim isn’t paid

- Report valid for insurance, legal, and small-claims use

Related Florida Locations

Order Your Total Loss Appraisal

Get Your Appraisal Report and Demand Letter Now!

Free Estimate, no credit card required.

Dispute an Unfair Total Loss Offer in Delray Beach

How SnapClaim Helps Delray Beach Drivers

- Eligibility Check: Find out in seconds if your total loss case qualifies for an independent appraisal.

- Free Estimate: Instantly see your vehicle’s fair market value based on verified Delray Beach market data — no cost, no obligation.

- Certified Appraisal Report: Receive a detailed, data-backed report reflecting true resale prices across the Delray Beach metro area.

- Appraisal Clause Support: Use our report to invoke your policy’s appraisal clause and challenge unfair insurer valuations.

- Money-Back Guarantee: If your recovery is under $1,000 using our report, we’ll refund your appraisal fee — no risk, full transparency.

“When my SUV was declared a total loss in Delray Beach, the insurer’s initial offer barely covered a fraction of its true value. I turned to SnapClaim for a total loss appraisal, and their detailed report included local market data that proved the offer was too low. Thanks to their help, the final settlement was enough to get me back into a reliable car without any financial stress.”

— Samantha T., Delray Beach, FL

Delray Beach Total Loss – Frequently Asked Questions

What qualifies a car as a total loss in Delray Beach?

In Delray Beach, a vehicle is considered a total loss if the cost to repair it, combined with its salvage value, meets or exceeds its Actual Cash Value (ACV) at the time of the accident. Florida law governs this calculation to ensure fair compensation. Learn more: state-by-state rules.

What is Actual Cash Value (ACV) in Delray Beach?

ACV represents the fair market value of your vehicle immediately before the accident. It is based on your car’s make, model, mileage, trim, condition, and recent sales of comparable vehicles in Delray Beach and surrounding Palm Beach County, including Boca Raton and Boynton Beach. More details: Fair Market Value.

How much will insurance pay if my car is totaled in Delray Beach?

Florida insurers are required to pay your car’s ACV at the time of loss. If you file through your own insurance, a deductible may apply; if the at-fault driver’s insurance pays, typically no deductible is required.

Can I dispute the total loss valuation in Delray Beach?

Yes. You can request the insurer’s detailed valuation report, verify that the comparable vehicles are local, and provide stronger market examples. You may also order an independent total loss appraisal from SnapClaim: Delray Beach Total Loss Appraisals.

What happens to my car title after a total loss in Delray Beach?

Florida issues a Salvage title for totaled vehicles. If you repair the car, it must pass a DMV inspection before a rebuilt or restored title is issued, allowing it to be legally driven again.

Can I keep my totaled car in Delray Beach?

Yes, you can retain your vehicle. However, your insurance payout will be reduced by the car’s salvage value, and you must follow Florida’s rebuilt title procedures before driving it again.

Are taxes and fees included in a Delray Beach total loss settlement?

Yes, settlements may include applicable sales tax, title, and registration fees. Request an itemized breakdown to understand exactly what is covered. Learn more: ACV & line items.

What should I do if my Delray Beach insurance offer is too low?

Compare the insurer’s report to local Delray Beach comps and check for any missing options on your car. If the offer is undervalued, consider a certified total loss appraisal from SnapClaim: Start your appraisal.

How long do I have to file a total loss claim in Delray Beach?

Florida law generally allows up to four years from the accident date to file a property damage claim. Filing sooner ensures evidence and market data remain current.

Why is local market data important in Delray Beach?

Vehicle values can vary across Florida. Using local Delray Beach and Palm Beach County comparables ensures your ACV reflects true resale conditions in your area.

What is an appraisal clause and how does it protect Delray Beach drivers?

An appraisal clause allows either side to hire an appraiser if there is a dispute over your vehicle’s value. A neutral umpire decides the final ACV, giving Delray Beach drivers an extra layer of protection.

Can I use an independent appraisal in court or arbitration?

Yes. SnapClaim’s certified appraisals are accepted in Delray Beach small claims court, arbitration, or mediation as evidence of your vehicle’s true value.

How quickly can I get a total loss appraisal in Delray Beach?

Most Delray Beach appraisals are completed same day, often in under an hour, so you can respond quickly to a low insurance offer.

What if I owe more than my car’s value?

Any negative equity is your responsibility, but GAP insurance—if purchased—may cover the difference between the ACV and your loan balance. A higher ACV from SnapClaim can help reduce this gap.

How does SnapClaim help Delray Beach drivers?

SnapClaim uses verified local vehicle data from Delray Beach and Palm Beach County to produce accurate, court-ready total loss appraisals. Many drivers recover thousands more than their initial insurance offer. Start now.

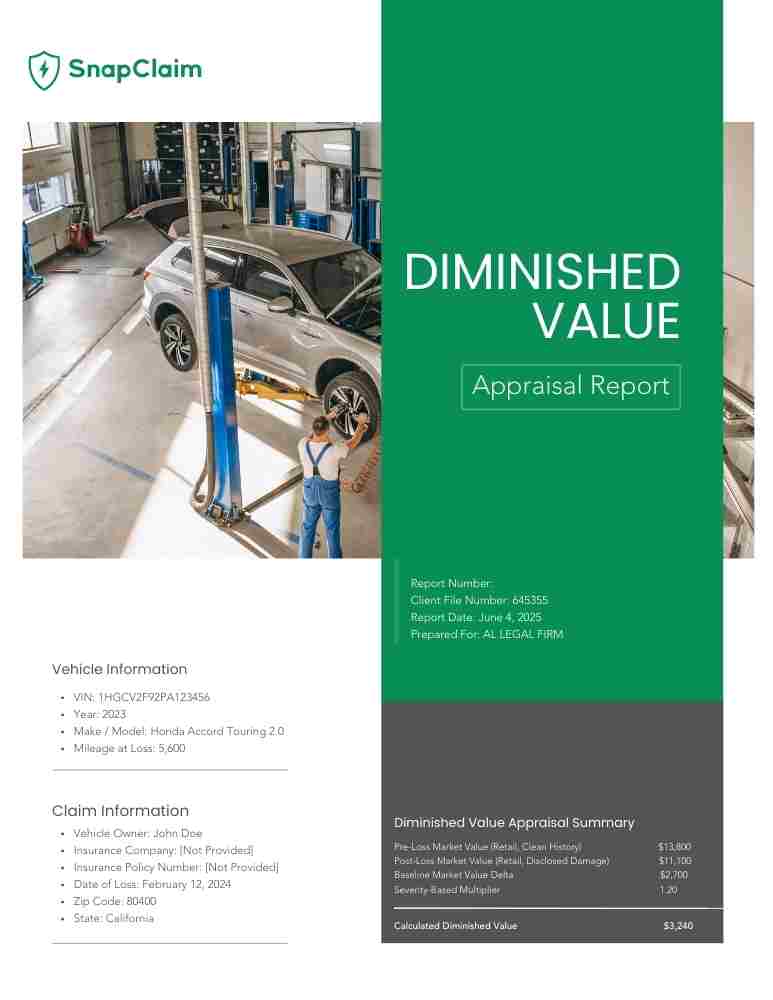

Diminished Value & Total Loss Appraisal Reports

Instant Free Estimate

Instant diminished value and total loss appraisals — no guesswork, no delays, backed by a 100% money-back guarantee.

Free Estimate, no credit card required.