Dover Total Loss Appraisal

Get Your Free Estimate in a Minute!

If your car was declared a total loss and you’re not happy with the insurance payout, you have the right to request a Dover total loss appraisal. SnapClaim helps you dispute unfair insurance valuations with certified, data-backed reports that show your vehicle’s true fair market value.

No credit card required [Takes less than 30 second]

Dover Total Loss Appraisal — Get What Your Vehicle Is Truly Worth

If your vehicle was declared a total loss in Dover, Manchester, or Nashua and the payout seems too low, you don’t have to accept it. New Hampshire drivers have the right under their insurance policy’s appraisal clause to request an independent Dover total loss appraisal that determines the car’s actual cash value (ACV) before the accident. SnapClaim provides USPAP-compliant, data-driven total loss reports trusted by insurers, attorneys, and appraisers throughout New Hampshire to resolve valuation disputes quickly.Why Total Loss Appraisals Matter in Dover

Insurance valuations (CCC or Mitchell) often use data that doesn’t fully reflect the local market trends in the Manchester and Nashua metro areas. SnapClaim ensures your vehicle’s valuation includes accurate dealer and retail pricing from the Dover region.Why Dover Vehicle Owners Often See Undervalued Offers

- Dover’s used car market remains strong, especially for trucks and SUVs like Ford F-150, Chevrolet Silverado, Toyota Tacoma, and Honda CR-V.

- Insurance valuations often rely on cheaper listings from rural counties.

- Local demand around Manchester, Nashua, Concord, and Portsmouth raises vehicle resale prices.

What Your Dover Total Loss Appraisal Report Includes

- Verified VIN, year, make, model, trim, mileage, and options

- Comparable listings from Dover, Manchester, Nashua, and Concord markets

- Transparent pre-loss fair market value analysis

- Documentation to invoke your appraisal clause or use in small claims court

- Optional expert-witness support within New Hampshire

Dover and Surrounding Areas We Serve

- Manchester

- Nashua

- Concord

- Portsmouth

- Rochester

- Keene

- Claremont

- Lebanon

- Dover

- Somersworth

- Hanover

- Salem

- Laconia

- Milford

How to Dispute a Dover Total Loss Offer

- Get a copy of your insurer’s CCC or Mitchell valuation report.

- Order your Dover total loss appraisal to verify pre-loss ACV.

- Invoke the appraisal clause in writing if there’s a large difference.

- Use SnapClaim’s report to negotiate or proceed to arbitration.

- Recover your loss — many New Hampshire clients gain $2,000–$6,000 more with proper documentation.

Local Insight: Dover Market Trends

- High demand for trucks, SUVs, and crossovers across New Hampshire.

- Dealerships in Manchester, Nashua, and Concord set the state’s pricing benchmarks.

- Insurers often pull comps from lower-priced rural markets, reducing valuations.

Example Dover Case Study

Vehicle: 2019 Honda Accord EX Insurance Offer (CCC): $18,400 SnapClaim Appraisal: $21,300 Final Settlement: $20,950 after invoking the appraisal clauseHelpful New Hampshire Resources

- New Hampshire Department of Insurance — File a Complaint

- New Hampshire Revised Statutes — Insurance Laws

- New Hampshire Courts — Small Claims

Ready to Get Your Dover Total Loss Appraisal?

- Delivered same day — usually within an hour

- Money-back guarantee if your claim isn’t paid

- Report valid for insurance, legal, and small-claims use

Related New Hampshire Locations

Order Your Total Loss Appraisal

Get Your Appraisal Report and Demand Letter Now!

Free Estimate, no credit card required.

Dispute an Unfair Total Loss Offer in Dover

How SnapClaim Helps Dover Drivers

- Eligibility Check: Find out in seconds if your total loss case qualifies for an independent appraisal.

- Free Estimate: Instantly see your vehicle’s fair market value based on verified Dover market data — no cost, no obligation.

- Certified Appraisal Report: Receive a detailed, data-backed report reflecting true resale prices across the Dover metro area.

- Appraisal Clause Support: Use our report to invoke your policy’s appraisal clause and challenge unfair insurer valuations.

- Money-Back Guarantee: If your recovery is under $1,000 using our report, we’ll refund your appraisal fee — no risk, full transparency.

“After my car was totaled near Central Avenue in Dover, the insurance payout was thousands below what my Honda Accord was worth. I ordered a New Hampshire total loss appraisal from SnapClaim, and they delivered the report the same day. With their documentation, I recovered $3,200 more than the original offer.”

— Chip T., Dover, NH

Dover Total Loss – Frequently Asked Questions

What factors lead to a total loss decision in Dover?

Insurers usually label a vehicle a total loss when projected repairs outweigh its resale potential based on Dover-area transactions and vehicle condition. State Total Loss Overview.

Why do Dover drivers frequently review the initial settlement?

First offers may rely on generalized pricing models and fail to reflect Dover’s active vehicle market and proximity to coastal demand.

Does Dover’s location influence vehicle values?

Yes. Coastal access, year-round travel, and mixed city driving patterns all play a role in shaping local vehicle pricing. How Vehicle Value Is Calculated.

Which vehicle styles tend to hold value in Dover?

Compact SUVs, dependable sedans, and vehicles with balanced fuel economy often remain in strong demand within the Dover area.

Can aftermarket additions change a Dover total loss valuation?

Yes. Verified enhancements such as navigation systems, upgraded safety features, or recent component replacements can influence assessed value.

What errors should Dover vehicle owners avoid after a total loss?

Overlooking discrepancies in mileage, trim level, or options and approving paperwork without clarification can lead to undervaluation.

How are loan balances handled for Dover total loss claims?

Settlement funds are typically sent to the financing institution first, with any remaining portion distributed to the vehicle owner afterward.

Why might a Dover-specific appraisal be helpful?

Appraisals using Dover-area listings can correct values derived from broader regions that don’t reflect nearby pricing behavior. Dover Total Loss Appraisal.

Does a total loss automatically raise insurance rates in Dover?

Not necessarily. Premium changes depend on liability, driving history, and insurer guidelines rather than the loss classification alone.

How does SnapClaim assist Dover drivers after a total loss?

SnapClaim assembles Dover-focused valuation reports using verified regional listings to support fair insurance negotiations. Start Your Dover Claim.

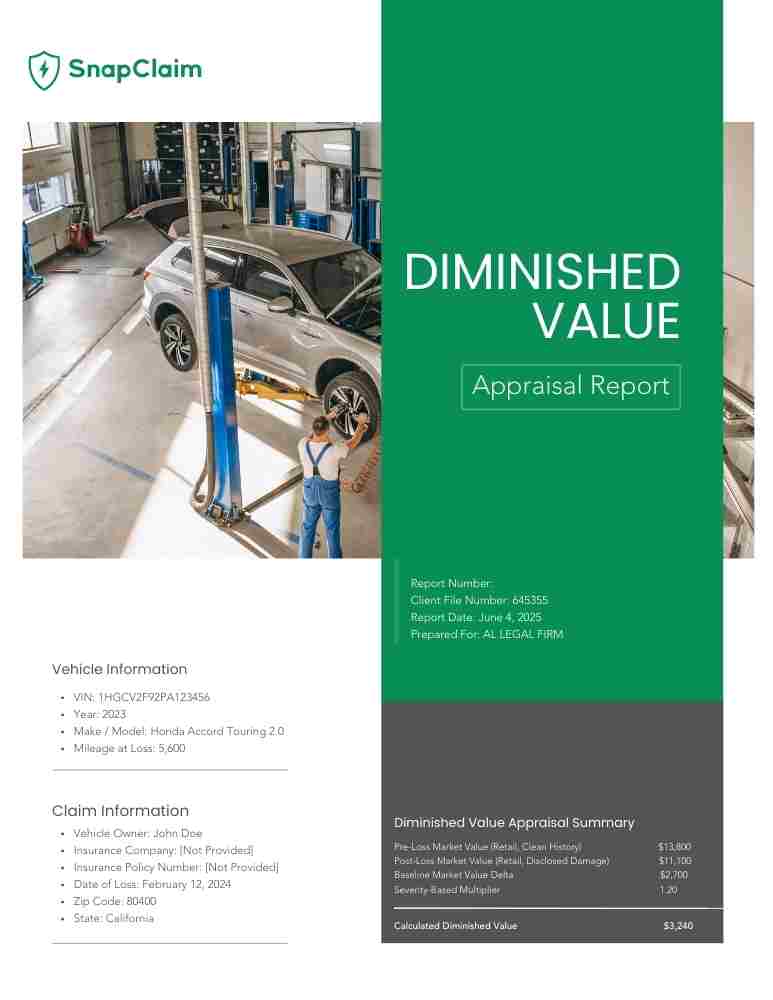

Diminished Value & Total Loss Appraisal Reports

Instant Free Estimate

Instant diminished value and total loss appraisals — no guesswork, no delays, backed by a 100% money-back guarantee.

Free Estimate, no credit card required.