Fair Market Value (Total Loss) Appraisal

Get Your Free Estimate in minutes.

If your car was declared a total loss, the insurance company’s first offer might not reflect your car’s true market value. Get an independent Fair Market Value (total loss) Appraisal accepted by insurers, attorneys, and courts nationwide

No credit card required • 100% Money-Back Guarantee

As Seen in Trusted Media

Acknowledged by trusted publications and experts as a trusted vehicle appraisal solution.

Your State’s Total Loss Laws"

Need Total Loss Appraisal?

Insurers often undervalue total-loss vehicles by using outdated data or wrong comparables. A Fair Market Value (Total Loss) Appraisal Report ensures you get a payout based on your car’s true market value.

- Challenge low offers with accurate, data-driven valuations.

- Use true comparables from recent sales and listings in your area.

- Strengthen your claim with appraisal reports accepted by insurers and courts.

- Recover thousands in undervalued compensation.

No credit card required • 100% Money-Back Guarantee

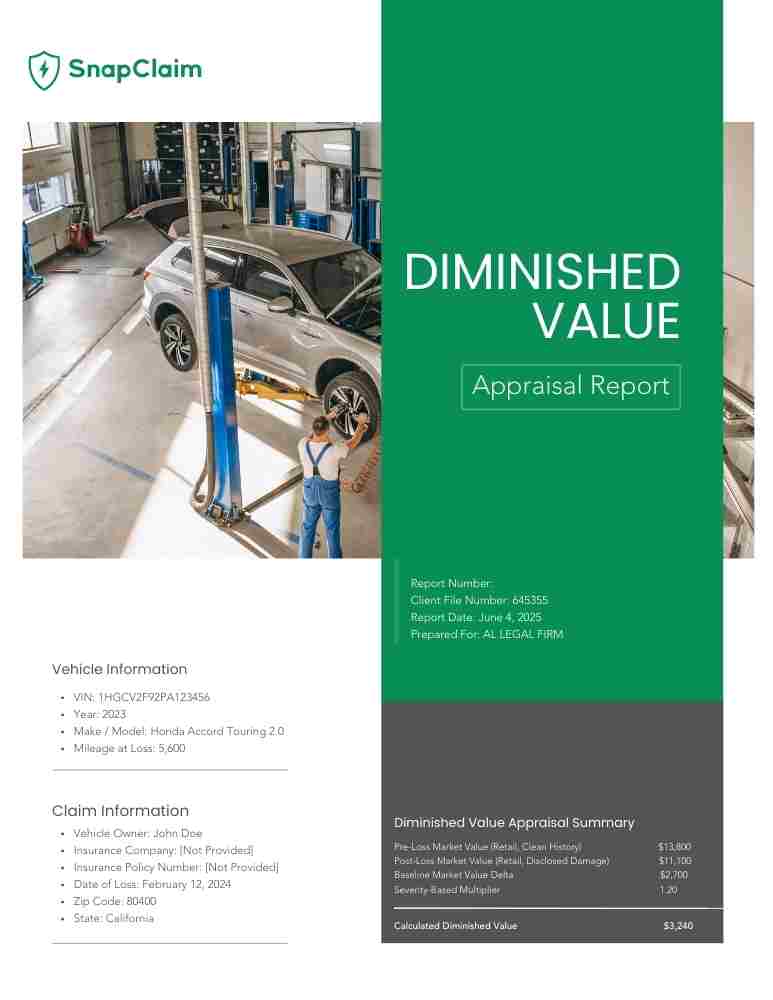

Total Loss Appraisal Report

Your Total Loss Appraisal Report includes everything needed to support your claim and provide an accurate fair market value accepted by insurers, attorneys, and courts.

- Market-Based Valuation: Uses real sold and listed comparables to determine your car’s true value.

- Vehicle-Specific Adjustments: Adjusted for mileage, trim, condition, upgrades, and options.

- Regional Pricing: Reflects current market trends in your local area.

- Documentation: A professional report accepted nationwide by insurers and courts.

- Money-Back Guarantee: Full refund if your claim is denied or recovery is under $1,000.

Money-Back Guarantee

We stand behind every appraisal. If your claim results in less than $1,000 in extra recovery, we’ll refund your full report fee

- Risk-free: get your money back if recovery is under $1,000

- Applies to all certified diminished value and FMV reports

- Backed by our nationwide guarantee

Total Loss Thresholds

Every state defines a Total Loss Threshold (TLT) differently. Some use a fixed percentage (like 70–80% of your car’s pre-accident value), while others use the Total Loss Formula (TLF), comparing repair costs plus salvage value to your vehicle’s fair market value.

Knowing your state’s rule helps you understand whether your car qualifies as a total loss. SnapClaim appraisal reports are recognized nationwide by insurance adjusters, attorneys, and courts giving you the evidence you need to negotiate confidently.

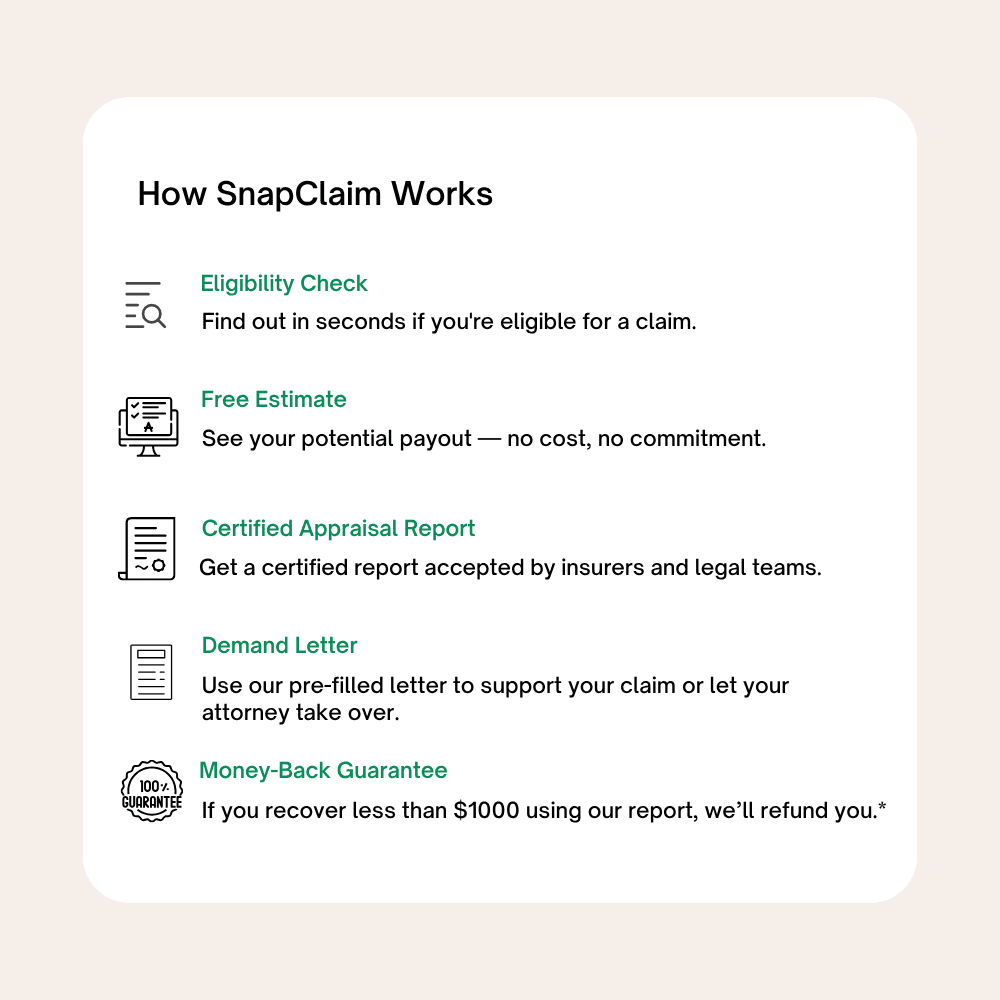

How it works

Getting your fair market value appraisal through SnapClaim is fast, transparent, and risk-free. In just a few steps, you can challenge a low insurance payout and recover the full value your vehicle deserves.

- Check Eligibility: Enter your vehicle details to confirm if it qualifies for a total loss appraisal.

- Get a Free Estimate: Receive an instant fair market value estimate — no credit card required.

- Order Full Report: Our certified appraisers analyze comparable sales from the past 90 days to determine your car’s true value.

- Submit to Insurance: Use the report to negotiate with your adjuster or invoke the Appraisal Clause to dispute the offer if required.

Backed by our 100% Money-Back Guarantee

Order Your Appraisal Report

Get Your Appraisal Report and Demand Letter Now!

Free Estimate, no credit card required.

Frequently Asked Questions:

- What is a Fair Market Value (Total Loss) Appraisal Report?

We’ll need your VIN,, mileage at time of accident, condition notes, ZIP code, the insurer’s offer or CCC valuation, and claim number. This lets us match accurate, recent comparable sales and listings to your vehicle.

- How does a total loss appraisal help me dispute a low insurance offer

Our independent report documents your car’s fair market value using recent, regionally relevant comps and vehicle-specific adjustments. You can submit it to your adjuster or use it under the policy’s Appraisal Clause to formally dispute the offer.

- What is the Appraisal Clause and how do I use it for a total loss dispute?

The Appraisal Clause allows both you and the insurer to hire independent appraisers when you disagree on value. You present our report; if needed, each side’s appraiser selects an umpire to reach a binding value. Our team can guide you through the steps.

- How do you determine fair market value for a totaled vehicle?

We analyze recent sales and active listings of comparable vehicles within your market and time window, then adjust for mileage, trim, options, condition, and regional pricing. We do not rely on automated or formula based reports; we prioritize verifiable market data.

- How long does a total loss appraisal report take?

Most reports are delivered within same business day after we receive your details and the insurer’s valuation (if provided).

- How much does a total loss appraisal cost and do you offer a guarantee?

See current pricing here: SnapClaim Pricing. We back reports with a 100% Money-Back Guarantee if your claim is denied or your recovery is less than $1,000.

- Will insurers accept a SnapClaim total loss appraisal report?

Yes. Our reports are recognized nationwide by major insurance carriers, as well as by attorneys and courts. Many customers use the report to successfully negotiate higher payouts.

- What is my state’s total loss threshold, and does it affect my claim?

States use either a fixed Total Loss Threshold (e.g., 70–80% of value) or the Total Loss Formula (repair cost + salvage value ≥ market value). Check your state here: State Total Loss & DV Laws.

- What is the difference between a Diminished Value report and a Total Loss appraisal?

A Diminished Value report measures the loss in value after repairs when the car is not totaled. A Total Loss appraisal establishes the full fair market value when the vehicle is deemed a total loss. Learn more about DV here: Diminished Value Appraisals.

- Can my attorney or body shop use your total loss appraisal report?

Absolutely. We work with law firms, body shops & estimators, and claim professionals nationwide. Reports are formatted for insurance negotiations, arbitration, or court if needed.

- What if I already received a CCC valuation—should I still order a report?

Yes. CCC valuations can miss regional pricing or vehicle options. Our report independently verifies market value and often identifies higher, better-matched comps to support a stronger settlement.

Latest articles

Fair Market Value (Total Loss) Appraisal Reports

Instant Free Estimate

Instant diminished value and total loss appraisals — no guesswork, no delays, backed by a 100% money-back guarantee.

Free Estimate, no credit card required.