Car insurance can feel like a maze of confusing terms, leaving you wondering what you’re actually paying for. So, what is comprehensive auto insurance, and do you really need it?

Think of comprehensive coverage as your vehicle’s financial shield against the unexpected. While collision insurance handles damage from accidents, comprehensive steps in to cover just about everything else—events that are almost always out of your control.

Understanding Your Vehicle’s Financial Shield

Comprehensive insurance is a key part of your auto policy, designed to cover a wide range of non-collision incidents. This coverage prevents a major headache when your car is damaged by Mother Nature, thieves, or just plain bad luck.

What Does Comprehensive Cover?

You’ll often hear this coverage called “other than collision,” which is a perfect description. It applies to situations where your car is damaged without being in a traditional accident with another vehicle or object.

Here’s a quick rundown of what’s typically included:

- Theft and Vandalism: Your car is stolen or someone intentionally damages it.

- Weather Events: Damage from hail, floods, hurricanes, and tornadoes.

- Falling Objects: A tree branch lands on your roof during a storm, or debris falls from an overpass.

- Animal Collisions: Hitting a deer or another animal on the road.

- Fire and Explosions: Your vehicle catches fire, whether from a mechanical issue or an external source.

Unexpected events can easily lead to thousands in repair bills or even a total loss. Comprehensive coverage is what stands between you and a massive financial hit.

Comprehensive Coverage At a Glance

| Covered Events (Non-Collision) | Not Covered |

|---|---|

| Theft of your vehicle | Damage from hitting another car |

| Vandalism and riots | Colliding with an object (like a pole) |

| Hail, floods, and fire | Your own medical expenses |

| Hitting an animal (e.g., a deer) | Damage you cause to others’ property |

| Falling trees or other objects | Normal wear and tear or maintenance |

| Broken or cracked windshield | Mechanical breakdowns |

This table makes it clear: comprehensive is for the unpredictable, non-driving incidents, while other policies handle the rest.

What Is Not Covered?

Understanding what isn’t covered is just as critical. Comprehensive insurance won’t pay for damages if you collide with another vehicle or run into a stationary object—that’s what collision coverage is for. It also doesn’t cover your medical bills or the damage you cause to other people or their property; that’s the job of liability insurance.

Comprehensive vs. Collision vs. Liability Coverage

Diving into auto insurance can feel like learning a new language. You’ve got comprehensive, collision, and liability—three terms that sound similar but do very different jobs. The best way to think of them is like a team of specialists, each trained to handle a specific type of problem.

Together, comprehensive and collision are often bundled into what people call “full coverage” because they protect your vehicle. Liability, on the other hand, is all about covering damages you cause to other people.

Liability: The Foundation of Your Policy

Think of liability coverage as the bare minimum required by law in most states. Its job is simple but critical: to pay for the damage you cause to other people and their property if you’re at fault in an accident.

If you cause an accident, your liability insurance covers the other driver’s medical bills and vehicle repairs. But liability does nothing to pay for the damage to your own car. You can get a full rundown on its protections in our guide to what liability insurance covers.

Collision: Your Shield in a Crash

This is where collision coverage enters the picture. As its name suggests, it pays to repair or replace your car after it collides with something—whether that’s another vehicle, a guardrail, or a telephone pole.

Collision kicks in regardless of who was at fault. If you back into a post or get in a multi-car pileup, this is the part of your policy that covers your repair bills (minus your deductible).

Comprehensive: The “Everything Else” Protector

So, if liability covers others and collision covers crashes, what’s left? That’s where what is comprehensive auto insurance comes in. It’s your safety net for just about every other kind of damage that isn’t a direct collision.

Picture these real-world scenarios:

- A hailstorm leaves your car covered in dents.

- Someone smashes your window to steal personal items.

- You hit a deer on a country road at dusk.

- A tree branch snaps during a windstorm and lands on your roof.

In these situations, comprehensive coverage is what pays for the repairs. It’s designed to protect your car from a huge range of non-accident incidents, making it essential for total financial protection.

What Does Comprehensive Insurance Actually Cover?

Now that we’ve drawn the line between comprehensive, collision, and liability, let’s get into the specifics. What are the real-world situations where comprehensive coverage saves the day? Think of this as the “unlucky but covered” list—the stuff that’s almost always out of your control.

The whole point of this coverage is to shield you from damage that isn’t from a collision. These events can be anything from a minor headache to a catastrophic event that totals your vehicle.

While resources like the National Highway Traffic Safety Administration (NHTSA) are fantastic for checking vehicle safety, the safest car in the world can’t stop a falling tree branch. This is where comprehensive shines—it handles the things you can’t predict or prevent.

The Most Common Comprehensive Claims

Here’s a practical breakdown of what typically falls under the comprehensive umbrella:

- Theft and Vandalism: Your car gets stolen overnight or someone keys your doors. Comprehensive helps pay to repair the damage or, if the car is gone for good, provides an insurance total loss payout.

- Wild Weather: This is a big one. Think hail leaving dents on your roof, floodwaters swamping your engine, or a hurricane tossing debris into your car.

- Falling Objects: An old tree drops a massive limb onto your hood during a storm. Comprehensive is designed to cover exactly that kind of freak accident.

- Animal Collisions: Hitting a deer can cause thousands in front-end damage. This is one of the most common reasons people file a comprehensive claim.

- Fire, Riots, and Explosions: If your vehicle catches fire from a faulty wire or gets damaged during a protest, your comprehensive policy is there to cover the repair costs.

- Glass Damage: A truck kicks up a rock on the highway and cracks your windshield. This is usually covered by comprehensive, and many policies even have a lower deductible for glass repair.

Even after perfect repairs, your car value after accident will likely drop. This loss is called diminished value. Filing a diminished value claim is the best way to recover that lost value, and a SnapClaim report provides the data-backed proof you need to negotiate fairly.

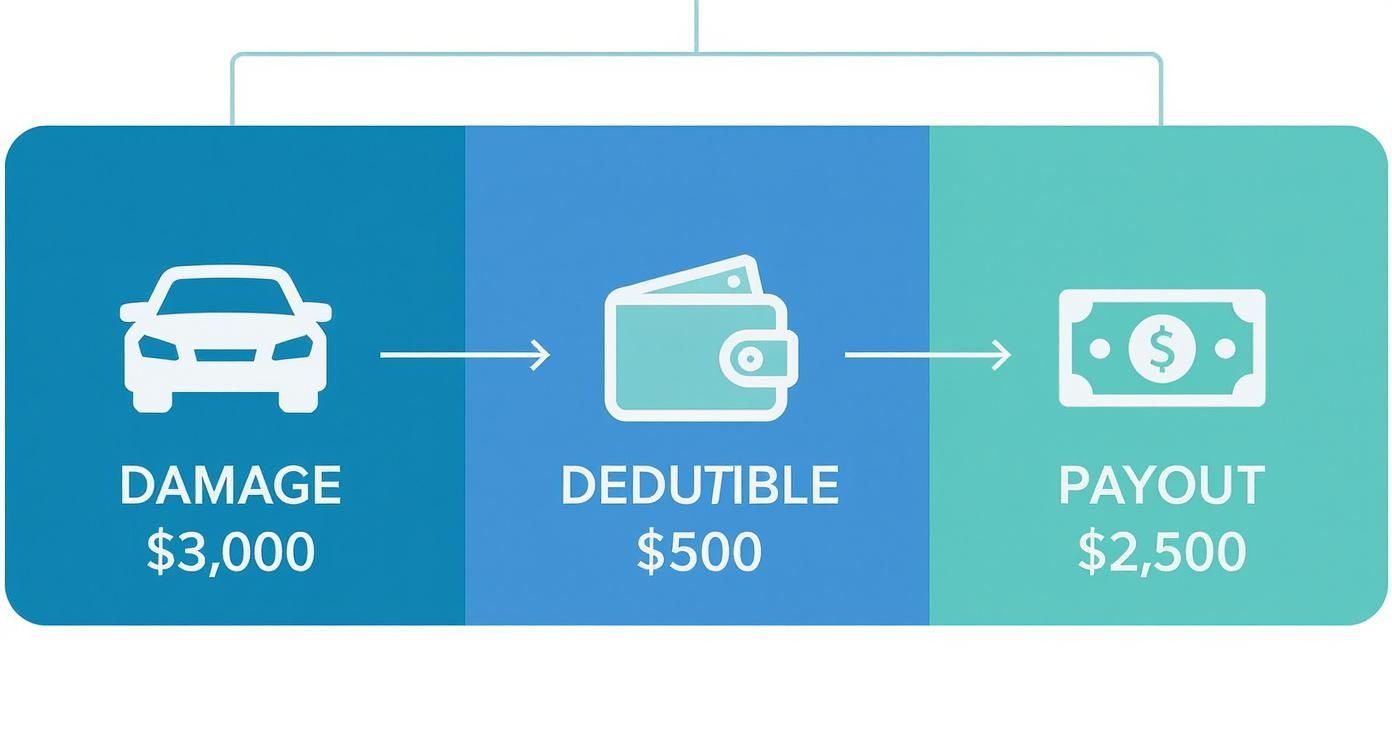

How Deductibles and Payouts Work

When you file a comprehensive claim, two terms dictate how much money you get back: your deductible and the payout. Understanding this relationship is key to knowing what your policy will actually do for you.

Your deductible is the fixed amount you agree to pay out-of-pocket for a covered claim before your insurance company pays anything. You choose this amount when you buy the policy.

The Trade-Off Between Premiums and Deductibles

Choosing a deductible is a simple trade-off.

- Higher Deductible: A higher deductible, like $1,000, means you take on more financial risk. Your insurer rewards you with a lower premium.

- Lower Deductible: A lower deductible, like $500, means the insurer is on the hook for more, so your premium will be higher.

Finding the right balance depends on your budget and what you could comfortably pay on short notice.

A Real-World Payout Example

Let’s use a common scenario. A hailstorm rolls through, leaving your car covered in dents. A trusted body shop gives you a repair estimate of $3,000.

Your comprehensive policy has a $500 deductible. Here’s how the payout is calculated:

- Total Repair Cost: The body shop quotes $3,000.

- Your Deductible: You are responsible for the first $500.

- Insurance Payout: Your insurer covers the rest.

Calculation: $3,000 (Total Damage) – $500 (Your Deductible) = $2,500 (Insurance Payout)

In this case, you’d pay the body shop $500, and your insurance company would issue a check for the remaining $2,500.

This same math applies if your car is declared a total loss. The insurer calculates its pre-accident value, subtracts your deductible, and pays you the rest. If their valuation is too low, a certified appraisal from SnapClaim gives you the hard evidence you need to negotiate for fair compensation.

Is Comprehensive Coverage Worth It for You?

So, is comprehensive insurance actually worth it? The honest answer is: it depends on your car’s value and your tolerance for risk.

The biggest factor is your vehicle’s Actual Cash Value (ACV)—what it was worth right before the incident. If you’re driving a newer car with a high price tag, comprehensive coverage is almost always a no-brainer. The cost to replace it is steep, making the premium a small price for peace of mind.

On the other hand, if you’re driving an older, paid-off car worth only $2,000, the math changes. If your annual comprehensive premium is $500 and your deductible is $500, you might be better off saving that money for repairs yourself. Our guide can help you figure out how much your car is worth to make this decision.

Factors That Make It a Necessity

Beyond your car’s value, a few situations can make the decision for you. You almost certainly need comprehensive coverage if:

- You Have a Loan or Lease: Your lender or leasing company will require you to carry both comprehensive and collision coverage to protect their investment.

- You Live in a High-Risk Area: Is car theft common in your neighborhood? Do you live in an area prone to hail, floods, or hurricanes? If your risk of a non-collision claim is high, comprehensive is a critical shield.

- You Can’t Afford a Surprise Replacement: If having to suddenly replace your car would be a financial disaster, comprehensive insurance is your safety net.

This infographic breaks down exactly how an insurer calculates your payout for a covered claim after you’ve met your deductible.

As you can see, the payout is simply the total cost of the damage minus your out-of-pocket deductible.

How to Navigate a Comprehensive Insurance Claim

Filing an insurance claim can feel overwhelming, but knowing the right steps from the start can make a huge difference. A clear plan keeps you organized and puts you in a much stronger negotiating position.

Whether you’re looking at a shattered windshield or dealing with a stolen car, these first few steps are critical for a smooth claims process.

Your Step-by-Step Claim Checklist

When you need to use your comprehensive coverage, follow this simple checklist to stay on track.

Document Everything Immediately: Before calling anyone, grab your phone. Take detailed photos and videos of the damage from every angle. This visual proof is your most powerful evidence.

File a Police Report if Necessary: If your claim involves theft or vandalism, a police report is non-negotiable. Your insurance company will almost certainly ask for the report number.

Contact Your Insurer Promptly: Call your insurance provider as soon as you can to report what happened. Have your policy number and all the details handy. They’ll assign a claims adjuster to your case.

Get a Repair Estimate: Your insurer might suggest a “preferred” repair shop, but remember, you have the right to get an independent estimate from a mechanic you trust. For a closer look at how auto body shops can help, check out this guide on navigating the insurance claims process.

Avoiding Common Pitfalls

One of the costliest mistakes people make is blindly accepting the insurer’s first offer, especially if the car is declared a total loss. Insurance companies often use valuation methods that lead to a lowball insurance total loss payout.

An insurer’s initial valuation is a starting point for negotiation, not a final decision. You have the right to challenge it with your own evidence.

If your car insurance claim has been unfairly denied or you feel the payout is too low, you need objective proof of your vehicle’s true value. This is where a certified appraisal from SnapClaim becomes your most valuable tool. Our reports provide the data-backed proof you need to negotiate a fair settlement.

Frequently Asked Questions About Comprehensive Insurance

Does filing a comprehensive claim raise my insurance rates?

Generally, a comprehensive claim is less likely to raise your rates than an at-fault collision claim. That’s because the events it covers—like hail or hitting a deer—are considered out of your control. However, filing multiple claims in a short period could lead your insurer to see you as a higher risk.

Is comprehensive insurance required by law?

No. State laws typically only require liability coverage, which pays for damage you cause to others. However, if you have a car loan or are leasing your vehicle, the lender will almost always require you to carry both comprehensive and collision coverage to protect their financial interest.

Can I get comprehensive without collision coverage?

Yes, most insurance companies let you buy comprehensive coverage by itself. This can be a smart, cost-effective option for owners of older, paid-off cars. You get protection from major events like theft or fire while saving money by self-insuring for accident damage.

What if my car is a total loss after a comprehensive claim?

If a covered event totals your vehicle, your insurer is supposed to pay you its Actual Cash Value (ACV), minus your deductible. Unfortunately, this initial insurance total loss payout is often lower than expected. Don’t just accept the first offer. A certified total loss appraisal gives you the hard evidence you need to negotiate for the fair payout you deserve.

Don’t let an insurance company decide what your car is worth. SnapClaim provides the certified, data-driven reports you need to prove your claim and get the compensation you rightfully deserve. If your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee—guaranteed.

Get your free estimate today or order a certified appraisal report to strengthen your insurance claim.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This guide was reviewed and verified by SnapClaim’s auto appraisers, who specialize in diminished value and total loss disputes.

Our team continually updates every article to reflect current insurer guidelines, valuation standards, and court-accepted appraisal practices, ensuring that you’re relying on information trusted by professionals nationwide.

Get Started Today

Whether you’re challenging a low total loss settlement or proving your vehicle’s post-repair loss in value, SnapClaim makes it simple to take the next step.

Generate a free diminished value or total loss estimate in minutes and see how much compensation you may be owed.

👉 Get your free estimate today