It’s a call no one wants to get from their insurance company: “Your car is a total loss.” This statement can be confusing and stressful, leaving you wondering what happens next and if you’ll get enough money to replace your vehicle. Understanding how your total loss car value is determined is the first step toward securing the fair compensation you’re entitled to.

What “Total Loss” Really Means

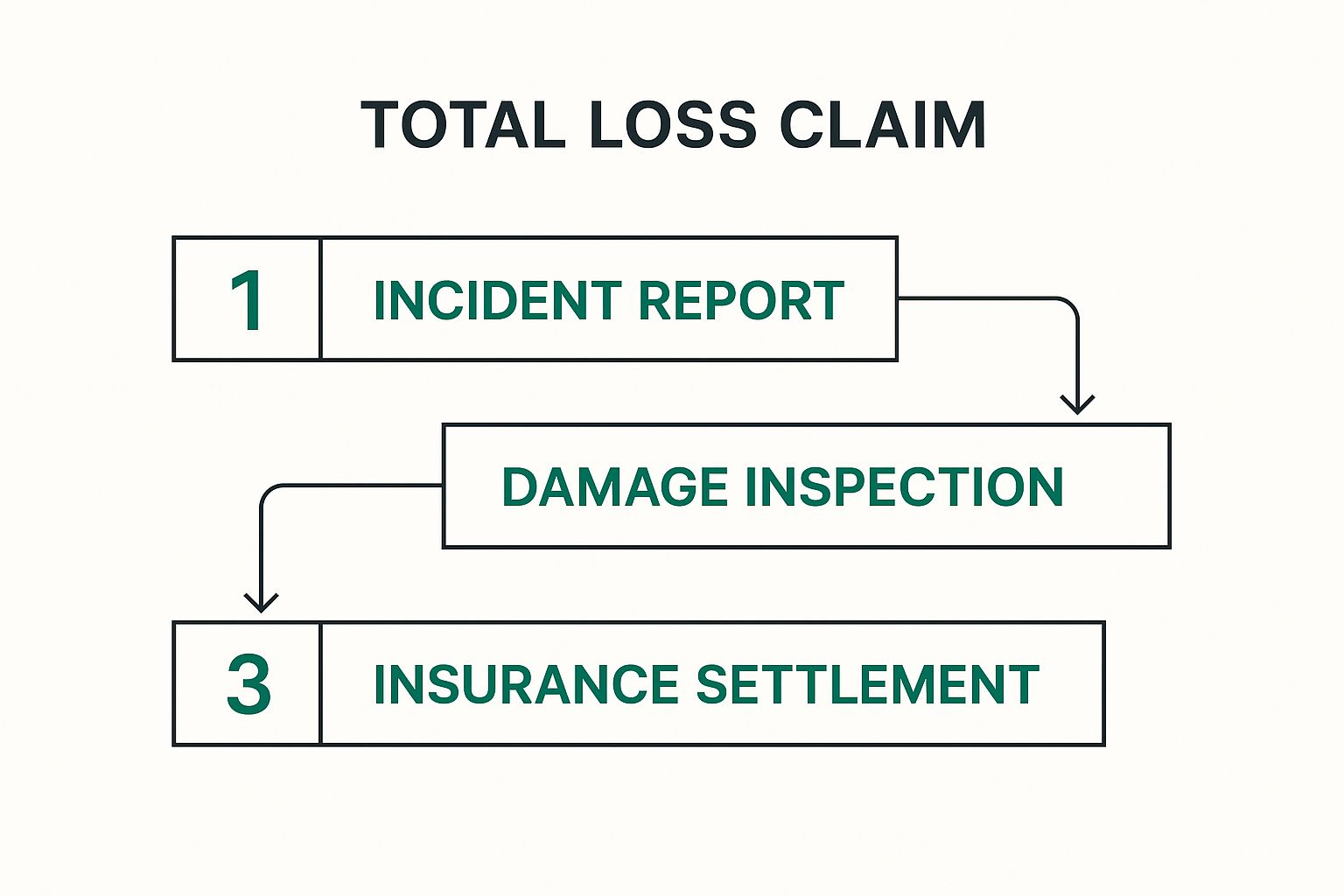

Hearing your car is “totaled” might make you picture a twisted pile of metal, but that’s often not the case. It’s a purely financial calculation on the insurer’s part. what happens when your car is totaled

An insurance company declares a car a total loss when the estimated cost of repairs is higher than the car’s pre-accident value. The entire settlement offer hinges on one key number: your car’s Actual Cash Value (ACV). This isn’t the price you paid for it, nor is it what a similar car is listed for at a dealership today.

Actual Cash Value (ACV) is a simple term for what your specific car—with its exact age, mileage, condition, and options—would have realistically sold for in your local market the second before the collision happened.

Too often, the insurance company’s first ACV assessment feels like a number pulled out of thin air, resulting in a lowball offer. This is precisely the point where many car owners unknowingly leave money on the table.

The Key Ingredients in a Total Loss Valuation

Insurers use a few key ingredients to decide if your car is totaled:

- Repair Costs: The full estimate for all parts and labor needed to bring it back to its pre-accident condition.

- Salvage Value: What the damaged car is worth if sold as-is, usually for parts or scrap.

- Actual Cash Value (ACV): The car’s fair market value right before the crash.

- State Total Loss Threshold (TLT): A specific percentage set by state law. Once repair costs hit that mark, an insurer must declare the vehicle a total loss.

As our cars get older, their ACV naturally goes down. This makes it much easier for them to be declared a total loss, even from a seemingly minor accident. As you can imagine, this trend is pushing more and more cars over that economic tipping point. You can read more about these market shifts in this analysis from Claims Journal.

Understanding these factors is your first step toward challenging the insurer’s math and fighting for the fair settlement you deserve.

How Insurers Calculate Your Car’s Value

When your car is declared a total loss, the insurance adjuster doesn’t just pick a number. They follow a specific process to determine your car’s Actual Cash Value (ACV). However, their method has blind spots that often lead to lowball offers, which is why it’s important to understand how they work. total loss dispute guide

Most large insurance companies outsource this task to third-party valuation services, like CCC ONE or Audatex. These companies generate a report that becomes the basis for your payout.

The Search for “Comparable” Cars

At the heart of the calculation is a search for “comparable” vehicles, or “comps.” These are cars similar to yours that have recently sold or are currently listed for sale in your local area. The software uses these comps to establish a base value and then makes a series of adjustments.

Here’s what they look at:

- Mileage: They add or subtract value depending on whether your car had more or fewer miles than the average for its year.

- Condition: The adjuster assigns a grade to your car’s pre-accident condition (e.g., excellent, average, poor), which has a huge impact on the final number.

- Options and Trim: That sunroof, premium sound system, or tech package you paid extra for should be accounted for.

- Recent Upgrades: Major work, like brand-new tires or a recently replaced engine, should be factored into the equation.

Where Their Math Often Goes Wrong

On the surface, this process sounds logical. The problem is, the automated systems they rely on are only as good as the data they’re fed—and that data is often incomplete or simply wrong.

Common problems that lower your offer include:

- Poor “Comps”: The system might use comps from a different part of the state where cars sell for less. Or, it might compare your fully-loaded model to a base trim level.

- Ignoring Upgrades: Did you just spend $1,500 on new brakes and tires? If it wasn’t noted perfectly in the initial report, the adjuster’s software will likely miss it completely.

- Unfair Condition Ratings: An adjuster who never saw your car before the crash might arbitrarily label it “average” condition, even if you kept it in pristine shape.

A low settlement offer isn’t personal—it’s often the output of a system built for speed and volume, not for accuracy. But that system’s flaws can cost you dearly if you don’t challenge them with your own evidence.

A SnapClaim report helps strengthen your claim by providing the proof you need. We perform real, hands-on market research to find true local comps and document every feature and upgrade, giving you the ammunition you need to negotiate a fair total loss car value.

Why the First Insurance Offer Is Often Too Low

When an insurance adjuster gives you that first settlement offer, it’s easy to feel like it’s the final word. But here’s a secret from inside the industry: it’s almost always just a starting point. Think of it as their opening bid in a negotiation.

Insurance companies are massive businesses built on efficiency. They process thousands of claims every day, and their business model depends on closing them out as quickly and inexpensively as possible. To do this, they rely on automated systems that often miss what made your car special.

The Problem with Automated Valuations

The valuation report they send you wasn’t created by a car expert who spent hours analyzing your vehicle. It was generated by an algorithm that pulls from broad market data.

An initial lowball offer is often the result of:

- Outdated Sales Data: The system might be using sales figures that are weeks or even months old, failing to capture recent price increases in the used car market.

- Bad “Comps”: It might compare your meticulously maintained, top-of-the-line model to a basic, high-mileage version located 100 miles away.

- Generic Condition Ratings: Your car could be automatically slapped with an “average” condition rating, completely ignoring your detailed service records or recent upgrades.

This process is built for speed, not accuracy. The unique things that boost your total loss car value can get lost in the shuffle. The insurer isn’t necessarily trying to cheat you—their system is just designed to find the cheapest comparable vehicles, not the most accurate ones.

Modern Tech Drives Up Repair Costs

Another reason more cars are being totaled is technology. Vehicles are more complex than ever, and a simple fender-bender can damage a network of expensive electronics. The Advanced Driver Assistance Systems (ADAS) in newer cars—sensors, cameras, and computers tucked into bumpers and mirrors—require specialized tools and precise recalibration, sending repair bills skyrocketing. This is why insurers are often quick to declare a tech-heavy vehicle a total loss.

An insurer’s initial offer is an invitation to negotiate, not a final verdict. It’s based on a quick, automated assessment, and it’s up to you to provide the evidence that proves your car’s true value.

An independent appraisal from SnapClaim gives you the detailed, local market evidence needed to support your negotiations and fight for every dollar you deserve. Plus, our service comes with a money-back guarantee, offering you a risk-free way to secure a fair settlement.

How to Negotiate Your Total Loss Settlement

It’s a sinking feeling. You get the call from the insurance adjuster, and their settlement offer is way lower than you expected. But don’t despair. That first number is a starting point, and you absolutely have the right to negotiate for what your car was actually worth.

Step 1: Build Your Case File

Before you call the adjuster back, assemble a file that paints a complete and accurate picture of your car’s pre-accident condition and value.

Start gathering every relevant document you can find:

- Maintenance Records: Receipts for oil changes, tire rotations, and regular tune-ups are hard evidence that your car was meticulously cared for.

- Receipts for Recent Upgrades: Did you just spend $800 on new tires? What about a new battery or brakes? Those receipts represent real value that needs to be accounted for.

- Pre-Accident Photos: Recent photos showing your car looking clean and well-maintained can be powerful visual proof to counter a low “average” condition rating.

- Original Window Sticker: If you have it, this document is gold. It lists every factory-installed option and package, many of which are easily overlooked by valuation software.

Step 2: Become a Local Market Expert

Next, it’s time to do some detective work. You need to find your own “comparable” vehicles to counter the ones the insurance company used. It’s common for their reports to pull comps from hundreds of miles away or use vehicles in much worse condition than yours was. Kelley Blue Book

Search websites like Autotrader, Cars.com, or local dealership sites for the exact same year, make, and model as your car, with similar mileage and options, being sold in your geographic area. Take screenshots of every one. This is real-time, local market data and some of the strongest evidence you can present.

The key is to be factual and organized, not aggressive. Lay out your evidence—receipts, photos, and local comps—in a calm, clear email to the adjuster.

Step 3: Use the Appraisal Clause in Your Policy

What if the adjuster still refuses to budge? It’s time to invoke the appraisal clause. Buried in the fine print of most auto insurance policies, this provision gives you the right to hire your own independent appraiser. The insurance company does the same, and the two appraisers then work to agree on a fair value.

This is where a certified report from a service like SnapClaim can be a game-changer. An unbiased, data-driven valuation from a third-party expert carries serious weight and shifts the conversation from opinions to verifiable market facts.

Your Total Loss Negotiation Checklist

| Action Item | Why It Matters | Where to Find It |

|---|---|---|

| Get the Insurer’s Valuation Report | You can’t challenge their numbers if you don’t know how they got them. | Ask your insurance adjuster for the full CCC, Audatex, or Mitchell report. |

| Gather All Maintenance & Repair Records | Proves the vehicle was in excellent mechanical condition, justifying a higher rating. | Your personal files, mechanic’s office, or dealership service department. |

| Collect Receipts for Recent Purchases | New tires, brakes, or other parts add direct value that must be included. | Your email, credit card statements, or personal files. |

| Find Pre-Accident Photos | Visual evidence that counters an unfair, low condition rating (e.g., “average”). | Your phone’s camera roll, social media accounts, or family photos. |

| Locate the Original Window Sticker | Ensures every factory-installed option is accounted for in the valuation. | Your car’s original purchase paperwork or glove compartment. |

| Research Local Comparable Vehicles | Provides real-world, current market data to challenge the insurer’s out-of-area or poor comps. | Autotrader, Cars.com, Kelley Blue Book, local dealership websites. |

| Draft a Clear Rebuttal Letter/Email | Organizes your evidence professionally and creates a paper trail of your dispute. | A simple document you create, attaching all your evidence. |

By methodically checking off these items, you’ll build a compelling case that is much harder for an insurance company to dismiss.

The Power of an Independent Appraisal

You’ve done your homework, but what if the adjuster still won’t offer a fair value? When you hit that wall, it’s time to bring in your strongest tool: an independent appraisal.

An independent appraisal is a formal valuation performed by a certified, unbiased expert who works for you, not the insurance company. While your insurer relies on a quick, automated report, a professional appraiser conducts a thorough, real-world assessment. It’s the professional leverage you need to level the playing field.

Why an Appraisal Carries So Much Weight

A certified appraiser from a trusted service like SnapClaim digs into the critical specifics that automated systems almost always miss. Their process includes:

- A Detailed Vehicle Inspection: The appraiser examines your car’s specific condition, unique features, and any aftermarket upgrades that add value.

- Hyper-Local Market Research: They don’t pull comps from a national database. They research what truly comparable vehicles are selling for right now, in your local market.

- Precise Value Adjustments: Every detail counts. New tires, a premium sound system, or a recent major service—each is documented and assigned a specific value.

The final product is a comprehensive, data-driven report that provides undeniable proof of your car’s actual total loss car value. It effectively replaces the insurer’s lowball opinion with cold, hard market facts. A professional appraiser is also dialed into the latest market dynamics that impact total loss valuations.

An independent appraisal isn’t just another opinion—it’s expert evidence. It forces the insurance company to address the real-world value of your specific vehicle.

A Risk-Free Path to a Fairer Settlement

Handing the adjuster an independent appraisal report fundamentally changes the conversation. It signals that you’re serious, you’re well-informed, and you have concrete proof to back up your claim. This is often all it takes to get them to negotiate in good faith.

We understand that spending money on an appraisal when you’re already dealing with a financial loss can be a concern. That’s why SnapClaim offers a risk-free money-back guarantee. If our certified appraisal report doesn’t help you recover at least $1,000 more from your insurance claim, we will fully refund your appraisal fee. This provides you with a risk-free way to fight for the fair settlement you deserve.

Get the Total Loss Car Value You Deserve

Being told your car is a “total loss” isn’t the end of the road—it’s the start of a negotiation. You are now armed with the knowledge of how insurance companies determine your car’s value, why their first offer is often low, and what you can do about it.

Your job is to build a case. Gather your evidence, pull together maintenance records, and find local listings for similar cars to get a clear picture of its replacement cost. This is how you counter their initial offer with hard facts. A professional, independent appraisal is your most powerful piece of leverage.

Your car’s real value isn’t based on an algorithm. It’s determined by the real-world market, and a solid independent appraisal provides the proof you need to get a fair settlement.

Get a Free Estimate from SnapClaim

FAQ: Your Top Questions About Total Loss Car Value

Can I keep my car if it’s a total loss?

Yes, in most cases you can. This is called “owner retention.” The insurance company pays you the car’s actual cash value minus its salvage value (what the wrecked car is worth to a scrap yard). You keep the car and a check for the difference. Be aware that you will need to get a “salvage title” from your state’s DMV, and there are specific steps required to make the car road-legal again.

What if the insurer’s “comparable cars” don’t match mine?

This is a very common issue, and you should absolutely push back. Your job is to point out every difference. Does their comp have more miles? Is it a base model when yours was fully loaded? Was yours garage-kept while theirs shows significant wear? The best way to strengthen your claim is with your own research. Find examples of cars just like yours for sale in your area to provide hard evidence and negotiate a higher total loss car value.

How does my car loan affect the settlement?

Your loan balance does not affect your car’s Actual Cash Value (ACV). The ACV is based solely on the vehicle’s market value before the accident. However, the loan does affect who gets paid. The insurance company will send the settlement check directly to your lender first. If the settlement is more than your loan balance, you receive the remainder. If you owe more than the car is worth (known as being “upside-down”), you are responsible for paying the difference.

About SnapClaim

SnapClaim is a leading provider of independent vehicle appraisals for diminish value and total loss dispute claims. Our team utilizes cutting-edge technology and extensive market knowledge to deliver accurate and defensible valuations. We are dedicated to empowering vehicle owners and personal injury attorneys with the information and expertise needed to negotiate fair settlements with insurance companies. With a commitment to transparency and customer satisfaction, SnapClaim ensures you receive the true value of your vehicle.