Diminished Value Appraisal in

New Jersey

Get Your Free Estimate in a Minute!

Recover the lost value of your car after an accident with a certified New Jersery diminished value appraisal. Our reports are fast, accurate, and court-ready—trusted by insurers and attorneys across New Jersey.

No credit card required [Takes less than 30 second]

Filing a Diminished Value Claim in New Jersey: What You Need to Know

New Jersey Diminished Value Appraisal — Recover What Your Vehicle Lost After an Accident

Even after professional repairs, your vehicle can lose significant market value once the accident appears on Carfax or AutoCheck. If your crash occurred anywhere in New Jersey—including Newark, Jersey City, Paterson, Elizabeth, or Edison—a New Jersey diminished value appraisal helps you document that loss and pursue the compensation you deserve. SnapClaim provides court-ready, data-driven appraisal reports trusted by New Jersey insurers, personal-injury attorneys, and small-claims courts statewide.Does New Jersey Allow Diminished Value Claims?

Third-party (at-fault driver’s insurer)Yes. Under New Jersey law, you may recover the measurable loss in your vehicle’s market value when another driver is at fault. Diminished value (DV) is recognized as a form of recoverable property damage.

First-party (your own insurer)

Typically no, unless your policy explicitly covers DV. Most standard auto policies in New Jersey exclude first-party diminished value claims under collision or comprehensive coverage.

Key New Jersey Law & Claim Authority

- Statute of limitations: You have 6 years to file property-damage claims, including DV (N.J. Stat. § 2A:14-1).

- Consumer protection: The New Jersey Department of Banking & Insurance regulates insurers and assists consumers with complaints.

- Small claims court: You can pursue claims up to $3,000 in New Jersey Small Claims Court.

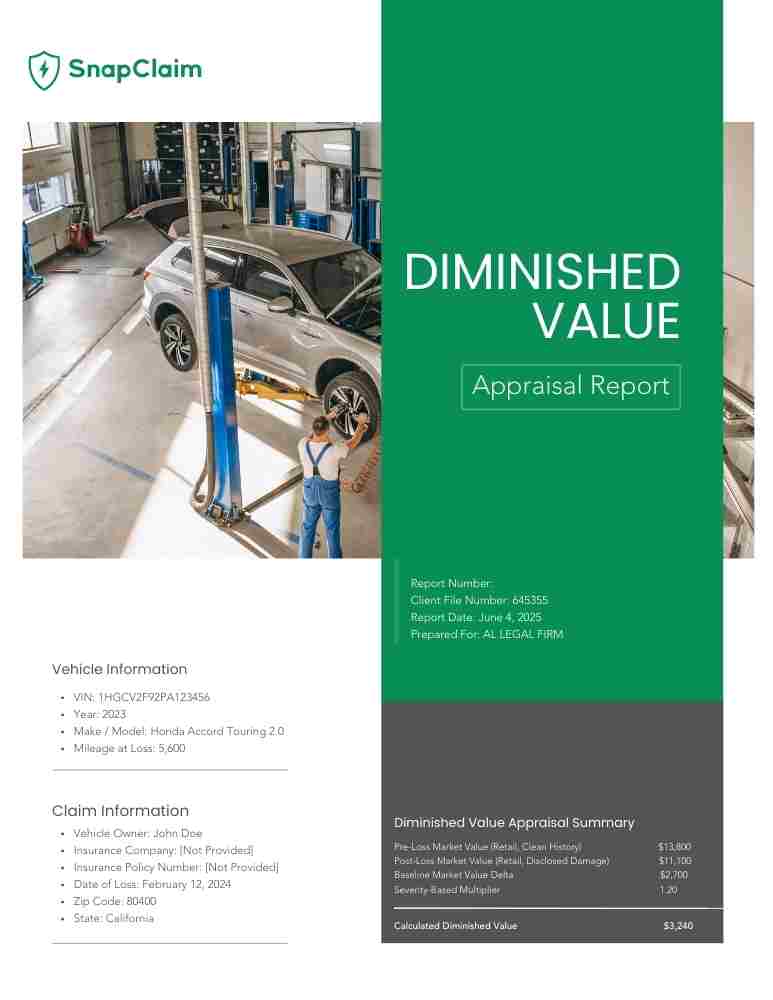

What Your New Jersey Diminished Value Appraisal Report Includes

- Vehicle details: year, make, model, trim, mileage, and condition

- Comparable listings filtered by New Jersey ZIP codes (e.g., Newark, Jersey City, Edison)

- Pre-accident vs. post-repair market valuation using verified sales data

- DV calculation adjusted for repair quality, damage severity, and vehicle condition

- Transparent methodology aligned with USPAP and insurer standards

- Optional expert-witness testimony for arbitration or court

New Jersey Areas We Serve

We provide Diminished Value and Total Loss appraisals statewide across New Jersey, including:- Newark, NJ

- Jersey City, NJ

- Paterson, NJ

- Elizabeth, NJ

- Edison, NJ

- Woodbridge, NJ

- Lakewood, NJ

- Toms River, NJ

- Clifton, NJ

- Trenton, NJ

- Camden, NJ

- Passaic, NJ

- Union City, NJ

- Bayonne, NJ

- East Orange, NJ

How to File a Diminished Value Claim in New Jersey

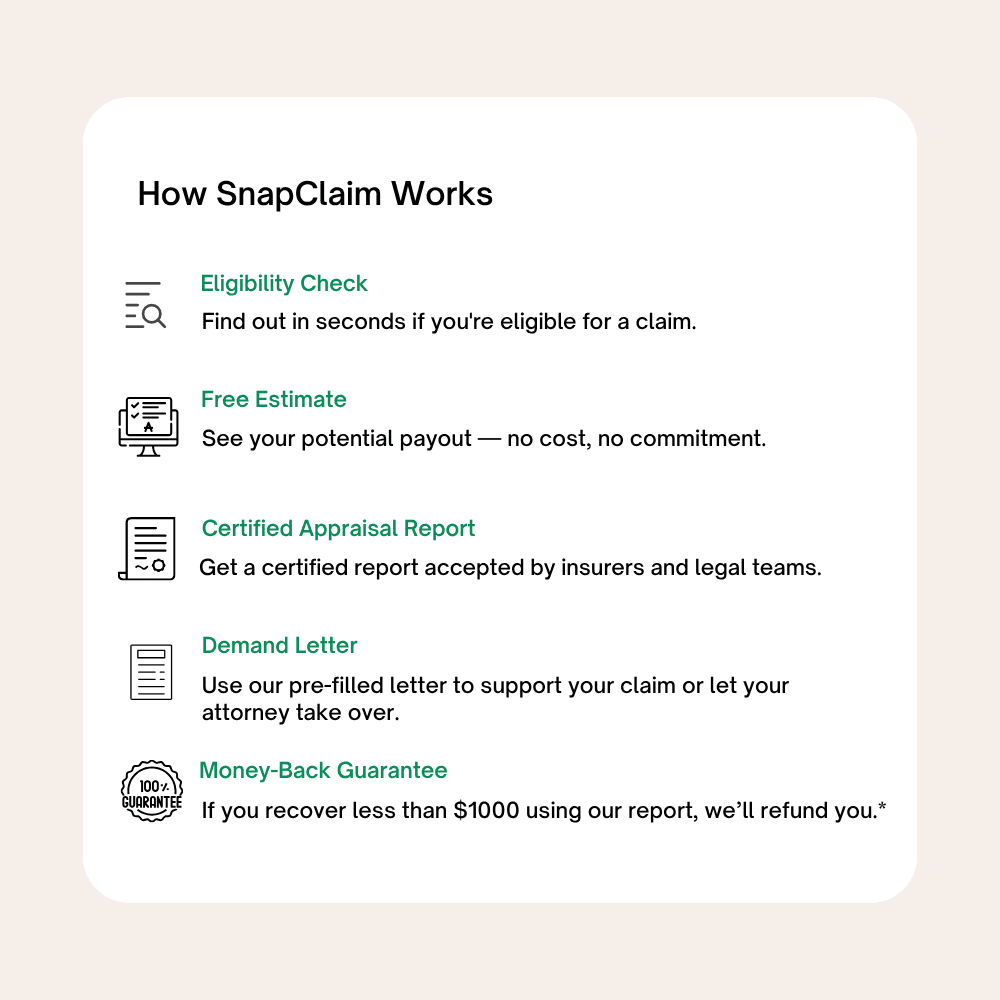

- Order your appraisal — get a professional valuation quantifying your vehicle’s market-value loss.

- Send a DV demand letter to the at-fault driver’s insurer.

- Negotiate or escalate — our reports are designed for attorney or small-claims submission.

- Recover compensation — many New Jersey drivers recover thousands depending on damage and vehicle type.

New Jersey Insurance Practices to Know

Some insurers use simplified formulas that undervalue claims. SnapClaim delivers:- Verified listings from AutoTrader, CarGurus, and Cars.com filtered for New Jersey markets

- Dealer quotes from within 50 miles of your ZIP code

- Localized adjustments for color, trim, and market demand

Example New Jersey Case Study

Vehicle: 2020 Honda Accord EX-LRepair Cost: $7,100 (front bumper and fender damage)

Initial Insurer Offer: $950 (formula-based)

SnapClaim DV Result: $4,500

Final Settlement: $4,200 after negotiation

Helpful New Jersey Resources

- N.J. Stat. § 2A:14-1 — 6-year statute of limitations for property damage

- NJ Department of Banking & Insurance — complaints and regulatory guidance

- New Jersey Small Claims Court — filing guidelines and forms

Ready to Get Your New Jersey Diminished Value Appraisal?

Start now — fast turnaround, verified market data, and reports trusted by New Jersey attorneys and insurers.- No credit card required

- Delivery in about 1 hour

- Includes appraisal + demand-letter template

Click a pin to open the city’s diminished value page.

Find your New Jersey city below to order your Diminished Value Appraisal.

Order Your Diminished Value Appraisal

Get Your Appraisal Report and Demand Letter Now!

Free Estimate, no credit card required.

Recover Diminished Value After an Accident in New Jersey

If your vehicle was damaged in a New Jersey car accident, it may lose resale value even after high-quality repairs. This is called diminished value. With a New Jersey diminished value appraisal, you can prove your vehicle’s loss in value and recover it under New Jersey state law. In fact, New Jersey is one of the most favorable states for pursuing diminished value claims.

SnapClaim makes filing a New Jersey diminished value claim fast and stress-free. We provide a free diminished value estimate, a certified New Jersey diminished value appraisal report, and an insurer-ready demand letter you can submit immediately. No waiting. No confusion. Just accurate, court-ready documentation trusted by attorneys and insurance adjusters across New Jersey.

“After my car was rear-ended in Newark, I assumed the repairs had made things right—until I discovered my vehicle’s value had dropped significantly. SnapClaim’s New Jersey diminished value appraisal gave me the documentation I needed. My attorney submitted the report, and the insurer settled quickly for the full amount. What could have been a frustrating fight turned into a fair and easy resolution.”

Jasmine M.

Newark, NJ

Diminished Value & Total Loss Appraisal Reports

Instant Free Estimate

Instant diminished value and total loss appraisals — no guesswork, no delays, backed by a 100% money-back guarantee.

Free Estimate, no credit card required.