Dealing with an insurance adjuster after an accident can feel intimidating. They handle claims every day, but for you, it’s a stressful and unfamiliar process. Understanding how to navigate the conversation and what proof you need can put you in control and ensure you get fair compensation for your vehicle.

The adjuster’s primary role is to settle your claim efficiently for their company, which often means aiming for the lowest possible payout. Your goal is to make sure you’re compensated for all your losses—not just the repairs, but also the diminished value of your car. This guide will show you how to deal with insurance adjusters effectively to protect your interests.

How to Deal With Insurance Adjusters in Your First Conversation

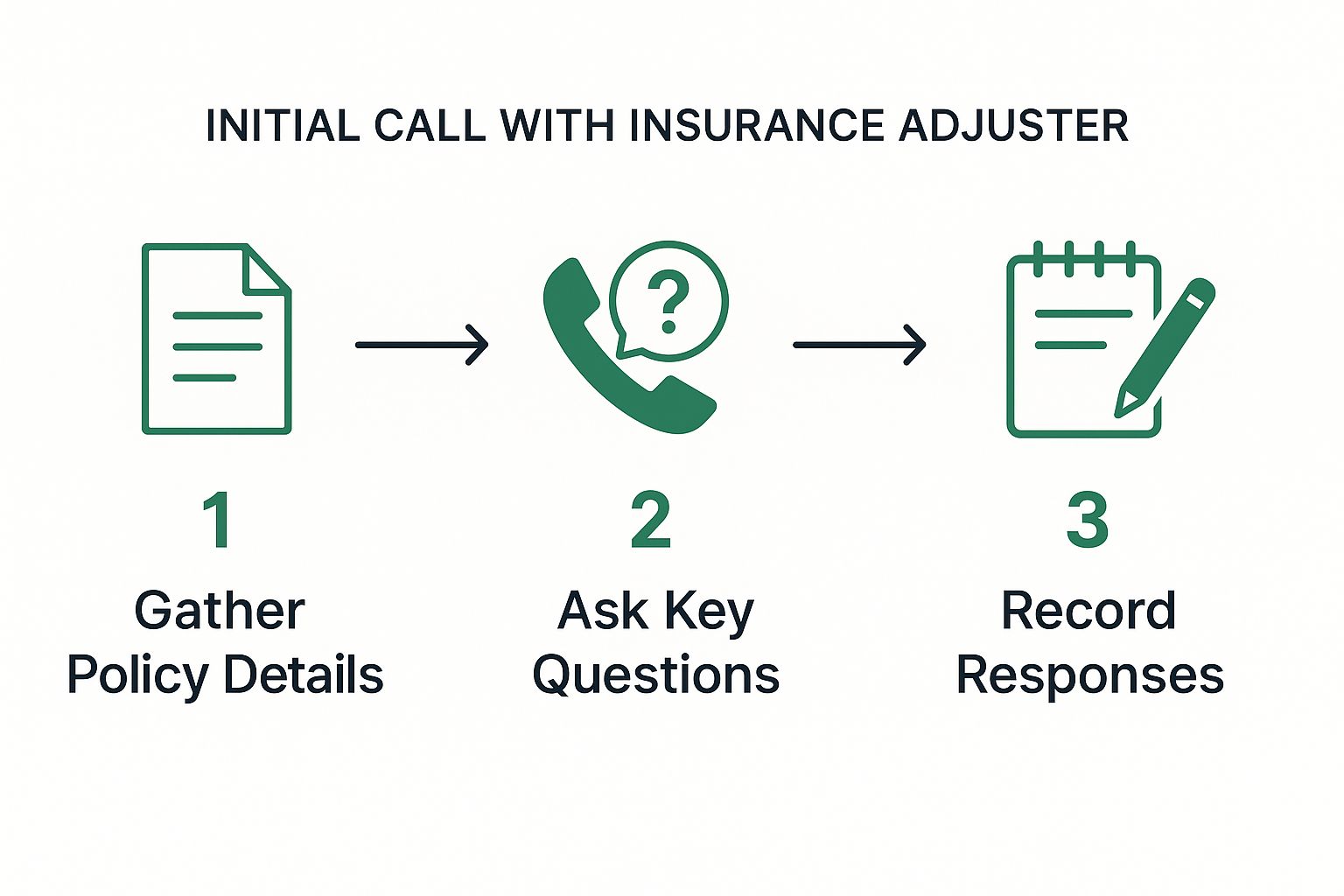

That initial phone call with the adjuster is critical because it sets the tone for your entire claim. Being prepared is your best strategy for a successful outcome.

How to Deal with Insurance Adjusters Before You Pick Up the Phone

Before speaking with an adjuster, take a few moments to gather your information. Having your facts straight shows you’re serious and helps you stay calm under pressure.

Here’s a simple checklist of what to have ready:

- Your Policy Information: Have your policy number accessible.

- The Police Report: The report number is essential, as it provides an objective account of the accident.

- Photos and Videos: Keep your visual evidence from the scene organized and easy to reference.

- Witness Information: Have the names and contact details for anyone who saw the accident.

Having these items on hand helps you stick to the facts and communicate clearly.

What to Say and What to Avoid

When you speak with the adjuster, choose your words carefully. This is a business conversation, not a casual chat. Your role is to provide clear, factual information.

- Stick to the facts: Only describe what happened. Do not guess about details like speed or distance, and avoid offering opinions.

- Don’t admit fault: An innocent phrase like “I’m sorry” can be misinterpreted as an admission of responsibility.

- Politely decline a recorded statement: A common tactic is to ask for a recorded statement right away. You can say, “I’m not prepared to give a recorded statement at this time.” This prevents your words from being used out of context later.

Remember that if you weren’t at fault, you are likely owed more than just repair costs. Your car’s resale value has dropped, a loss known as diminished value. You can learn more about what a diminished value claim is to understand how it can significantly increase your settlement.

Understanding The Adjuster’s Role And Objectives

To negotiate effectively, you need to understand the adjuster’s perspective. They aren’t your adversary, but their goals are different from yours. An adjuster’s primary loyalty is to the insurance company they work for.

Their job is to investigate the claim, determine what the policy covers, and settle it as quickly and inexpensively as possible. They manage many cases at once and are evaluated on their efficiency.

The Business of Claims Adjusting

The insurance industry is a massive, data-driven business. Globally, claims adjusting services represent a market valued at an estimated $14.6 billion and have seen a strong annual growth rate of 9.6% as claims become more complex. You can read more about these global insurance market trends to see how the industry is evolving.

This context is important because it shows that adjusters operate within a strict corporate system. They often use standardized software to generate a settlement offer. This software relies on averages and usually fails to account for your vehicle’s specific details, such as its excellent pre-accident condition, recent upgrades, or true local market value.

Your claim is one of many. By understanding this, you can shift from an emotional response to a strategic one. Your job is to provide the specific, verifiable proof they need to justify paying you what your claim is truly worth. Think of their first offer as a starting point for negotiation, not the final word.

How Adjusters Evaluate Your Claim

Adjusters are trained to identify facts that can minimize their company’s payout. They view your claim through a lens of cost control and risk management. This is why professional, organized documentation is your most powerful tool.

When you present clear, third-party evidence, you make their job easier while strengthening your claim. For instance, a certified appraisal for a total loss vehicle from SnapClaim provides an objective, market-based valuation that is hard to dispute. It shifts the focus from their software’s generic estimate to the real-world value of your car.

By understanding what motivates the adjuster, you can build a case that meets their need for documentation while fighting for your financial interests.

Mastering Your Claim Documentation And Communication

When you’re dealing with an insurance adjuster, meticulous records and clear communication are essential. The strength of your claim depends on the quality of your documentation. A well-organized file turns a subjective argument into a fact-based negotiation you can win.

Start by creating a dedicated claim file, either a physical folder or a digital one. This simple step ensures you have everything you need when you need it.

What Goes In Your Claim File

Your file should be a complete record of the entire claims process. Every document you add strengthens your position and shows the insurer you are serious.

Be sure to include:

- The Police Report: The official, unbiased account of the accident.

- Photos and Videos: Take extensive photos of the vehicle damage from all angles, the accident scene, and any visible injuries.

- Repair Estimates: Get at least two estimates from reputable, certified body shops that you trust. Don’t feel obligated to use the insurer’s preferred shop.

- Communication Log: This is crucial. Use a notebook or document to log every conversation with the adjuster. Note the date, time, person you spoke with, and a summary of the discussion.

This infographic outlines the key steps for your first communication, which should be the first entry in your log.

The Power of Precise Language

How you communicate matters just as much as what you say. Adjusters are trained to listen for words that can minimize the company’s payout. Vague or emotional language can be misinterpreted. Sticking to factual, neutral statements is the best way to protect your claim.

Effective Communication Dos and Don’ts

| Do Say This… | Don’t Say This… |

|---|---|

| “I’m still assessing my injuries with my doctor.” | “I think I’m fine.” or “I’m not hurt.” |

| “I have two repair estimates detailing the damage.” | “It doesn’t look that bad.” |

| “The other driver’s vehicle struck my car.” | “It was an accident.” or “We collided.” |

| “I need to review the offer with my documentation.” | “Okay, that sounds fair.” (on the first offer) |

Use this table as a guide to keep your conversations grounded in fact, not opinion.

Don’t Forget Diminished Value

One of the most overlooked parts of an auto claim is Diminished Value (DV). This is the loss in your car’s resale value simply because it has an accident history—even with perfect repairs. Insurers rarely bring this up, but in most states, you are entitled to compensation for this loss.

To claim it, you must prove your car is worth less with objective, third-party evidence. This is where an independent appraisal from SnapClaim becomes essential. It provides the concrete evidence needed to negotiate for your car’s lost value. We are so confident our reports help strengthen claims that we offer a money-back guarantee: if the insurance recovery from the claim is less than $1,000, the appraisal fee is fully refunded.

How To Respond To The First Settlement Offer

Receiving the first settlement offer may feel like progress, but it’s almost never the best you can get. Treat it as an opening offer in a negotiation.

Insurance companies often use valuation software that produces a generic value for your vehicle. This software rarely accounts for unique factors like excellent condition, recent upgrades, or the true local market demand. Your job is to counter their offer not with emotion, but with facts that justify a higher, fairer payout.

Deconstructing The Initial Offer

The first offer is strategically calculated to seem reasonable enough that you might accept it just to be done with the process. Adjusters know you’re stressed and want to move on. Accepting it saves them money and closes the file—a win for them, but often a loss for you.

Never accept the first offer on the spot. Your response should be calm and professional: “Thank you for the offer. I need time to review it with my documentation and will get back to you in writing.”

This simple sentence buys you time to build your case without pressure and signals to the adjuster that you won’t be rushed.

Building Your Counter-Offer With Evidence

A strong counter-offer is based on what you can prove, not what you feel your car was worth. Your documentation is your most powerful tool. The goal is to present undeniable evidence showing why their valuation is too low.

Your counter-offer letter should be professional and direct. Include the following:

- A Clear Rejection: Politely state that their offer is insufficient to cover your losses.

- Your Proposed Amount: Clearly state the settlement figure you are requesting, based on your evidence.

- Supporting Evidence: Attach your independent repair estimates, photos, and most importantly, a certified appraisal report.

A SnapClaim appraisal report provides a data-driven valuation that is difficult for an adjuster to dismiss. It shifts the conversation away from their lowball software estimate and forces them to address the real-world fair market value of your vehicle.

Remember, SnapClaim backs its reports with a money-back guarantee. If your insurance recovery from the claim is less than $1,000, we refund your appraisal fee completely. It’s a risk-free way to get the professional evidence needed to secure a fair settlement.

What To Do When Negotiations Stall

It’s frustrating when you’ve presented your evidence and made a reasonable counter-offer, but the adjuster won’t budge. This isn’t the end of the road; it’s a signal to change your strategy.

When negotiations stall, you still have options. The key is to remain professional and persistent. An adjuster’s refusal to move is often a tactic designed to wear you down until you accept their low offer. Don’t fall for it.

Escalating Your Claim The Right Way

If the adjuster continues to repeat the same low offer without providing new data, it’s time to escalate the claim.

- Ask to speak with a supervisor: Politely say, “It seems we’ve reached an impasse. I’d like to discuss my claim with your manager to see if we can find a resolution.”

When you speak with the supervisor, calmly restate your position and walk them through your evidence, emphasizing your certified appraisal. Supervisors often have more authority to approve a higher settlement. Always follow up with an email to document your conversation.

When To Involve Your State’s Department Of Insurance

If the supervisor is also unwilling to negotiate fairly, your next step is to file a complaint with your state’s Department of Insurance (DOI). Every state has a consumer protection division that regulates insurance companies.

Filing a complaint is a serious step that gets an insurer’s attention. The DOI will investigate to ensure the company is following state laws and not engaging in bad faith negotiation tactics. For this to be effective, your position must be supported by strong, objective proof. A professional report from SnapClaim provides the evidence needed to strengthen your case with a supervisor or the DOI.

We are so confident our reports provide the proof you need that we back them with a guarantee: if your insurance recovery is less than $1,000, we’ll refund your appraisal fee. It’s a risk-free way to arm yourself for the fight for a fair settlement.

FAQs: How to Deal with Insurance Adjusters

Here are answers to common questions vehicle owners have on How to Deal with Insurance Adjusters: A Car Owner’s Guide

What if the adjuster pressures me to accept a low offer quickly?

A quick offer is a common tactic to settle a claim for a low amount before you know the full extent of your damages. Never agree to an offer on the spot. Politely tell the adjuster, “Thank you for the offer. I’m going to review it with my documentation and will get back to you in writing.” This shows you are organized and won’t be rushed.

Do I have to use the repair shop the adjuster recommends?

No. In nearly every state, you have the right to choose your own repair shop. Insurers have “preferred” shops because they’ve negotiated lower rates, but that doesn’t guarantee the best quality work. Get estimates from certified shops you trust and provide them to the adjuster. For more on consumer rights, you can visit trusted resources like the National Association of Insurance Commissioners (NAIC).

What if the adjuster says my car is a total loss, but I disagree?

You can challenge a total loss declaration if you believe your car is repairable. An insurer declares a car a total loss when repair costs exceed a certain percentage of its Actual Cash Value (ACV). Often, their ACV calculation is too low. An independent, certified appraisal can establish your vehicle’s true pre-accident fair market value. If that value is high enough, it may prevent the total loss designation.

How do I prove my car’s diminished value?

You can’t just say your car is worth less; you need to prove it. The most effective way is with a certified diminished value appraisal report. A SnapClaim report uses market data and industry-standard methodologies to calculate the exact loss in resale value your vehicle has suffered. This report serves as the expert evidence you need to support your diminished value claim during negotiations with the insurance adjuster. Understanding how much an accident can devalue a car is the first step.

Feeling overwhelmed by the claims process? Let SnapClaim provide the proof you need. Our certified appraisal reports give you the data-driven evidence to counter lowball offers and strengthen your negotiations.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This article was reviewed by SnapClaim’s team of certified auto appraisers and claim specialists with years of experience preparing court-ready reports for attorneys and accident victims. Our content is regularly updated to reflect the latest industry practices and insurer guidelines.

Get Started Today

Ready to prove your claim? Generate a free diminished value estimate in minutes and see how much you may be owed.

Get your free estimate today