This guide explains exactly how to handle your Geico diminished value claim after an accident. Getting into a car accident is stressful enough, but the headache doesn’t end when the repairs are done. Even with perfect bodywork, a collision permanently damages your car’s history report, significantly lowering its resale value. The key to recovering that lost money is understanding GEICO diminished value claim process and having the right proof to get paid fairly.

What Is a Diminished Value Claim with Geico?

Here’s the simple truth: the moment another driver hits your car, it loses value. This immediate, permanent drop in what your vehicle is worth is called inherent diminished value. It’s the difference between your car’s fair market value right before the crash and its value right after repairs—all because it now has an accident on its record.

Think about it from a buyer’s perspective. Given two identical cars, a buyer will always pay less for the one with an accident history, no matter how great the repairs look. A diminished value claim is your formal demand to Geico, as the at-fault driver’s insurance company, to compensate you for that specific financial loss. You can learn more about Geico diminished value claim in reddit.

Getting a Handle on the Basics

To successfully navigate your claim, you need to understand the language. You’re not just asking Geico for money; you’re proving a real, measurable loss with solid market data.

Here are a few key terms explained in simple terms:

- Inherent Diminished Value: This is the most common type. It’s the automatic loss in value simply because your vehicle now has an accident history.

- Repair-Related Diminished Value: This is any extra value lost because of poor repair work, like mismatched paint or cheap, non-original parts. It’s harder to prove but important to claim if the repairs aren’t perfect.

- Fair Market Value (FMV): This is the magic number—the price your car would have sold for seconds before the accident happened. All diminished value calculations start from this number.

Geico, like all insurers, aims to minimize payouts. Their first offer is almost always a lowball figure calculated by an internal formula designed to save them money, not make you whole. You can get a deeper dive into these concepts in our complete guide on what is a diminished value claim.

Key Terms in a Diminished Value Claim

| Term | Simple Definition |

|---|---|

| Inherent Diminished Value | The automatic loss of value because the car now has an accident history. This is the focus of most claims. |

| Repair-Related Diminished Value | Extra value lost due to low-quality repairs (e.g., mismatched paint, non-OEM parts). |

| Fair Market Value (FMV) | What your car was worth on the market right before the accident. This is your starting point. |

| Appraisal | An independent, expert report that calculates your vehicle’s true loss in value. This is your most powerful evidence. |

| Adjuster | The insurance company employee assigned to manage and settle your claim. |

Knowing these terms helps you speak confidently with adjusters and shows them you’ve done your homework.

Key Takeaway: Your goal is to provide undeniable proof that your car is worth less after the accident. A certified, independent appraisal report is the best tool to counter Geico lowball offer and support your claim for what you’re actually owed.

How Geico Calculates Your Claim Offer

When you file a diminished value claim, GEICO first offer is not random. It comes from a standardized, internal calculation designed for one purpose: to minimize their payout. To effectively challenge their lowball offer, you first have to understand how they arrive at it.

Instead of analyzing real-world market data for your specific car, GEICO often uses a rigid formula known as the “17c Formula.” While this gives them a consistent method for handling claims, it almost always fails to capture the true market value your vehicle has lost.

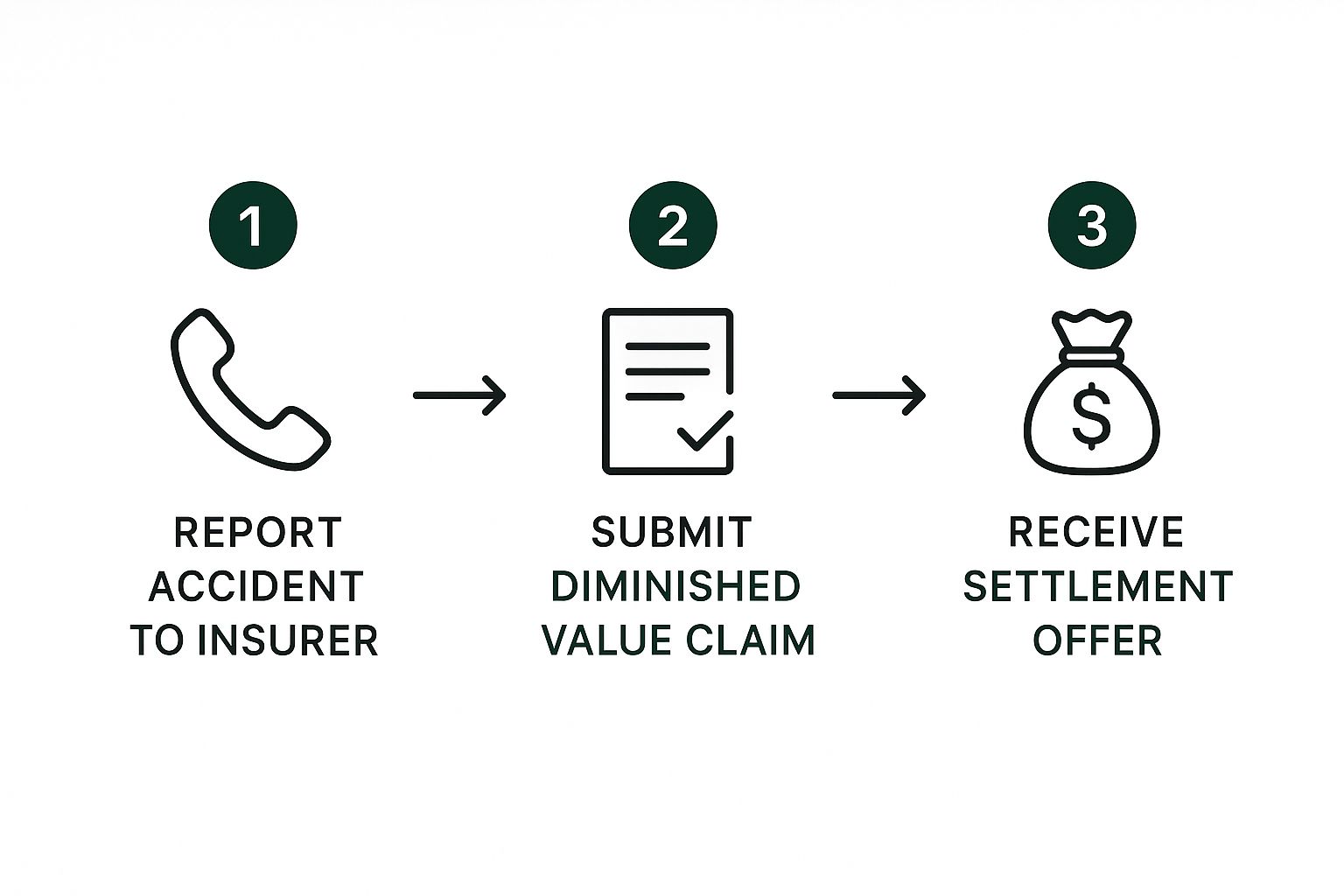

This chart shows the standard path your claim takes with Geico, from the initial accident report to their settlement offer.

As you can see, the final step is GEICO offer—and that’s exactly where their internal formula can leave you with far less than you deserve.

The Problem with the 17c Formula

The 17c Formula is not on your side. It was created by an insurance company during a Georgia court case to standardize payouts, and it has been widely criticized for producing unfairly low settlement offers.

GEICO still uses a version of this method in many states. The formula starts by capping the potential diminished value at just 10% of your vehicle’s pre-accident market value. From there, it applies two negative “multipliers” that reduce the payout even further—one for damage severity and another for mileage.

The bottom line: A formula-based approach ignores the most important factor—what a real buyer in your local market would actually pay for a car with a recent accident history. This is where their offer falls short.

How the Math Works Against You

Let’s break down how these multipliers systematically lower your claim’s value.

- Damage Multiplier: This adjusts the base 10% figure based on how bad the damage was. A car with minor cosmetic scratches might get a 0.25 multiplier, while a vehicle with major structural damage gets a 1.0 multiplier.

- Mileage Multiplier: This reduces your payout based on how many miles are on your vehicle. A brand-new car might have a 1.0 multiplier, but a car with 100,000 miles could see its payout cut in half with a 0.5 multiplier.

For example, imagine your car was worth $30,000 before the accident. GEICO’s formula immediately caps your maximum loss at $3,000 (10%). If you have moderate damage (a 0.5 multiplier) and 60,000 miles on the odometer (a 0.6 multiplier), their offer could drop to just $900.

This calculation has nothing to do with what a real car buyer at a dealership would deduct from the asking price. It’s an internal process designed to protect GEICO’s profits, not your investment. You can see how your own vehicle might be valued by using our free diminished value claim calculator to get a quick estimate.

A professional, independent appraisal bypasses this flawed formula entirely. It provides a real-world valuation based on actual market data, input from local dealers, and sales of comparable vehicles, giving you the solid proof you need to demand fair compensation.

Building Your Case with The Right Evidence

Simply telling GEICO your car is worth less isn’t enough. To beat their system, you need to build a strong case backed by clear proof. Your job is to gather the documents that make your claim undeniable.

The foundation of your entire case rests on a solid pile of official records. You need to paint a complete picture of your vehicle’s journey—from its great condition before the crash to its post-repair reality.

Assembling Your Essential Documents

Your first step is to gather every piece of paper related to the accident and repairs. The goal is to create a file so thorough that it leaves the adjuster with no room for doubt.

Here’s your evidence checklist:

- The Official Police Report: This is essential. It establishes the basic facts of the accident, including who was determined to be at fault.

- The Final Repair Invoice: Get the detailed, itemized list of every part replaced and all labor performed. This proves how extensive the damage really was.

- Pre-Accident Vehicle Records: Collect any service records or maintenance history you have. This helps prove your car was well-maintained before the collision.

- Post-Repair Photographs: Take clear, well-lit photos of the repaired areas from multiple angles. This creates a visual record of the work that was done.

This collection of documents is your starting point. It proves the accident happened and shows the scope of the repairs. But it doesn’t quantify the most important part of your claim: the actual dollar amount your car’s value has dropped.

The Cornerstone of Your Claim: An Independent Appraisal

This is, without a doubt, the single most powerful tool you have.

While your paperwork proves an accident happened, a certified, independent appraisal proves the financial damage. It transforms your claim from a simple opinion (“I think my car is worth less”) to an objective, market-based valuation that directly challenges GEICO’s internal formulas.

An independent appraisal provides an unbiased, data-driven assessment of your vehicle’s true loss in value. It analyzes local market data, comparable vehicle sales, and dealer insights to calculate a real-world figure, giving your demand immediate credibility.

A professional report from a trusted source like SnapClaim is designed to hold up under an adjuster’s scrutiny. We specialize in providing a detailed car appraisal after an accident that gives you the specific, hard evidence needed to negotiate from a position of strength.

And remember, SnapClaim provides a money-back guarantee. If your insurance recovery from the diminished value claim is less than $1,000, your appraisal fee is fully refunded. This allows you to build the strongest possible case without financial risk.

Negotiating Your Claim With a Geico Adjuster

You’ve submitted your demand letter and all your evidence. Now comes the real test: negotiating with a GEICO claims adjuster. This is a business conversation, and you need to be prepared.

The person on the other end of the line is a trained professional whose job is to settle claims for the lowest amount possible to protect GEICO’s bottom line. Your mission is to stay calm, be persistent, and keep the focus on the facts you’ve presented. You can file your Geico claim after accident here.

Understanding the Adjuster’s Tactics

GEICO adjusters often follow a predictable playbook. Knowing what to expect helps you stay in control and counter their arguments without getting frustrated. They count on vehicle owners feeling intimidated and accepting a low offer just to be done with it.

Here’s what you can expect them to do:

- Downplay the Loss: The adjuster will likely argue that modern repair techniques make your car “good as new,” ignoring the fact that an accident history permanently damages its market value.

- Question Your Evidence: They may try to discredit your dealer quotes as biased or claim your independent appraisal isn’t based on “real” market data, even when it is.

- Push for a Quick Settlement: A classic tactic is to offer a small, immediate payment. This often signals they know your claim is worth much more and are hoping you’ll take the easy cash.

These aren’t just isolated incidents; it’s a common strategy. Consumer legal sources have highlighted a pattern where adjusters offer quick but low settlements and may even use recorded statements to undermine a claimant’s position.

Presenting Your Case with Confidence

Your certified appraisal report is your strongest negotiating tool. It’s not just your opinion—it’s an expert valuation based on objective market data. When the adjuster pushes back, calmly guide them back to the specifics in your report.

Getting emotional won’t help. Stick to the facts. For instance, if the adjuster says, “Your car looks brand new after the repairs,” a solid response is, “I agree the shop did excellent work, but as my appraisal shows on page four, comparable vehicles with accident histories in our area are selling for $4,200 less than those with a clean record.”

Pro Tip: Keep communication in writing whenever possible. After every phone call, send a brief follow-up email summarizing the conversation. This creates a paper trail and holds everyone accountable.

Remember, a SnapClaim appraisal provides the data-driven proof needed to make a compelling case. We stand behind our work with a money-back guarantee: if your insurance recovery is less than $1,000, we refund your appraisal fee completely. This lets you negotiate from a position of strength, knowing you have a risk-free tool supporting your claim.

Our guide on how to file a diminished value claim walks you through even more details of the process.

Overcoming Common Claim Delays and Denials

Getting an initial denial or a low offer from a GEICO adjuster isn’t the end of the road. In fact, it’s often just the beginning of the negotiation. Insurance companies frequently put up roadblocks, hoping you’ll get frustrated and give up. Knowing their common tactics is the first step to overcoming them.

Many vehicle owners find their claims stonewalled when an adjuster demands an impossible level of proof, calling a dealer quote “biased” or an appraisal report “not enough.” This isn’t an accident; it’s a strategy designed to wear you down.

Countering Common Denial Tactics

The only way to break through these roadblocks is with professional, solid evidence. When an adjuster challenges your claim, you can’t respond with an opinion. You need a USPAP-compliant appraisal—meaning it meets national standards—that can withstand intense scrutiny.

Here are a few common excuses to prepare for:

- “Your Appraisal Lacks Proof”: The adjuster might say your report doesn’t have enough market data. A professional appraisal will be packed with comparable vehicle sales, insights from local dealers, and a clear methodology that leaves no room for doubt.

- “We Don’t Accept Dealer Opinions”: This is a classic tactic used to invalidate input from experts in the used car market. Your report should use real-world data from local dealers to show how an accident history impacts a car’s resale value.

- “The Repairs Made the Car Whole”: This argument misses the point of inherent diminished value. Your response should always circle back to the permanent mark the accident leaves on your car’s history—something no repair can ever erase.

Some insurers have become more aggressive lately. Legal professionals have pointed out that GEICO may reject appraisals by demanding hard-to-find market data or dismissing valid comparable sales. By labeling your evidence as “insufficient proof,” they hope to drag out the process until you accept a lowball offer. You can get more details on tactics that attorneys have observed on diminishedvaluemethod.com. You can also read How Do I File a Car Accident Claim with GEICO Insurance After a Car Accident?.

Your Risk-Free Path to Fair Compensation

This is exactly why SnapClaim’s money-back guarantee is so important. It gives you peace of mind. We are so confident in the quality of our appraisal reports that we take the financial risk off your shoulders.

Our Promise: If your insurance recovery from the diminished value claim is less than $1,000, we will give you a full refund for your appraisal fee. This guarantee lets you fight an unfair denial without the fear of losing money.

This isn’t just about buying an appraisal; it’s about arming yourself with the right evidence for the fight. Our reports are specifically built to dismantle the common arguments used in GEICO diminished value claim process.

While the strategies for diminished value and total loss claims differ, they both depend on solid proof. If you’re dealing with another type of valuation dispute, our guide on how to dispute a total loss offer can help.

When you invest in a certified appraisal backed by a guarantee, you send a powerful message to the adjuster: you’re serious, you have the proof, and you won’t be pushed around.

FAQ: Geico Diminished Value Claims

Navigating GEICO diminished value claim process can be confusing, but you’re not alone. Here are answers to the most common questions we hear from vehicle owners.

How long do I have to file a diminished value claim?

The clock starts ticking on the date of the accident. The deadline to file is determined by your state’s statute of limitations for property damage, which varies widely. For example, you might have just one year in Louisiana but three years or more in other states. It’s always best to start the claim process as soon as your repairs are complete to avoid missing the deadline.

Do I need a lawyer to file a claim with Geico?

No, you are not required to hire a lawyer to file a diminished value claim. Many vehicle owners successfully handle their claims on their own, especially when they have a strong, evidence-based appraisal report. However, if your claim involves a high-value vehicle, serious injuries, or if the GEICO adjuster is unresponsive, consulting an attorney is a smart move.

Can I file a diminished value claim if I was at fault?

In almost all cases, the answer is no. Diminished value is considered a “third-party” claim, which means you file it against the insurance policy of the driver who caused the accident (GEICO in this case). Your own collision coverage is designed to pay for your car’s repairs, not the loss of its market value. The one major exception is Georgia, where drivers can file a first-party diminished value claim under certain conditions. For rules in your area, check with your local Department of Motor Vehicles (DMV).

What if Geico’s offer is still too low?

Don’t accept an offer that you know is unfair. If you’ve presented a professional appraisal and GEICO’s offer is still unreasonably low, your next step is often to invoke the appraisal clause in the at-fault party’s insurance policy (if available in your state). This process allows you and GEICO to each hire an appraiser, and those two experts negotiate a binding settlement. If that fails, small claims court is another option. This is where SnapClaim’s money-back guarantee offers peace of mind—if your insurance recovery is less than $1,000, we will refund your appraisal fee. It lets you fight for what you’re owed without taking a financial risk.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This article was reviewed by SnapClaim’s team of certified auto appraisers and claim specialists with years of experience preparing court-ready reports for attorneys and accident victims. Our content is regularly updated to reflect the latest industry practices and insurer guidelines.

Get Started Today

Ready to prove your claim? Generate a free diminished value estimate in minutes and see how much you may be owed.

Get your free estimate today