Your car has been in an accident, the repairs are done, but its value has permanently dropped because of its new accident history. This loss, known as diminished value, is a real financial hit that you shouldn’t have to absorb when the accident wasn’t your fault. Understanding diminished value laws is the first step toward getting the fair compensation you deserve from the at-fault driver’s insurance company.

Your Car Is Repaired, but Its Value Is Gone

Think of it this way: imagine you own a rare, pristine comic book. If it gets torn and then expertly repaired, it might look great on the shelf, but a serious collector will never pay the same price as they would for an undamaged original.

The exact same logic applies to your car. Even with flawless, factory-spec repairs, the accident history creates a stigma that automatically lowers what a buyer is willing to pay. This isn’t just a “what if” scenario; it’s real money that will disappear from your pocket the day you try to sell or trade in your vehicle. Insurance companies are experts on this topic, but they bank on you focusing only on the repair bill and forgetting about the lost value.

Understanding Your Right to Compensation

The good news? You don’t have to just eat that loss. Most states recognize your right to file a claim against the at-fault driver’s insurance to get compensated for this drop in value.

But here’s the catch: you have to prove exactly how much value your car has lost. The insurer isn’t just going to take your word for it—they demand hard, verifiable evidence. This is where a professional appraisal becomes your most important tool, providing a data-driven report that helps strengthen your claim.

For a deeper dive into the nuts and bolts, you can learn more about what vehicle diminished value is and how it affects your finances.

Why Insurers Push Back on Claims

Insurance companies are in the business of minimizing payouts, so they often use their own internal—and frequently flawed—formulas to calculate your loss. A common tactic is to argue that because the repairs were done properly, your car has been restored to its “pre-accident condition,” completely sidestepping the impact of its new accident history.

A diminished value claim is a demand for the lost market value of your vehicle after an accident. It seeks compensation for the drop in your vehicle’s resale value after it has been damaged and repaired.

To fight back effectively, you need to build a strong, fact-based case. This means getting organized.

- Know Your State’s Rules: The first step is understanding the specific diminished value laws in your state, because they can vary quite a bit.

- Document Everything: Hold onto every repair invoice, photo of the damage, and the official police report.

- Get a Certified Appraisal: An independent report from a trusted source like SnapClaim provides the proof you need to negotiate from a position of strength.

SnapClaim reports provide the certified proof you need to support negotiations with insurers. Plus, we back it up with our money-back guarantee: if the insurance recovery from the claim is less than $1,000, your appraisal fee is fully refunded. This gives you the confidence to pursue fair compensation.

Navigating Diminished Value Laws by State

Figuring out if you can file a diminished value claim isn’t as straightforward as it should be. The biggest hurdle? The rules can change dramatically depending on which state you’re in. What’s standard practice in one place might be completely off-limits just across the state line.

This legal patchwork means you absolutely have to know your local diminished value laws before you even think about starting a claim.

The single most important factor is who you’re filing the claim against. This splits every claim into two distinct types: third-party and first-party. Understanding the difference is your first step toward getting paid what you’re owed.

Third-Party vs. First-Party Claims

Nearly all successful diminished value claims are third-party claims. This is where you file a claim against the at-fault driver’s insurance company. It’s simple, really—their driver’s mistake caused your car’s value to drop, so their insurance is on the hook to make you whole again.

A first-party claim, on the other hand, is when you file with your own insurance company. These are a much tougher battle. Most auto policies are designed to cover the cost of repairs, not the invisible loss of market value that follows. In fact, many states flat-out prohibit first-party diminished value claims unless your policy specifically says it’s covered (which is almost unheard of).

A third-party claim is your strongest path to recovering lost value. State laws are designed to hold the negligent party accountable, and that accountability extends to the diminished value of your vehicle.

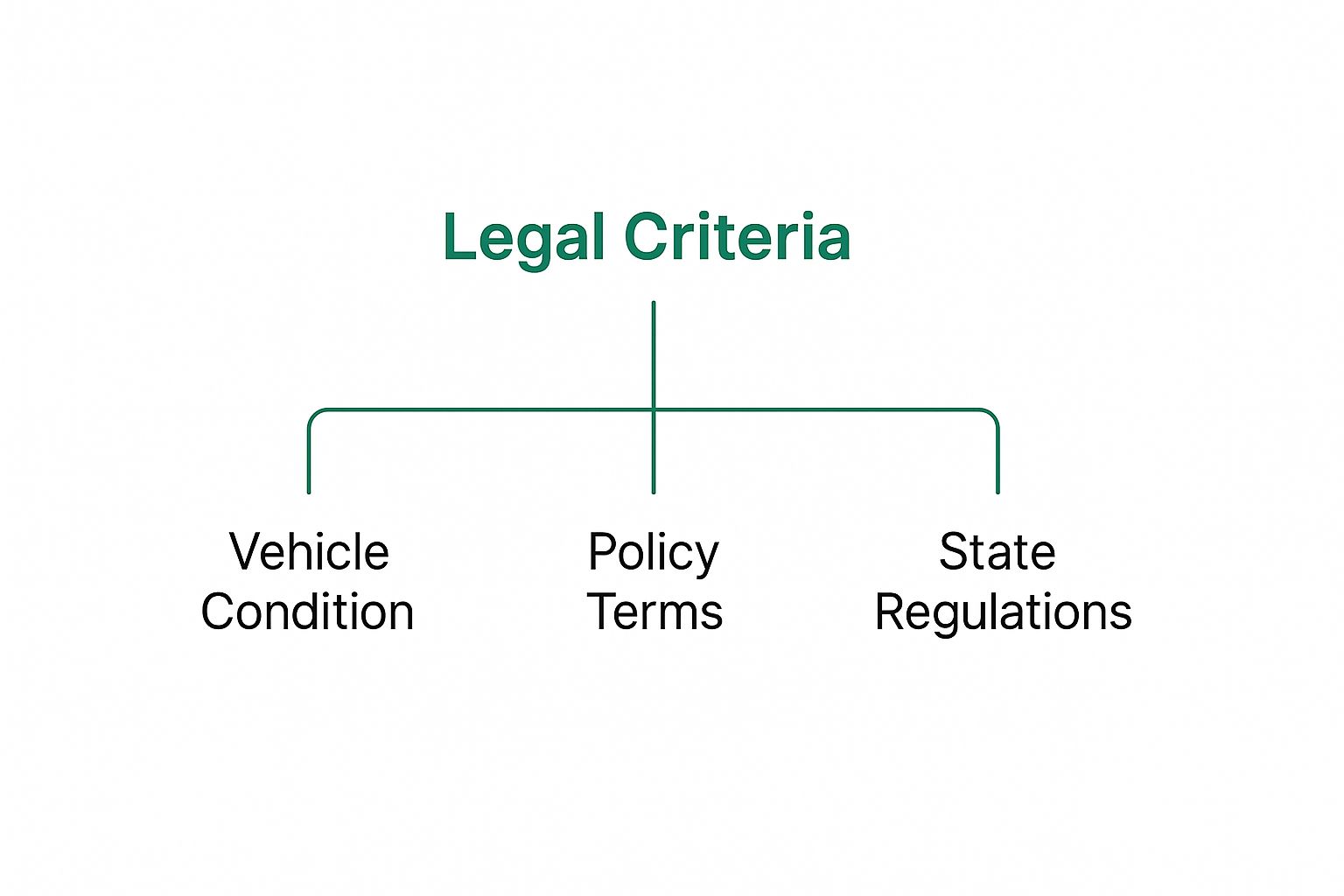

This infographic breaks down the key ingredients that make or break a diminished value claim.

As you can see, a winning claim sits at the intersection of your car’s condition, the insurance policy fine print, and the specific rules in your state.

The State-By-State Legal Landscape

Because the laws are all over the map, there’s no single strategy that works everywhere. Still, most states fall into one of three general camps:

- States That Welcome Third-Party Claims: This is the majority. Places like California, Texas, and New York have solid legal history backing a car owner’s right to sue the at-fault driver’s insurer for diminished value.

- States with Some Hoops to Jump Through: A few states add extra conditions. They might have specific court cases that limit which cars or what kind of damage qualifies for a claim.

- States That Make It Nearly Impossible: In a handful of states, the laws are written to make filing these claims incredibly difficult, no matter the circumstances.

State Positions on First-Party Diminished Value Claims

To give you a clearer picture, here’s a quick look at how states generally handle claims against your own insurer.

It’s also worth noting that these laws aren’t set in stone. The legal landscape is always shifting, and the trend is moving toward stronger protections for drivers. More states are recognizing the validity of these claims and pushing for independent appraisals over the insurance-friendly formulas that have dominated for years.

Given this complexity, you need to confirm you’re even eligible to file a claim from day one. You can find a complete state-by-state breakdown in our guide on diminished value state laws.

Why Your State Matters So Much

Knowing your state’s position isn’t just a technicality—it shapes your entire game plan. It tells you if you have a case, what proof you’ll need, and what kind of pushback to expect from the insurance adjuster.

An adjuster handling a claim in Georgia, a state with strong consumer protection laws, will treat it very differently than one working a claim in a state with restrictive rules.

This is exactly why a professional appraisal is a non-negotiable. A certified SnapClaim report is built from the ground up with your state’s legal standards in mind. It gives you the objective, market-driven proof needed to build a case that an adjuster can’t ignore, giving you the leverage you need to win a fair settlement.

And with our money-back guarantee, there’s zero risk. If your insurance recovery is less than $1,000, your appraisal is on us.

How Market Conditions Affect Your Claim

A diminished value claim isn’t some fixed number pulled from a hat. It’s a dynamic figure that’s directly tied to the real-time economy and the constantly shifting used car market. Understanding these forces is absolutely critical, because they dictate the compensation you’re rightfully owed.

Think of your car’s value like a stock price—it rises and falls based on factors completely outside of your control. An insurance company’s generic formula rarely, if ever, accounts for this volatility. That’s a big reason why their first offer is almost always way too low.

The strength of your claim hinges on proving your car’s value based on what’s happening in the market right now, not what some spreadsheet says. This is where a professional appraisal becomes essential. It provides a rock-solid foundation for negotiations by analyzing these complex variables to pinpoint your true financial loss.

The Role of Supply and Demand

The classic economic principle of supply and demand is a huge driver of your car’s value. When used cars are in high demand and the supply is tight, your vehicle’s pre-accident value is naturally higher. This, in turn, can lead to a much more substantial diminished value claim.

On the flip side, if the market is flooded with cars just like yours, its pre-accident value might be lower, which could reduce your claim amount. Even seasonal shifts play a part. For example, demand for SUVs and trucks almost always climbs in the fall and winter, pushing their market value up.

A vehicle’s value is never static. It is constantly influenced by regional demand, economic health, and consumer trends. A proper diminished value calculation must reflect these real-world conditions, not just a set of arbitrary rules.

An expert appraisal captures these fluctuations, giving you a snapshot of your car’s true worth at the precise moment of the accident. To get a better handle on this, check out our guide on how to determine a vehicle’s fair market value.

Broader Economic and Vehicle-Specific Factors

Beyond basic supply and demand, a whole host of other elements can dramatically alter your claim’s final calculation. An independent appraiser will dig into each of these to build an accurate picture of your loss.

Key market factors include:

- Regional Price Variations: A popular truck in Texas will hold its value completely differently than the same truck in California. Any credible claim must be built on local market data.

- Economic Inflation: During periods of high inflation, the cost of both new and used vehicles tends to rise. This can actually increase your car’s pre-accident value and, consequently, your claim.

- Brand Reputation and Popularity: Brands known for legendary reliability and high resale value (think Toyota or Honda) often suffer a greater percentage of diminished value. Why? Because buyers for these cars expect a pristine, accident-free history.

- Fuel Prices: When gas prices skyrocket, demand for larger, less efficient vehicles can plummet, temporarily dragging their market value down with it.

These real-world conditions are precisely what standardized insurance formulas ignore, and it’s why market factors are so critical to the outcome of your claim. This is what makes a SnapClaim report so powerful; it replaces the insurance company’s guesswork with verifiable, location-specific market analysis.

And with our money-back guarantee, you can order your appraisal with total confidence. If your recovery is less than $1,000, your fee is fully refunded.

Decoding the Insurer’s Calculation Methods

When you file a diminished value claim, you’re expecting a fair shake based on real-world numbers. What you’ll probably get instead is a shockingly low offer spit out by the insurance company’s internal formula.

Let’s be clear: these formulas aren’t designed for accuracy. They’re built to minimize payouts and protect the insurer’s bottom line.

The most infamous of these is the “17c formula.” It has become the go-to weapon for adjusters everywhere because it uses a series of bogus caps and arbitrary deductions to systematically crush your claim’s value. Understanding how this game is played is the first step in dismantling their lowball offer and fighting for what you’re actually owed.

The Notorious 17c Formula Explained

The 17c formula has almost nothing to do with how cars are actually valued and sold in the real world. It was born out of a Georgia court case (Mabry v. State Farm) and was never meant to be a universal standard. So why is it so common? Because it works—for them. It consistently produces laughably low figures.

Here’s a quick look at how they cook the books:

- Cap the Value: The formula starts by capping your vehicle’s maximum possible diminished value at 10% of its pre-accident NADA or KBB value. This initial ceiling is completely made up and instantly limits what you can recover before anything else is even considered.

- Apply a Damage Modifier: Next, the adjuster applies a subjective “damage modifier,” assigning a multiplier from 0.00 to 1.00 based on their opinion of the damage severity. These ratings are wildly inconsistent and always seem to lean in the insurer’s favor.

- Apply a Mileage Modifier: Finally, they hit you with another multiplier based on your car’s mileage. A vehicle with more miles gets its claim value slashed, even if it was in pristine condition with a high resale value.

The number that comes out the other end has no connection to your car’s true loss in your local market. It totally ignores crucial factors like brand reputation, the quality of repairs, and—most importantly—what a real buyer is willing to pay.

A quick Google search for the 17c formula tells you everything you need to know about its reputation.

The results are packed with articles from law firms and consumer watchdogs explaining exactly why this formula is a sham and how to fight back.

A Real-World Example of the 17c Flaw

Let’s watch this formula in action with a typical scenario.

- Vehicle: A 2022 Toyota Highlander, great condition.

- Pre-Accident Value (NADA): $40,000

- Accident: Moderate rear-end collision.

Now, let’s run the 17c playbook:

- Value Cap: 10% of $40,000 is $4,000. That’s the absolute most they’ll even think about, no matter what a real market analysis says.

- Damage Modifier: The adjuster calls the damage “moderate” and slaps a 0.50 multiplier on it. The value is now cut to $4,000 x 0.50 = $2,000.

- Mileage Modifier: The Highlander has 40,000 miles, so the adjuster applies another multiplier of 0.75. This drops the figure again to $2,000 x 0.75 = $1,500.

The insurance company’s final offer, based on their self-serving formula, is just $1,500. But in the real world, a buyer would likely pay $5,000 to $6,000 less for a Highlander with that kind of accident on its record.

This is the gap you’re up against. The 17c formula isn’t a valuation tool; it’s a negotiation tactic designed to make you feel like you’re getting something.

How to Counter the Insurer’s Low Offer

Your best defense against the 17c formula is a credible, independent appraisal. A USPAP-compliant report from a certified appraiser like SnapClaim gives you the hard evidence you need to blow their lowball number out of the water.

Unlike their bogus formula, a professional appraisal:

- Analyzes your specific local market conditions.

- Pulls sales data from comparable vehicles with and without accident histories.

- Considers factors they ignore, like brand reputation, luxury features, and repair quality.

When you hand the adjuster a data-driven report, you change the entire conversation. It’s no longer about their flawed formula—it’s about the cold, hard facts of your financial loss. A SnapClaim appraisal provides the proof you need to negotiate from a position of strength and secure a fair settlement.

And with our money-back guarantee, you can challenge their offer with total confidence. If your claim recovery is under $1,000, we’ll refund your appraisal fee completely.

Filing Your Diminished Value Claim Step by Step

Alright, you’ve confirmed you’re eligible and you know how insurers try to lowball your claim. Now it’s time to take action.

Filing a diminished value claim is a methodical process. Think of it like building a case—the stronger your evidence, the better your chances. The goal here is to hand the at-fault driver’s insurance company a professional, evidence-backed demand they simply can’t ignore.

Step 1: Gather Your Essential Documents

Before you even think about picking up the phone, get your paperwork in order. A disorganized claim is an easy claim to dismiss. A well-organized one shows you mean business.

Here’s your checklist:

- The Police Report: This is non-negotiable. It officially establishes who was at fault, which is the foundation of any third-party claim.

- Repair Invoices and Estimates: Get the final, itemized repair bill along with any initial estimates. This paperwork proves the extent of the damage and just how complex the repairs were.

- Photos of the Damage: Pictures are powerful. You’ll want photos from before, during, and after the repairs. Visuals tell a story that words and numbers can’t.

- Vehicle Title and Registration: Simple enough—you need to prove you actually own the car to claim a loss on it.

Step 2: Confirm Your Eligibility

Even with a neat pile of documents, it’s smart to double-check the rules. Every state has its own specific diminished value laws, and you need to be sure you’re on solid ground.

Remember the golden rule: you cannot be the at-fault driver. This is strictly a third-party claim.

Also, be mindful of the clock. Most states have a statute of limitations for property damage claims, usually two or three years from the date of the accident. If you miss that deadline, you lose your right to file forever. Don’t wait.

A successful claim starts with a solid foundation. Confirming your eligibility and gathering comprehensive documentation are the first critical steps toward proving your loss and securing a fair settlement.

Step 3: Obtain a Certified Appraisal

This is the single most important step in the entire process. Don’t skip it.

An independent, certified appraisal is the engine that drives your claim. It replaces the insurance company’s self-serving, biased formulas with an objective, market-based valuation of your car’s true financial loss. It’s your proof.

A SnapClaim report is USPAP-compliant, which means it meets the highest professional standards recognized by insurers and courts across the country. This report becomes your primary piece of evidence. You can learn more about how to file a diminished value claim and see just how crucial an appraisal is in our detailed guide.

Step 4: Submit a Formal Demand Letter

With your certified appraisal in hand, you’re ready to make your move. You’ll send the at-fault driver’s insurance company a complete package containing:

- A professional demand letter that clearly states the amount you are claiming for diminished value.

- A full copy of your certified appraisal report from SnapClaim.

- Copies of all the supporting documents you gathered back in Step 1.

Keep your demand letter polite but firm. Briefly outline the facts of the crash, reference your appraisal, and state the specific dollar amount you’re seeking.

Step 5: Negotiate with the Insurance Adjuster

Don’t be surprised or discouraged if the adjuster’s first move is to reject your claim or come back with a ridiculously low offer. This is Negotiation 101 for them. Stay calm, and stay professional.

Politely refer them back to your certified appraisal. Then, ask them to provide a written explanation detailing why they disagree with its findings, including the specific market data they used to arrive at their number. You’ll find their internal formulas rarely hold up to that kind of scrutiny.

And with SnapClaim, this entire process is completely risk-free. Our money-back guarantee means that if your total insurance recovery from the claim is less than $1,000, we will fully refund your appraisal fee. You can go after what you’re owed with total confidence.

Proving Your Loss With an Independent Appraisal

So, how do you fight back when an insurance adjuster slides a lowball offer across the table? The single most powerful tool in your corner is an independent appraisal.

Think of it this way: the insurance company arrives with their own calculation, a number cooked up using internal formulas designed to pay out as little as possible. An independent appraisal is your expert counter-argument. It shifts the conversation away from their flawed math and grounds it in objective, real-world market data.

This isn’t just about getting a second opinion. A certified appraisal tells the complete story of your car’s lost value in a language that insurers not only understand but are legally required to consider. It provides the proof you need to negotiate a fair settlement, all backed by solid facts.

The Power of a USPAP-Compliant Report

What makes an independent appraisal so effective? The secret sauce is its compliance with the Uniform Standards of Professional Appraisal Practice (USPAP). These are the nationally recognized ethical and performance standards for the entire appraisal profession.

An insurer’s internal estimate is just that—internal. It’s their number, for their benefit. A USPAP-compliant report from a certified appraiser, however, is a credible, third-party document that holds up under scrutiny, whether you’re negotiating with an adjuster or presenting your case in court.

A professional appraisal isn’t just a number; it’s a comprehensive analysis that documents your vehicle’s pre-loss value, its post-repair value, and the specific market data used to justify the loss. It provides the concrete evidence needed to strengthen your claim.

A proper report will include a detailed breakdown of:

- Pre-Accident Value: Based on recognized guides like NADA and real-time local market comparables.

- Post-Repair Value: An analysis of how the accident history now impacts what a willing buyer in your area would actually pay for the car.

- Market Data: Sales information from comparable vehicles, clearly showing the real-world price gap between accident-free cars and ones with a crash history.

Navigating Market Dynamics With Expert Analysis

The used car market is always changing, and those shifts directly impact your claim’s value. For instance, recent analysis projects that total loss market values will stay well above historical averages, a trend driven by vehicle demand and broader economic factors. These are precisely the kinds of dynamics a professional appraiser digs into. If you want to dive deeper into these trends, you can explore this global insurance outlook from EY.com.

A SnapClaim appraisal takes all these nuances into account, ensuring your claim reflects current market realities, not outdated formulas. To see exactly how we build a rock-solid case for your claim, check out our certified auto appraisal guide.

Best of all, getting this crucial evidence with SnapClaim is completely risk-free. Our money-back guarantee means that if your insurance recovery is less than $1,000, we’ll refund your appraisal fee in full.

Frequently Asked Questions About Diminished Value Laws

When you’re dealing with the aftermath of an accident, diminished value laws can feel confusing. Let’s clear things up with straightforward answers to the questions we hear most often from drivers just like you.

Can I File a Diminished Value Claim if I Was at Fault?

Almost certainly not. Think of it this way: a diminished value claim is about holding the responsible party accountable for your car’s lost market value. That means you file against the at-fault driver’s insurance, which is called a third-party claim. Your own policy is designed to pay for repairs, not to compensate you for a drop in resale value.

Is There a Deadline for Filing My Claim?

Yes, and this is a big one. Every state has a legal clock ticking on property damage claims called the statute of limitations. This window, which includes diminished value, is usually two or three years from the date of the accident. If you miss that deadline, you lose your right to recover anything for your car’s lost value, so don’t wait.

What if the Insurance Company Rejects My Appraisal?

Don’t be surprised if they do—it’s a common tactic. An adjuster might ignore your independent appraisal or make a lowball counteroffer. Stand your ground. A certified, USPAP-compliant report isn’t just an opinion; it’s a credible valuation backed by real market data that they can’t easily dismiss. When an insurer pushes back, ask for their rejection in writing and demand the specific data they used to justify their lower number.

Will Filing This Claim Increase My Insurance Rates?

No. When you file a claim against the at-fault driver’s insurance, it shouldn’t touch your own policy’s rates. Claims follow fault, which means the responsible driver’s insurance record takes the hit. You are legally entitled to be made whole after a loss caused by someone else, and filing a claim to recover what you’re owed is not a valid reason for your own insurer to penalize you.

Ready to stop guessing and start proving your vehicle’s true loss in value? The expert team at SnapClaim is here to help. We provide the certified, data-driven appraisal report you need to strengthen your negotiations and fight for a fair settlement.

Get your free estimate today or order a certified appraisal report to get started.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This article was reviewed by SnapClaim’s team of certified auto appraisers and claim specialists with years of experience preparing court-ready reports for attorneys and accident victims. Our content is regularly updated to reflect the latest industry practices and insurer guidelines.

Get Started Today

Ready to prove your claim? Generate a free diminished value estimate in minutes and see how much you may be owed.

Get your free estimate today