If an Allstate-insured driver hit your car, you’re likely facing a frustrating reality: even after perfect repairs, your vehicle is now worth less money. This loss in resale value is called diminished value, and filing a diminished value claim with Allstate is your legal right to recover that financial loss.

Understanding Your Right to Fair Compensation

When another driver is at fault, their insurance company is responsible for making you “whole” again. This doesn’t just mean paying for repairs; it includes compensating you for the permanent drop in your car’s market value, a loss known as inherent diminished value.

Think about it from a buyer’s perspective. Given two identical used cars, one with a clean history and one with a reported accident, which would you choose? Most buyers would pick the one without an accident history or demand a significant discount on the other. That “discount” is the diminished value you’ve already lost as the owner.

What Is a Diminished Value Claim?

A diminished value claim is a formal demand you make to the at-fault driver’s insurance—in this case, Allstate. It’s completely separate from the property damage claim that covered the repairs. You are simply asking Allstate to pay you for the difference between your car’s value before the crash and its value now with an accident on its permanent record.

Before you begin, here’s a quick overview of what you need to know.

| Concept | What It Means for Your Allstate Claim |

|---|---|

| Claim Type | This is a third-party claim. You file against the at-fault driver’s Allstate policy, not your own. |

| Your Role | The burden of proof is on you. You must prove how much value your vehicle lost. |

| Adjuster’s Goal | The adjuster’s job is to minimize the payout. Expect to negotiate, likely from a very low initial offer. |

| State Laws | Your rights vary by state. Some states have more favorable laws for these claims than others. |

Securing a fair settlement requires effort, but it’s achievable with the right approach and solid proof. A SnapClaim report provides the data-backed evidence you need to strengthen your claim and negotiate for fair compensation.

A common tactic adjusters use is to delay or offer a tiny “nuisance” payment of a few hundred dollars, hoping you’ll get frustrated and give up. Don’t fall for it. Persistence and strong documentation are your best tools.

Why Allstate Pushes Back on Diminished Value

Filing a diminished value claim with Allstate can often feel like an uphill battle. The company is known for defending these claims aggressively to protect its bottom line. Research indicates Allstate has one of the lowest acceptance rates, with average payouts often between $750 and $1,900—far less than what many vehicles actually lose in value.

Their adjusters are trained to find weaknesses in your argument. You’ll likely hear statements like, “The certified repairs restored the car to its pre-accident condition,” or they will use a flawed internal calculation like the “17c formula” to arrive at a shockingly low number.

This is why you can’t counter their opinion with your own. You need an independent, data-driven appraisal to shift the conversation from their self-serving formula to verifiable market facts. You can learn more in our detailed guides on appraisals.

How Allstate Calculates Your Car’s Lost Value

That low settlement offer from Allstate isn’t random. It’s the result of a deliberate, insurer-friendly calculation designed to pay you as little as possible. Understanding their method is the first step toward fighting for the compensation you’re actually owed.

At the core of Allstate’s process is a controversial formula known as 17c. It creates the appearance of a fair, standardized system, but in reality, it’s filled with arbitrary caps and penalties that work against you from the start.

The Problem with the 17c Formula

The 17c formula is an industry-wide tool used to systematically lowball diminished value claims. Originally from a Georgia court case, it was quickly adopted by insurers because it consistently produces a low number and is easy to apply.

For a deeper look at how insurers use this flawed model, see our detailed breakdown of the 17c formula.

This calculation is designed to undervalue your vehicle by applying a series of reductions that don’t reflect real-world market depreciation. Here’s how the math is structured against you.

The process typically involves three flawed steps:

- It Starts with a Flawed Baseline: The formula immediately caps the maximum possible diminished value at just 10% of your car’s pre-accident value (often based on sources like Kelley Blue Book or NADAguides).

- It Applies a Subjective Damage Modifier: Next, it multiplies that capped amount by a “damage modifier”—a subjective number between 0.00 and 1.00 that rarely accounts for the major impact of structural or frame damage on resale value.

- It Adds a Mileage Penalty: Finally, it applies another multiplier to penalize your car for its mileage, reducing the payout even further.

Key Takeaway: The 17c formula is a tool built by insurers, for insurers. Its sole purpose is to generate a predictable, low-cost outcome for Allstate—not to accurately measure your car’s true loss in market value.

A Real-World Scenario

Let’s see how this works with an example. Imagine your two-year-old sedan was worth $30,000 before an accident caused moderate structural damage.

Here’s a simplified look at how an Allstate adjuster would calculate the loss:

- Step 1: The 10% Cap: First, they cap the maximum potential loss at 10% of the car’s pre-accident value.

- $30,000 x 10% = $3,000

- Step 2: Damage Penalty: The adjuster assigns a subjective damage modifier of 0.50 for “moderate” damage.

- $3,000 x 0.50 = $1,500

- Step 3: Mileage Penalty: Your car has 40,000 miles, so they apply a mileage modifier of 0.80.

- $1,500 x 0.80 = $1,200

Allstate’s final offer is just $1,200. This number completely ignores the market reality that a car with a history of structural damage could easily lose $5,000 or more in resale value, especially when complex repairs like ADAS calibrations are involved.

This insurer-friendly math is why accepting Allstate’s first offer is a significant mistake. The only way to counter their formula is with a comprehensive, market-based analysis that proves what real buyers would actually pay for your car now. An independent appraisal report provides the hard evidence you need to challenge their flawed calculations and force a fair negotiation.

Gathering Evidence to Prove Your Diminished Value Claim

Knowing your car has lost value is one thing. Proving the exact amount to an Allstate adjuster requires a solid, evidence-based strategy. Your opinion alone isn’t enough; you need to build a strong case that leaves no room for their subjective formulas.

An Allstate adjuster’s main goal is to close your file for the lowest possible amount. They are trained to spot weaknesses in a claim. A disorganized submission signals you may not be prepared for a tough negotiation, making it easy for them to delay, deny, or offer a tiny settlement.

Building Your Case File

Think of it as preparing a case for a judge—every document strengthens your position. Your goal is to present a professional package that clearly shows the vehicle’s pre-accident condition, the full extent of the damage, the quality of repairs, and the real-world loss in market value.

Here’s the essential documentation you should collect:

- Pre-Accident Photos: Establishes a high baseline value by showing your car was in excellent condition.

- Post-Accident Photos: Provides visual proof of the damage severity, countering any attempt to downplay it.

- The Police Report: Officially establishes who was at fault, a crucial requirement for any third-party claim.

- Final Itemized Repair Bill: Details every part, labor hour, and specifies any structural or frame damage.

- Proof of Repairs: Includes the final invoice and post-repair diagnostic scans to prove the work was completed correctly.

Having these documents organized shows the adjuster you are serious and prepared. It forces them to address the facts, not rely on internal assumptions.

The Power of an Independent Appraisal

While the documents above are crucial, the centerpiece of your diminished value claim against Allstate is a certified, independent appraisal. This isn’t just another estimate; it’s objective, third-party proof that dismantles their internal calculations like the 17c formula.

Frankly, it shifts the entire conversation away from their opinion and onto verifiable market data.

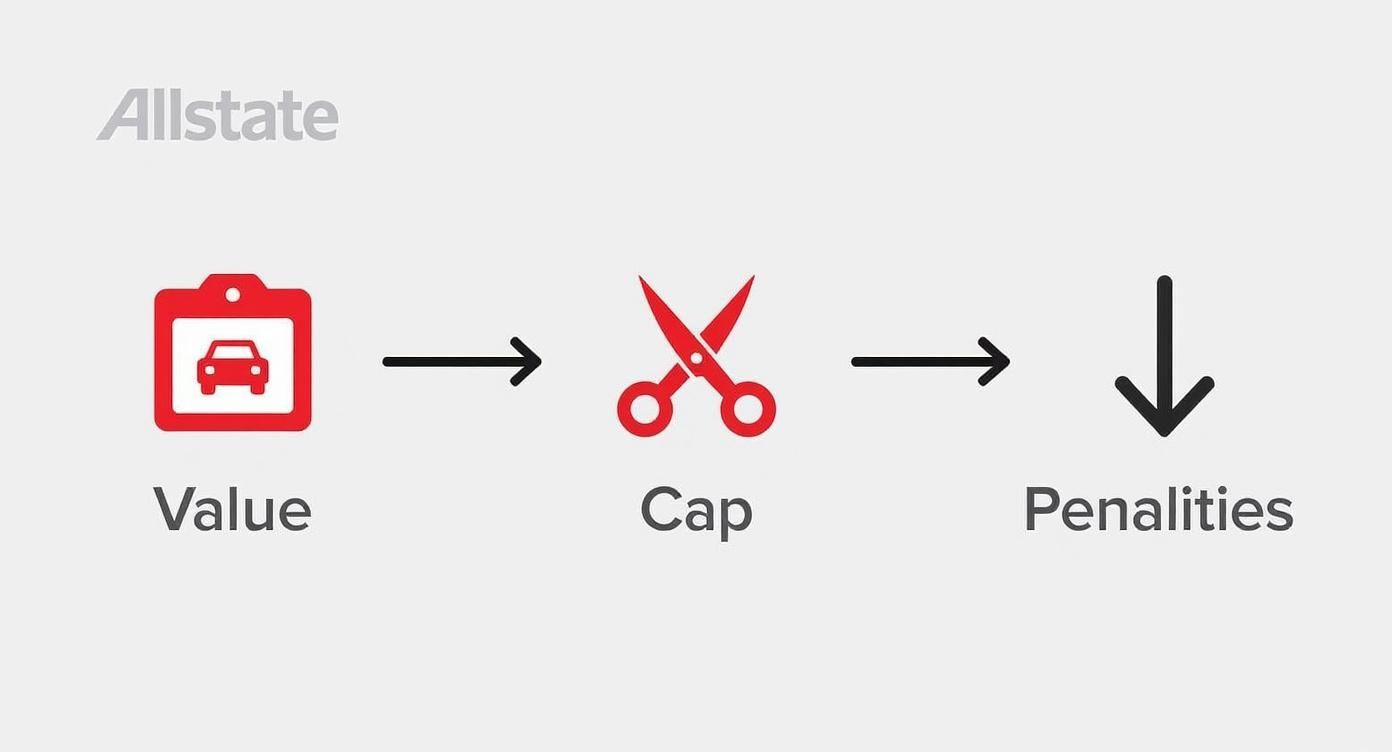

The infographic below shows the simplified, insurer-friendly process Allstate often uses—a process an independent appraisal directly challenges.

This flawed method of applying an arbitrary cap and penalties is precisely why a SnapClaim report is so effective. It replaces their formula with real-world market analysis.

An independent appraisal provides three things you can’t get on your own:

- An Unbiased Valuation: It’s created by a certified expert with no ties to the insurance company.

- Market-Based Evidence: It analyzes sales data for comparable vehicles in your local market, comparing examples with and without accident histories.

- A Defensible Figure: It provides a specific, justifiable dollar amount for your loss that you can confidently stand behind during negotiations.

A SnapClaim report is designed to be easily understood by adjusters, providing the concrete evidence needed to support your claim. Our certified methodology ensures the report is defensible and credible. To get comfortable with the details, you can learn how to read an appraisal report and see exactly how the data is presented.

Assembling Your Demand Package

Once you have your evidence and appraisal, it’s time to assemble it professionally. This involves writing a formal demand letter that clearly lays out your case. Your letter should state the facts, reference your enclosed evidence, and formally demand payment for the specific diminished value amount identified in your appraisal.

This professional approach transforms you from a frustrated claimant into a prepared negotiator. It forces Allstate to respond to a well-documented argument, not just an angry phone call. The historical challenges in dealing with the company are well-documented; the $10 million Allstate Diminished Value class action settlement highlights just how widespread these disputes over fair compensation have been.

Negotiating Effectively with the Allstate Adjuster

Once your demand letter and appraisal are submitted, the real negotiation begins. Allstate adjusters are trained professionals whose primary goal is protecting the company’s bottom line. The key is to be prepared for their common objections and delay tactics.

Remember, the adjuster works for Allstate, not for you. Their job is to settle claims for as little as possible. Your mission is to remain calm, be firm, and always steer the conversation back to the hard data in your certified appraisal.

It helps to know what you’re up against. In 2023, Allstate reported $5.64 billion in catastrophe losses, an 81% increase from the previous year. This financial pressure motivates them to scrutinize every payout, including diminished value claims. You can see more on how Allstate’s finances influence their claims process at TapTwiceDigital.com.

Countering Common Allstate Objections

When the adjuster calls, they will likely use a few common arguments to dismiss your claim or justify a low offer. Here’s how to handle their most frequent lines of pushback.

- Objection 1: “We don’t pay for diminished value in this state.”

- Your Response: “My understanding of [Your State]’s law is that a third-party claimant can recover all damages caused by your insured, including the inherent loss of my car’s market value. Could you point me to the specific statute you’re referencing?” This places the burden of proof back on them and shows you’ve researched your rights, which you can do on our state-specific law pages.

- Objection 2: “Your appraisal is just one person’s opinion.”

- Your Response: “This appraisal is a market analysis based on verifiable sales data for similar cars in my local area. It uses a certified methodology to calculate the loss. Can you provide the specific market data Allstate used to arrive at its number? I’d be happy to compare the facts.”

- Objection 3: “We already paid for quality repairs, so the car is whole again.”

- Your Response: “I appreciate the repairs were completed, but my vehicle now has a permanent accident history. That history must be disclosed to any future buyer, which legally and financially damages the car’s resale value. This is a separate loss from the physical repair cost.”

Pro Tip: Never argue or raise your voice. The best negotiators are calm, persistent, and stick to the facts. If a call isn’t productive, end it politely and follow up in writing. Try saying, “It seems we’re at an impasse. I’ll send a follow-up email summarizing our discussion.”

Document Everything and Stay Persistent

Documentation is your most powerful tool. After every phone call with the adjuster, send a brief email recapping the conversation. Note any offers made and the reasons provided for their position. This creates a paper trail that is invaluable if you need to escalate the claim.

Persistence is key. Adjusters often use delays, hoping you’ll get frustrated and accept a low offer. Don’t fall for it. If you haven’t heard back within a reasonable timeframe, like 5-7 business days, send a polite email or call to check in.

If you hit a wall and the adjuster refuses to negotiate in good faith, it’s time to escalate. Politely ask to speak with their direct supervisor. A manager typically has more authority to approve a higher settlement and may be more willing to find a compromise.

What to Do If Allstate Denies Your Claim

Receiving a denial from Allstate can be discouraging, but it’s often just their opening move in the negotiation process. Whether they’ve made a ridiculously low offer or an outright denial, this is not the end of the road.

The key is to understand the type of denial you’re facing. Allstate typically uses two tactics: the “soft denial” and the “hard denial.” Knowing the difference will help you push back effectively.

Understanding Soft vs. Hard Denials

A soft denial isn’t a formal rejection but an insultingly low offer. Allstate might offer a few hundred dollars for a claim worth thousands, hoping you’ll get discouraged and give up. Treat this as their opening offer, not their final one.

A hard denial is a flat-out refusal to pay anything. The adjuster will give a specific reason, such as claiming diminished value isn’t covered in your state. This tactic requires a more direct and forceful response.

Don’t let an initial denial discourage you. It’s a standard insurance strategy designed to filter out claimants who aren’t prepared to fight for what they’re owed. A well-documented case supported by a SnapClaim report completely changes the dynamic.

No matter which type of denial you receive, your first step is to challenge their decision in writing. Politely but firmly restate the facts of your claim, backed by your evidence and certified appraisal. This creates a paper trail and shows you will not be easily dismissed.

If you’re unsure why they rejected your claim, our guide on common reasons car insurance claims get denied can provide additional insight.

Escalating Your Claim to the Department of Insurance

If Allstate ignores your written response or refuses to negotiate, it’s time to involve the regulators. Your next move is to file a formal complaint with your state’s Department of Insurance (DOI). This is a powerful step that costs you nothing.

The DOI is the government agency that regulates insurance companies. When you file a complaint, Allstate is legally required to respond directly to the agency with a detailed explanation for their decision.

This accomplishes a few critical things:

- Forces Accountability: Allstate can’t ignore you anymore. They must officially justify their denial to a regulatory body.

- Adds Pressure: No insurer wants a long record of consumer complaints, which can trigger audits and fines.

- Levels the Playing Field: A complaint often gets your claim escalated to a senior adjuster or internal resolution team with more authority to settle.

Filing is usually a simple online process. Visit your state’s DOI website, find the consumer complaint form, and write a clear summary of your diminished value claim Allstate dispute. Be sure to attach all supporting documents, especially your demand letter and appraisal.

Exploring Your Legal Options

If a DOI complaint doesn’t break the stalemate, your final option is legal action. You generally have two paths: small claims court or hiring an attorney.

Small claims court is ideal for these types of disputes. It’s designed for individuals to resolve issues without needing expensive lawyers. Every state has a limit on how much you can sue for, typically between $5,000 to $15,000. If your diminished value claim is within that range, it’s a very effective way to get a binding decision from a judge. Your SnapClaim appraisal report will be your most important piece of evidence.

If your claim exceeds the small claims limit, hiring an attorney may be the best path. An attorney will handle all communications and file a formal lawsuit. The act of hiring legal counsel often signals to Allstate that you’re serious, which can be enough to bring them back to the negotiating table with a fair settlement offer.

FAQ: Your Allstate Diminished Value Claim Questions

Filing a diminished value claim with Allstate can be complex. Here are clear, straightforward answers to the most common questions we hear from vehicle owners.

Can I claim diminished value if the accident wasn’t my fault?

Yes, absolutely. A diminished value claim is a third-party claim, meaning you can only file it against the at-fault driver’s insurance company (in this case, Allstate). If you were the one at fault, your own insurance policy will cover repairs but not the loss in your vehicle’s resale value.

How long do I have to file a diminished value claim with Allstate?

The deadline is determined by your state’s statute of limitations for property damage, which can range from two to six years. However, it’s best to start your claim as soon as your vehicle repairs are complete. Waiting too long can make it harder to gather evidence and may give Allstate a reason to deny your claim. You can check the specific rules for your area on our state-specific law pages.

Does Allstate pay diminished value on leased vehicles?

In most cases, you cannot personally file a diminished value claim with Allstate on a leased car because you don’t legally own it—the leasing company does. However, your lease agreement likely holds you financially responsible for that lost value. Your best approach is to contact the leasing company and urge them to file the claim to cover the loss.

What if Allstate’s offer is still too low after negotiating?

If the adjuster won’t budge from a lowball offer, you still have options. First, politely ask to speak with a supervisor, who has more authority to approve a higher settlement. If that doesn’t work, file a complaint with your state’s Department of Insurance (DOI). Your final step is to take your case to small claims court, where your certified appraisal will serve as powerful evidence to support your claim for fair compensation.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This guide was reviewed and verified by SnapClaim’s auto appraisers, who specialize in diminished value and total loss disputes.

Our team continually updates every article to reflect current insurer guidelines, valuation standards, and court-accepted appraisal practices, ensuring that you’re relying on information trusted by professionals nationwide.

Get Started Today

Whether you’re challenging a low total loss settlement or proving your vehicle’s post-repair loss in value, SnapClaim makes it simple to take the next step.

Generate a free diminished value or total loss estimate in minutes and see how much compensation you may be owed.

Get your free estimate today or order a certified appraisal report to strengthen your insurance claim.

If your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee — guaranteed.