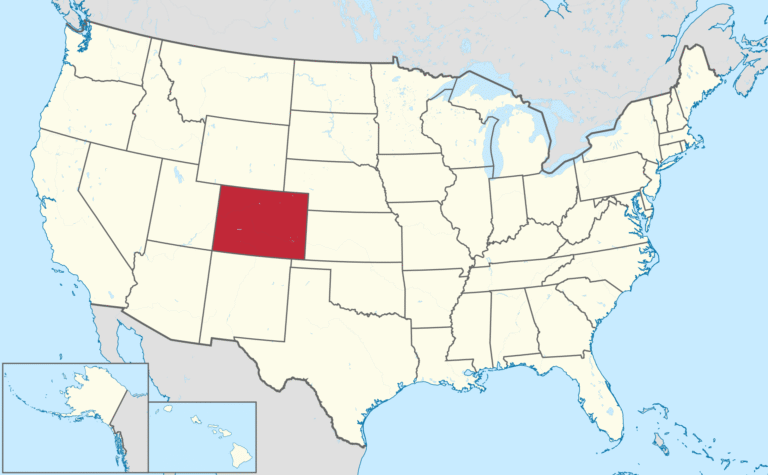

Diminished Value Appraisal in

Colorado

Get Your Free Estimate in a Minute!

Recover the lost value of your car after an accident with a certified Colorado diminished value appraisal. Our reports are fast, accurate, and court-ready—trusted by insurers and attorneys across Georgia.

No credit card required [Takes less than 30 second]

Filing a Diminished Value Claim in Colorado: What You Need to Know

Colorado Diminished Value Appraisal — Get the True Value of Your Car After an Accident

Even after quality repairs, your vehicle can lose resale value once its accident history appears on Carfax or AutoCheck. If your accident happened in Denver, Colorado Springs, Aurora, Fort Collins, or anywhere in Colorado, a Colorado diminished value appraisal helps document that loss — often worth $2,000–$7,000 depending on vehicle type and damage severity. SnapClaim delivers data-driven, court-ready appraisal reports used by Colorado insurers, attorneys, and small-claims courts.Why Diminished Value Matters in Colorado

Colorado recognizes recovery for the difference in fair market value before and after damage in third-party claims (see Trujillo v. Wilson; Larson v. Long). If you were not at fault, you can pursue compensation for that post-repair loss in value. First-party collision policies typically exclude DV unless the policy expressly covers it (see Lovell v. State Farm).Why Colorado Vehicle Owners Are Affected

- Front Range resale markets (Denver–Aurora–Lakewood, Colorado Springs, Fort Collins–Greeley, Boulder, etc.) are competitive; accident history materially impacts price.

- Higher prevalence of late-model SUVs, trucks, and EVs (Toyota, Subaru, Ford, Tesla, Lexus) increases typical DV percentages.

- Initial insurer offers may rely on simplified formulas that understate Colorado market realities.

What Your Colorado Diminished Value Appraisal Report Includes

- Vehicle details (year, make, model, trim, mileage, options)

- Comparable listings drawn from your local Colorado market (e.g., Denver, Colorado Springs, Aurora, Fort Collins, Boulder)

- Pre- and post-accident market value estimates using verified Colorado market data

- DV calculation incorporating repair severity and dealer feedback

- Transparent methodology aligned with appraisal best practices (USPAP-aware)

- Optional expert-witness support for court or arbitration

Colorado Areas We Serve

We provide DV and Total Loss appraisals statewide, including:- Denver

- Colorado Springs

- Aurora

- Fort Collins

- Lakewood

- Thornton

- Arvada

- Westminster

- Pueblo

- Greeley

- Centennial

- Boulder

- Longmont

- Loveland

- Broomfield

How to File a Diminished Value Claim in Colorado

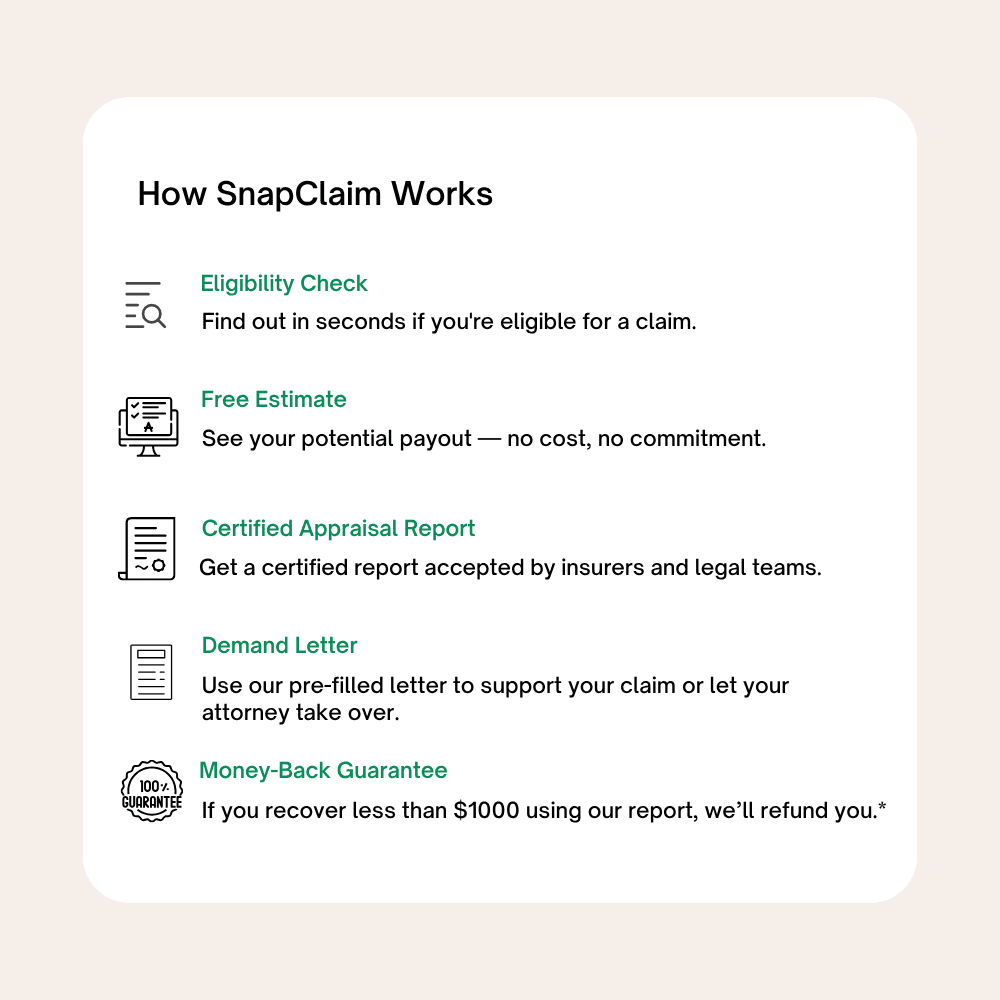

- Order your appraisal to document the loss with clear market evidence.

- Complete repairs (DV is measured after repairs).

- Submit a DV demand letter to the at-fault driver’s insurer (cite Trujillo and Larson).

- Negotiate or escalate — our reports are formatted for attorney and arbitration review.

- Recover compensation — many Colorado clients recover several thousand dollars with proper documentation.

Local Insight: Common Colorado Insurance Practices

Insurers such as State Farm, Allstate, GEICO, and Progressive may reference simplified formulas that don’t reflect Colorado’s metro resale values. SnapClaim counters with:- Real-world listings from Colorado sources (AutoTrader, CarGurus, Cars.com) filtered to your city/ZIP radius

- Dealer quotes within ~50 miles of your market

- Localized adjustments for mileage, color, options, and trim demand

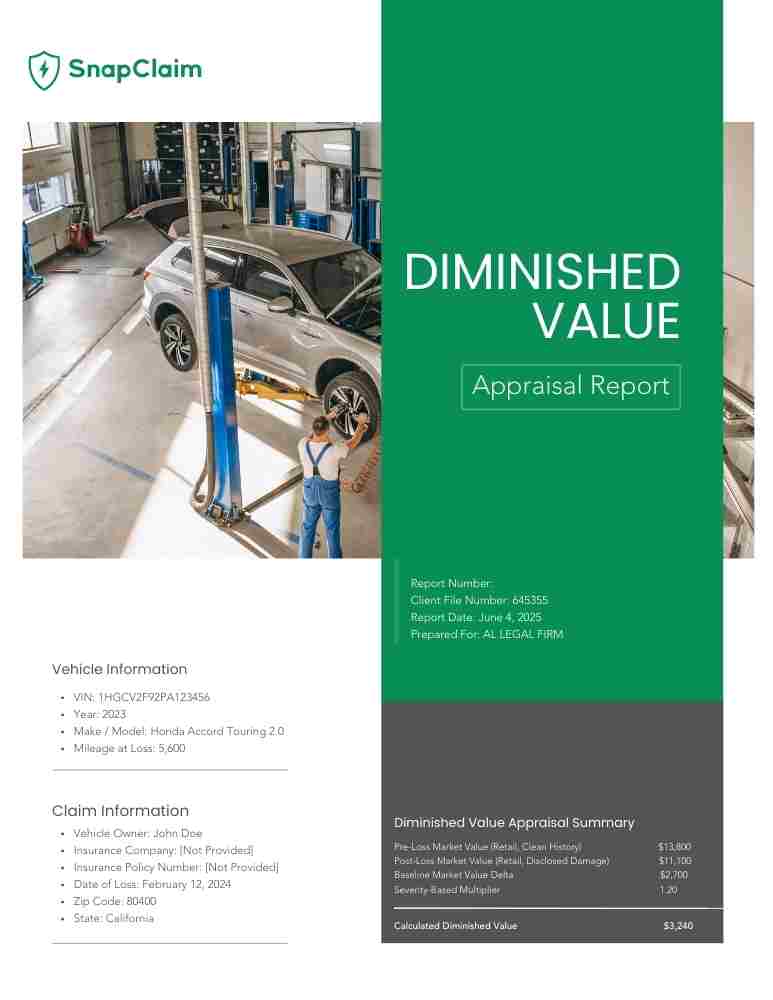

Example Colorado Case Study

Vehicle: 2021 Toyota RAV4 Limited Repair Cost: $7,900 (rear-end) Initial Insurer Offer: $1,100 (formula method) SnapClaim DV Result: $5,150 Final Settlement: $4,900 after submitting our report and demand letterHelpful Colorado Resources

- C.R.S. §13-80-101 — 3-year statute of limitations for motor-vehicle property damage

- C.R.S. §13-21-111 — modified comparative negligence (barred at ≥50% fault)

- Colorado Small Claims Court — jurisdiction up to $7,500

- Colorado Division of Insurance — File a Complaint

- CDOT Crash Data & Reports

Ready to Get Your Colorado Diminished Value Appraisal?

Start now — fast turnaround, clear evidence, and strong market comparables tailored to your Colorado city.- No credit card required

- Delivery in about 1 hour

- Includes appraisal and demand-letter template

Related Colorado Locations

Click a pin to open the city’s diminished value page.

Find your Colorado city below to order your Diminished Value Appraisal.

Order Your Diminished Value Appraisal

Get Your Appraisal Report and Demand Letter Now!

Free Estimate, no credit card required.

Recover Diminished Value After an Accident in Colorado

If your car was damaged in a Colorado crash, it may have lost market value even after repairs. That loss is called diminished value, and under Colorado law you may be entitled to recover it from the at-fault driver’s insurance. SnapClaim makes the process simple: get a free diminished value estimate, a certified Colorado appraisal report, and a ready-to-send demand letter — all within minutes. No guesswork. No delays.

"After my accident in Denver, I didn’t realize how much value my car had lost. SnapClaim gave me everything I needed — a certified Colorado diminished value report and demand letter — in less than an hour. I got my claim paid quickly."

Jasmine R.

Atlanta, GA

Frequently Asked Questions:

- Does Colorado allow diminished value claims?

Yes — in third-party claims (you were not at fault). Colorado case law recognizes recovery for the difference in fair market value before and after the crash. See our overview: Colorado Diminished Value Guide.

- Can I claim diminished value if I caused the accident?

Typically no. First-party collision policies in Colorado usually exclude DV unless your policy explicitly covers it. Most successful DV claims are third-party against the at-fault driver’s insurer. Learn more in the Colorado DV overview.

- How long do I have to file a Colorado diminished value claim?

The statute of limitations for motor-vehicle property damage is generally 3 years from the crash date. Don’t wait—insurers negotiate more readily when documentation is prepared early. See timelines in Colorado DV timelines.

- Do I need to know about how to code?

Yes, you need to have a fair amount of knowledge in dealing with HTML/CSS as well as JavaScript in order to be able to use Lexend.

- Do I need to finish repairs before getting a DV appraisal?

Yes. DV is measured after repairs. Once repairs are complete, order a report and submit your demand. Start here: Order a Diminished Value Appraisal.

- What documents should I collect for a Colorado diminished value claim?

Repair estimate(s) and final invoice, parts list (OEM vs aftermarket), crash report, photos (pre-loss if available), VIN/odometer, and your title/history report. You can upload everything in your dashboard when ordering: Get My Appraisal.

- How much does a SnapClaim diminished value appraisal cost in Colorado?

Legal-partner pricing starts around our published rates, with discounts for law firms and repeat users. See current options on Pricing. Every report includes a demand-letter template.

- How fast can I get my Colorado DV report?

Most reports are delivered in about 1 hour after we receive your documents. If something’s missing, we’ll flag it so you can upload it quickly. Start your order: Begin in Minutes.

- Will insurance companies accept a SnapClaim appraisal in Colorado?

Our reports are data-driven, with local Colorado comparables and transparent adjustments. They’re designed for insurer review and small-claims court if needed. See example structure on our Colorado DV page and view a sample during checkout.

- What if the insurer offers a low amount using a simple formula?

Counter with a market-based appraisal that uses real Colorado comps (Denver, Colorado Springs, Fort Collins, Boulder, etc.). Our report and included demand letter help you negotiate effectively. Learn how we calculate DV: Colorado DV Overview.

- What are my options if negotiations stall?

You can file a complaint with the Colorado Division of Insurance, pursue small claims (up to $7,500), or escalate further. We can provide expert support if needed. Read next steps on Colorado DV or start with a city page like Denver or Colorado Springs.

- Is there a money-back guarantee?

Yes. If you’re unable to recover at least $1,000 on a DV claim after using our report (and meeting policy terms), you’re covered by our Money-Back Guarantee.

- Do you cover total loss (Fair Market Value) appraisals too?

Yes. If your vehicle was declared a total loss, request a Fair Market Value Appraisal. We also maintain a national guide to laws by state: Diminished Value State Laws.

Diminished Value & Total Loss Appraisal Reports

Instant Free Estimate

Instant diminished value and total loss appraisals — no guesswork, no delays, backed by a 100% money-back guarantee.

Free Estimate, no credit card required.