Getting into a car accident is stressful enough without having to worry about the insurance claim. While your focus is on getting your car fixed, the insurance company has a different priority: settling your claim for as little as possible. This is why a professional car appraisal after an accident is your most powerful tool for getting the fair compensation you’re truly owed.

An independent car appraisal provides an unbiased, evidence-based valuation of your vehicle. Unlike the insurance adjuster who works for the company paying the claim, an independent appraiser works for you. Their job is to calculate the real financial damage the accident caused, giving you the solid proof needed to strengthen your claim and support your negotiations.

The Two Financial Losses Insurers Don’t Talk About

The damage from a collision goes deeper than bent metal. The moment your car gets an accident on its record, its resale value drops—and it never fully recovers, no matter how perfect the repairs are.

A certified car appraisal is designed to pinpoint two key parts of your financial loss:

- Fair Market Value (FMV): This is what your car was worth moments before the crash. Insurers often use automated software that produces low values, especially for well-maintained cars or those with custom upgrades. A real car appraisal analyzes actual market data to find its true worth.

- Diminished Value (DV): This is the cash value your car loses just for having an accident history. A vehicle can lose 10% to 30% of its value after a significant collision. Insurers rarely offer to pay for this unless you provide proof of the loss.

An independent car appraisal isn’t just an opinion; it’s documented, verifiable proof. It’s the evidence you need to back up your claim and negotiate for the full cost of repairs and the permanent loss in your car’s value.

Without that proof, you’re often stuck accepting the insurance company’s initial offer. At SnapClaim, we create certified reports built to withstand scrutiny from adjusters, giving you a much stronger negotiating position. We’re so confident in our reports that we back them with a money-back guarantee. If the insurance recovery from the claim is less than $1,000, the car appraisal fee is fully refunded, making it a risk-free way to fight for a fair settlement.

Understanding Diminished Value and Fair Market Value

After an accident, you’ll hear two terms that insurance companies count on you not fully understanding: Fair Market Value (FMV) and Diminished Value (DV). Grasping what these mean is the first step toward getting the money you are actually owed. They are the core of a proper car appraisal after an accident.

Think of it this way: a mint-condition, first-edition book has a certain value. If someone damages the cover and a professional expertly repairs it, the book might look nearly perfect, but it will never sell for its original, undamaged price again. The same principle applies to your car.

What Is Fair Market Value?

Fair Market Value (FMV) is simply what your car was worth the moment before the crash happened. It’s the price a willing buyer would have paid for your vehicle in its pre-accident condition.

This isn’t just a number from a generic online estimator. A true FMV considers your car’s specific age, mileage, overall condition, and any special features, then compares it to recent sales of similar cars in your local market. Insurance adjusters often use automated systems that generate lowball numbers, conveniently ignoring how well you maintained the car or the new tires you just bought. An independent appraiser does the real work, digging into market data to establish the actual FMV, which serves as the baseline for your claim.

The Real Cost of Diminished Value

Diminished Value (DV) is one of the most overlooked parts of an auto insurance claim. It’s the permanent, measurable drop in your car’s resale value simply because it now has an accident on its record.

Even with flawless repairs using original factory parts, the car is now worth less. Why? Because a savvy buyer will almost always choose an identical car with a clean history over one that’s been in a wreck—or they will demand a significant discount.

This loss is real, and in most states, you are legally entitled to be compensated for it if the other driver was at fault. You can learn more about the specific rules in your area on our state law pages.

A vehicle can easily lose 10% to 30% of its value after a collision, even with perfect repairs. On a $30,000 car, that’s a $3,000 to $9,000 loss the insurance company has no intention of telling you about.

The Three Types of Diminished Value

To build a strong claim, it helps to know the different ways your car loses value. An expert car appraisal after an accident breaks it down to ensure no money is left on the table.

- Immediate Diminished Value: This is the loss in value right after the crash but before any repairs have been made.

- Inherent Diminished Value: This is the most common and important type. It’s the automatic loss in value that sticks to your car forever simply because it has a documented accident history, even if the repairs are perfect.

- Repair-Related Diminished Value: This occurs when the body shop uses cheap aftermarket parts, fails to match the paint correctly, or does a sloppy job, causing your car to lose even more value.

Insurance companies are known for denying inherent diminished value claims, often arguing, “The car is fixed, so there’s no problem.” This is exactly where a professional, independent car appraisal from a service like SnapClaim becomes essential. It provides the hard evidence and market data to prove your financial loss. You can also find trusted consumer resources on vehicle safety and repair standards from government agencies to better understand what a quality repair involves.

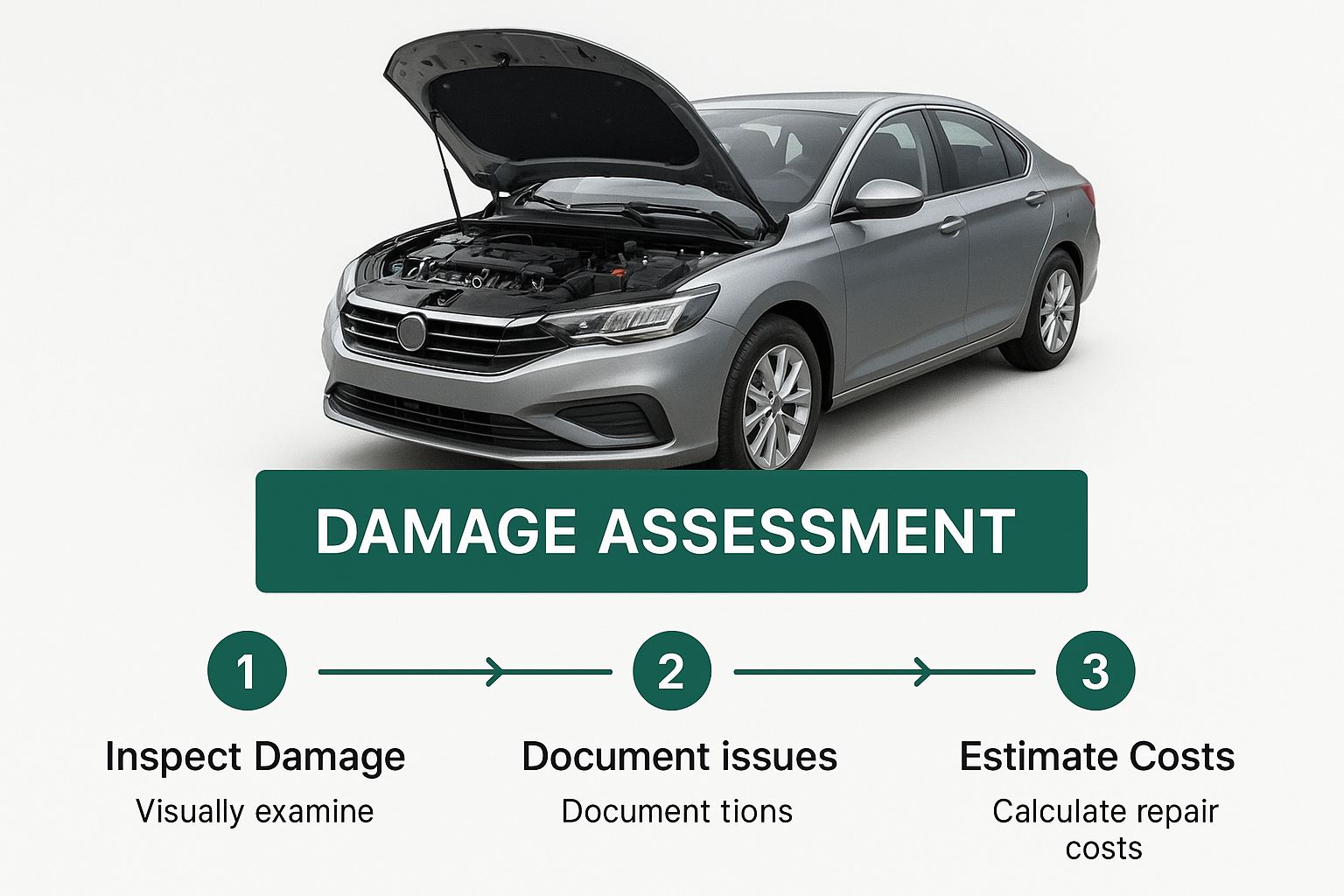

Your Step-by-Step Post-Accident car Appraisal Process

Feeling overwhelmed after an accident is normal, but knowing what to do next can make all the difference. While the claims process might seem complicated, it’s a series of straightforward steps. This guide will walk you through the process, from the crash scene to submitting your evidence for a fair settlement.

Think of this as building a solid case for your vehicle’s true value. Each step adds another layer of proof, strengthening your position when you negotiate with the insurance adjuster.

Step 1: Document Everything and Notify Your Insurer

Immediately after a collision, your first priority is safety. Once everyone is safe, the documentation process begins.

- Use your phone: Take extensive photos and videos of the accident scene, the damage to all vehicles from every angle, and any relevant road conditions.

- Exchange information: Get the other driver’s contact and insurance details.

- Get a police report: Make sure you get a copy of the official police report, as it’s a crucial piece of initial evidence.

- Notify your insurer: Call your insurance company as soon as possible to start the claims process.

Step 2: Receive the Insurer’s Initial Offer

After you file your claim, the insurance company’s adjuster will inspect your car. Shortly after, they’ll present you with an initial settlement offer. This will either be for the cost of repairs or, if the damage is severe, an amount for the vehicle’s “Actual Cash Value” if they declare it a total loss.

It’s critical to remember that this first offer is just that—an offer. It is almost always calculated to benefit the insurance company, not you. Do not accept it without doing your own research.

Step 3: Order an Independent Car Appraisal After an Accident

This is where you take back control. Ordering an independent car appraisal after an accident gives you an unbiased, evidence-based valuation of both your vehicle’s true pre-accident Fair Market Value and its Diminished Value. Unlike the insurer’s adjuster, an independent appraiser works for you. At SnapClaim, our experts analyze real-time market data, your vehicle’s specific condition, and local comparables to produce a comprehensive valuation that becomes your most powerful piece of evidence.

Step 4: Submit Your Professional Report

Once you have your certified appraisal report, you will formally submit it to the insurance adjuster handling your claim. This document isn’t just an opinion; it’s a detailed analysis that systematically breaks down why your vehicle is worth more than their offer. It lays out a clear, logical argument for a higher payout, backed by verifiable market data. This single action shifts the negotiation from their lowball number to your evidence-based valuation.

A professional appraisal report transforms your claim from a simple request into a formal demand supported by expert analysis. It signals to the insurer that you are serious about receiving fair compensation.

Step 5: Negotiate a Fair Settlement

Now you’re ready to negotiate from a position of strength. With your appraisal report as leverage, you have the facts you need to counter the adjuster’s low offer. If they push back, you can point directly to the market data and comparable sales listed in the report. This evidence-based approach makes it much harder for them to justify their initial figure. We’re so confident in the power of our reports that we offer a money-back guarantee: if our appraisal doesn’t help you get at least $1,000 more on your claim, we’ll refund our fee in full.

What to Do When Your Car Is Declared a Total Loss

Hearing an insurance adjuster say your car is a “total loss” can feel final, but it’s not. It’s the opening of a negotiation, and you don’t have to accept their first offer. A fair payout starts with understanding how they reached that decision.

An insurer declares a car a total loss when the estimated cost of repairs plus its salvage value is more than its Actual Cash Value (ACV)—what your car was worth moments before the accident. The problem is, their ACV often comes from generic valuation software that undervalues well-kept vehicles, leaving you with a low offer that won’t cover a truly comparable replacement car.

How Insurers Calculate a Total Loss

Every state has a “total loss threshold,” which is a set percentage. For example, in a state with a 75% threshold, a car worth $20,000 would be declared a total loss if repair estimates reached $15,000.

But that entire calculation hinges on one thing: the initial ACV. If the insurance company undervalues your car at $18,000 instead of its true $20,000, their settlement offer is instantly thousands of dollars short. This is where an independent car appraisal after an accident becomes your most powerful tool.

Challenging a Lowball Total Loss Offer

You have the right to challenge the insurer’s valuation, but you need evidence. An independent appraisal delivers a detailed, market-based valuation report grounded in recent sales of similar vehicles in your local area. It accounts for your car’s specific condition, mileage, and recent upgrades—details the insurer’s software often overlooks. This report is the concrete proof you need to dispute their low offer and present a true, defensible ACV.

An insurer’s total loss offer is just that—an offer. A certified appraisal from SnapClaim gives you the ammunition to turn their initial offer into a fair negotiation, ensuring you get the funds to buy a genuinely similar replacement car.

Broader industry data from sources like the National Highway Traffic Safety Administration (NHTSA) provides essential context for understanding how insurance companies approach claims. For example, the NHTSA projects a decrease in traffic fatalities for early 2025, which reflects ongoing vehicle safety improvements. Learn more about these traffic safety trends and their implications from the NHTSA. This kind of data influences how insurers evaluate risk and value vehicles.

Your Next Steps After a Total Loss Declaration

If you’ve received a total loss offer that seems too low, don’t sign anything. Here’s what to do instead:

- Request the Insurer’s Valuation Report: Ask the adjuster for a copy of the report they used to calculate your car’s ACV.

- Scrutinize Their Comparables: Review the “comparable” vehicles they used. Are they truly similar to your car in trim, mileage, and condition?

- Order Your Independent Appraisal: A certified appraisal from a service like SnapClaim gives you an accurate, market-based valuation to counter their low offer.

- Submit Your Evidence and Negotiate: Send your appraisal report to the insurance company as clear evidence supporting a higher, fairer settlement.

Remember, SnapClaim’s money-back guarantee ensures this is a risk-free step. If our appraisal doesn’t help you recover at least $1,000 more, we’ll refund our fee.

How to Use Your Appraisal to Maximize Your Claim

A certified appraisal report is the leverage you need to turn an insurer’s low offer into a real negotiation. But simply having the report isn’t enough; knowing how to use it is key to getting the money you’re owed. Your appraisal brings an independent, market-based expert to your side of the table.

Presenting Your Case to the Adjuster

Once the report is in your hands, it’s time to communicate with the insurer professionally and firmly.

- Draft a demand letter: Write a clear, concise document that includes your claim number, officially rejects their initial offer, and attaches your independent appraisal as evidence of your vehicle’s true value and diminished value.

- Walk the adjuster through the report: On the phone, point to the specific comparable vehicles and market data that back up your valuation.

- Stay data-driven: A logical, evidence-based approach is much harder for an adjuster to dismiss than an emotional appeal.

Handling Pushback and Common Tactics

Insurance adjusters are trained negotiators. Expect to hear arguments like your appraisal is just an “opinion” or that their software is the “industry standard.”

Politely counter these talking points by referencing the specific market analysis in your appraisal. For example, you can say, “My report identifies three similar vehicles that recently sold locally for this price. Can you show me the data your system used to arrive at a different number?” This simple question shifts the burden of proof back to them.

An independent car appraisal after an accident changes the conversation from “what the insurer wants to pay” to “what the evidence proves you are owed.” It provides an objective, data-backed foundation for your claim.

Understanding the Appraisal Clause in Your Policy

If the adjuster still refuses to negotiate in good faith, you have another powerful tool: the appraisal clause. Most auto insurance policies include one, and it acts as a built-in dispute resolution process.

Here’s how it works:

- Invoke the Clause: You formally notify the insurer in writing that you are invoking the appraisal clause.

- Each Side Hires an Appraiser: You use your independent appraiser, and the insurance company hires theirs.

- An Umpire Is Chosen: The two appraisers agree on a neutral third-party appraiser to act as an “umpire.”

- A Binding Decision Is Made: If the two appraisers can’t agree on a value, they each present their case to the umpire. A decision agreed upon by any two of the three becomes legally binding.

This process is critical because an accident has long-term financial consequences. On average, a U.S. car insurance premium jumps by roughly 42% after a collision. Maximizing your initial claim is essential to help offset these future costs. You can explore more data on post-accident insurance rate hikes to see how they vary.

A Risk-Free Way to Fight for More

We understand that taking on an insurance company can feel intimidating. That’s why SnapClaim offers a money-back guarantee: if our certified appraisal report doesn’t help you recover at least $1,000 more than the insurer’s initial offer, we will fully refund our fee. This makes ordering an appraisal a completely risk-free decision, giving you the confidence to fight for every dollar you deserve.

Frequently Asked Questions (FAQ)

Here are answers to some of the most common questions vehicle owners have about getting a car appraisal after an accident.

How much value does a car lose after an accident?

The amount of value a car loses depends on the severity of the damage, the vehicle’s age, and its make and model. As a general rule, a vehicle can lose anywhere from 10% to 30% of its pre-accident value. For a car worth $30,000, that could mean a loss of $3,000 to $9,000. This permanent drop is known as inherent diminished value, which a professional appraisal is designed to calculate.

Should I get my own appraisal or use the insurer’s?

You should always get your own independent appraisal. The insurance company’s adjuster works for them, and their goal is to minimize the company’s payout. An independent appraiser from a service like SnapClaim works for you. Our only objective is to determine the true, market-based value of your vehicle with no conflict of interest, providing you with an unbiased report to support your claim.

Can I claim diminished value if I was at fault?

In most cases, diminished value claims are filed against the at-fault driver’s insurance company. If you were at fault, your own collision coverage typically only pays for the cost of repairs, not for the loss in your vehicle’s resale value. However, policies and state laws vary, so it’s always a good idea to review your policy and consult our state law guides to understand the rules where you live.

How do I prove my diminished value claim?

You can’t just tell the insurance company your car is worth less—you have to prove it with documented evidence. A certified appraisal report from SnapClaim provides the proof you need. It includes a detailed breakdown of your vehicle’s pre-accident condition, real market data from recent local sales of similar cars, and a clear, professional calculation of the financial loss. This transforms your claim from an opinion into a fact-based demand.

Don’t let an insurance company dictate what your car is worth. Take control of your claim with the evidence you need to get a fair settlement. SnapClaim delivers certified reports that help you negotiate effectively and recover the compensation you are rightfully owed. Get your free estimate today or order your certified appraisal now!