Diminished Value Appraisal in

West Virginia

Get fast, accurate, and court-ready Diminished Value and Fair Market Value reports.

No guesswork, No delays. Trusted by insurers and legal professionals.

No credit card required.

Recover What Insurance Owes You After an Accident

SnapClaim makes it easy to recover your car’s lost value after an accident. We provide a free estimate, a fully certified appraisal report, and a ready-to-send demand letter — all within minutes. No guesswork, no waiting.

“I had no idea my car had lost that much value after the crash. SnapClaim gave me everything I needed to file the diminished value claim — I got the report in less than an hour.”

Mark

Vehicle Owner, Colorado

Filing A Diminished Value Claim In West Virginia

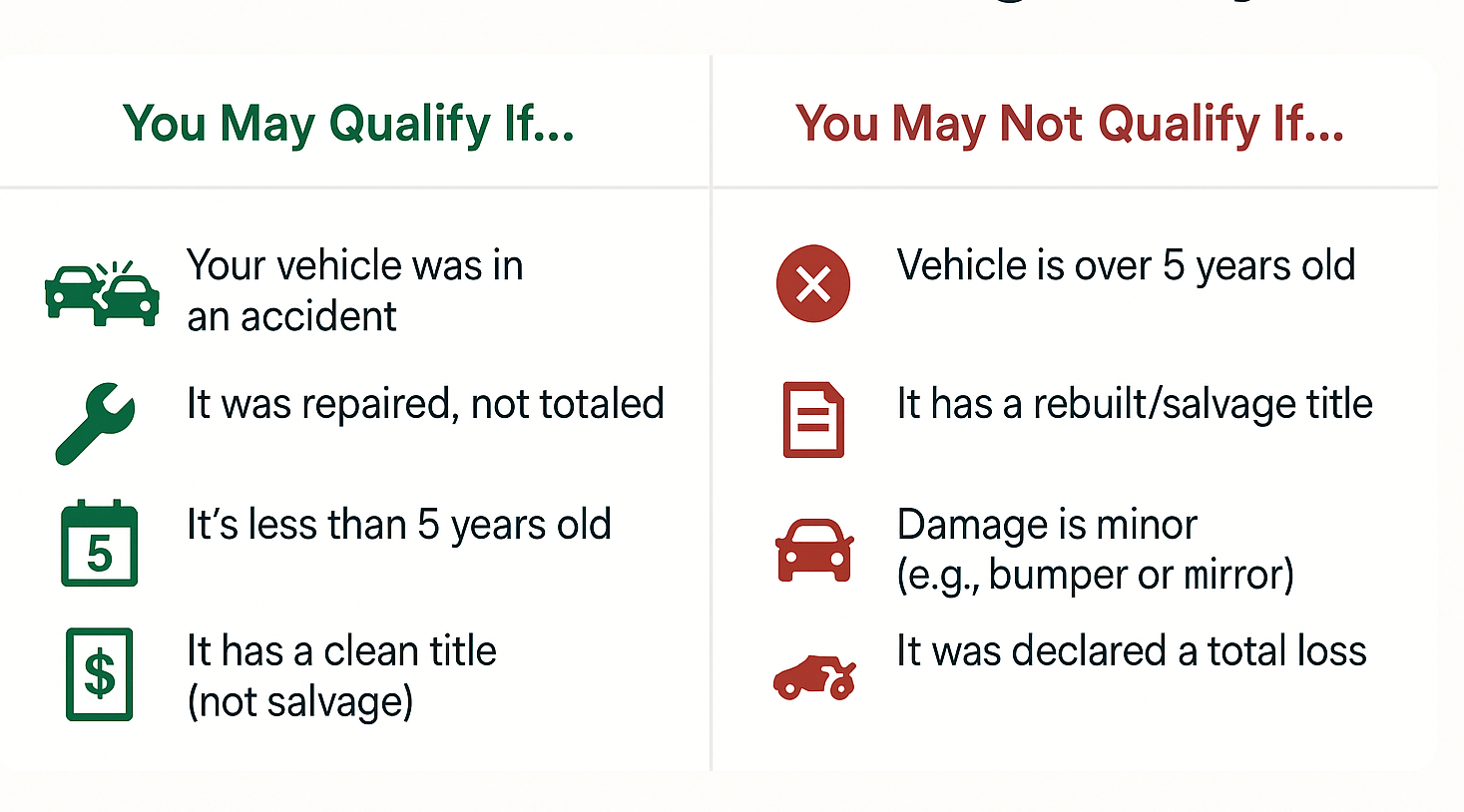

If your vehicle was damaged in an accident in the state of West Virginia and underwent repairs, its resale value is likely to be less than what it was before the crash. This loss in market value is known as diminished value, and it is recoverable in West Virginia through a diminished value claim filed with the at-fault party’s insurance company. If the other driver was uninsured, you can also file a diminished value claim with your own insurance company.

West Virginia diminished value law

The Supreme Court of Appeals of West Virginia recognized in Ellis v. King, 400 S.E.2d 235 (1990), that damages are not limited to the cost of repairs actually made when it is shown that the repairs did not restore the vehicle to its pre-accident condition and a greater expense would have been required to do so. In such cases, the proper measure of damages includes both the cost of repairs and the diminution in value of the property. Id. at § 436.

If the damaged vehicle, even after repair, cannot be returned to its prior condition, the court held that damages for diminished value are recoverable. However, not all damage qualifies—plaintiffs must prove an actual reduction in value following repair, and the damage must be structural, integral to the vehicle’s framework.

For example, if a sideswipe requires replacement of a right front panel, diminished value recovery would typically not be permitted. But if the frame is damaged in a way that affects future usability of the vehicle, then diminished value is recoverable. The court also noted that only vehicles with significant pre-accident value qualify—old or poorly maintained vehicles with minimal value are not eligible for diminished value recovery.

Ellis v. King, 400 S.E.2d 235 (1990)

Supreme Court of Appeals of West Virginia

Filed: 1990

Precedential status: Precedential

Citations: 400 S.E.2d 235

How to file a diminished value claim in West Virginia

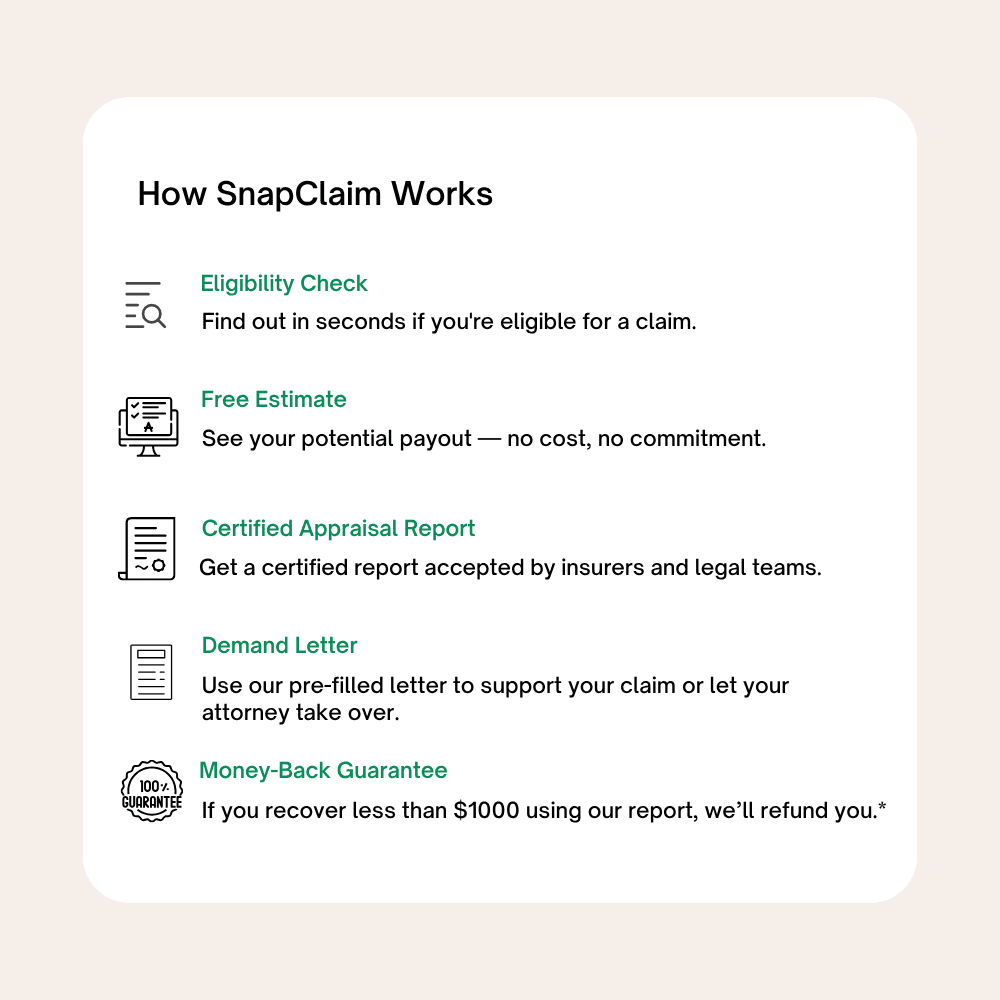

Step 1. Get a free estimate. Start by checking if your vehicle qualifies for a diminished value claim. SnapClaim provides a fast, no-cost estimate to help you understand your potential recovery.

Step 2. Order your certified appraisal report. If eligible, SnapClaim will generate a professional, independent diminished value appraisal—often in minutes. This report is formatted for insurance use and backed by industry data.

Step 3. Submit your claim. Along with your appraisal, SnapClaim provides a pre-filled demand letter to send to the at-fault driver’s insurance company. This makes it easy to start the claims process without a lawyer.

Step 4. Settle your claim. Most insurers will respond with a settlement offer. You can choose to accept, negotiate, or escalate the claim. If needed, SnapClaim can help you provide documentation to support further action.

SnapClaim is designed to help you recover fair compensation with less stress, faster turnaround, and no upfront legal fees.

Money-back guarantee: If your final insurance recovery is under $1,000, SnapClaim will refund 100% of your appraisal fee. We only succeed when you do.

West Virginia diminished value law

Statute of Limitations: 2 years

Third Party Diminished Value Claim: Yes

First Party Diminished Value Claim: No

Most insurance policies will exclude diminished value.

West Virginia Property Damage Minimum Limits: $25,000 in coverage

Uninsured Motorist Coverage for Diminished Value: Yes, it is required with a minimum of $25,000 in coverage. It includes coverage for hit and run drivers with physical contact between the vehicles.

Underinsured Motorist Coverage for Diminished Value: Yes, it is an optional coverage

West Virginia Small Claims Court Limit: $10,000

attorney representation and appeals are permitted

See what ourclientsare sharing about us!

“I didn’t know about diminished value until I found SnapClaim. Their report was done in minutes, and the support team explained everything clearly. I used the letter they provided and ended up with an extra $3,200. Super easy.”

“SnapClaim helped me file a diminished value claim after repairs. The process was smooth, fast, and I received more money than expected. Their team handled everything so I could focus on getting my car and life back to normal.”

“I uploaded my repair estimate and got a professional report the same day. SnapClaim made everything so simple. Their platform saved me hours of back-and-forth with insurance and got me a solid payout”

“After my car was totaled, SnapClaim gave me a fair market value report that clearly beat the insurance offer. I submitted it with my claim and they increased the payout. The process was fast, fair, and worth every penny."

“SnapClaim made a huge difference for me. I had no clue how to value my vehicle post-accident. Their diminished value report was detailed, with comps and expert review. I sent it in and got a great settlement in less than a week. Truly amazing.”

“SnapClaim is a game-changer. I used their fair market value report after a total loss, and it helped me negotiate a much better offer. The design, speed, and clarity of the report made a real difference with my adjuster..”

Frequently asked questions:

-

What is a Diminished Value (DV) claim?

Diminished Value is the loss in market value a vehicle suffers after an accident, even after repairs. If your car has been in an accident caused by someone else, you may be entitled to compensation for this loss.

-

What is a Fair Market Value (FMV) report?

A Fair Market Value report estimates your vehicle’s current value based on verified market data. It’s commonly used for insurance negotiations, resale, legal cases, and total loss disputes.

-

What do I need to get started?

You’ll need your VIN number, mileage, repair document (if applicable), and your contact information. We’ll guide you step by step through the process.

-

What is your refund policy?

If you recover less than $1000 from your claim using our report, we offer a full refund of the report cost—no questions asked. Terms and conditions apply.

Latest articles

What Is Diminished Value? A Guide

- •

-

22/07/2025

What to Do If Your Vehicle

- •

-

16/07/2025

Certified appraisal report in minutes.

Let us help you recover the true value of your car

Free Estimate, no credit card required.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.