Diminished Value Appraisal in

Texas

Get fast, accurate, and court-ready Diminished Value and Fair Market Value reports.

No guesswork, No delays. Trusted by insurers and legal professionals.

No credit card required.

Recover What Insurance Owes You After an Accident

SnapClaim makes it easy to recover your car’s lost value after an accident. We provide a free estimate, a fully certified appraisal report, and a ready-to-send demand letter — all within minutes. No guesswork, no waiting.

“I had no idea my car had lost that much value after the crash. SnapClaim gave me everything I needed to file the diminished value claim — I got the report in less than an hour.”

Mark

Vehicle Owner, Colorado

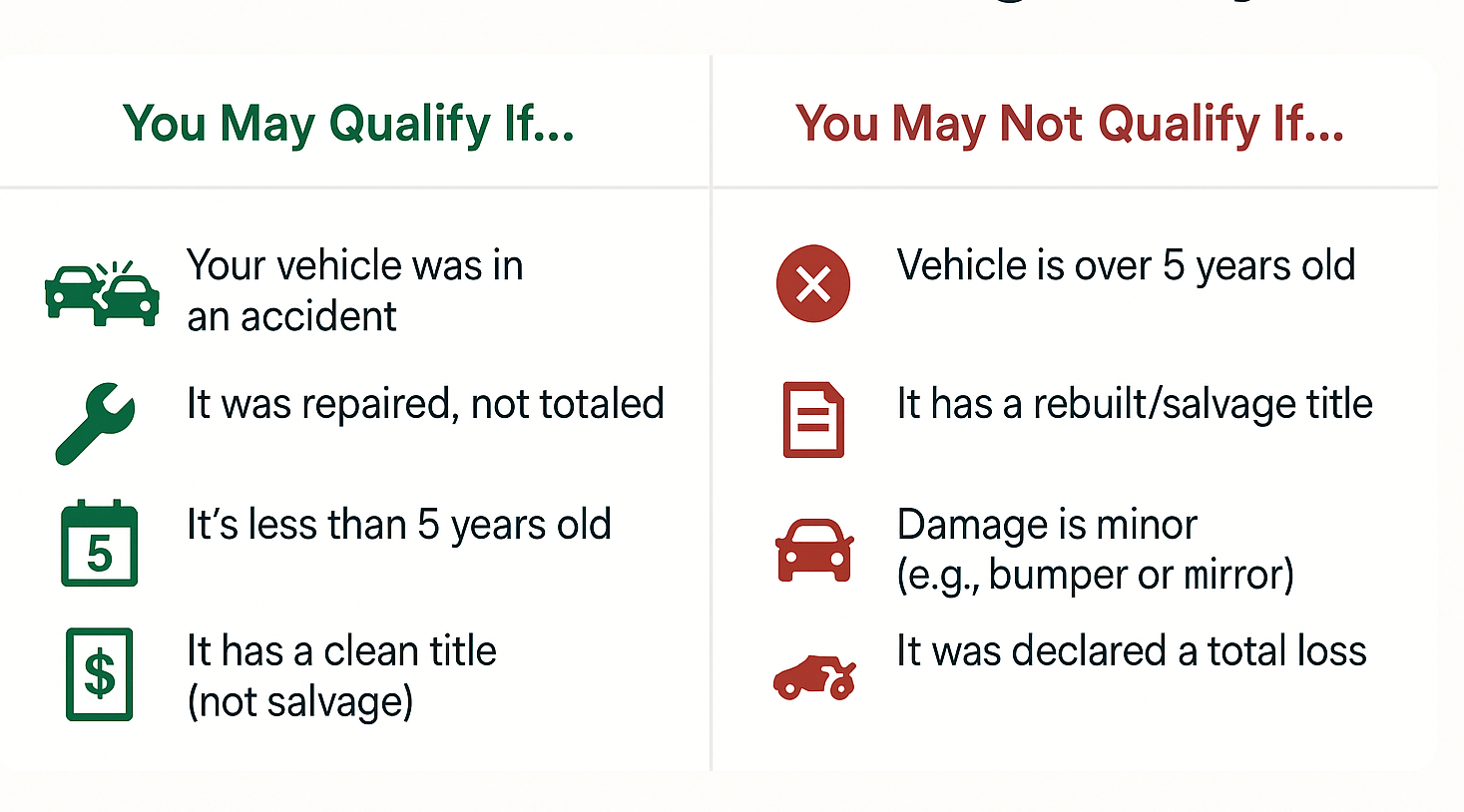

Filing A Diminished Value Claim In Texas

Diminished value claims in Texas are recoverable for third-party claimants who are not at-fault for the accident. A previously damaged vehicle is less valuable compared to a similar vehicle with a clean history. This loss in market value is known as diminished value, and it is recoverable in Texas through a diminished value claim. If the other driver was uninsured, you can also file a diminished value claim with your own insurance company.

Texas diminished value law

The general rule for damages to personal property in Texas is that a plaintiff is entitled to recover the difference between the vehicle’s reasonable market value immediately before and immediately after the damage occurred. This principle was upheld in Central Freight Lines, Inc. v. Naztec, Inc., 790 S.W.2d 733, 734 (Tex. App.—El Paso 1990, no writ).

Central Freight Lines, Inc. v. Naztec, Inc., 790 S.W.2d 733 (Tex. App.—El Paso 1990)

Texas Court of Appeals

Filed: 1990

Precedential status: Precedential

Citations: 790 S.W.2d 733

Market value is defined as the price the property would bring if offered for sale by a willing but not obligated seller and purchased by a willing but not obligated buyer, as established in Exxon Corp. v. Middleton, 613 S.W.2d 240, 246 (Tex. 1981).

According to Texas Standard Pattern Jury Instructions, when repairs do not fully restore a vehicle’s original value, the plaintiff may recover the difference between its pre-accident value and post-repair value. This reflects Texas law’s recognition of diminished value as a valid component of property damage.

While first-party diminished value claims are typically excluded under the standard Texas personal auto insurance policy, the Texas Department of Insurance clarified in Commissioner’s Bulletin # B-0027-00 that insurers may still be liable in certain cases. Specifically, an insurer may be obligated to pay a third-party claimant for diminished value, even if repairs are complete, and may also be responsible for diminished value under first-party UM/UIM coverage.

Commissioner’s Bulletin # B-0027-00

Texas Department of Insurance

Issued: 2000

Key Point: Insurers may be required to pay diminished value under third-party liability or UM/UIM claims regardless of repair completeness

Texas law also requires sellers to disclose any known accident history when selling a vehicle. Once disclosed, the accident history often leads to reduced resale value, reinforcing the economic impact of diminished value even after repairs.

Texas minimum property damage liability coverage is $25,000. If the cost of repairs, rental, and diminished value exceeds the at-fault driver’s coverage limit, claimants can pursue compensation through their own Uninsured/Underinsured Motorist (UM/UIM) Property Damage coverage. This coverage helps recover expenses and diminished value caused by uninsured drivers, underinsured drivers, or hit-and-run accidents.

How to file a diminished value claim in Texas

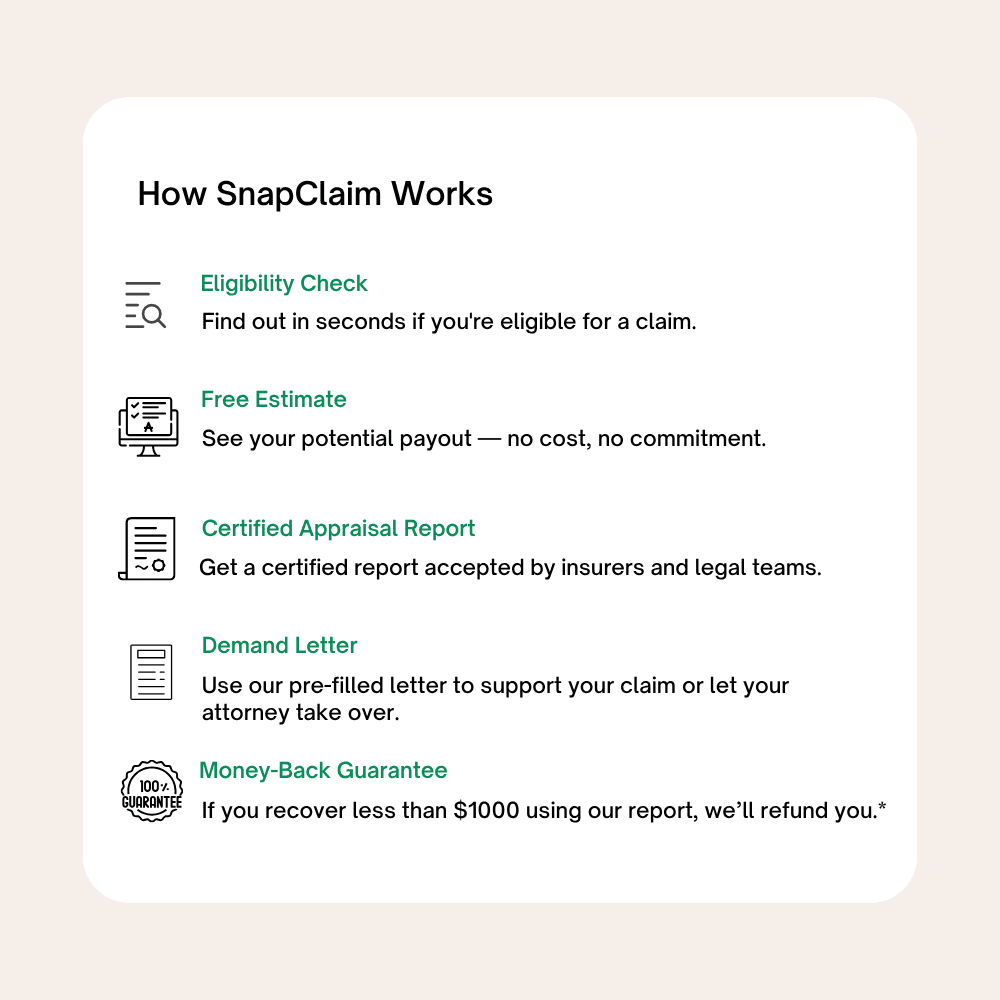

Step 1. Get a free estimate. Start by checking if your vehicle qualifies for a diminished value claim. SnapClaim provides a fast, no-cost estimate to help you understand your potential recovery.

Step 2. Order your certified appraisal report. If eligible, SnapClaim will generate a professional, independent diminished value appraisal—often in minutes. This report is formatted for insurance use and backed by industry data.

Step 3. Submit your claim. Along with your appraisal, SnapClaim provides a pre-filled demand letter to send to the at-fault driver’s insurance company. This makes it easy to start the claims process without a lawyer.

Step 4. Settle your claim. Most insurers will respond with a settlement offer. You can choose to accept, negotiate, or escalate the claim. If needed, SnapClaim can help you provide documentation to support further action.

SnapClaim is designed to help you recover fair compensation with less stress, faster turnaround, and no upfront legal fees.

Money-back guarantee: If your final insurance recovery is under $1,000, SnapClaim will refund 100% of your appraisal fee. We only succeed when you do.

Texas diminished value law

Statute of Limitations: 2 years

Third Party Diminished Value Claim: Yes

First Party Diminished Value Claim: No

Most insurance policies will exclude diminished value.

Texas Property Damage Minimum Limits: $25,000 in coverage

Uninsured Motorist Coverage for Diminished Value: Yes, diminished value is covered when you’re struck by an uninsured driver and a hit and run with physical contact. You must file a police report as well. $250 deductible applies.

Underinsured Motorist Coverage for Diminished Value: Yes

Texas Small Claims Court Limit: $20,000

attorney representation and appeals are permitted

See what ourclientsare sharing about us!

“I didn’t know about diminished value until I found SnapClaim. Their report was done in minutes, and the support team explained everything clearly. I used the letter they provided and ended up with an extra $3,200. Super easy.”

“SnapClaim helped me file a diminished value claim after repairs. The process was smooth, fast, and I received more money than expected. Their team handled everything so I could focus on getting my car and life back to normal.”

“I uploaded my repair estimate and got a professional report the same day. SnapClaim made everything so simple. Their platform saved me hours of back-and-forth with insurance and got me a solid payout”

“After my car was totaled, SnapClaim gave me a fair market value report that clearly beat the insurance offer. I submitted it with my claim and they increased the payout. The process was fast, fair, and worth every penny."

“SnapClaim made a huge difference for me. I had no clue how to value my vehicle post-accident. Their diminished value report was detailed, with comps and expert review. I sent it in and got a great settlement in less than a week. Truly amazing.”

“SnapClaim is a game-changer. I used their fair market value report after a total loss, and it helped me negotiate a much better offer. The design, speed, and clarity of the report made a real difference with my adjuster..”

Frequently asked questions:

-

What is a Diminished Value (DV) claim?

Diminished Value is the loss in market value a vehicle suffers after an accident, even after repairs. If your car has been in an accident caused by someone else, you may be entitled to compensation for this loss.

-

What is a Fair Market Value (FMV) report?

A Fair Market Value report estimates your vehicle’s current value based on verified market data. It’s commonly used for insurance negotiations, resale, legal cases, and total loss disputes.

-

What do I need to get started?

You’ll need your VIN number, mileage, repair document (if applicable), and your contact information. We’ll guide you step by step through the process.

-

What is your refund policy?

If you recover less than $1000 from your claim using our report, we offer a full refund of the report cost—no questions asked. Terms and conditions apply.

Latest articles

What Is Diminished Value? A Guide

- •

-

22/07/2025

What to Do If Your Vehicle

- •

-

16/07/2025

Certified appraisal report in minutes.

Let us help you recover the true value of your car

Free Estimate, no credit card required.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.