After a car accident, one of the first questions drivers ask is what is fair market value in car insurance. Your claim hinges on this key number: its Fair Market Value (FMV).Simply put, FMV is the price your vehicle would have realistically sold for the moment before the crash. Understanding what is fair market value is the first step to ensuring you receive a fair settlement from the insurance company.

Why Fair Market Value Is Critical for Your Claim?

Understanding your car’s true FMV is the most crucial step to getting the settlement you’re legally owed. Whether your car is a total loss or needs repairs, its pre-accident value is the bedrock of your entire claim. It’s the starting point insurance companies use to decide what they’ll pay out.

Unfortunately, the insurer’s first valuation often protects their bottom line, not yours. They lean on automated systems that can easily miss the unique features, recent upgrades, or excellent condition that made your car worth more. This is why many vehicle owners find themselves facing a lowball offer that won’t cover the cost of a comparable replacement.

Fair Market Value is what a willing buyer would pay a willing seller for your car—assuming neither party is under pressure and both know all the relevant facts about its condition and features. This real-world standard is the key to any fair negotiation with an insurer.

This is exactly where the fight for fair compensation begins. A low FMV creates a huge financial gap, making it impossible for you to buy a truly comparable replacement vehicle. To get what you’re truly owed, an independent appraisal is often your best move. For instance, a detailed total loss appraisal digs into every factor contributing to your car’s actual worth, giving you the hard evidence needed to push back against a lowball offer.

Ultimately, knowing your vehicle’s true FMV is what gives you power. It allows you to negotiate from a position of strength and ensures you don’t get shortchanged.

How FMV Determines Your Insurance Payout

Fair Market Value isn’t just industry jargon; it’s the number that dictates what an insurance company owes you after an accident. This single figure is the foundation for two of the most common outcomes: a total loss or a diminished value claim. Getting this number right can be the difference between a fair settlement that makes you whole and a massive financial hit.

FMV in Total Loss Claims

When an insurer declares your car a total loss, they are required by law to pay you its pre-accident Fair Market Value. If your car was worth $22,000 the moment before the collision, the insurance payout should be enough for you to buy a comparable vehicle for that same price.

The problem starts when their valuation comes in low. Let’s say they offer you $18,000. Suddenly, you’re facing a $4,000 gap. That shortfall comes straight out of your pocket, forcing you to either downgrade your next car or take on debt you never planned for. Knowing how to get an accurate total loss estimate after an accident is the only way to prevent this.

FMV in Diminished Value Claims

If your car is repairable, FMV becomes the baseline for your diminished value claim. This type of claim compensates you for the loss in resale value your car now has simply because it has an accident on its record.

It works like this:

- Pre-Accident FMV: This is the starting point—what your car was worth before the crash.

- Post-Repair Value: This is what a buyer would pay for it after repairs, knowing it’s been in an accident.

- Diminished Value: The difference between those two numbers is the value you’ve lost, and it’s what the insurer owes you.

Without a rock-solid, well-documented pre-accident FMV, proving your diminished value claim is nearly impossible. If the insurance company starts with a lowball initial value, it shrinks the gap between the pre-accident and post-repair numbers, conveniently reducing what they have to pay you.

What Is Fair Market Value and How the Insurer’s Method for Calculating Fair Market Value

So, how does an insurance company determine your car’s fair market value and what is fair market value in car insurance? Adjusters almost always rely on third-party valuation software, with names like CCC ONE or Mitchell being the most common. These systems process market data to produce a report and, with it, a settlement offer.

On the surface, this process sounds objective. But in reality, it’s often where the trouble starts. These automated reports are built to process a high volume of claims quickly, not to capture the unique story and condition of your specific vehicle. The result is often an initial offer that doesn’t come close to your car’s true pre-accident worth.

Where Automated Valuations Go Wrong

The biggest problem with these reports is the “comparable” vehicles the software chooses. An insurer’s valuation might take your meticulously maintained, low-mileage SUV and compare it to base models or vehicles in rough shape from distant areas.

Here’s a breakdown of how an insurer’s software compares to what a certified appraisal considers.

Insurer Valuation vs Certified Appraisal Factors

| Valuation Factor | Typical Insurer Report | SnapClaim Certified Appraisal |

|---|---|---|

| Comparable Vehicles | Often mismatched trims, high mileage, or poor condition “comps” from broad geographic areas. | Hand-selected, truly comparable vehicles from your local market, matching trim, options, and mileage. |

| Condition Adjustments | Uses generic, preset deductions or additions that rarely reflect the vehicle’s actual state. | A detailed, line-by-line analysis of your vehicle’s specific pre-accident condition, inside and out. |

| Optional Equipment | Frequently misses or undervalues factory-installed packages and desirable add-ons. | Accurately accounts for all factory options, packages, and recent high-value maintenance. |

| Market Data Source | Relies on a closed system database that may not reflect current, real-time dealer pricing. | Pulls from multiple live market data sources, including dealer asking prices and private sale listings. |

| Appraiser | An automated system generates the value based on an algorithm. | A certified, independent human appraiser reviews and signs off on the final valuation. |

The automated approach leaves significant room for error. Common flaws we see in these reports every day include:

- Mismatched Trim Levels: Comparing your top-of-the-line model to a basic version.

- Ignoring Condition: Overlooking your vehicle’s pristine pre-accident condition.

- Geographic Gaps: Using “comps” from cheaper, distant markets instead of your local area.

- Missing Value-Adds: Failing to account for thousands of dollars in recent maintenance or sought-after factory options.

These systems aren’t set up to catch the details that determine what a vehicle would actually sell for. You can learn more about how public tools differ in our guide on the Kelley Blue Book diminished value calculator.

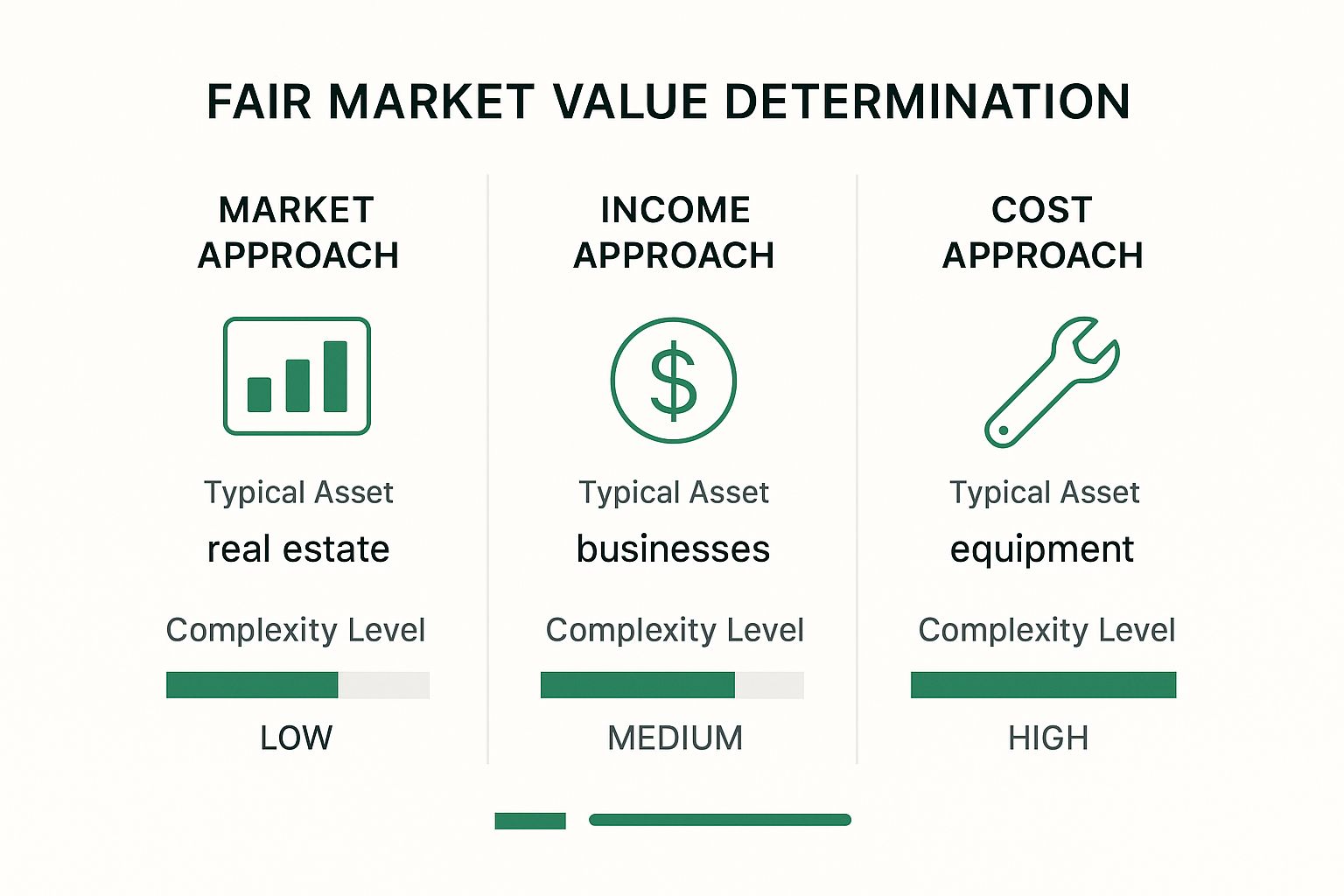

As the chart illustrates, the Market Approach is the gold standard for cars because it relies on real sales data. This is why the quality of the comparable vehicles is so critical—and why the insurer’s automated report should be a starting point for negotiation, not the final word.

Fair Market Value vs. Fair Value: What’s the Difference?

While they sound similar, Fair Market Value (FMV) and Fair Value are completely different concepts. It’s a critical distinction, because only one of them matters when you’re filing a car insurance claim.

Fair Value is an accounting term used by companies for financial reports. It’s often a theoretical number not grounded in everyday transactions.

Fair Market Value, on the other hand, lives in the real world. It’s the standard used in legal and tax situations because it reflects what a willing buyer and a willing seller would actually agree on in an open market.

When it comes to your auto claim, that difference is everything. The insurance company owes you the real-world cash value of your vehicle right before the crash. This is why FMV is the bedrock of both total loss and diminished value claims.

A car’s Fair Market Value isn’t just a number pulled from a database. It’s shaped by local supply and demand, recent sales of identical vehicles in your area, and its specific pre-accident condition.

This is why getting an independent appraisal is so powerful. A report from SnapClaim provides a defensible FMV rooted in current, local market data—not an abstract formula. It provides proof of the actual transaction value, which is the only number that gives you the leverage needed to negotiate and secure a fair settlement.

How a Certified Appraisal Proves Your Car’s True Worth

When an insurer’s valuation comes in far below what your car was worth, how can you prove its real value? An independent, certified appraisal is your most powerful tool. A professional appraisal report from SnapClaim provides the unbiased, data-driven evidence you need to push back against a lowball offer.

Our experts dive into real-time, local market data, analyzing actual comparable vehicles for sale in your area. This isn’t a guess; it’s a reflection of what a willing buyer would pay for a car just like yours before the accident.

A SnapClaim report documents every detail that adds value, including things like:

- Specific Trim and Packages: We identify every factory option, from premium sound systems to advanced safety features that automated systems often miss.

- Exceptional Pre-Accident Condition: We document the real-world state of your vehicle, ensuring its superior upkeep is properly factored into the final value.

- Recent Maintenance and Upgrades: Those new tires or recent engine work? We include significant investments to show their true contribution to your car’s worth.

This detailed, market-based valuation hands the adjuster solid, evidence-backed proof they can’t easily ignore.

We are so confident in our process that we offer a money-back guarantee. If our certified appraisal report does not help you recover at least $1,000 more than the insurer’s initial offer, we will refund your appraisal fee in full.

This guarantee removes the financial risk, so you can challenge the insurance company’s lowball number with confidence. For a full rundown of how it all works, check out our certified auto appraisal guide.

Take Control of Your Car Insurance Claim

Your journey to a fair settlement starts with understanding one critical concept: Fair Market Value (FMV). The first offer from the insurer is just their starting point for a negotiation, not the final word on what your car was really worth. You have the right to challenge their valuation and fight for the compensation you are owed.

Your Next Steps to a Fair Payout

The next step is to arm yourself with the proof needed to strengthen your position. To take charge of your claim, it helps to understand the big picture of how to file a car accident claim. Knowing the process gives you a major advantage during negotiations.

Don’t leave money on the table just because the insurance company’s initial offer looks official. With the right documentation, you can successfully negotiate for a higher, more accurate settlement that truly reflects your loss.

Start by getting a free estimate from SnapClaim to see what your claim could be worth. When you’re ready, order your certified appraisal report and give yourself the facts you need to secure a fair deal.

FAQ: Your Fair Market Value Questions Answered

What is the simplest definition of fair market value?

The simplest definition of fair market value is the price a vehicle would sell for between a willing buyer and a willing seller, with neither being under pressure and both knowing all the relevant facts. For your insurance claim, it’s what your car was worth right before the accident.

What is the difference between fair market value and actual cash value?

In most car insurance contexts, Fair Market Value (FMV) and Actual Cash Value (ACV) are used interchangeably to mean the same thing: your car’s pre-accident worth. ACV is simply the term most commonly used in insurance policies.

Can I disagree with the insurance company’s FMV?

Absolutely. The insurance company’s initial valuation is just an offer. You have every right to challenge their number if you believe it’s too low. However, you need proof to support your position, which is where an independent appraisal from SnapClaim becomes your most powerful tool.

How is fair market value determined for a total loss?

For a total loss, FMV is determined by analyzing recent sales of comparable vehicles in your local market. This includes cars of the same make, model, year, trim, and mileage, with adjustments made for your vehicle’s specific condition and optional features right before the accident occurred.

Ready to get the fair settlement you deserve? Let SnapClaim provide the proof you need to challenge the insurer’s lowball offer.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This article was reviewed by SnapClaim’s team of certified auto appraisers and claim specialists with years of experience preparing court-ready reports for attorneys and accident victims. Our content is regularly updated to reflect the latest industry practices and insurer guidelines.

Get Started Today

Ready to prove your claim? Generate a free diminished value estimate in minutes and see how much you may be owed.

Get your free estimate today