How to file a diminished value claim is a question for many drivers after an accident. A diminished value (DV) claim is how you recover the money your car loses in resale value after an accident, even with perfect repairs. When another driver is at fault, their insurance company is responsible for compensating you for that loss. This guide will walk you through the exact steps on how to file a diminished value claim and get the compensation you deserve.

Step 1 – Confirm Your Eligibility to File

Before you start, you must confirm that you’re eligible to file a diminished value claim. Getting this right from the start saves time and ensures you’re on the right track. check your eligibility

The most important rule is that diminished value claims are filed against the at-fault driver’s insurance policy. If you caused the accident, your own insurance typically won’t cover your car’s lost resale value.

Beyond fault, several other factors come into play:

State Laws: Every state has different rules. Some are very consumer-friendly, while others have more restrictions. Because the laws vary so much, it’s critical to know where your state stands. You can Check your state laws here.

Vehicle Ownership: You must be the legal owner of the vehicle. If you have a leased vehicle, you are typically not eligible to file a claim, as the leasing company is the legal owner and is the party that suffers the financial loss.

Vehicle Status: Your car must be repaired, not declared a “total loss.” If it’s a total loss, the insurer pays its pre-accident value, so there’s no future resale value to claim.

Accident History: A clean pre-accident history is best. If your vehicle has been in a previous accident, it makes proving the value lost from this specific collision much more difficult.

If you meet these criteria, you’re in a strong position to move forward.

Step 2 – Gather All Essential Documentation

When dealing with an insurance company, an organized, evidence-backed claim is one they can’t ignore. Your mission is to build a rock-solid file that tells the complete story of your vehicle’s loss.

Here is the essential paperwork you’ll need:

Accident Report or Police Report: This is your primary proof that the other driver was at fault.

Repair Invoices: Gather the final, itemized repair bill from the body shop. It details every part replaced and all labor performed, painting a clear picture of the damage’s severity.

Photos: Include any “before” photos of the damage at the scene and “after” photos of the completed repairs.

Proof of Ownership and Condition: Collect documents that prove your car’s value and condition before the accident, such as your vehicle’s title, recent maintenance records, and proof of mileage.

Organizing these documents into a single file makes the submission process look professional and sets the stage for the most critical piece of evidence: the certified appraisal.

Step 3 – Get a Certified Diminished Value Appraisal

This is the most critical step. Without a professional appraisal, your claim is just your opinion, and insurance companies often undervalue or deny claims without independent proof. A certified appraisal from an expert provides the hard data needed to prove your financial loss.

Insurance companies love to use their own internal formulas, which are designed to produce the lowest possible diminished value number. An independent appraisal from a service like SnapClaim bypasses their biased calculations. A high-quality appraisal will include:

Comparable Sales: An analysis of what similar vehicles are actually selling for in your local market.

some sources like Carfax, BlackBookVehicle-Specific Adjustments: A breakdown accounting for your car’s exact mileage, options, and pre-accident condition.

Calculated Loss: A transparent explanation of how the final diminished value amount was determined.

This document is your leverage. It transforms your claim from a simple request into a professional, evidence-based demand.

Our Guarantee: We are so confident in the power of our certified reports that we offer a money-back guarantee. If the insurance recovery from the claim is less than $1,000, your appraisal fee is fully refunded. This makes getting an appraisal a risk-free step to strengthen your claim.

Step 4 – File the diminished value Claim with the Insurer

With your documentation and certified appraisal in hand, it’s time to formally submit your claim.

Start by drafting a professional demand letter to the at-fault driver’s insurance adjuster. Keep it concise. State the facts of the accident, declare you are seeking compensation for your vehicle’s diminished value, and clearly state the dollar amount you are requesting, as proven by your appraisal.

Submit your certified DV appraisal report along with copies of all your supporting documents. From this point forward, keep detailed records of all communication, including emails, letters, and phone calls.

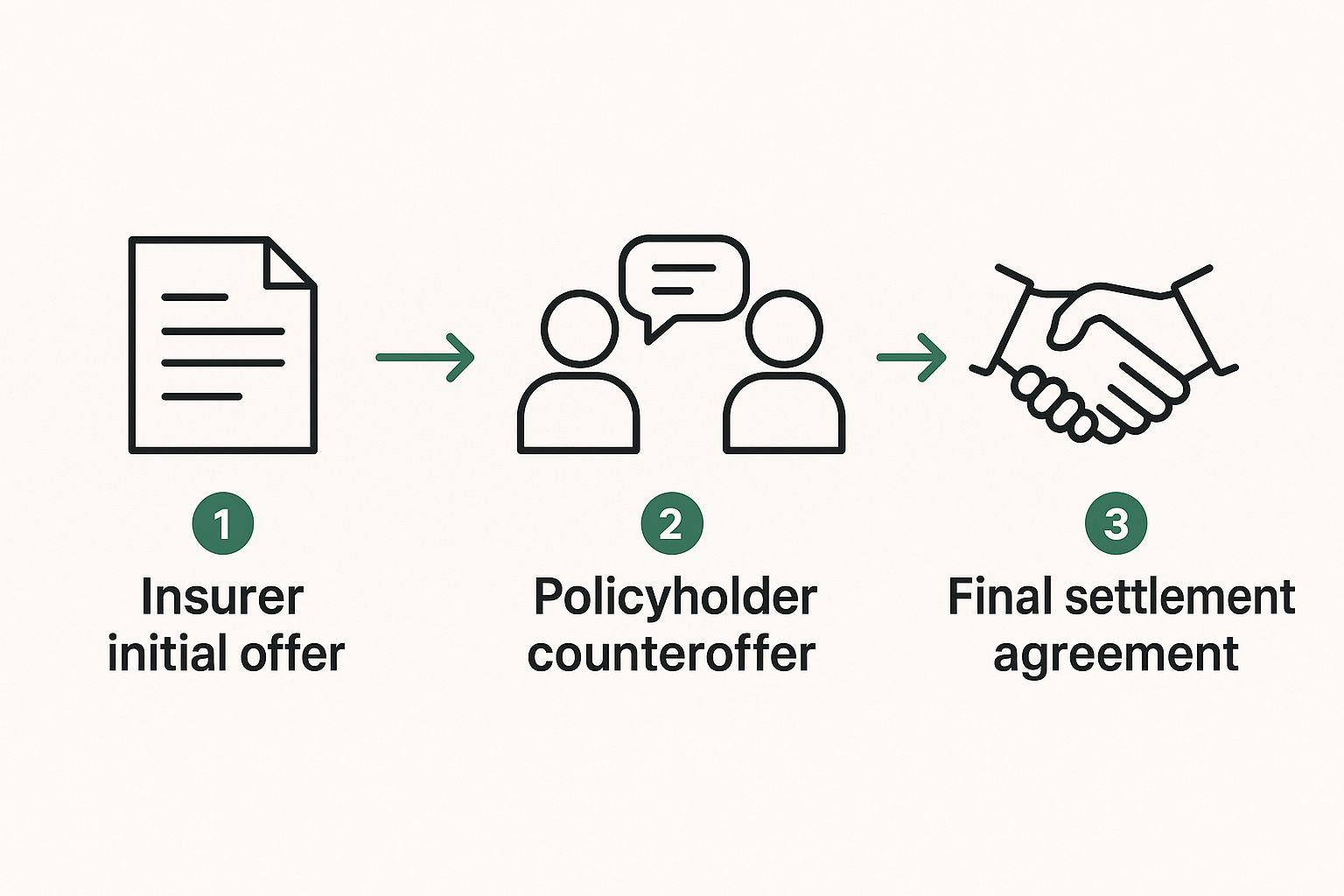

Step 5 – Negotiate with the Insurance Company

Don’t be surprised if the insurance company pushes back or makes a low initial offer. This is a standard negotiating tactic. Your certified appraisal is your best tool for leverage. When the adjuster questions your claim amount, refer them back to the market data and objective analysis in your report.

If the insurer denies your claim or refuses to negotiate fairly, you have options. You can file a formal complaint with your state’s Department of Insurance or consider mediation. For larger claims, consulting with an attorney may be necessary.

Step 6 – Know Your Rights

It’s important to understand your rights throughout this process. Most states give you a few years after the accident to file a property damage claim, but it’s always best to act quickly. Remember, you do not have to accept the first low offer an insurance company makes. Your goal is to be made financially whole for the loss caused by their insured driver’s negligence.

Quick Tips for a Smoother Process

File Promptly: File your diminished value claim as soon as your vehicle repairs are completed.

Stay Professional: Always remain polite and professional in your communications with insurance adjusters. Let your evidence do the talking.

Consider Legal Help: If the claim is significant or the insurer is uncooperative, contacting a personal injury attorney can provide the leverage you need.

Frequently Asked Questions (FAQ)

How long do I have to file a diminished value claim?

The time frame for filing property damage claims differs by state, generally ranging from two to four years from the date of the accident. It is recommended to file after completing repairs to directly link the loss in value to the collision.

What should I do if the at-fault driver’s insurance denies my claim?

A claim denial is not the final outcome. Respond in writing and support your case with evidence from your certified appraisal. If the claim remains denied, you may consider filing a complaint with your state’s Department of Insurance or seeking legal counsel.

Is it possible to file a claim if I was partially at fault?

This depends on state laws. In “comparative negligence” states, you may recover a portion of your loss. However, in “contributory negligence” states, any degree of fault may prevent recovery. It’s important to understand how accidents impact vehicle depreciation and familiarize yourself with your state’s laws. For more information, visit snapclaim.com or check our internal resources on insurance claims.

How can I ensure my claim is successful?

Collect thorough documentation, including repair estimates, appraisals, and relevant communications. Providing clear evidence is essential in supporting your claim.

Where can I find more information about diminished value claims?

For more information on diminished value claims, visit snapclaim.com for insights and updates on insurance claims.

Need a certified diminished value report fast? SnapClaim delivers appraisals in under an hour, backed by real market data and accepted by insurers. Get your free estimate or order your certified appraisal report now at https://www.snapclaim.com.