Diminished Value State Laws

Diminished Value Claims by State

When your vehicle is involved in an accident, its history will almost always reduce its market value—even after professional repairs. This reduction is called diminished value. Filing a diminished value claim by state law ensures that you recover compensation for that lost value instead of bearing the financial burden yourself.

At SnapClaim, we provide state-specific diminished value reports that meet insurance and legal standards. With our platform, you can:

- Check diminished value eligibility instantly.

- Generate a report in less than an hour.

- Understand how your state’s diminished value laws affect your claim.

Disclaimer: We make every effort to keep this information accurate and up to date. However, insurance laws can change, and interpretations may vary by case. Before taking action, we strongly recommend consulting with a qualified attorney or speaking with your insurance adjuster to confirm how Diminished Value laws apply to your specific situation.

Why Would I File a Diminished Value Claim?

Even after perfect repairs, your vehicle’s history report shows the accident—reducing its fair market value by thousands. Buyers and dealerships almost always pay less for cars with accident history.

Filing a diminished value claim by state law protects your financial investment by:

- Compensating you for the lost resale value.

- Ensuring the at-fault party, not you, pays for the damage.

- Maximizing your recovery before you sell or trade in.

Find and learn more about diminished value appraisal near you and state law

Learn more about SnapClaim diminished value pricing here

SnapClaim makes this process seamless by providing court-ready diminished value reports that insurance companies and attorneys accept.

Who Pays for Diminished Value Claims?

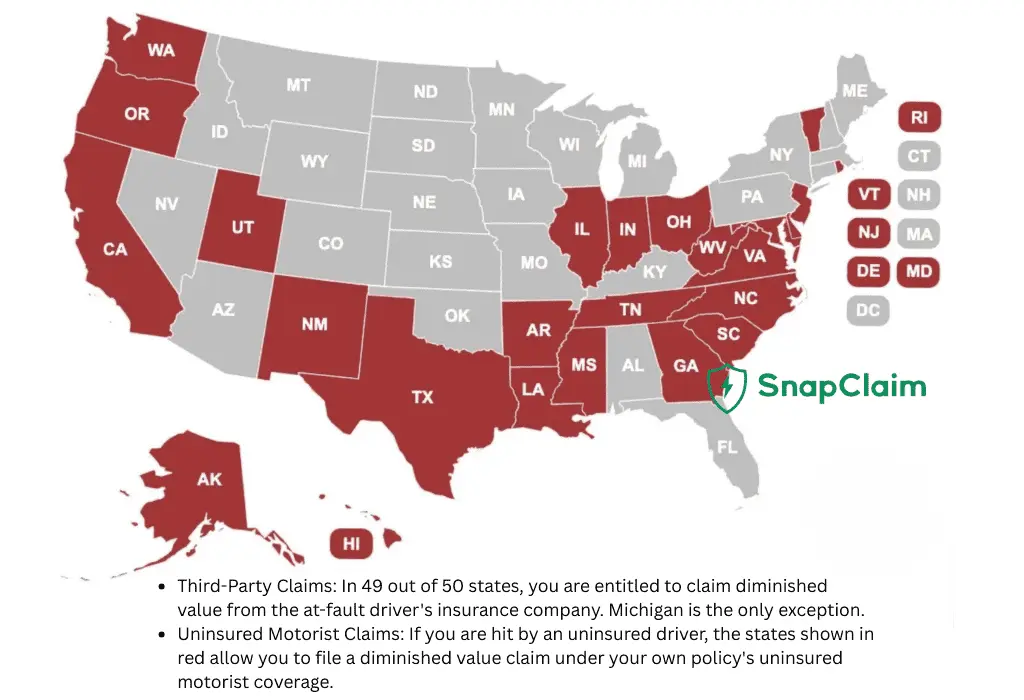

In most cases, the at-fault driver’s insurance company is responsible for paying diminished value.

- Third-party claims: Most common. Filed against the negligent driver’s insurer.

- First-party claims: In some states, you can file under your own policy through uninsured/underinsured motorist coverage (UM/UIM).

SnapClaim’s state-by-state guide ensures you know which path applies to you.

Is There a Statute of Limitations for Diminished Value Claims?

Yes. Each state sets a filing deadline:

- Shortest: Louisiana (1 year)

- Longest: Rhode Island (10 years)

- Typical: 2–4 years

Failing to file in time means permanently losing eligibility.

How Do I Prove a Diminished Value Claim?

To succeed, you must show clear evidence of your vehicle’s value loss. SnapClaim helps you build this with:

- Certified Appraisal Report – Independent, data-backed valuation.

- Repair Records – Invoices and work orders proving accident damage.

- Pre-Accident Documentation – Photos, mileage records, dealer quotes.

- Market Comparisons – Sales data from your region and zip code.

- Expert Analysis – Every SnapClaim report is reviewed by a licensed appraiser.

This combination creates a strong foundation for insurance negotiations—or litigation, if necessary.

Diminished Value Claims FAQ

1. Can I file a diminished value claim if I was partially at fault?

In most states, diminished value claims require the other driver to be primarily at fault. However, some states with comparative negligence rules allow recovery if your share of fault is under a threshold (e.g., 50% in Georgia).

2. Do diminished value claims affect my insurance rates?

No. When you file against the at-fault driver’s insurance (third-party), it does not impact your premiums.

3. What if my car already had prior damage?

You can still file, but the payout may be reduced based on pre-existing conditions. SnapClaim generally does not recommend to file for diminished value claim if your car had an accident before.

5. Do I need a lawyer to file a diminished value claim?

No. In most cases, you can file a diminished value claim directly with the at-fault driver’s insurance company using a professional appraisal report. However, if the insurer refuses to pay or offers a low settlement, having an attorney may help strengthen your case. SnapClaim provides court-ready reports that attorneys and insurance companies recognize, making the process smoother whether or not you hire legal representation.

5. How long does it take to get paid?

Traditional appraisals can take weeks. SnapClaim delivers reports in under an hour, which accelerates claim negotiations significantly.

6. How much can I recover?

Payouts vary but often range from $2,000–$10,000+, depending on your car’s age, mileage, and damage severity.

7. Do all states recognize diminished value claims?

Almost all states allow third-party claims, but rules differ for first-party coverage. Some (like Michigan) only allow limited recovery. For detailed breakdowns by state, see the SnapClaim Blog.

Diminished Value or Total Loss appraisal reports in minutes.

Let us help you recover the true value of your vehicle.

Contact our sales team for a demo and free trial.