If you’re a vehicle owner who’s been in a car accident, you may be facing a hidden financial loss beyond repair costs. Even after your vehicle is restored, its market value often decreases due to its accident history. This loss, known as diminished value (DV), can cost you thousands when selling or trading in your car. Understanding diminished value and your legal rights is key to recovering fair compensation. In this guide, we’ll explain what diminished value is, the legal aspects of filing a claim, and how SnapClaim’s diminished value appraisals and free eligibility check can help vehicle owners nationwide secure what they deserve—backed by our 100% money-back guarantee if your claim recovers less than $1,000.

What Is Diminished Value? The Problem Explained

Diminished value is the reduction in your vehicle’s resale or trade-in value after an accident, even if repairs are done perfectly. Buyers are hesitant to pay full price for a car with an accident history, leading to significant financial loss for you. Here are the three main types of diminished value:

- Inherent Diminished Value: The loss in value due to the accident record alone, even with high-quality repairs.

- Immediate Diminished Value: The difference in your car’s value immediately before and after the accident, before repairs.

- Repair-Related Diminished Value: Additional value loss from poor-quality repairs or incomplete restoration.

This financial hit can be frustrating, especially if the accident wasn’t your fault. Without proper documentation, insurance companies may deny or undervalue your diminished value claim, leaving you to cover the loss.

The Legal Side of Diminished Value Claims

As a vehicle owner, you may be entitled to compensation for diminished value, especially if another party caused the accident. However, the legal process can be complex. Here’s what you need to know:

- State-Specific Rules: Most states recognize diminished value claims, but regulations differ. Some allow claims only against the at-fault party’s insurance, while others permit claims under your own policy, like uninsured motorist coverage.

- Proving Your Claim: You need evidence, such as a professional appraisal, to demonstrate the loss in value. Without this, insurers may dismiss your claim.

- Time Limits: Statutes of limitations vary by state, so acting quickly is essential to protect your rights.

Navigating these legal challenges can feel overwhelming, but SnapClaim’s expert services and free eligibility check make it easier to determine if you qualify and how to proceed.

How SnapClaim Helps Vehicle Owners Recover Compensation

SnapClaim is dedicated to helping vehicle owners like you maximize their diminished value claims. Our services are designed to simplify the process and ensure you get the compensation you’re entitled to, backed by our 100% money-back guarantee if your claim recovers less than $1,000. Here’s how we support you:

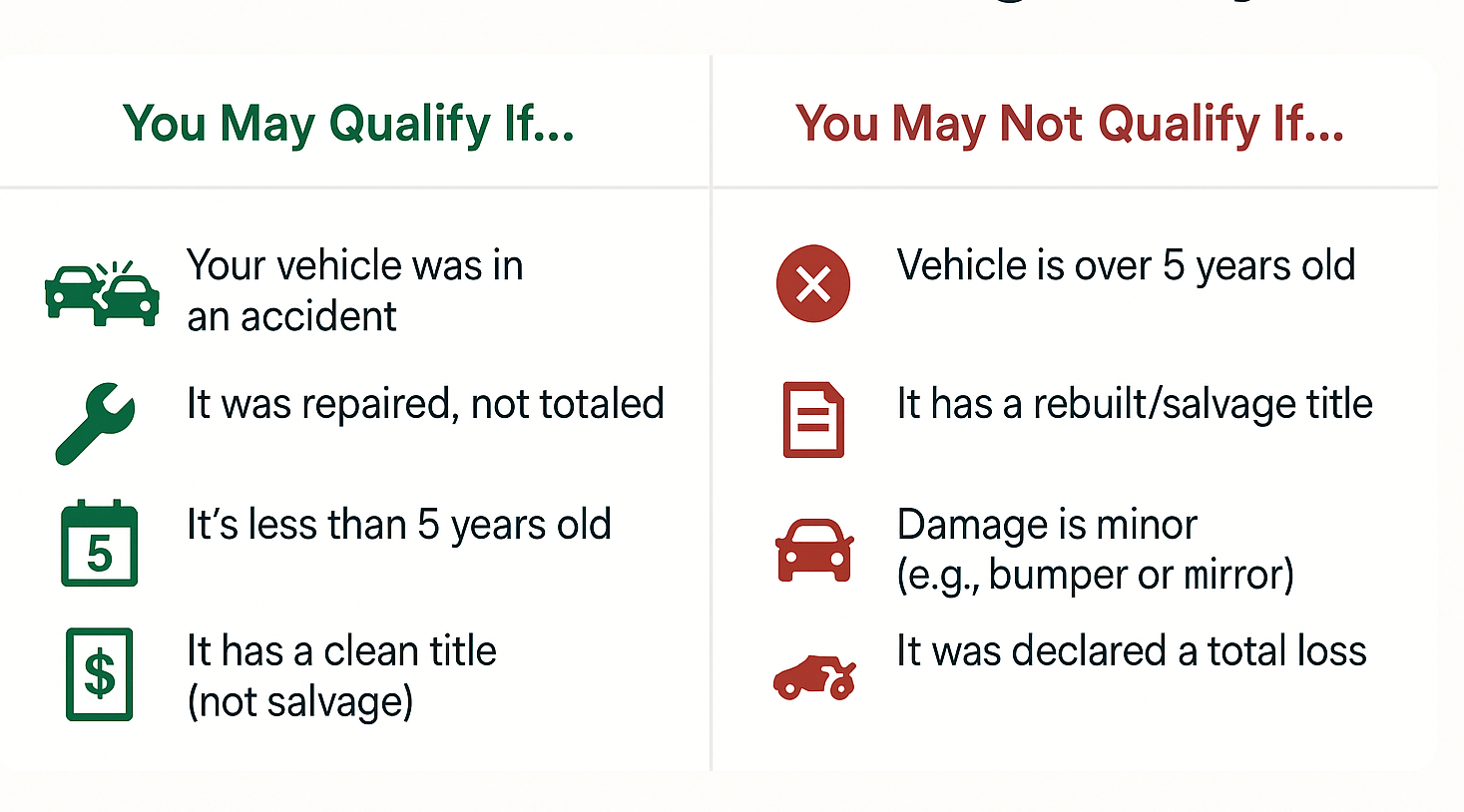

1. Free Eligibility Check with Estimate

Not sure if you qualify for a diminished value claim? Our eligibility check tool is a quick, free questionnaire that determines whether you’re eligible and provides a free estimate of your potential claim value. Benefits include:

- A clear understanding of your claim’s viability in minutes.

- A no-cost estimate to guide your decision-making.

- A risk-free way to explore your options before committing.

Start with our eligibility check at snapclaim.com to see how much your claim could be worth.

2. Expert Diminished Value Appraisals

Our certified appraisers provide detailed diminished value appraisals that accurately quantify your vehicle’s loss in value. These reports include:

- A thorough comparison of your car’s pre- and post-accident value.

- Region-specific market data to reflect local resale trends.

- Industry-standard documentation to strengthen your case with insurers.

With a SnapClaim appraisal, you’ll have the evidence needed to negotiate a fair settlement and avoid lowball offers.

3. 100% Money-Back Guarantee

We’re confident in our ability to help you recover fair compensation. If your diminished value claim recovers less than $1,000, we’ll refund your appraisal fee in full. This 100% money-back guarantee ensures you can trust SnapClaim to deliver results with no financial risk.

Why Vehicle Owners Choose SnapClaim

SnapClaim is the trusted choice for vehicle owners nationwide. Here’s what sets us apart:

- Nationwide Expertise: We serve vehicle owners in every state, with knowledge of local laws and markets.

- Client-Focused Service: Our goal is your satisfaction, delivering appraisals that lead to successful claims.

- Fast Turnaround: We provide appraisals quickly to meet insurance deadlines without compromising quality.

- Proven Results: Our clients have used our reports to secure fair settlements, protecting their financial interests.

With SnapClaim, you gain a partner committed to your financial recovery after an accident.

Take Control with SnapClaim Today

Don’t let an accident reduce your vehicle’s value without fair compensation. A successful diminished value claim starts with understanding your eligibility and securing expert support. SnapClaim’s free eligibility check and diminished value appraisals, backed by our 100% money-back guarantee, make the process simple and risk-free.

Visit snapclaim.com today to complete our free eligibility check and get your estimate. Protect your vehicle’s value and secure the compensation you deserve!

Have questions? Contact us at support@snapclaim.com or follow us on @SnapClaim for tips on navigating totaled vehicle claims. Let SnapClaim help you get the compensation you deserve—act today.