After a car accident, even if your vehicle is professionally repaired, its market value often drops. This decrease in value is known as diminished value, and it can result in a financial loss when selling or trading in your vehicle. Fortunately, many drivers are eligible to file what’s called a diminished value claim to recover part of that loss.

What is diminished value?

Diminished value refers to the reduction in a vehicle’s resale or trade-in value due to its accident history. Even if the vehicle has been restored to its pre-accident condition, the mere fact that it was in a collision can make buyers more hesitant. Dealerships and private buyers often pay less for a car with a reported accident, especially if structural damage or airbag deployment was involved.

There are three main types of diminished value:

- Inherent diminished value: This is the most common and refers to the loss in market value simply because the car now has an accident history. Even with perfect repairs, the vehicle is considered less desirable.

- Repair-related diminished value: This occurs when substandard or incomplete repairs reduce the value. For example, if the paint does not match perfectly or aftermarket parts were used instead of original manufacturer parts.

- Immediate diminished value: The loss in value calculated immediately after the accident, before any repairs are made.

Most insurance claims are focused on inherent diminished value, as this is the type typically recognized by insurers and courts.

When can you file a diminished value claim?

Not everyone is eligible to file a diminished value claim. Your ability to file depends on the circumstances of the accident and state laws. Here are common eligibility factors:

- The accident was not your fault.

- You are filing a claim against the at-fault driver’s insurance company (a third-party claim).

- Your vehicle has a clean title with no previous accidents.

- Repairs have been completed and properly documented.

- You are within your state’s statute of limitations (usually 1 to 3 years).

Some states, like Georgia, allow first-party diminished value claims (against your own insurance), but most do not.

How is diminished value calculated?

There is no standardized formula used across all insurance companies, but most calculations include the following factors:

- Pre-accident market value of your vehicle

- Age, mileage, and overall condition of the vehicle

- Extent and severity of the damage

- Quality of repairs performed

- Comparable sales data of similar vehicles with and without accident history

Some insurance companies use the “17c formula,” which applies a base percentage (often 10%) to the car’s pre-accident value and adjusts for mileage and severity. However, this method is often criticized for undervaluing claims.

To support a fair value, many drivers turn to certified appraisers who use market data, industry standards, and documented methodology to produce an independent diminished value report.

Why does diminished value matter?

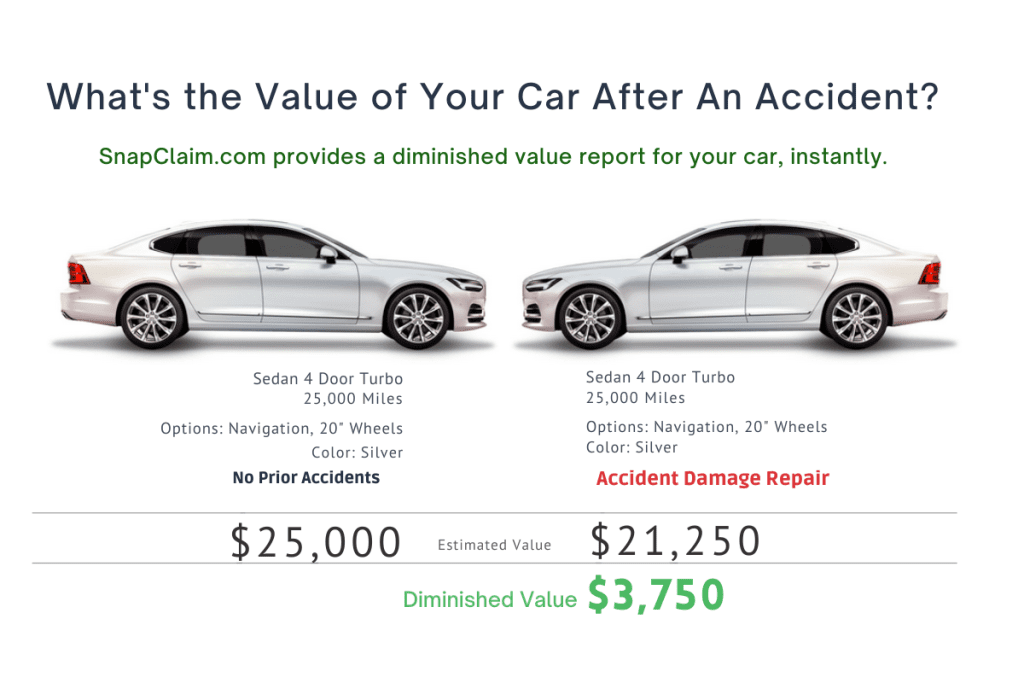

Many vehicle owners are unaware that they can recover this lost value. If your car was worth $25,000 before the accident and is now worth $22,000—even after perfect repairs—that $3,000 loss could be claimed from the at-fault driver’s insurer. Without filing a diminished value claim, that money is lost.

This can be especially important if:

- You plan to sell or trade in your vehicle in the next few years.

- Your car is relatively new or high-value.

- The damage involved structural components or airbags.

Diminished value can significantly impact trade-in offers and negotiations with buyers.

How to file a diminished value claim

Filing a diminished value claim typically involves the following steps:

- Confirm that you are eligible under your state’s laws and the accident circumstances.

- Gather documentation, including repair records, the accident report, and proof of the car’s value.

- Obtain a diminished value appraisal report from a certified vehicle appraiser.

- Submit the claim with supporting documents to the at-fault party’s insurance company.

- Negotiate if the insurer disputes the claim amount. An independent report can be crucial here.

- If necessary, consider legal action in small claims court if your claim is denied or undervalued.

It’s important to act within your state’s time limit. In most states, the window to file is between one and three years from the date of the accident.

Common mistakes to avoid

- Waiting too long to file your claim

- Filing with your own insurer when not allowed

- Accepting a low settlement without a proper appraisal

- Filing a claim when your car has prior damage, which can weaken your case

Even if you’re unsure about your eligibility, a free estimate from an appraiser can help determine whether pursuing a claim is worthwhile.

Final thoughts

A diminished value claim is a powerful tool for car owners to recover the real-world financial impact of an accident. Insurance may pay for repairs, but that doesn’t mean your car is truly restored to its former value in the eyes of future buyers or dealers.

If you suspect your vehicle has lost value after an accident and the crash wasn’t your fault, you may be entitled to compensation. A professional appraisal can help you understand the potential value of your claim.

To see if your vehicle qualifies or to request a certified appraisal report, visit www.snapclaim.com for more information and a no-obligation estimate.