Total Loss Appraisal Near Me

Get a total loss appraisal anywhere in the U.S. We provide total loss appraisal reports based on real market data, used by vehicle owners, attorneys, and insurance professionals across all 50 states. Select your state to view local total loss and appraisal clause requirements.

No credit card required.

What Is a Total Loss Appraisal?

A total loss appraisal determines your vehicle’s true market value when an insurer declares it a total loss.

- Insurance offers are often based on automated valuation tools.

- A total loss appraisal service near you helps challenge undervalued payouts.

- SnapClaim uses real market data — no in-person inspection required.

- Supports first-party appraisal clause disputes when you and your insurer disagree on value.

Total loss rules vary by state. View local requirements in our state laws guide.

How to Get a Total Loss Appraisal Report

After a serious accident, your insurance company may declare your vehicle a total loss and make an offer based on its own valuation tools. These offers are often lower than the vehicle’s true market value, leaving drivers short on their payout.

SnapClaim makes it easy to get a total loss appraisal. Our experts use real market listings, vehicle details, and condition adjustments to determine a fair actual cash value (ACV) when you disagree with your insurer’s offer.

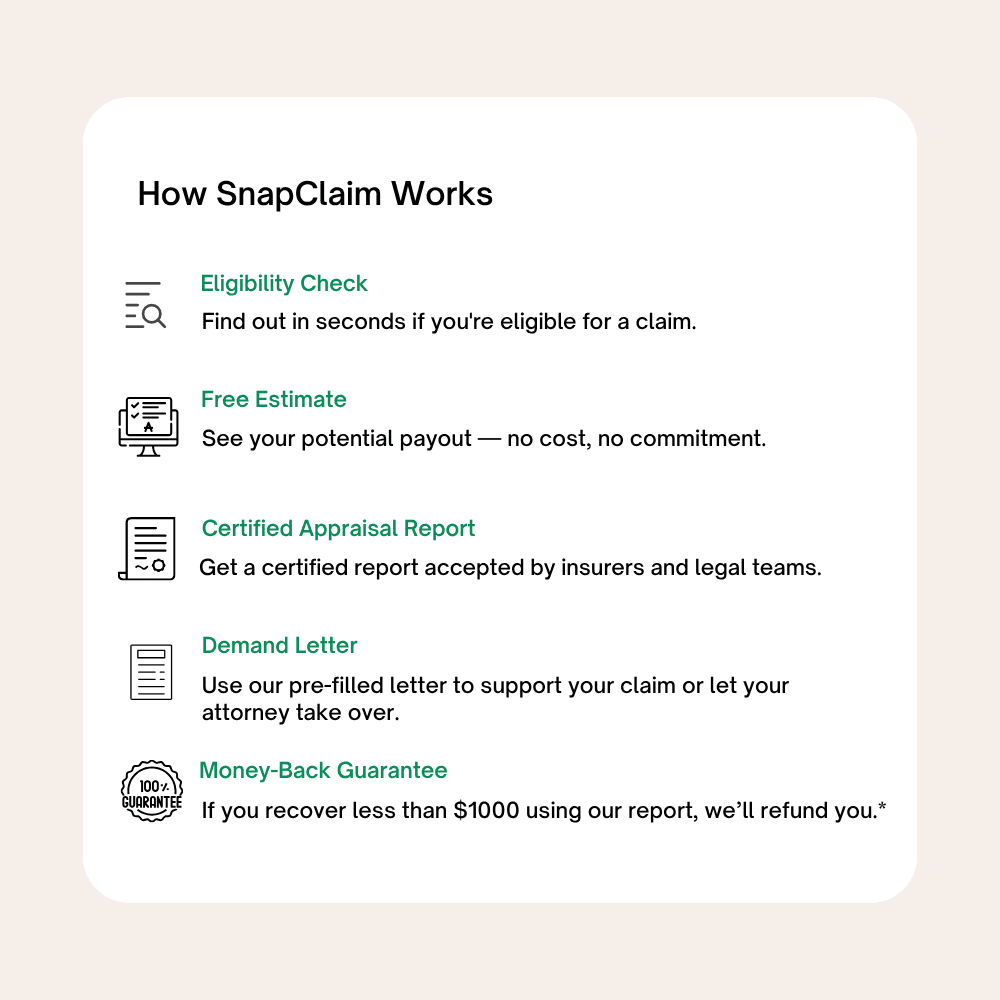

How SnapClaim Works

- Step 1: Check your eligibility in seconds

- Step 2: Get a free total loss value estimate instantly.

- Step 3: Receive your total loss appraisal report based on real market data.

- Step 4: Use your report in a first-party appraisal clause dispute if you and your insurer can’t agree on value.

Don’t accept a low total loss offer. Start your total loss appraisal today and see what your vehicle is really worth.

Frequently asked questions:

- What is a total loss appraisal?

A total loss appraisal determines the actual cash value (ACV) of your vehicle when an insurance company declares it a total loss. It helps verify whether the insurer’s payout reflects true market value.

- When should I get a total loss appraisal?

You should consider a total loss appraisal after your insurer makes an offer and you believe it’s too low to replace your vehicle with a comparable one.

- Is a total loss appraisal only for first-party insurance claims?

No. A total loss appraisal can be used in both first-party and third-party claims to help establish a vehicle’s fair market value. However, the appraisal clause process applies only to first-party claims under your own insurance policy when you and your insurer disagree on value.

- How does a total loss appraisal help if I disagree with my insurer?

A total loss appraisal provides independent market-based evidence that can be used to challenge an undervalued offer or support a first-party appraisal clause process.

- What data is used in a SnapClaim total loss appraisal?

SnapClaim uses real market listings, vehicle-specific details (year, trim, mileage, options), and condition adjustments to estimate fair market value — not generic formulas.

- Do I need to bring my car in for an inspection?

No. SnapClaim’s total loss appraisal process does not require an inspection.

- How long does it take to receive a total loss appraisal report?

Most customers receive their total loss appraisal report within hours, not days.

- Can I use a total loss appraisal for an appraisal clause dispute?

Yes. A total loss appraisal can be used to support a first-party appraisal clause when you and your insurer cannot agree on vehicle value.

- Are total loss rules the same in every state?

No. Total loss and appraisal clause rules vary by state, which is why it’s important to understand your local requirements before disputing an offer.

- Is a total loss appraisal worth it?

If your insurer’s offer is thousands below what it would cost to replace your vehicle, a total loss appraisal can help you understand your options and pursue a fair payout.

Looking for a total loss appraisal near you?

SnapClaim offers total loss appraisal services across the U.S., serving drivers in major cities such as Atlanta, Dallas, Miami, Los Angeles, Chicago, and Denver. Wherever your claim is filed, we help you understand your vehicle’s true market value and dispute unfair total loss settlements.

Free Estimate, no credit card required.