Was your car in an accident? Even with perfect repairs, its value has likely taken a hit simply because it now has a crash history. This hidden financial loss is known as vehicle diminished value. If someone else caused the wreck, you have the right to reclaim that lost money, but insurance companies aren’t exactly eager to help.

The True Cost of a Collision: Beyond Just Repairs

When you’re involved in a crash, your immediate focus is getting your car fixed and back on the road. But the financial fallout doesn’t end when you drive away from the body shop. The simple fact that your vehicle now carries an accident history permanently reduces its resale value. It’s a genuine, tangible loss—and one you’re entitled to recover from the at-fault party’s insurer.

All vehicles depreciate over time; that’s just normal wear and tear. However, an accident accelerates this process dramatically. While cars typically lose about 50% of their value in the first five years, an accident can trigger an additional 10-30% drop on top of that. For a more in-depth look at how this works, you can explore the 2025 car value overview from industry experts.

Understanding the Three Types of Vehicle Diminished Value

To effectively pursue your claim, it’s essential to understand the three main types of diminished value. Each category addresses a specific aspect of the financial loss you’ve experienced.

| Type of Diminished Value | Simple Explanation | Who It Affects |

|---|---|---|

| Inherent Vehicle Diminished Value | The automatic reduction in value simply because the car now has an accident on its record. This is the most common type. | Virtually every vehicle owner after a collision, regardless of the quality of repairs. |

| Repair-Related Vehicle Diminished Value | Additional value lost because the repairs weren’t executed perfectly—think mismatched paint, subpar parts, or faulty frame work. | Vehicle owners who received substandard or incomplete repairs from the body shop. |

| Immediate Vehicle Diminished Value | The loss in value that occurs even before any repairs are performed. This represents the resale value of the damaged, unrepaired vehicle. | This is less frequently claimed, as the at-fault insurer typically covers repair costs directly. |

Most claims focus on Inherent VehicleDiminished Value because even the most meticulous repairs cannot erase a vehicle’s accident history as reported by services like CARFAX or AutoCheck.

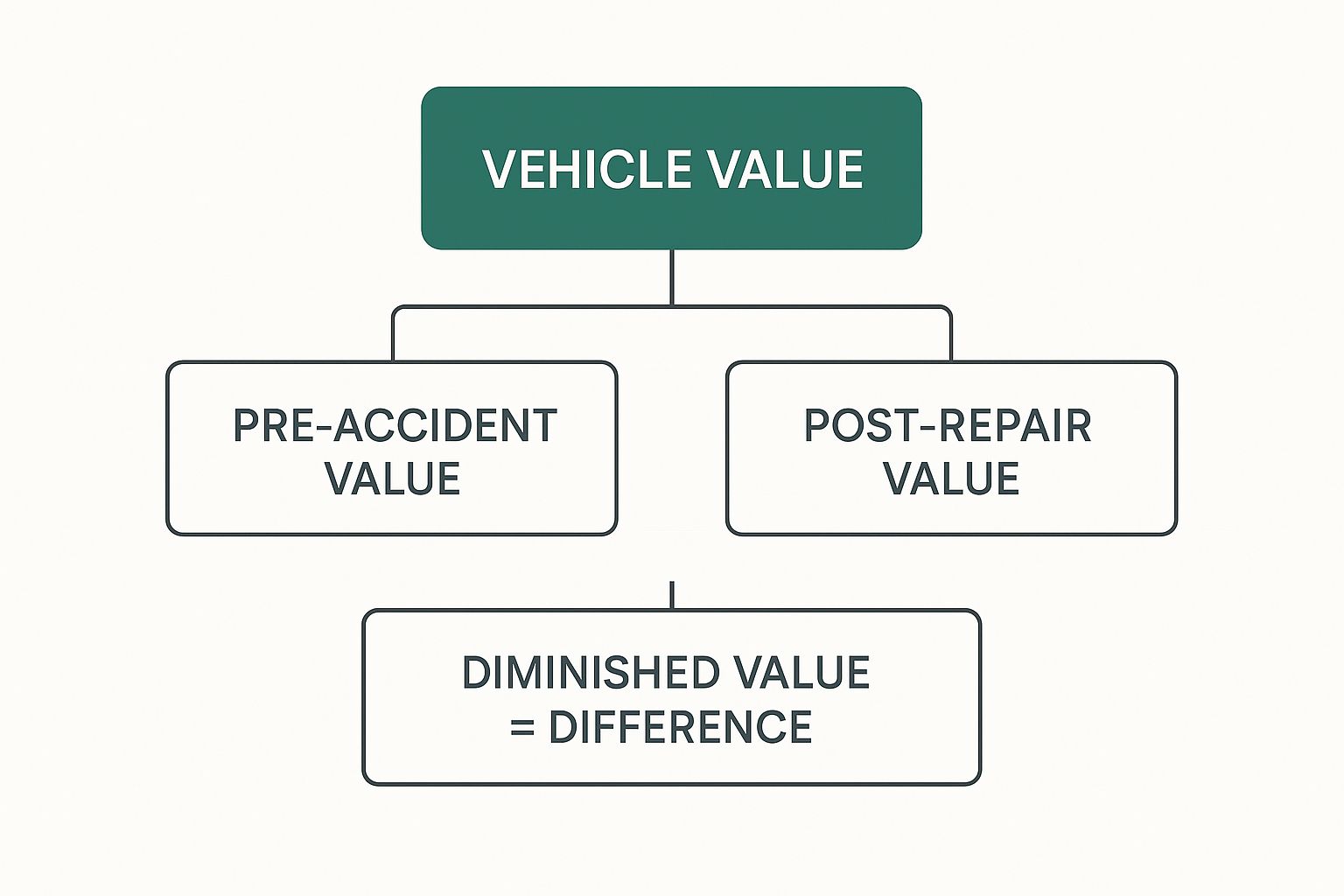

Here’s where things get interesting. The image below illustrates precisely how the pre-accident value and post-repair value create the “Vehicle diminished value gap.”

As you can see, vehicle diminished value represents the financial chasm between what your car was worth moments before the crash and what it’s worth after being restored. Filing a claim is the only way to bridge that gap. The crucial first step? Obtaining a professional, data-backed appraisal that provides concrete proof of exactly how much value your car has lost.

Why Insurance Companies Push Back on Vehicle Diminished Value Claims

If you’ve ever attempted to file a vehicle diminished value claim, you’ve likely encountered resistance. Don’t take it personally—it’s simply how they operate. Insurance companies are profit-driven entities built on a straightforward model: collect maximum premiums and pay out minimum claims.

Every dollar they pay out for diminished value directly impacts their profits. This is the fundamental reason adjusters are trained to challenge these claims. Their primary objective is to safeguard the company’s financial performance, which involves scrutinizing, minimizing, and sometimes outright denying claims that lack irrefutable evidence.

Common Tactics to Undervalue Your Claim

So, how do they systematically offer you less than your car is worth? Most insurers rely on standardized, often flawed, formulas to calculate their offers. The most notorious of these is the “17c formula,” a one-size-fits-all calculation that almost invariably produces a significantly low valuation.

The 17c formula begins by capping your potential loss at 10% of your car’s pre-accident value. It then applies vague “multipliers” for factors like damage severity and mileage, further reducing the final payout.

The Flaw in Formulas: The 17c method is a tool designed to benefit the insurer, not you. It completely disregards critical real-world factors: your vehicle’s specific make and model, local market demand, its pre-accident condition, and the undeniable fact that buyers are hesitant to purchase a car with an accident history.

This is precisely why you can’t win a formula-based argument with logic alone. You need to counter their flawed calculations with a professional, data-driven appraisal. An independent report from SnapClaim provides the specific market evidence necessary to overcome these lowball tactics and negotiate from a position of strength.

Arguments You Can Expect to Hear

When you submit your claim, the adjuster will likely have a prepared list of common objections. Being aware of their typical responses will help you remain focused and confident.

Prepare yourself to hear statements such as:

- “Our high-quality repairs made your car whole again.” This is a classic diversionary tactic. Even if the car looks pristine, its accident history is now permanently linked to its VIN. That is what diminishes its market value, and repairs cannot erase a CARFAX report.

- “We don’t pay for diminished valuein your state.” This statement is frequently inaccurate. While regulations vary, nearly every state permits filing a third-party claim against the at-fault driver’s insurance. A quick review of your state’s laws will clarify your rights.

- “There is no such thing as inherent vehicle diminished value.” Some adjusters will attempt to deny the existence of this concept. However, vehicle diminished value is a legally recognized loss, and a brief search on any used car marketplace will confirm that buyers consistently pay less for a previously wrecked and repaired vehicle.

- “You haven’t sold the car, so you haven’t realized a loss.” This argument lacks logic. You are not required to sell your car to be made whole. The financial damage occurred the moment the accident took place, and you have the right to be compensated for that loss now.

A low offer or an initial denial is not the end of the process—it’s merely the beginning of the negotiation. View it as a clear indication that it’s time to introduce credible, independent evidence. A certified appraisal report is your most potent tool for dismantling their arguments and securing a fair settlement.

How to Prove Your Vehicle’s True Lost Value

Following an accident, the insurance company will present a figure for your car’s diminished value. This number isn’t based on your car’s actual current worth. Instead, it’s calculated to minimize their payout, not to fully compensate you.

To receive fair compensation, you must demonstrate the true loss in market value yourself. This means moving beyond their flawed calculations and constructing a robust case supported by independent evidence. The key is to counter their self-serving formulas with a credible, data-driven valuation that reflects real-world market conditions. This is where a professional, certified appraisal becomes your most valuable asset.

The Anatomy of a Proper Valuation

A legitimate vehicle diminished value appraisal isn’t generated by a generic formula. It involves a thorough analysis of your specific vehicle and its standing in the current used car market.

A certified appraiser meticulously examines several critical factors to determine your actual financial loss:

- VehicleSpecifics: Your car’s make, model, year, trim level, and factory-installed options form the basis of the appraisal.

- Condition and Mileage: The appraiser assesses its pre-accident condition, accounting for normal wear and tear, and notes the mileage.

- Accident Severity: Structural damage, for example, significantly impacts a car’s value more than a minor fender bender.

- Quality of Repairs: The final report will detail the quality of the repairs, including whether aftermarket parts were used instead of Original Equipment Manufacturer (OEM) parts.

This comprehensive approach grounds the valuation in reality, rather than in a convenient algorithm designed to benefit the insurer.

Why a Certified Appraisal Is Your Gold Standard

Attempting to file a claim without a professional report is akin to appearing in court without evidence. An adjuster has no inherent reason to accept your word, but they cannot simply dismiss a certified document from a reputable third-party expert. This is why a SnapClaim report serves as the cornerstone of a strong vehicle diminished value claim.

A professional appraisal elevates your claim from a subjective opinion to a factual, evidence-based demand. It provides the objective proof necessary to counteract the insurer’s lowball offers and substantiates your right to fair compensation.

Our reports are packed with real-world market data and a definitive, defensible valuation. This transforms the appraisal from an “expense” into the essential proof you need for a successful claim. With vehicles becoming increasingly complex and repair costs rising, accurately proving this loss has never been more critical. Recent data indicates that approximately 22.6% of all insured vehicle losses are now declared total losses due to sophisticated technology making repairs more expensive. You can review the latest Crash Course report from industry analysts to observe these trends firsthand.

We are so confident that our reports will strengthen your claim that we offer a money-back guarantee. If your insurance recovery from the claim is less than $1,000, we will fully refund your appraisal fee. You can pursue the compensation you are owed without incurring financial risk.

Your Step-By-Step Guide to Filing a Claim

Navigating a vehicle diminished value claim can seem complex, but it essentially involves a series of logical steps. By staying organized and methodical, you can build an exceptionally strong case. Consider this your roadmap to securing the funds you are rightfully owed.

Step 1: Confirm You Have a Case

First, ensure you are eligible. Vehicle Diminished value claims are almost always filed as third-party claims against the at-fault driver’s insurance. Therefore, the most critical element is establishing that the other driver was responsible for the accident. Once liability is confirmed, your next action is to formally notify their insurance company, typically via a letter or email, stating your intention to file for vehicle diminished value.

Step 2: Gather All Your Documentation

This is where most claims are either won or lost. You must collect the evidence that will form the foundation of your claim. Your objective is to assemble a file so comprehensive that it leaves no room for doubt.

Ensure your documentation package includes:

- The Police Report: This official record of the accident identifies the at-fault party.

- Repair Invoices and Estimates: This combined documentation clearly illustrates the extent of the damage.

- Photos and Videos: Visual evidence is powerful. Collect every photo taken at the scene, during repairs, and after completion.

- VehicleTitle and Registration: Simple proof of your ownership of the car.

- Pre-Accident Maintenance Records: These records help establish its excellent pre-accident condition and value.

Step 3: Get a Certified Appraisal Report

This is the single most crucial component of your entire claim. You need an objective, expert valuation from an independent source—something the insurance company cannot easily dismiss.

An independent appraisal is not merely a suggestion; it is your primary piece of evidence. It transforms your claim from a simple request into a data-driven demand, providing the insurance adjuster with a defensible figure to consider.

A professional report from a service like SnapClaim handles the heavy lifting. It analyzes real-time market data, compares your vehicle to similar undamaged cars, and delivers a clear, defensible calculation of your vehicle diminished value. This report serves as your leverage.

Step 4: Draft and Submit Your Demand Letter

With your appraisal and evidence file prepared, it’s time to submit your formal demand. The demand letter is a professional document that outlines your case and officially requests a specific dollar amount based on your appraisal.

Keep your letter concise and focused on the facts. It must include:

- Your Information: Name, contact details, and the claim number.

- VehicleDetails: The year, make, model, and VIN.

- Accident Summary: A brief overview of the date, location, and determination of fault.

- The Demand: Clearly state the vehicle diminished value amount you are claiming.

- Supporting Documents: Indicate that you have enclosed copies of all your evidence.

Send the complete package to the insurance adjuster via certified mail with return receipt requested. This provides undeniable proof of delivery.

How to Negotiate with the Insurance Adjuster

Engaging in a negotiation with an insurance adjuster can feel daunting. They handle claims daily, and their primary role is to protect their company’s financial interests—not yours. However, you can effectively level the playing field. With the right evidence and a well-defined strategy, you can successfully advocate for the vehicle diminished value you are owed.

Approach it this way: your objective is not to argue, but to present a fact-based case for a legitimate financial loss. Your independent appraisal serves as the solid foundation for this entire discussion.

Prepare for the Conversation

Before you even consider contacting them, get mentally prepared and organize your documents.

- Review Your Evidence: Keep your certified appraisal from a trusted source like SnapClaim readily accessible. Familiarize yourself with the key figures and arguments presented in your report.

- Set a Goal: Understand what you are aiming to achieve. Your appraisal provides a target, so determine the minimum settlement amount you are willing to accept.

- Document Everything: Maintain a log of all phone calls and emails. Record the date, time, the name of the individual you spoke with, and a brief summary of the conversation.

Master the Negotiation Itself

Once the conversation begins, maintain a polite, professional, and firm demeanor. You are not requesting a favor; you are presenting a claim for a real financial loss. The adjuster is trained to question and minimize your claim, so be prepared to counter their standard talking points with the facts from your appraisal.

Here’s how to handle common objections:

Adjuster: “Our internal formula indicates your vehicle diminished value is only $500.”

You: “I understand you utilize internal formulas, but these often do not accurately reflect the current used car market. My certified appraisal is based on real-world sales data for vehicles similar to mine, documenting a loss of [Your Appraisal Amount]. Could you please identify any specific inaccuracies in my report’s methodology?”

Adjuster: “Your car was repaired flawlessly, so there is no loss in value.”

You: “The repair work was excellent, but high-quality repairs cannot erase the accident history that is now permanently associated with my vehicle’s VIN. As my appraisal demonstrates, informed buyers will pay significantly less for a car with a documented crash history. My claim is intended to recover that specific loss.”

Regardless of their arguments, consistently redirect the conversation back to the evidence presented in your appraisal. A professional report empowers you to stand firm and provides the adjuster with a justifiable reason to increase their offer.

Understanding State Laws and Legal Rules

Navigating a vehicle diminished value claim can be complex due to varying state regulations. Your ability to recover your car’s lost value depends heavily on your state’s laws and, crucially, on establishing fault for the accident.

The most significant legal consideration is the distinction between a first-party and a third-party claim.

First-Party vs. Third-Party Claims

While the terminology may sound technical, it simply refers to whom you are submitting the claim against.

- First-Party Claim: This is a claim you file with your own insurance company. Regarding diminished value, this avenue is almost always unsuccessful, as most policies explicitly exclude coverage for the loss of value to your own vehicle.

- Third-Party Claim: This is a claim you file against the at-fault driver’s insurance company. This is the standard procedure for nearly all successful diminished value claims. The negligence of their driver caused your financial loss, making their liability insurance responsible for making you whole.

Consequently, proving the other driver’s liability for the crash is the essential first step.

State-Specific Rules Matter

While the third-party claim process is standard, other regulations can differ significantly. Every state has a statute of limitations—a legal deadline that commences on the date of the accident. If you fail to file your property damage claim within this timeframe, you forfeit your right to any recovery.

It is vital to be aware of your rights within your specific jurisdiction. While we provide the tools to substantiate your claim, we are not a legal firm and cannot offer legal advice. Understanding your state’s guidelines is paramount.

To assist you in getting started, SnapClaim has compiled guides detailing the rules for various locations. You can find your state’s specific diminished value laws here to determine their applicability to your case. For a broader understanding of consumer rights, the National Association of Insurance Commissioners (NAIC) offers a valuable, unbiased resource for policyholders nationwide.

Frequently Asked Questions About Vehicle Diminished Value

We’ve covered the essential aspects of recovering compensation for your vehicle’s diminished value, but you may still have some lingering questions. Let’s address some of the most common inquiries.

Can I file a diminished value claim if I caused the accident?

In almost all situations, the answer is no. A vehicle diminished value claim is typically classified as a “third-party claim,” meaning you submit it to the at-fault driver’s insurance. Your own insurance policy (a “first-party claim”) generally excludes coverage for your car’s loss in resale value.

Is there a deadline for filing my claim?

Yes, absolutely. States impose a “statute of limitations” for property damage claims, which can range from one to several years following the accident. It is advisable to initiate your claim as soon as your vehicle repairs are completed to ensure you do not miss this critical timeframe.

What if my car is leased or I have a loan on it?

You can and should still file a claim. An accident history reduces your car’s value, but your loan or lease balance remains unchanged. A successful diminished value claim provides the funds to cover that discrepancy, helping you avoid being “underwater” when it’s time to sell or trade in the vehicle.

About SnapClaim

SnapClaim is a premier provider of expert diminished value appraisals. Our core mission is to equip vehicle owners with the data-driven evidence necessary to recover the full financial loss incurred after an accident. We utilize cutting-edge technology and extensive industry expertise to produce accurate, defensible reports that empower you to negotiate confidently with insurance companies. With a steadfast commitment to transparency and customer satisfaction, SnapClaim streamlines the intricate process of claiming diminished value, ensuring you receive the compensation you rightfully deserve.

Ready to move beyond guesswork and start proving your claim? The dedicated team at SnapClaim is prepared to provide the certified, data-driven appraisal report essential for confident negotiation. Our reports offer the proof needed to strengthen your claim, and with our money-back guarantee, you can begin the process risk-free.