If you’re the one who caused an accident, liability insurance is what pays for the other person’s damages—not your own. Think of it as a financial shield protecting your personal assets, stepping in to cover the costs you’re legally responsible for after a crash. Understanding what liability insurance covers is key to protecting yourself on the road.

Your Financial First Line of Defense

Knowing what does liability insurance cover is the first step toward safeguarding your savings and your future. At its core, this coverage is split into two simple but critical categories that deal with the harm you cause to others.

The Two Pillars of Liability Coverage

It’s a common misconception, but liability insurance doesn’t pay for your own car repairs or medical bills. Its entire job is to handle the expenses for the other party involved in an accident where you were at fault.

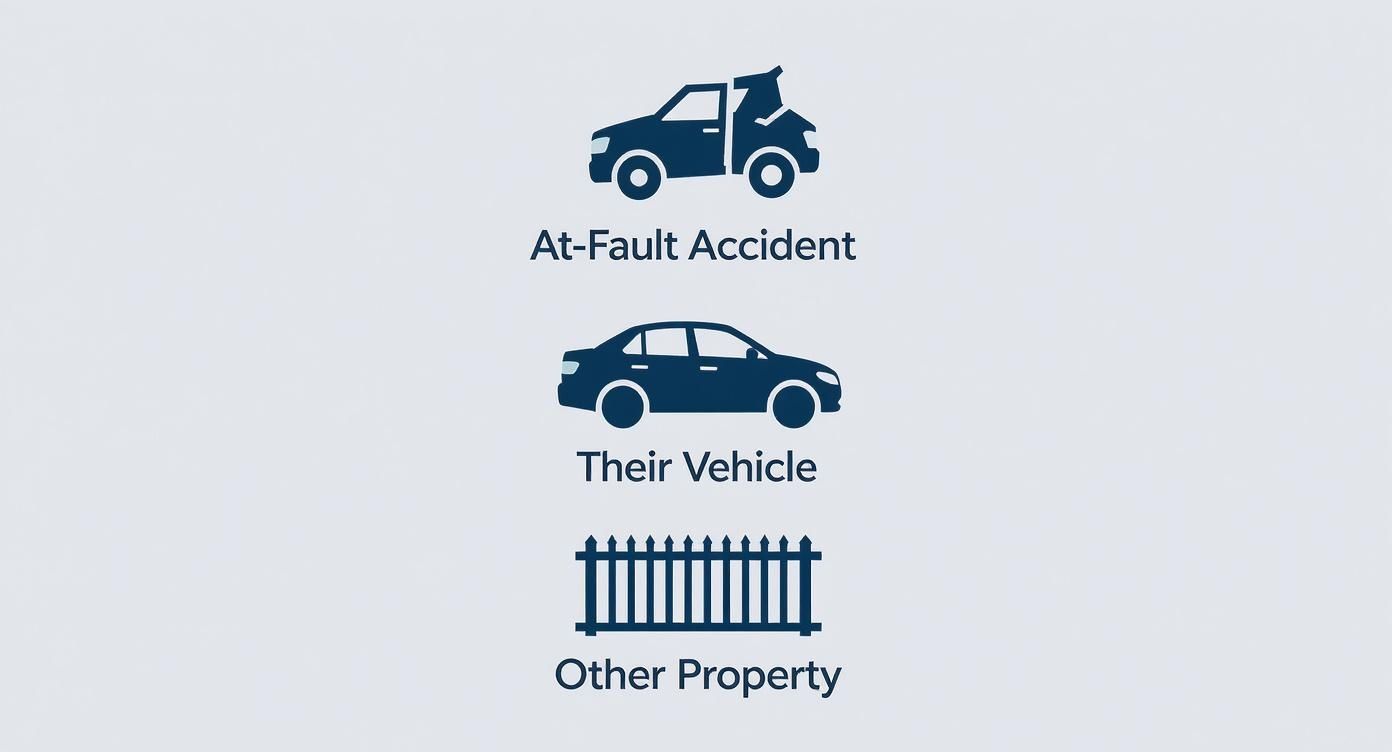

Here’s a quick look at what it pays for:

- Bodily Injury Liability (BI): This is for the people. BI covers the other person’s medical bills, which can include everything from ambulance rides and hospital stays to lost wages if they can’t work. If they decide to sue, it can also cover your legal fees.

- Property Damage Liability (PD): This is for the stuff. PD pays to repair or replace the other driver’s car. It also covers damage to other property you might have hit, like a fence, a mailbox, or even a storefront.

To give you a better idea of just how complex liability claims can get, it can be helpful to look at major legal cases, such as these product liability case examples, which show how liability is determined and defended in the real world.

Let’s break that down into an even simpler format.

Liability Insurance Coverage at a Glance

This table offers a quick summary of what liability insurance pays for when you’re at fault in an accident.

| Coverage Type | What It Covers for the Other Party |

|---|---|

| Bodily Injury (BI) | Medical bills, hospital stays, lost income, and legal fees. |

| Property Damage (PD) | Vehicle repairs or replacement, plus damage to other property. |

This protection is essential, preventing you from having to drain your savings to pay for what can be astronomical costs.

Ultimately, carrying enough liability coverage is non-negotiable for any responsible driver. Without it, a single bad day on the road could put your financial stability at risk for years to come.

A Deeper Look at What Bodily Injury Liability Covers

When someone gets hurt in an accident you caused, the bills can start piling up faster than you can imagine. This is where your Bodily Injury (BI) liability coverage comes in. Think of it as your financial shield against the massive costs that come with injuring another person.

Let’s paint a picture. You’re in stop-and-go traffic and accidentally rear-end the car in front of you. The other driver gets out clutching their neck and needs an ambulance. Right away, your BI coverage gets to work, covering the ambulance ride and their initial trip to the ER. But its job is far from over.

Covering Costs Beyond the ER

The real financial pain of an injury often lingers long after the crash. Bodily Injury liability is designed to handle these ongoing, and often hidden, expenses.

It’s not just about the first hospital bill. It can also cover:

- Follow-Up Medical Care: Think weeks of physical therapy, multiple chiropractor visits, or appointments with specialists.

- Lost Wages: If the injured person can’t work for a month while they recover, BI can compensate them for that lost paycheck.

- Pain and Suffering: This is for the non-financial toll—the physical pain and emotional distress the injury caused.

These costs can easily skyrocket into the tens or even hundreds of thousands of dollars. Without enough BI coverage, you’d be on the hook for that bill personally. That could mean draining your savings or even losing your assets.

A single serious accident can have devastating financial consequences. This is why understanding what does liability insurance cover isn’t just about being legal—it’s about protecting your entire financial future.

The Rising Cost of Accidents

Accident claims are getting more frequent and a lot more expensive. In fact, motor vehicle incidents were behind nearly half of all liability payouts in the U.S. in 2023. That number alone shows just how serious the financial risk has become for every single driver on the road.

You can discover more about these liability insurance statistics to see just how much things have changed. In today’s world, having strong BI coverage isn’t a luxury; it’s a necessity to keep you financially safe when the worst happens.

Understanding Property Damage Liability

While Bodily Injury coverage deals with the human side of an accident, Property Damage (PD) Liability is all about fixing or replacing whatever you hit. Think of it as the part of your insurance that pays for the other person’s stuff when you’re the one at fault.

Most of us immediately think of the other driver’s car, and that’s definitely the most common claim. If you cause a wreck, your PD liability is what pays the repair bills for their vehicle. If the car is too banged up to fix—what the industry calls a total loss—your policy pays to replace it, up to whatever limit you’ve chosen.

It’s Not Just About Other Cars

But PD liability is much broader than just covering other vehicles. Its protection kicks in for almost any kind of property you might damage with your car. Life happens, right?

Here are a few common scenarios where it saves the day:

- Stationary Objects: Ever seen someone back into a neighbor’s garage door, clip a fence, or take out a mailbox? That’s PD.

- Public Property: It also covers damage to things like street signs, guardrails, or city landscaping.

- Commercial Property: It even applies if you accidentally drive into a storefront or shatter an expensive sign.

In every one of these situations, your Property Damage liability is the financial shield that keeps you from paying for those costly repairs out of your own pocket. It’s a non-negotiable safety net for those expensive, unexpected moments.

The Hidden Cost Your PD Policy Misses

Here’s something crucial to understand: your PD liability pays to repair the other person’s car, but it doesn’t cover the hit to its resale value. This is called diminished value. Even a perfectly repaired car is worth less on the market simply because it now has an accident history.

The other driver is often entitled to file a separate diminished value claim to recover that lost value. To do that, they’ll need a professional car appraisal after an accident to prove exactly how much their vehicle’s value dropped. This expert report is their key to negotiating a fair settlement with your insurance company.

How to Read Your Policy Limits

When you first glance at your car insurance policy, you’ll probably see a string of numbers that looks something like 50/100/50. These aren’t just random digits; they are your policy limits, and they are the heart of your liability coverage.

Think of them as the absolute maximum your insurance company will pay out if you’re found at fault in an accident. Getting a handle on what these numbers mean is crucial to understanding just how protected you really are.

Decoding Your Liability Limits

It helps to imagine these three numbers as separate pools of money your insurer sets aside for any claim you might cause. Let’s stick with that common 50/100/50 example to break it down.

- First Number (50): Bodily Injury Liability Per Person. This means your insurer will pay a maximum of $50,000 for injuries to any single person in an accident you cause.

- Second Number (100): Bodily Injury Liability Per Accident. This is the total cap your insurer will pay for injuries for the entire accident, no matter how many people get hurt. In this case, that total is $100,000.

- Third Number (50): Property Damage Liability Per Accident. This is the most your insurer will pay for all property damage you cause in one go, capped here at $50,000.

Property damage isn’t just about fixing the other driver’s car. It covers a lot more than you might think.

As you can see, if you hit someone’s car and it then crashes into their fence, both are covered under your property damage limit.

What Happens When Damages Exceed Your Limits?

This is where things get serious. Let’s say you cause a multi-car pile-up. The aftermath is messy: one person’s medical bills hit $60,000, another’s are $50,000, and you’ve caused $70,000 in damage to a few vehicles.

With your 50/100/50 limits, here’s how the math plays out:

Your insurance pays $50,000 for the first person (hitting the per-person limit). It pays $50,000 for the second person (now you’ve maxed out the $100,000 per-accident limit). And it pays $50,000 for property damage. You are now personally on the hook for the remaining $30,000.

That’s a big deal. This scenario is exactly why just carrying your state’s minimum required coverage is a massive financial gamble. A single bad accident can blow past those low limits in a heartbeat, leaving your savings, home, and other personal assets completely exposed to a lawsuit.

To check what your state requires, a good starting point is your local insurance commissioner’s website.

What Liability Insurance Will Not Cover

Understanding what your liability insurance covers is only half the battle. Knowing what it doesn’t cover is where you can save yourself a lot of headaches and financial pain down the road.

The single biggest surprise for most drivers? Liability insurance does not cover damage to your own vehicle. If you cause an accident, you’ll need a totally separate coverage—called Collision—to handle your own repair bills. Think of liability as outward-facing protection, only paying for others’ damages.

Likewise, liability won’t touch your own medical bills after a crash you caused. That’s a job for other parts of your policy, like Medical Payments (MedPay) or Personal Injury Protection (PIP), depending on where you live. Getting these distinctions right is crucial for building an insurance plan that actually protects you.

Common Policy Exclusions

Liability insurance is designed to cover accidents—unexpected, unintentional events. That means there are a handful of specific situations where it simply won’t step in. Being aware of these common exclusions can help you avoid a denied claim when you least expect it.

Here are the big ones your liability policy will almost certainly not pay for:

- Intentional Acts: If you deliberately cause damage or injury with your vehicle, you’re on your own. Insurance is for accidents, not for acts of road rage or intentional harm.

- Business Use: Using your personal car for commercial activities like delivering pizzas or driving for a rideshare app is a major no-go. You’ll need a commercial policy or a specific endorsement for that kind of work.

- Your Own Property: While it protects you from claims by others, liability won’t cover damage to your own stuff. For niche things like lost or stolen car keys, you’d need a separate, dedicated policy like the one detailed in this guide on Car Key Replacement Insurance Explained.

- Diminished Value for Your Car: Your policy will never pay you for your own car’s loss in value after a crash you caused. You can only explore what is a diminished value claim when another insured driver is at fault for hitting your car.

The global general liability market is expected to hit a staggering $329.60 billion in premiums by 2025. This massive figure is fueled by a growing awareness of just how complex and costly legal liabilities have become. In a world where lawsuits are common, knowing exactly what your policy excludes is more critical than ever.

Protecting Your Financial Interests After a Claim

So, you understand what does liability insurance cover. Now comes the hard part: making sure you’re paid fairly when the other driver is at fault. Their liability insurance is supposed to make you whole again, but let’s be realistic—the insurer’s primary goal is to pay out as little as possible.

This is where the real fight begins. If you want fair compensation for a total loss or your car’s diminished value, you need stone-cold proof of what your vehicle was really worth before the crash. Without it, you’re walking into a negotiation unarmed.

Proving Your Vehicle’s True Value

An insurer’s first offer is almost always a lowball. It’s based on their internal valuation models, which are designed to save them money, not give you a fair shake. To counter this, you need an independent, certified appraisal that shows them the hard data. This is exactly where SnapClaim comes in, providing expert reports that put leverage back on your side.

In the U.S., the liability insurance market is constantly squeezed by rising claim costs, which gives insurers even more motivation to minimize every single payout. It’s a different story in other global markets with unique economic pressures, which you can read more about in this global insurance market overview.

An appraisal report is your most powerful tool. It provides the objective, market-based evidence needed to demand the compensation you rightfully deserve and can be essential if you face a situation where your car insurance claim is denied.

We make this process completely risk-free with our Money-Back Guarantee: if your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee — guaranteed. Get your free estimate and see what you’re owed today.

Frequently Asked Questions

Here are quick answers to some of the most common questions vehicle owners have about what liability insurance covers.

Is state-minimum liability coverage enough?

While carrying your state’s minimum liability insurance keeps you legal, it’s almost never enough to cover the costs of a serious accident. A single crash can easily blow past typical minimums, leaving your personal assets at risk. To be truly protected, most experts suggest much higher limits—something like 100/300/100 is a good starting point to shield your assets.

Does my liability insurance cover a rental car?

For the most part, yes. Your personal auto policy’s liability coverage usually extends to a rental car you’re driving for personal reasons within the U.S. and Canada. However, it’s always a good idea to check with your agent before you travel, as certain situations (like renting a moving truck) might not be covered.

What’s the difference between liability and full coverage?

“Full coverage” is a common term for a policy that bundles three key protections: Liability, Collision, and Comprehensive insurance. Liability pays for the other person’s damages, while Collision and Comprehensive pay to repair your car after a crash or other incidents like theft or hail.

Can I claim diminished value if the accident wasn’t my fault?

Yes. If the other driver was at-fault, you have the right to file a diminished value claim against their liability insurance policy. This claim seeks compensation for the loss in your vehicle’s resale value due to its accident history. A certified appraisal from SnapClaim provides the data-backed proof you need to negotiate a fair payout.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This article was reviewed by SnapClaim’s team of certified auto appraisers and claim specialists with years of experience preparing court-ready reports for attorneys and accident victims. Our content is regularly updated to reflect the latest industry practices and insurer guidelines.

Get Started Today

Ready to prove your claim? Generate a free diminished value estimate in minutes and see how much you may be owed.

👉 Get your free estimate today