After a car accident, hearing the words “total loss” from your insurance adjuster can be overwhelming. You’re left wondering what it means and, more importantly, if you’ll get a fair payout. Understanding your total loss estimate is the first step toward taking control of the process and getting the money you deserve.

So, what exactly is a total loss estimate? It’s the insurance company’s calculation of what your car was worth moments before the crash. They call this its Actual Cash Value (ACV), and this single number is the foundation for your entire settlement.

What a Total Loss Estimate Really Means for You

When an insurer declares your vehicle a total loss, they’ve decided it’s cheaper to pay you its value than to repair it. This isn’t just about how bad the damage looks—it’s a straightforward financial calculation.

The core of this calculation is the Actual Cash Value (ACV). Think of it as the fair market price for your car right before the accident, considering its exact year, make, model, condition, and mileage.

The Total Loss Formula

Every insurance company uses a variation of the same basic formula. A vehicle is typically declared a total loss when:

- Cost of Repairs + Salvage Value > Actual Cash Value (ACV)

Let’s break that down in simple terms:

- Cost of Repairs: The total amount needed for parts and labor to fix the vehicle.

- Salvage Value: What the insurance company can get by selling the wrecked car to a salvage yard.

- Actual Cash Value (ACV): The market value of your vehicle right before the accident.

If the cost to fix your car plus its salvage value is more than its pre-accident worth, the insurer will “total” it. The exact rules can vary by state, so it’s a good idea to check the total loss threshold for your area in our guide to state insurance laws.

An insurer’s initial total loss estimate is their opening offer, not the final word. It’s a starting point for a negotiation, and your evidence is crucial for reaching a fair settlement.

Getting an accurate valuation is more important than ever. With vehicle and repair costs on the rise, a lowball offer can leave you without enough money to buy a comparable replacement. You can learn more about global insurance trends from trusted sources like the World Economic Forum.

How Insurers Determine Your Vehicle’s Value

Insurance companies often present their valuation as a final, non-negotiable number. But it’s crucial to understand that their first offer is just that—an offer. Knowing how they calculate your vehicle’s Actual Cash Value (ACV) is your best tool for ensuring their total loss estimate is fair.

The calculation should go far beyond the basic make, model, and year. The real value is found in the details that made your car unique.

Beyond the Basics: What Makes Your Car Unique

A fair valuation should reflect a complete picture of your vehicle just before the accident. This means digging into key factors that can significantly impact the final number.

Was your car kept in excellent condition, or did it have some prior cosmetic issues? Did you recently invest in new tires, brakes, or a premium sound system? These are the details that separate your car from a generic one listed in a pricing guide.

The insurer’s first offer is a starting point for negotiation, not the final word. Every detail, from your car’s maintenance history to local market trends, can be used to build a case for a higher payout.

Let’s break down exactly what adjusters should be looking for.

Key Factors in Your Vehicle’s Total Loss Valuation

Insurers look at several factors to determine your vehicle’s pre-accident value. While the make and model are the starting point, its specific condition, features, and recent maintenance have a major impact. Understanding these elements is the first step in knowing if the insurer’s offer is fair.

| Valuation Factor | Why It Matters | How It Affects Your Estimate |

|---|---|---|

| Mileage | A primary indicator of wear and tear. | Lower-than-average mileage typically increases value; high mileage decreases it. |

| Overall Condition | Reflects the car’s pre-accident state. | Excellent condition adds value, while pre-existing damage or excessive interior wear will lead to deductions. |

| Recent Upgrades | Investments you made that add real value. | New tires, a sound system, or significant mechanical repairs can increase your payout, but you’ll need receipts as proof. |

| Trim Level & Options | Not all models are created equal. | A fully-loaded model with a sunroof, leather seats, and advanced safety features is worth much more than a base model. |

These factors combine to create a unique value for your specific car. That’s why you can’t rely on a generic online calculator to know what your car was truly worth.

The Role of Third-Party Valuation Services

Here’s an industry secret: most insurance companies don’t calculate your car’s value themselves. They use reports from large third-party data companies like CCC Intelligent Solutions or Audatex. These services generate automated reports by pulling data on “comparable” vehicles sold in your area.

While this is efficient for the insurer, it’s often not accurate for you. These automated systems can easily miss the crucial details that made your car special, like a premium trim package or recent upgrades. This is a primary reason why that first offer often feels so low.

Why Local Market Demand Matters

Where you live plays a bigger role than you might think. A four-wheel-drive SUV is typically worth more in a state with harsh winters than it is in a warm climate. It’s simple supply and demand.

Insurance valuation reports are supposed to use local comparable vehicles, but sometimes they pull data from hundreds of miles away, which can unfairly lower your total loss estimate.

Challenging these reports requires proof. This is where an independent appraisal from a service like SnapClaim becomes a game-changer. Our certified reports provide a detailed, market-correct valuation that provides the proof needed to negotiate fair compensation. We’re so confident we can help strengthen your claim that we offer a money-back guarantee. If you don’t recover at least $1,000 more from the insurance company, we’ll refund your appraisal fee. For more information on vehicle regulations that can influence value, official resources like the NHTSA are always a reliable source.

Why Your First Settlement Offer Is Often Too Low

You get the call from the adjuster, see their offer for your total loss estimate, and your stomach drops. The number feels completely disconnected from the car you knew and drove every day. You’re not wrong to feel that way.

The first offer is rarely the insurance company’s best offer. Think of it as their opening bid in a negotiation—one designed to minimize their payout. Insurers are businesses, and controlling claim costs is their priority. Once you understand their playbook, you can prepare to get what your car was actually worth.

Spotting Red Flags in the Valuation Report

Your first step is to request a copy of their valuation report. This document is their “proof” for the low offer, and it’s often filled with errors and questionable assumptions that lower your vehicle’s value.

Learning to spot these red flags is key to a successful negotiation. Here are three of the most common issues:

- Using bad “comps”: They may compare your car to others from a different city, or pick ones with fewer features or in worse condition.

- Ignoring recent investments: Did you just buy new tires or have major engine work done? Insurers often overlook these investments.

- Applying excessive deductions: They might deduct hundreds of dollars for minor, pre-existing scratches or normal wear and tear that had little impact on your car’s real market value.

These aren’t just small details; they can add up to thousands of dollars they’re trying to keep in their pockets instead of putting in yours.

The Problem with Distant Comparable Vehicles

One of the most common ways insurers undervalue a vehicle is by using inappropriate comparable vehicles, or “comps.” To get an accurate value, they should be looking at similar cars sold recently in your local market. A car’s value in Los Angeles is very different from its value in Omaha.

Adjusters often expand their search radius by hundreds of miles to find cheaper examples that support their low number. It’s an apples-to-oranges comparison that is almost always in their favor.

Remember this: the insurer’s first offer is a starting point, not the final word. It’s an invitation to provide your own evidence and advocate for the true value of your vehicle.

This is especially true as insurers face increasing financial pressure from large-scale events. For example, you can read about the impact of natural catastrophes in reports from organizations like the Swiss Re Institute. This pressure can trickle down to how they handle individual claims like yours.

Overlooked Upgrades and Excessive Deductions

If you spent $1,200 on new tires or $800 on a brake job a month before the crash, don’t expect their automated valuation system to catch it. Unless you provide receipts as proof, that money often disappears from your settlement.

At the same time, they can be overly aggressive with deductions for minor dings or stains. Your job is to challenge these deductions with evidence of your car’s great pre-accident condition.

This is exactly why an independent, certified appraisal from SnapClaim is so effective. Our detailed reports give you undeniable proof of your vehicle’s true fair market value, arming you with the leverage you need to negotiate. Plus, our money-back guarantee means there’s zero risk—if our report doesn’t help you recover at least $1,000 more, we refund your appraisal fee in full.

A Practical Guide to Disputing a Low Offer

Getting a low settlement offer isn’t the end of the road—it’s the start of a negotiation. Think of the insurance company’s initial total loss estimate as their starting bid. With the right strategy, you can effectively challenge their numbers and fight for what your car was actually worth.

This isn’t about arguing with the adjuster. It’s about building a clear, fact-based case that they can’t ignore. When you approach it methodically, you shift the power dynamic and negotiate from a position of strength.

Step 1: Request the Full Valuation Report

First, ask the insurance company for a complete copy of their valuation report. You have every right to see it. It’s often generated by a third-party service like CCC or Audatex, and it’s the foundation of their offer.

Once you have it, go through it line by line. Look at the “comparable” vehicles they chose. Did they get the trim level right? Did they miss any options? Scrutinize every deduction they made. This report is where you’ll find the errors that are lowering your payout.

Step 2: Build Your Evidence File

Now it’s time to assemble your counter-argument. Your goal is to create a file—digital or physical—that proves your vehicle’s real, pre-accident value. Documentation is your best weapon.

Gather the following to build a rock-solid case:

- Maintenance Records: Proof of regular oil changes or recent mechanical work shows you took great care of the vehicle.

- Receipts for Upgrades: Did you recently buy new tires, install a new stereo, or add a remote starter? Receipts are undeniable proof of added value.

- Pre-Accident Photos: If you have pictures showing your car was in great shape before the crash, they become powerful tools to push back against unfair deductions.

This evidence replaces the insurer’s assumptions with facts, making it much harder for them to stick to a lowball total loss estimate.

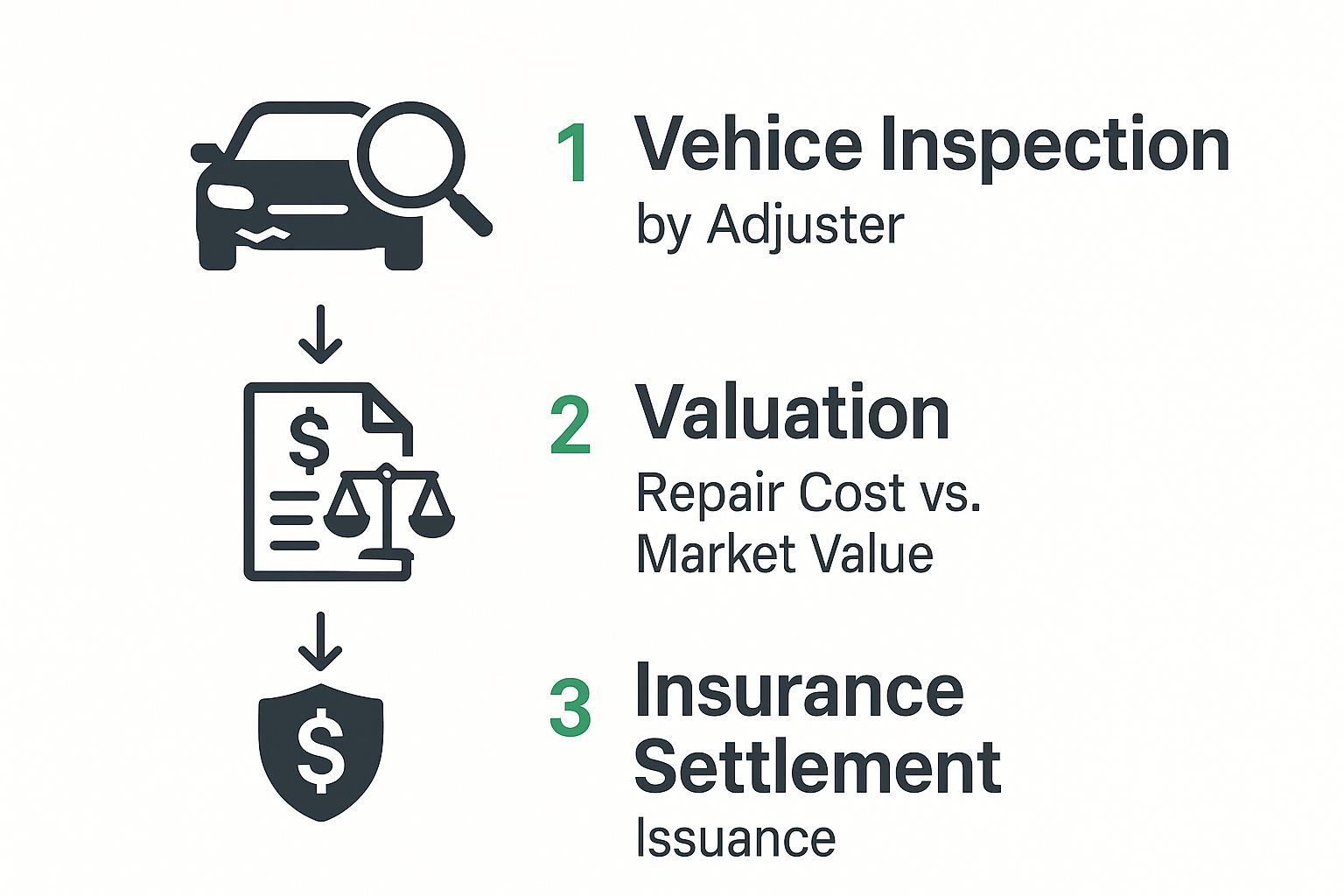

The total loss process follows a predictable path, from inspection to settlement offer.

The key moment where things often go wrong is the valuation step. That’s why having your own proof is so critical to getting a fair outcome.

Step 3: Find Your Own Comparable Vehicles

Don’t just accept the insurer’s “comps.” They have an incentive to find the cheapest examples. Do your own research to find vehicles that are a true match for the one you lost. Search online auto listings in your local geographic area for the exact same make, model, year, and trim.

Look for cars with similar mileage and options. Save screenshots of these listings, paying close attention to the private party asking prices—they often reflect the true market value better than dealer prices. This real-world data gives you a powerful benchmark for what it would cost to replace your car. You can also use official resources like the National Highway Traffic Safety Administration (NHTSA) to confirm specific vehicle features.

Step 4: Craft a Professional Counter-Offer

With your evidence in hand, it’s time to present your case. Draft a professional letter or email to the adjuster. Leave emotion out of it and stick to the facts.

Your letter should:

- Clearly state that you reject their initial offer.

- Point out the specific errors you found in their valuation report.

- Present your evidence—the comparable vehicle listings, receipts, and photos.

- End with your counter-offer: a specific dollar amount based on your research.

Always keep your communication in writing to create a clear paper trail. This documented, evidence-based approach shows the insurer you’re serious and well-prepared.

Using an Independent Appraisal to Secure a Fair Payout

You’ve presented your evidence, but the insurance adjuster won’t budge on their low total loss estimate. It can feel like hitting a brick wall. This is a common tactic designed to make you give up.

But this is not the end of the road. When your own efforts aren’t enough, an independent appraisal becomes your most powerful tool to level the playing field.

Think of it this way: the insurance company has their expert—the adjuster. An independent appraisal gives you your own expert, backed by unbiased, professional proof that strengthens your position.

The Power of an Unbiased Third-Party Opinion

An independent appraisal is a detailed valuation of your vehicle’s true fair market value, performed by a certified expert. Unlike the insurer’s report, which serves the company’s bottom line, an independent appraisal has one goal: to determine an accurate, pre-accident value.

This isn’t just a second opinion. It’s a formal, evidence-based document that carries weight in negotiations. Handing over a professional appraisal report shows you’re serious and have the facts to prove your counter-offer is correct.

A certified independent appraisal shifts the negotiation from a frustrating debate of opinions to a fact-based discussion. It replaces the insurer’s lowball number with a credible, market-correct valuation they can’t easily dismiss.

Insurers are facing pressure from major events, which can make them tougher on individual claims. According to reports like Aon’s catastrophe loss report on Artemis.bm, insured losses from catastrophic events have been at near-record highs. This is why having credible, expert proof is more critical than ever to ensure your claim is handled fairly.

How a SnapClaim Report Gives You Leverage

At SnapClaim, our experts conduct a meticulous analysis to create a comprehensive report that gives you the leverage you need. Here’s what makes our process so effective:

- USPAP-Compliant Analysis: Our reports follow the Uniform Standards of Professional Appraisal Practice (USPAP), the gold standard for ethics and performance in the appraisal industry. This makes our valuations credible and defensible.

- Hyper-Local Market Data: We dig deep into your specific local market to find truly comparable vehicles, ensuring your car’s value reflects what’s actually happening in your area.

- Detailed Adjustments: We account for everything—from your vehicle’s condition and mileage to any recent upgrades or maintenance. We build a complete picture of its true worth.

A SnapClaim report is a court-ready document that systematically proves your vehicle’s fair market value. When you present this level of detail, you force the insurer to justify their lowball offer against a certified, professional valuation.

Our No-Risk, Money-Back Guarantee

We understand that paying for an appraisal can feel like a risk, especially when you’re already dealing with the financial stress of an accident. That’s why we stand behind our work with a simple, no-risk guarantee.

If your SnapClaim appraisal report doesn’t help you recover at least $1,000 more from the insurance company than their last offer, we will fully refund your appraisal fee. No questions asked.

This guarantee removes all the risk, letting you challenge your insurer’s low total loss estimate with complete confidence. You either walk away with a much larger settlement, or you get your money back.

Your Next Steps Toward a Fair Total Loss Settlement

Dealing with the aftermath of an accident is stressful, but you have the right and the ability to question your insurer’s total loss estimate. You don’t have to accept an offer that feels too low. Pushing for the full compensation you’re owed is a manageable process when you’re prepared.

It all comes down to a few key actions: understanding how your vehicle’s value is calculated, gathering your own proof of its worth, and bringing in an expert if the insurance company won’t negotiate fairly. You now have the knowledge to handle this with confidence.

Take Control of Your Claim Today

Don’t leave money on the table or settle for less than your vehicle was worth. The most effective way to strengthen your position is to present undeniable, professional proof that your insurer can’t ignore. An independent appraisal report provides the evidence needed to support your claim.

Here’s what you can do right now:

- Get a Free fair market value or total loss Estimate: Visit SnapClaim for a quick, no-obligation estimate of your vehicle’s fair market value. This will give you an immediate idea of where you stand.

- Order a Certified Appraisal Report: For the strongest negotiation tool available, order a certified, USPAP-compliant appraisal. Our detailed reports provide the hard evidence needed to challenge a lowball offer and get what you’re truly owed.

With our money-back guarantee, there’s absolutely no risk. If our report doesn’t help you recover at least $1,000 more from the insurance company, we’ll refund your fee.

Don’t let the insurance company have the final say. Rear more about total loss and next step with SnapClaim and secure the fair total loss settlement you deserve.

Frequently Asked Questions About Total Loss Claims

Dealing with a total loss claim can be confusing. Here are straightforward answers to some of the most common questions from vehicle owners.

What happens if I still owe money on my car?

This is a common and stressful situation. When an insurer totals your car, their payout is based on its Actual Cash Value (ACV), not your loan balance. That settlement check goes directly to your lender first. If the insurance payout is less than what you owe, you are responsible for paying the difference. This is where Guaranteed Asset Protection (GAP) insurance comes in. If you have GAP coverage, it’s designed to cover that “gap” between the insurance payout and your remaining loan balance.

Can I keep my car if it is declared a total loss?

In most states, yes, you have the option to keep your vehicle through a process called owner retention. If you choose this, the insurance company pays you the car’s ACV minus its salvage value (what they would have received by selling the wreck). However, be aware that your vehicle will be issued a salvage title, which makes it very difficult to insure or sell in the future. You will also be responsible for all repair costs to make it roadworthy again.

How long does the total loss process take?

The timeline can vary from a few weeks to several months. The speed depends on several factors, including the complexity of the accident, how responsive your insurance adjuster is, and whether you negotiate the initial offer. If you dispute the total loss estimate, the back-and-forth will naturally add time to the process. Patience and good documentation are key.

Don’t let an insurance company tell you what your vehicle was worth. At SnapClaim, we provide the certified, data-backed proof you need to fight a lowball offer and get the fair settlement you’re owed. Our process is quick, our reports are accepted by all insurers, and our money-back guarantee means there’s zero risk.

Ready to take control? Order a certified appraisal report from SnapClaim today.

About SnapClaim

SnapClaim is a leading provider of independent vehicle appraisals, specializing in total loss claims. Our mission is to empower vehicle owners and personal injury attorneys with accurate, unbiased valuations to ensure they receive fair compensation from insurance companies. Our certified appraisers utilize USPAP-compliant methodologies and hyper-local market data to deliver detailed reports that stand up to scrutiny. We are committed to transparency and customer satisfaction, offering a money-back guarantee to ensure you recover at least $1,000 more than the insurer’s initial offer, or your appraisal fee is refunded.