When an insurance company declares your car a “total loss,” their initial settlement offer is just the start of the conversation, not the end. Facing an undervalued offer can be frustrating, but you have the right to challenge it. Disputing their number is not only possible but often necessary to get the fair compensation you’re legally owed in a total loss dispute.

Step 1: Review the Insurance Company’s Offer

Understanding Your Total Loss Dispute

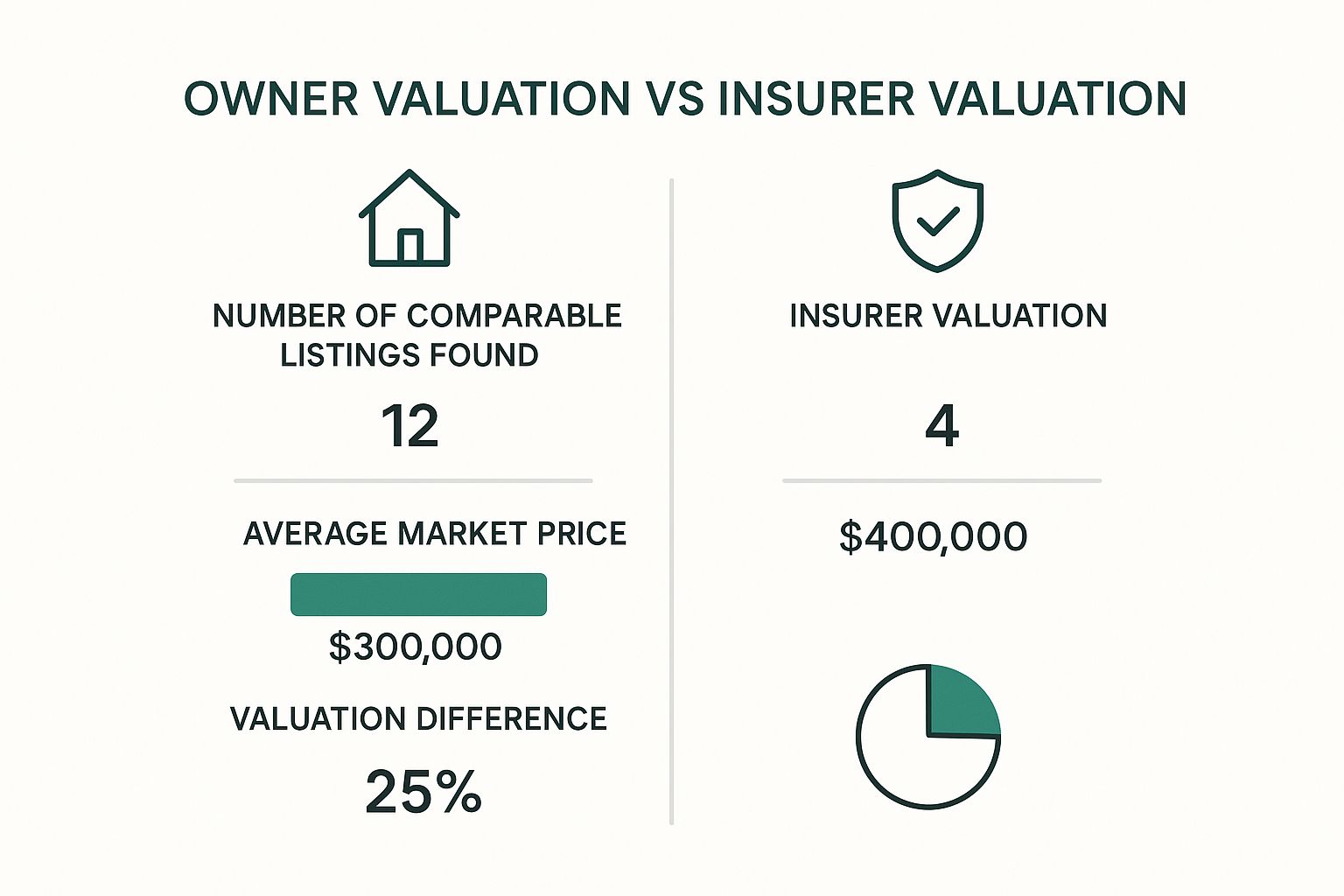

That initial offer letter can feel final, but it’s really just their opening bid. A “total loss” simply means the cost to repair your vehicle is more than its actual cash value (ACV) right before the accident. The problem is, insurance companies often use their own valuation vendors, which can miss key details and undervalue your car.

Your first move is to dissect their valuation report line by line. Treat it like a blueprint for their lowball offer and look for these common mistakes:

Wrong Trim or Package: Is your top-of-the-line model valued as a basic, no-frills version? This mistake alone can cost you thousands.

Incorrect Mileage: A simple typo can significantly reduce your car’s value.

Missing Optional Equipment: They almost never account for factory-installed extras like a sunroof, premium sound system, or tow package.

Poor Comparables: The “comps” they use might be from a different state, have higher mileage, or be in worse condition than your vehicle was.

Finding these errors is the first step in building your case for a higher payout.

Step 2: Gather Supporting Evidence

You can’t just tell the adjuster they’re wrong; you have to prove it with facts. Your mission is to paint a clear picture of your vehicle’s real, pre-accident condition and value.

Start by collecting your own records and then find real-world proof of what your car is worth.

Your Own Records are Gold

Gather everything you can that shows how well you cared for your vehicle:

Maintenance Records: Receipts for oil changes and regular service prove your car was mechanically sound.

Receipts for Upgrades: Did you recently buy new tires or replace the brakes? Every recent investment adds value.

Original Window Sticker: This is the ultimate proof of every option and package your car had from the factory.

Pre-Accident Photos: A few clear photos can instantly shut down a low “condition rating.”

Find Local Comparable Listings

Next, show the adjuster what your car is actually selling for in your local market. Search sites like Autotrader and Cars.com for vehicles that are as close a match to yours as possible in:

Year, Make, and Model

Trim Level and Major Options

Mileage

Geographic Location

Take screenshots of these listings as permanent proof. However, be prepared for the adjuster to dismiss your research. When that happens, you need the strongest form of evidence: an independent appraisal report.

Step 3: Order a Professional Appraisal Report

When an adjuster waves away your research, an independent, certified appraisal report is the most powerful tool you have. It shifts the conversation from a subjective argument to a factual, data-driven negotiation. An independent appraisal is often required to strengthen your case because it provides an unbiased Fair Market Value (FMV) built on hard data, not the insurer’s assumptions.

Traditionally, getting an appraisal was slow and expensive. That’s why SnapClaim created a fast, affordable, and risk-free way to get the professional proof you need.

Fast & Accurate: Get a certified Fair Market Value (Total Loss) appraisal in under an hour. Our reports are built on real, local market data, not just opinions.

Risk-Free: We’re so confident in our reports that we offer a 100% money-back guarantee. If the extra insurance recovery from your claim is less than $1,000, we fully refund your appraisal fee.

Ordering a SnapClaim report is the most efficient and risk-free way to get the professional evidence needed to fight for a fair settlement.

Step 4: Draft and Submit Your Dispute

With your independent appraisal in hand, it’s time to draft your official dispute letter. Keep your tone professional, polite, and fact-based. Your goal is to present new, more accurate information and make a logical request based on that evidence.

Attach your supporting documents, especially the independent appraisal report (your SnapClaim PDF is perfect for this).

Sample Dispute Letter Template

Here is a short, effective template you can adapt.

Subject: Dispute of Total Loss Settlement Offer – Claim #[Your Claim Number]

Dear [Adjuster’s Name],

Thank you for providing the valuation report for my [Year, Make, Model], VIN #[Your VIN].

After a thorough review, I must formally reject your settlement offer of $[Insurer’s Offer Amount]. The valuation does not accurately reflect my vehicle’s true fair market value in our local market.

I have obtained an independent appraisal from a certified valuation expert, which places the actual cash value of my vehicle at $[Your Appraised Value].

Please find the following documents attached for your review:

A certified Fair Market Value appraisal report from SnapClaim.

Receipts for recent upgrades and maintenance.

Based on this evidence, I am requesting a revised settlement of $[Your Appraised Value]. I am confident that once you review these materials, you will agree this is a fair and accurate valuation.

Sincerely,

[Your Name][Your Phone Number]

[Your Email Address]

Step 5: Negotiate With the Adjuster

After sending your dispute, prepare to negotiate. Stay calm, persistent, and focused on the facts. Your job is to consistently bring the conversation back to your professional appraisal report, treating it as the benchmark for a fair value.

Presenting professional, market-based data often gives adjusters the justification they need to reconsider their initial offer and approve a higher amount. Don’t be afraid to politely stand your ground.

Step 6: Escalate if Necessary

What if the adjuster refuses to budge? Don’t give up. You have several clear paths for escalation:

Invoke the Appraisal Clause: Most policies contain an “appraisal clause” that allows both you and the insurer to hire independent appraisers. If they can’t agree, a neutral third-party “umpire” makes a binding decision.

File a Complaint with Your State: You can file a complaint with your state’s Department of Insurance. These regulators oversee insurance companies and ensure they are acting in good faith. You can learn more about state-specific rules at your local DMV, like the California DMV.

Consult an Attorney: As a final step, you can speak with an attorney who specializes in total loss claims. Many work on a contingency basis, meaning you only pay if they win your case.

Understanding the Appraisal Clause

An appraisal clause is a provision commonly found in insurance policies. It serves as a mechanism to resolve disputes between the insurer and the insured regarding the value of a claim. This clause is activated when both parties cannot agree on the amount of loss or damage. When invoked, the appraisal process involves appointing an independent appraiser by each party. These appraisers then select a neutral umpire to help determine the actual value of the loss.

Invoking the Appraisal Clause

To initiate the appraisal process, the insured must typically submit a written request to the insurer. This request should outline the disagreement over the claim amount. Following this, both parties select their appraisers. The appraisers will independently assess the damage and try to reach an agreement. If they fail to agree, the umpire is called upon to make the final decision. The conclusion reached by any two of the three parties (the two appraisers and the umpire) is binding.

For further information, you can explore resources on websites such as Investopedia or Insurance Information Institute, where more detailed explanations and case studies on appraisal clauses are available.

Step 7: Fight for What You’re Owed

Disputing a lowball total loss offer is well worth the effort, and many policyholders who challenge their insurer’s valuation significantly increase their payout. By following this step-by-step guide and arming yourself with a professional appraisal, you can confidently negotiate the fair settlement you deserve. The key is to understand how market trends influence insurance payouts and use data to your advantage.

Don’t leave money on the table. Order your SnapClaim Total Loss Appraisal Report today and fight back with confidence.

Frequently Asked Questions (FAQ)

How long do I have to dispute a total loss offer?

Timelines vary by state, but you should act quickly. The most important thing is do not cash the settlement check from the insurance company, as this can be seen as accepting their offer and may end negotiations.

Can I keep my car if it’s a total loss?

Yes, in most cases. This is called an “owner-retained salvage.” The insurer will subtract the car’s salvage value from your settlement, and you keep the vehicle. However, it will be issued a salvage title, which can make it difficult to insure or sell later.

Will disputing my claim increase my insurance rates?

No. Negotiating your total loss settlement is a standard part of the claims process and your right as a policyholder. Your insurance rates are based on the accident itself, not on your efforts to secure a fair payout.

What is SnapClaim’s money-back guarantee?

We are so confident that our reports help strengthen claims that we offer a 100% money-back guarantee. If the insurance recovery from the claim is less than $1,000, SnapClaim will fully refund your appraisal fee.