If you’re wondering how to get a diminished value claim after an accident, this guide will walk you through the entire process step by step.. Even after perfect repairs, an accident leaves a permanent mark on your car’s history report, which can drag down its resale value. That loss is called diminished value, and if another driver was at fault, you have the right to get that money back. Learning how to get a diminished value claim is the key to recovering the full financial loss you suffered.

What Is Diminished Value and Why Does It Matter?

After an accident, the at-fault driver’s insurance company pays to repair your vehicle. But that only covers part of your loss. While repairs can make your car look and drive like new, they can’t erase the accident from its CARFAX or AutoCheck report. That permanent record becomes a red flag for any future buyer.

Imagine you’re shopping for a used car. You find two identical models with the same mileage and features. One has a clean history, while the other was in a collision. Which one would you choose? Most buyers would either walk away from the previously damaged car or demand a significant discount to even consider it. That discount is your car’s diminished value.

The Real-World Financial Impact

This isn’t a theoretical problem; it’s a direct hit to your wallet that can cost you thousands. For instance, a popular 3-year-old SUV with a fair market value of $32,000 before a crash could easily see its value drop to $28,400 after repairs.

That $3,600 difference is its diminished value, and it’s a loss you suffered because of someone else’s mistake. A diminished value claim is designed to recover exactly that amount. To understand the details, you can learn more about what vehicle diminished value is and how it’s calculated.

Understanding the Types of Diminished Value

To build a strong case, you need to know which type of loss you’ve experienced. Knowing which category your claim falls into is the first step toward getting the fair compensation you deserve.

Type of Diminished Value | What It Means | When It Applies | | Inherent Diminished Value | The automatic loss in value simply because the vehicle now has an accident history. | This is the most common type and applies even if repairs are flawless. | | Repair-Related Diminished Value | Additional value lost due to poor-quality repairs (e.g., mismatched paint, non-OEM parts). | Applies when the body shop’s work is subpar, further damaging the car’s value. | | Immediate Diminished Value | The loss in value right after the accident, before any repairs are made. | Less common in claims, as this is the basis for a “total loss” decision by the insurer. |

Most claims focus on Inherent Diminished Value because even the best body shop can’t erase a negative vehicle history report. This is the core of your claim and where you have the strongest argument for compensation.

How to Build a Diminished Value Claim Insurers Can’t Ignore

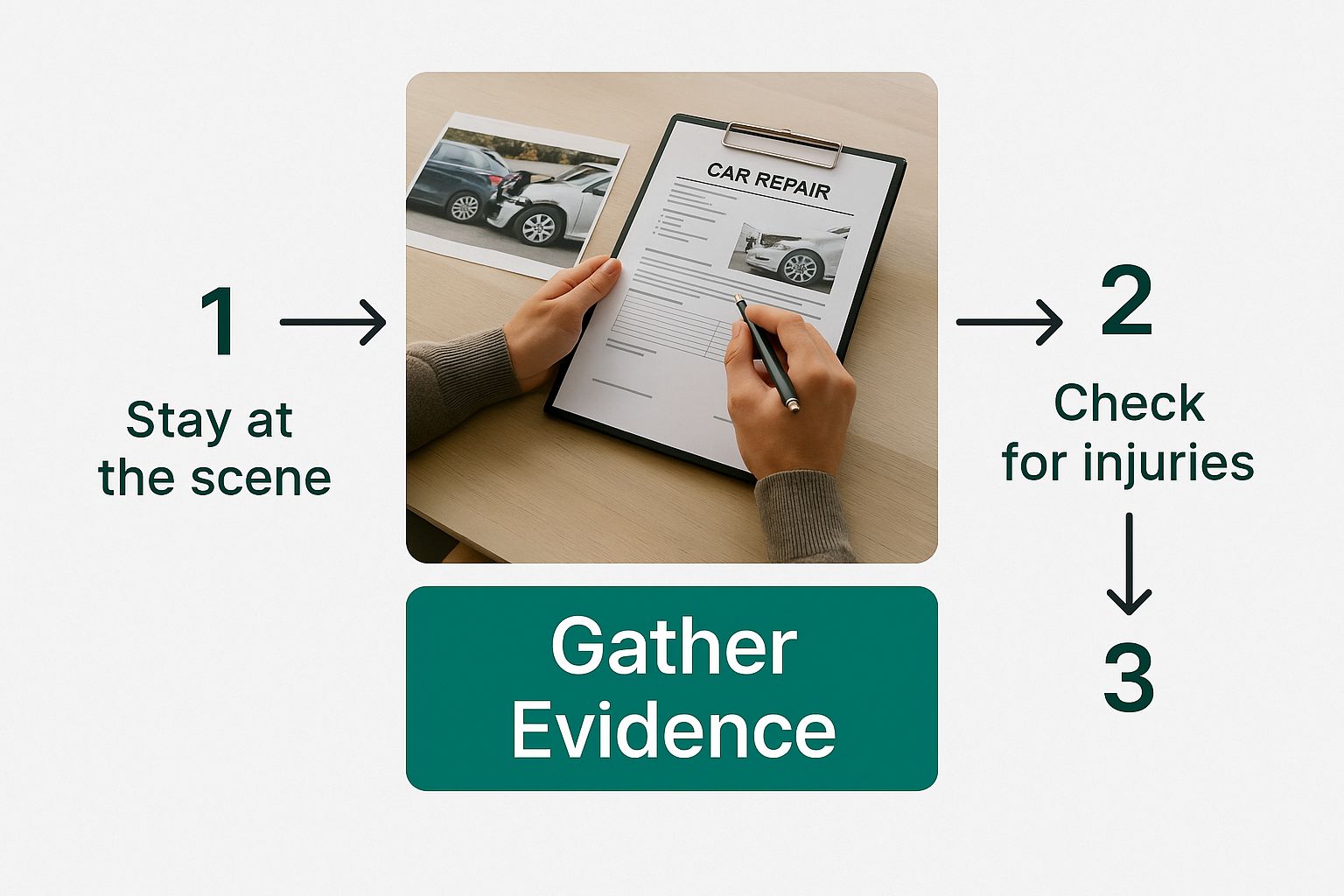

How to Get a Diminished Value Claim After an Accident | Step-by-Step Guide. Simply telling the insurance company your car is worth less won’t get you a check. Insurance companies operate on documentation, not just your word. To get a diminished value claim paid, you must build an airtight case with hard evidence they can’t easily dismiss. Your goal is to provide proof that clearly supports your claim for compensation.

Your Essential Evidence Checklist

First, let’s gather the foundational documents. Every piece of evidence you add gives your claim more weight and credibility.

- The Official Police Report: This establishes who was at fault, which is a requirement for filing a claim against the other driver’s insurance.

- The Body Shop Repair Estimate and Final Invoice: The final invoice is crucial proof. It lists every part replaced and hour of labor, painting a clear picture of the accident’s severity.

- Photos and Videos: Collect any pictures you took at the scene, during the repairs, and after the work was complete. Most importantly, find “before” photos of your car to prove its excellent pre-accident condition.

The Single Most Important Piece of Evidence

While the documents above are essential, they don’t put a specific dollar amount on your loss. This is where most people get stuck. The most powerful tool to strengthen your claim is an independent, certified diminished value appraisal.

An insurance company’s internal valuation is designed to minimize their payout. A SnapClaim report provides objective, data-backed proof of your car’s true loss in value, giving you the leverage needed to negotiate a fair settlement. Our reports are the cornerstone of a successful negotiation because they shift the conversation from opinion to verifiable market facts. You can learn more about why a professional car appraisal after an accident is so critical.

To bulletproof your claim, it helps to understand common insurance claim denial reasons so you can prepare for them. When you build a case based on undeniable evidence, you’re not just asking for compensation—you’re proving exactly what you’re owed.

How to Submit Your Diminished Value Claim

Once you’ve gathered your evidence, it’s time to formally submit your claim to the at-fault driver’s insurance company. A professional, well-documented package signals that you’re organized and serious about recovering your loss. This first impression sets the tone for the entire negotiation.

The heart of your submission is the demand letter. This is a formal, business-like document requesting the specific amount of diminished value you are owed, backed by the solid proof you’ve collected.

How To Structure Your Demand Letter

Keep your demand letter professional and to the point. Stick to the facts and avoid emotional language—this is a business transaction.

Here’s a simple structure that works:

- Introduction: State your name, the insurance claim number, the date of the accident, and the at-fault driver’s name. Clearly state, “I am writing to demand compensation for the inherent diminished value of my vehicle.”

- Brief Factual Summary: Briefly recap the accident, confirming the other driver was at fault. Reference the police report number.

- The Demand: State the exact dollar amount you are claiming for diminished value, taken directly from your certified SnapClaim appraisal report.

- Supporting Evidence: List the documents you’ve included to support your claim, specifically mentioning the independent appraisal report as the basis for your demand.

- Conclusion: Provide your contact information and state that you expect a response within a reasonable timeframe, such as 15-30 days.

For more guidance, check out these Tips to Get the Best Outcomes from Demand Letters from a trusted resource.

Assembling Your Submission Package

Bundle your letter with all supporting documents and send everything at once in a single, complete package via certified mail or as a consolidated PDF email attachment.

| Your Diminished Value Claim Submission Checklist |

|---|

| Signed Demand Letter |

| SnapClaim Certified Appraisal Report |

| Final Repair Invoice from the Body Shop |

| Official Police Report |

| Pre-Accident Photos of Your Vehicle |

A SnapClaim report provides a defensible valuation backed by market data. If you’re just getting started, our free online diminished value claim calculator can give you a quick estimate of your potential loss. After you submit your claim, keep a detailed log of every phone call, email, and letter.

Negotiating Your Settlement with the Insurance Company

After you submit your claim, the insurance adjuster will review it. Their first offer is almost always a lowball figure—it’s an opening bid, not their final offer. Adjusters are trained to minimize payouts, so being prepared for the negotiation is key to getting a fair settlement.

Common Adjuster Tactics and How to Respond

Insurance adjusters often use a few common arguments to downplay your loss. Knowing what to expect helps you stay in control.

- The “17c Formula” Argument: Many insurers present a low offer based on the flawed “17c formula.” This formula is notorious for using arbitrary caps that consistently undervalue claims.

- The “We Don’t Pay That” Tactic: An adjuster might incorrectly state that they don’t cover diminished value in your state. This is often a tactic to get you to drop the claim.

- The “No Real Loss” Assertion: They may argue that since your car was repaired perfectly, there’s no financial loss. This ignores the reality of the used car market, where an accident history significantly hurts resale value.

Stand Your Ground with Factual Evidence

When you receive a low offer, respond professionally and steer the conversation back to your evidence.

Expert Tip: Your certified appraisal is the factual anchor of the negotiation. When an adjuster questions your claim amount, simply refer them back to the report. Use phrases like, “My certified appraisal, based on current market data, calculates the loss at $X,” or, “The 17c formula is not an accurate market valuation, which is why I provided a professional appraisal.”

This approach keeps the negotiation grounded in facts, not opinions. It shows the adjuster that your claim is supported by more than just your own belief. And with SnapClaim, you can negotiate confidently thanks to our money-back guarantee. If your total recovery from the diminished value claim is less than $1,000, we will fully refund the fee for your appraisal report. You have nothing to lose by pursuing the full amount you’re owed.

If negotiations stall, you can ask to speak to a supervisor or explore your options with experienced diminished value claims attorneys.

Finalizing The Settlement and Getting Paid

After negotiating, you’ve finally agreed on a settlement amount. The final steps are critical to ensure you get paid correctly and without any surprises.

Get the Agreement in Writing

Before you do anything else, get the final settlement agreement in writing. Ask the adjuster to send a confirmation email or formal letter that clearly states the agreed-upon amount. This written record is your proof and eliminates any chance of misunderstandings.

Review the Release of Liability Form

The insurance company will send you a “release of liability“ form. This is a legally binding contract where you agree that the settlement is the final and full amount you will receive for this specific claim. By signing it, you waive your right to pursue more money for the property damage from the at-fault driver or their insurer.

Crucial Tip: Read the release form carefully. Make sure it only releases claims related to your vehicle’s property damage and does not prevent you from pursuing a separate claim for bodily injury if you were hurt.

Receiving Your Payment

Once you sign and return the release form, the insurance company will process and mail your settlement check, which usually takes one to two weeks. If your vehicle was declared a total loss instead of being repaired, the process may be different. In those cases, it helps to understand the details of a total loss appraisal.

When the check arrives, you have successfully navigated the entire diminished value claim process. Your persistence and preparation have paid off with real money back in your pocket.

FAQ: Common Questions About How to Get a Diminished Value Claim

Can I claim diminished value from my own insurance company?

Almost always, the answer is no. A diminished value claim is a third-party claim, meaning you file it against the at-fault driver’s insurance, not your own. Your policy typically covers repairs but excludes the drop in resale value. An exception may exist in some states (like Georgia) for claims involving an uninsured/underinsured motorist, so it’s wise to check your state’s laws on its official DMV website.

Is there a time limit to file my diminished value claim?

Yes. Every state has a statute of limitations for property damage, which sets a deadline for filing your claim. This window can range from one to six years from the date of the accident. To be safe, you should start the claim process as soon as your vehicle repairs are complete to avoid missing this critical deadline.

What if the insurance company denies my claim?

Don’t panic. A denial is often an initial tactic to see if you will go away. First, ask for the reason for the denial in writing. This forces the adjuster to provide a specific justification. Then, you can respond professionally by pointing back to the evidence in your certified SnapClaim appraisal report and reiterating your right to be compensated for your loss.

Can I still file for diminished value if my car is older?

Absolutely. It’s a common myth that only new or luxury cars qualify. While newer vehicles often have higher diminished value amounts, any car can lose significant value after an accident. What matters is the vehicle’s pre-accident condition, fair market value, and desirability. A professional appraisal is the best way to determine if a claim makes sense for your specific vehicle.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This article was reviewed by SnapClaim’s team of certified auto appraisers and claim specialists with years of experience preparing court-ready reports for attorneys and accident victims. Our content is regularly updated to reflect the latest industry practices and insurer guidelines.

Get Started Today

Ready to prove your claim? Generate a free diminished value estimate in minutes and see how much you may be owed.

Get your free estimate today