Figuring out “how much is my car worth” is the first step toward a fair deal, whether you’re selling it, trading it in, or negotiating an insurance claim. The answer is your car’s Actual Cash Value (ACV)—what a buyer would realistically pay for it today. This value isn’t a guess; it’s determined by your car’s complete story, from its condition and mileage to its accident history and local market demand.

Understanding Your Car’s Actual Cash Value

Knowing your car’s true worth is crucial, especially when you’re dealing with an insurance company after an accident. While it sounds simple, the method you use to determine that value can lead to very different outcomes. Choosing the right path ensures you don’t leave money on the table.

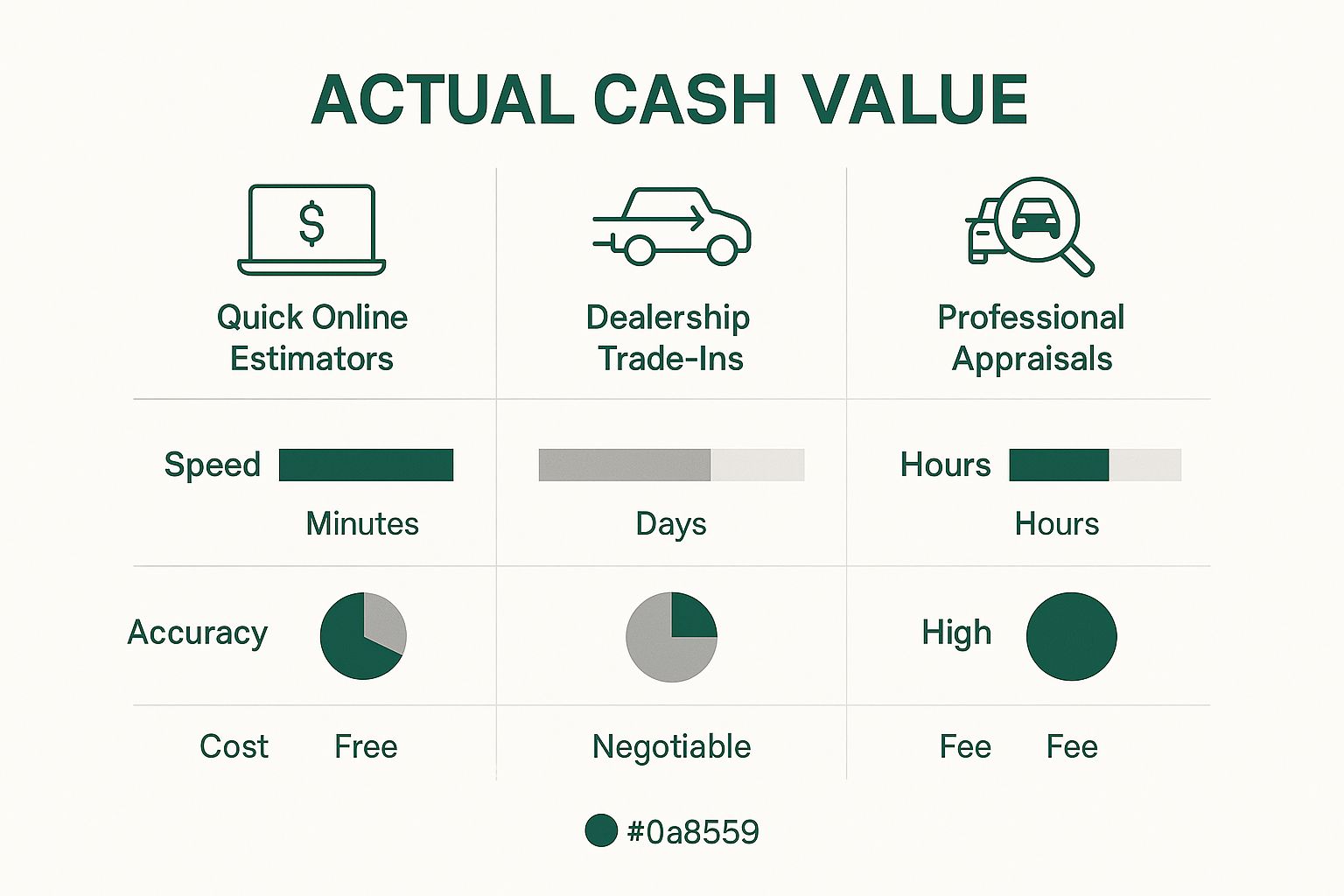

You have three main options for finding your vehicle’s ACV, each offering a different level of speed, cost, and accuracy.

- Quick Online Estimators: Free tools from sites like Kelley Blue Book provide a fast, general idea of your car’s value. They’re a good starting point but often miss the specific details that define a vehicle’s true market price.

- Dealership Trade-In Offers: A dealership will give you a firm number, but their goal is to buy your car for the lowest possible price to maximize their profit. This offer rarely reflects what you could get from a private sale.

- Professional Appraisals: This is the gold standard for accuracy. A certified appraiser provides a detailed analysis of your vehicle and the current market, creating a valuation you can rely on for insurance claims like a diminished value claim or a total loss payout.

Three Paths to Finding Your Car’s Value

To help you decide which route is best for your situation, here’s a quick comparison of the common valuation methods.

| Valuation Method | Best For | Pros | Cons |

|---|---|---|---|

| Online Estimators | Quick, initial research; getting a general idea of value. | Free, fast, and easy to use. | Lacks accuracy; doesn’t account for specific vehicle history or local market factors. |

| Dealership Trade-In | A convenient, guaranteed sale when buying another car. | Simple and fast process. | Almost always the lowest value; biased in the dealer’s favor. |

| Professional Appraisal | Insurance claims, legal disputes, and high-stakes negotiations. | Highest accuracy; defensible and data-driven. | Costs money and takes more time than instant estimators. |

Each path serves a purpose, but when fair compensation is on the line, accuracy is everything.

Choosing the Right Valuation Method

The infographic below breaks down these three common ways to determine your car’s value, highlighting the trade-offs between getting a number fast and getting the right number.

As you can see, a professional appraisal delivers the most accurate result. That level of precision is critical when you’re up against an insurance company that may be trying to undervalue your claim.

Why a Ballpark Figure Just Won’t Cut It

If you’re just casually curious, an online tool is fine. Reputable sites like Kelley Blue Book can give you a useful baseline for what your car might be worth.

But when the financial stakes are high—especially after an accident—that initial estimate is just the starting line. The generic data from these free tools can’t capture your vehicle’s unique story or subtle shifts in your local market. The insurance adjuster has their own professional data, and to get fair compensation, you need to provide evidence that can stand up to their scrutiny.

That’s where a data-driven, certified appraisal from SnapClaim becomes your most powerful tool.

The Factors That Define Your Car’s Value

Every car has a story, and its value is written in the details. When appraisers and insurers sit down to figure out how much is my car worth, they’re looking at much more than just the make and model. It’s like a puzzle where several key factors must be pieced together to get a clear picture of your car’s place in today’s market.

Imagine two identical cars rolling off the assembly line. A few years later, one is garage-kept with low miles and a perfect service history. The other has endured heavy city driving, missed oil changes, and collected dings. The difference in their value could easily be thousands of dollars.

Understanding these factors helps you see your car through the eyes of a professional.

Mileage and Mechanical Condition

The odometer is one of the first things anyone looks at, as it’s the simplest measure of a car’s life so far. Lower mileage generally means less wear on the engine, transmission, and other key components, which translates to a higher value. But high mileage isn’t an automatic deal-breaker.

What really matters is the story behind those miles. A pristine service history, with records of every oil change and timely repair, is proof that you’ve invested in the car’s health. That proof directly bumps up its value.

A vehicle with 100,000 well-maintained highway miles can often be in better mechanical shape than one with 50,000 miles of harsh city driving and neglected service.

Cosmetic Appearance and Features

First impressions count. How your car looks—inside and out—heavily influences what people think it’s worth.

- Exterior: Scratches, dents, rust, and faded paint are immediate red flags. They suggest the car may have been neglected in other ways, too.

- Interior: Stains, tears in the upholstery, a cracked dashboard, or unpleasant odors will drag the value down. A clean, fresh interior is essential for getting top dollar.

- Trim Level and Options: A higher trim level packed with desirable features like a sunroof, premium sound system, or advanced safety tech will always command a higher price.

Accident and Ownership History

A vehicle’s history report is its permanent record, and a clean one is what every buyer wants. A clean title with zero reported accidents is the gold standard. Any collision, no matter how well it was repaired, leaves a permanent mark on that record, creating what’s known as diminished value.

Even a minor fender-bender can slash a car’s value by 10% to 30%. Why? Because savvy buyers worry about hidden, long-term damage and will pay significantly less for a car with an accident in its past.

Market and Regional Influences

Finally, your car doesn’t exist in a bubble. Its value is also shaped by bigger forces you can’t control, like economic shifts and buyer trends, which can cause used car values to swing wildly. The average used car price in the U.S. is around $25,512, a figure still settling after recent market spikes. You can explore these used car price trends to see how the market is moving.

Your location matters, too. A convertible will be more valuable in sunny Florida than in snowy Alaska. A 4×4 truck will be in high demand in a rural, mountainous area. This is where a professional appraisal from SnapClaim shines. We analyze real-time, local market data to ensure your car’s value is based on what buyers in your area are actually paying.

How an Accident Tanks Your Car’s Worth

Even after a perfect repair job, an accident leaves a permanent black mark on your car’s history report. This leads to a concept insurance companies hope you don’t know about: diminished value. It’s the silent financial hit your vehicle takes long after the dents are gone.

Think of it this way: if a valuable comic book gets a tear and is meticulously restored, it will never fetch the same price as an undamaged copy. Your car is no different. The moment an accident is recorded, its appeal to future buyers drops for good.

This is why the check an insurer cuts for repairs doesn’t make you whole. It pays for parts and labor but ignores the chunk of resale value that vanished. Understanding this loss is your first step toward claiming the full amount you’re owed.

The Hard Reality of Diminished Value

Diminished value is the loss in your car’s market price because it now has an accident on its record. Even with factory parts and flawless repairs, buyers will be wary. They’ll wonder about hidden structural damage or future problems, and that doubt always translates to a lower offer.

A car can lose 10% to 30% of its pre-accident value after a wreck. For a $30,000 car, that’s a real-world loss of $3,000 to $9,000 that the standard repair check doesn’t cover.

A vehicle history report is standard in almost every used car sale. An accident on that report is a permanent red flag that directly cuts into what any informed buyer is willing to pay.

Different Kinds of Value Loss

Not all diminished value is the same, but the one that matters for your claim is inherent diminished value.

- Immediate Diminished Value: The value difference right after the crash, before repairs.

- Repair-Related Diminished Value: This occurs when repairs are sloppy, with mismatched paint or cheap aftermarket parts.

- Inherent Diminished Value: This is the big one. It’s the automatic loss in value that happens simply because the vehicle has an accident history—even with perfect repairs. This is the loss you can and should claim from the at-fault driver’s insurance.

This isn’t just an abstract idea; it’s a real financial blow. To get a better sense of the numbers, check out our guide on how much an accident can devalue a car.

Why Insurers Play Down This Loss

Insurance adjusters are trained to minimize payouts, and diminished value is often their first target. They might argue that because the car looks good as new, its value is fully restored. Sometimes they’ll use a flawed, generic calculation like the “17c formula” that produces an insultingly low number.

This is why you can’t just take their word for it. To win a diminished value claim, you need to bring your own proof to the table—independent and backed by real data. A certified appraisal from SnapClaim provides an unbiased report built on current market analysis that proves your car’s true loss in value, arming you for a fair negotiation.

Navigating a Total Loss Insurance Claim

When damage is so severe that repairs cost more than the car is worth, the insurance company declares it a total loss. When that happens, your settlement depends entirely on one number: your car’s Actual Cash Value (ACV) right before the crash.

This figure determines the size of the check you’ll get to replace your vehicle.

Unfortunately, the insurer’s first offer is often a lowball. Adjusters are trained to close claims for the lowest amount possible, so their initial valuation is a starting point for negotiation, not the final word. They’re counting on you to accept it without questions.

Why Initial Settlement Offers Are Low

Insurance companies use valuation models often skewed in their favor. They might use outdated market data or cherry-pick “comparable” vehicles that are in worse shape or have fewer options than yours. It’s a tactic that artificially drags down your payout.

They can undervalue your car by:

- Using a flawed list of comps: Citing cars for sale with higher mileage, fewer features, or from a cheaper market.

- Ignoring recent upgrades: Forgetting to add value for new tires, a premium sound system, or other improvements.

- Overlooking your car’s excellent condition: Applying a generic “average” condition rating to a well-maintained vehicle.

This is why knowing how much your car is worth based on real, local evidence is so critical. Learning how to report an accident to insurance effectively can also protect your rights from day one.

Building Your Case for a Fair Payout

You don’t have to accept the insurer’s low offer. The key to a fair insurance total loss payout is countering their valuation with your own data-driven proof. This isn’t about arguing; it’s about presenting undeniable facts that support a higher, more accurate value.

Your location plays a huge role here. A car’s value in California isn’t the same as in Ohio. For example, China is the world’s largest automotive market with a 29.2% share of global sales, while the United States is second with 19.4%. These market differences create unique depreciation trends, which is why localized data is essential.

The Power of a Certified Appraisal

The most effective tool for fighting a lowball offer is a certified, third-party appraisal. While you can find local listings for similar cars on your own, a professional report from SnapClaim carries far more weight in a negotiation.

An independent appraisal shifts the conversation from your opinion versus theirs to your evidence versus theirs. It replaces guesswork with a defensible, market-based valuation.

Our reports deliver the hard data you need to prove your vehicle’s true pre-accident worth. We analyze real-time sales data from your local market, make precise adjustments for your car’s condition, and package it in a format insurers respect. For a deeper look, check out our complete guide to total loss car valuation.

Why Online Value Estimators Fall Short

Punching your car’s details into a free online calculator is fast and easy. Tools like Kelley Blue Book (KBB) are fantastic for getting a quick, general idea of what your vehicle might be worth.

But that convenience comes at the cost of accuracy, especially when you need a number that can stand up to an insurance company’s scrutiny.

These estimators provide a ballpark figure, not a true market valuation. They use generalized algorithms that can’t capture your car’s unique story—its real condition, service history, recent upgrades, or local market trends. For a casual seller, a KBB printout is a decent starting point. For an insurance claim, it’s like bringing a pocket knife to a sword fight.

The Gaps in Generic Data

Online tools are built for the masses and must make broad assumptions. They can’t drill down into the details that create real-world value.

Here is where these estimators miss the mark:

- Specific Condition: Their condition ratings—like “Excellent” or “Good”—are subjective and can’t reflect your car’s true state. They often gloss over the difference between a garage-kept vehicle and one with obvious wear and tear.

- Local Market Dynamics: A popular truck in Texas will fetch a different price than the same truck in New York. Online calculators use national data that misses these critical regional supply and demand trends.

- Accident History Impact: While they might ask if the car has been in a crash, their algorithms can’t accurately measure the car value after an accident. They don’t perform the deep analysis required for a precise diminished value claim.

Broader Market Forces and Your Car’s Value

Big-picture trends also have a massive impact on your car’s value. The auto market has seen wild shifts, with global car sales recently topping 81 million units. Projections show steady growth, which, along with the rise of electric vehicles, influences resale values. You can get a sense of the bigger picture by exploring global car sales trends and forecasts.

When you’re negotiating a claim, the insurance adjuster is armed with professional-grade valuation software. Relying on a free online estimate puts you at a huge disadvantage.

An insurer’s job is to settle claims for the lowest amount possible. To counter their offer on a total loss payout, you need professional-grade proof. This is where a certified appraisal from SnapClaim is crucial. We move past generic algorithms to build a defensible, accurate valuation based on real-time, local market data.

How to Prove Your Car’s True Value

When you’re up against an insurance company, knowing what your car is worth isn’t enough—you have to prove it. A certified appraisal from SnapClaim is the hard, data-driven evidence you need to level the playing field.

An insurer’s valuation is designed to protect their bottom line, not yours. To fight back against a lowball offer, you need an airtight case built on facts. It’s not about arguing; it’s about providing a professional report that quantifies your financial loss so clearly they can’t ignore it.

The Power of Data-Driven Evidence

A SnapClaim report is built on a foundation of deep, real-time market analysis. Our certified methodology zeroes in on what actually matters for an accurate valuation.

Here’s how our reports give you the proof you need:

- We Analyze Your Local Market: We pinpoint what cars just like yours have recently sold for in your specific area.

- We Make Precise Adjustments: Our system digs into the details—your car’s exact mileage, options, trim level, and pre-accident condition.

- We Quantify Your Loss: For a diminished value claim, we calculate the precise drop in market value. For a total loss payout, we establish the true pre-accident Actual Cash Value.

A certified appraisal transforms the negotiation from a subjective argument into an objective, fact-based discussion. You are no longer just another claimant; you are an informed owner with documented proof.

What Makes a Certified Appraisal So Effective?

Handing the adjuster a SnapClaim report signals that you’re serious. Our appraisals are built to be court-ready, meaning they’re structured to hold up under scrutiny. This level of professionalism often convinces insurers to negotiate more reasonably to avoid a drawn-out dispute.

Our detailed car appraisal after an accident gives you the leverage you need to confidently challenge an insurer’s low offer. The report becomes the centerpiece of your claim, laying out the professional proof required to back up your demand for fair compensation.

Specialized Valuations for Modern Vehicles

For newer vehicles, the valuation process can be trickier. Electric car owners face unique factors like battery health that heavily impact their car’s worth. For those navigating that challenge, you can learn more about how to accurately value an electric vehicle from specialized resources.

Secure Your Proof Without Risk

We are so confident in our reports that we stand behind them completely. With SnapClaim’s Money-Back Guarantee, if your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee — guaranteed.

This takes the risk off your shoulders, allowing you to arm yourself with expert proof and negotiate with total confidence.

Frequently Asked Questions (FAQ)

Can I claim diminished value if the accident wasn’t my fault?

Yes, absolutely. In most states, you can file a diminished value claim against the at-fault driver’s insurance policy. This claim is intended to compensate you for the loss in your vehicle’s resale value, even after it has been fully repaired.

What if the insurance company undervalues my total loss claim?

If the insurer’s offer for your totaled car seems too low, you don’t have to accept it. You can challenge their valuation by providing your own evidence, such as a certified appraisal report from SnapClaim. This provides the proof you need to negotiate fairly for the vehicle’s true pre-accident market value.

How do I know how much my car is worth after an accident?

The best way to determine your car’s value after an accident is with a professional appraisal. An expert appraiser can calculate both the pre-accident value and the post-repair value to determine the exact amount of diminished value. This provides the data-backed proof needed to support your insurance claim.

Is a professional appraisal worth the cost?

A professional appraisal is a smart investment that often pays for itself many times over. Insurance companies frequently undervalue claims by thousands of dollars. An appraisal provides the leverage needed to recover the full amount you’re owed. Plus, SnapClaim’s Money-Back Guarantee makes it a risk-free way to strengthen your claim.

Get your free estimate today or order a certified appraisal report to strengthen your insurance claim.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This article was reviewed by SnapClaim’s team of certified auto appraisers and claim specialists with years of experience preparing court-ready reports for attorneys and accident victims. Our content is regularly updated to reflect the latest industry practices and insurer guidelines.

Get Started Today

Ready to prove your claim? Generate a free diminished value estimate in minutes and see how much you may be owed.

👉 Get your free estimate today of your car value to dispute low insurance offer