Diminished value after accident is the drop in your vehicle’s resale value once it has a damage history — even if repairs are flawless. This guide explains what diminished value is, how to calculate it, and how to claim compensation from the at-fault party’s insurance company.

What Is Diminished Value and Why It Matters

When your car is damaged in a collision, your first priority is getting it repaired. But the financial impact doesn’t end when you drive it off the body shop lot. The moment an accident is recorded on a vehicle history report (like CARFAX or AutoCheck), it permanently lowers your car’s fair market value—and this is the basis of a diminished value claim.

Imagine you’re buying a used car and find two identical models. They have the same year, mileage, and features, but one has a major collision on its record. Which would you pay more for? The discount you would expect for the previously damaged car is its diminished value.

Your Vehicle’s Permanent Financial Scar

Even the best repairs can’t erase the past. The simple knowledge that a vehicle was in an accident makes future buyers hesitate, worried about potential hidden issues or the long-term quality of the repairs.

This isn’t just a feeling; the data supports it. Vehicles with an accident history often see a 10-25% reduction in their resale or trade-in value compared to their accident-free counterparts. It’s a real financial loss that you’ll face when it’s time to sell. For a deeper dive into how these calculations work, you can discover more insights about vehicle depreciation on MeyersInjuryLaw.com.

The Three Types of Diminished Value

To understand your claim, it’s helpful to know the different types of diminished value. They all describe a loss in value, but each occurs at a different stage.

- Immediate Diminished Value: The difference in value right after the accident, before any repairs are made. This is the difference between the car’s pre-accident value and its value as a wrecked vehicle.

- Repair-Related Diminished Value: The value lost due to poor-quality repairs. This can include things like mismatched paint, aftermarket parts that don’t fit right, or sloppy bodywork.

- Inherent Diminished Value: The automatic loss in value that happens simply because the vehicle now has an accident history, even if the repairs are flawless.

Most claims focus on inherent diminished value. This is the unavoidable loss you suffer, and it’s what the at-fault driver’s insurance is responsible for covering. Filing a claim for inherent diminished value isn’t a criticism of the repair shop; it’s about getting compensated for the proven drop in your car’s market value.

How Insurance Companies Undervalue Your Claim

After an accident, you might assume the at-fault driver’s insurer will fairly calculate your diminished value after accident and write you a check. Unfortunately, that’s rarely the case. Insurance companies often use specific tactics and formulas designed to minimize their payout, leaving you with less than you deserve.

Their goal is to protect their bottom line, not yours. Understanding their common methods is key to fighting for fair compensation.

The Flawed 17c Formula

One of the most common tools insurers use is the “17c formula.” This calculation, derived from a court case, is widely criticized for producing unfairly low valuations.

Here’s how the 17c formula works against you:

- Starts with a 10% Cap: It automatically limits the maximum possible diminished value to 10% of your vehicle’s pre-accident value, regardless of the severity of the damage.

- Applies Unfair Deductions: It then uses arbitrary “multipliers” to reduce that amount further based on factors like mileage and the adjuster’s subjective view of the damage.

The result is a lowball offer that has little connection to your vehicle’s actual loss in market value. For example, a $30,000 vehicle with significant structural damage might only receive a few hundred dollars based on this formula, a fraction of the real-world loss.

Other Common Denials and Objections

In addition to using flawed formulas, adjusters often use a few standard arguments to deny or reduce your claim. Be prepared to hear these:

- “The repairs made your vehicle whole again.” This classic argument ignores the reality of inherent diminished value. While the car may be physically restored, its accident history permanently damages its market value. Different states have clear positions on this, as seen in our guide to Diminished Value in Georgia.

- “We don’t pay for diminished value.” Some adjusters will state this as a policy, but it’s often untrue. In most states, the at-fault insurer is legally obligated to compensate you for all damages, which includes the loss of market value.

- “You haven’t sold the car, so you haven’t realized the loss.” Don’t fall for this. The value is lost the moment the accident is recorded, not when you sell the vehicle. The loss is real and immediate.

You don’t have to accept an insurance company’s low offer. Their objective is to settle claims for as little as possible. Your objective is to be made whole for your actual financial loss. This is where an independent, third-party appraisal from SnapClaim provides the proof you need to counter their arguments.

Proving Your Loss with a Certified Appraisal Report

So, how do you fight back against an insurance company’s lowball offer? You replace their opinion with facts. A certified appraisal report is the single most effective tool for proving your vehicle’s diminished value after an accident. It shifts the negotiation from their biased formula to a data-driven, expert analysis of your actual loss.

Relying on a free online calculator or the insurer’s assessment is a sure way to leave money on the table. A professional appraisal gives you the leverage you need to negotiate a fair settlement.

What a Professional Appraisal Includes

Unlike a generic formula, a certified appraisal is a detailed report customized to your specific vehicle and accident. A credible appraiser analyzes all the unique factors that determine the true loss in market value.

A comprehensive SnapClaim report includes:

- Vehicle Details: The specific make, model, year, trim, mileage, and options of your car.

- Pre-Accident Condition: An assessment of your vehicle’s condition before the collision.

- Severity of Damage: A thorough review of the repair estimate to identify structural damage, frame repairs, and the extent of the impact.

- Quality of Repairs: An evaluation of the final repair quality.

- Local Market Analysis: Real-world sales data from your local market, comparing the value of accident-free vehicles to those with a damage history.

This detailed analysis produces a clear, defensible dollar amount for your loss. It’s no longer your word against the adjuster’s—it’s an expert’s documented findings. State laws can also play a role, as you can see in our guide on Diminished Value Claims in Texas.

Turning Your Claim from Opinion to Evidence

When you submit a certified appraisal, the dynamic of the conversation changes. You are no longer just asking for fair compensation; you are presenting proof of your financial loss. A professional report shows the insurer that you’ve done your research and are serious about your claim. This evidence supports your negotiations and strengthens your position, compelling the insurer to address your claim in good faith.

At SnapClaim, we make this step risk-free with our money-back guarantee. If the insurance recovery from your claim is less than $1,000, we fully refund your appraisal fee. This guarantee gives you the confidence to get the proof you need to fight for the compensation you deserve.

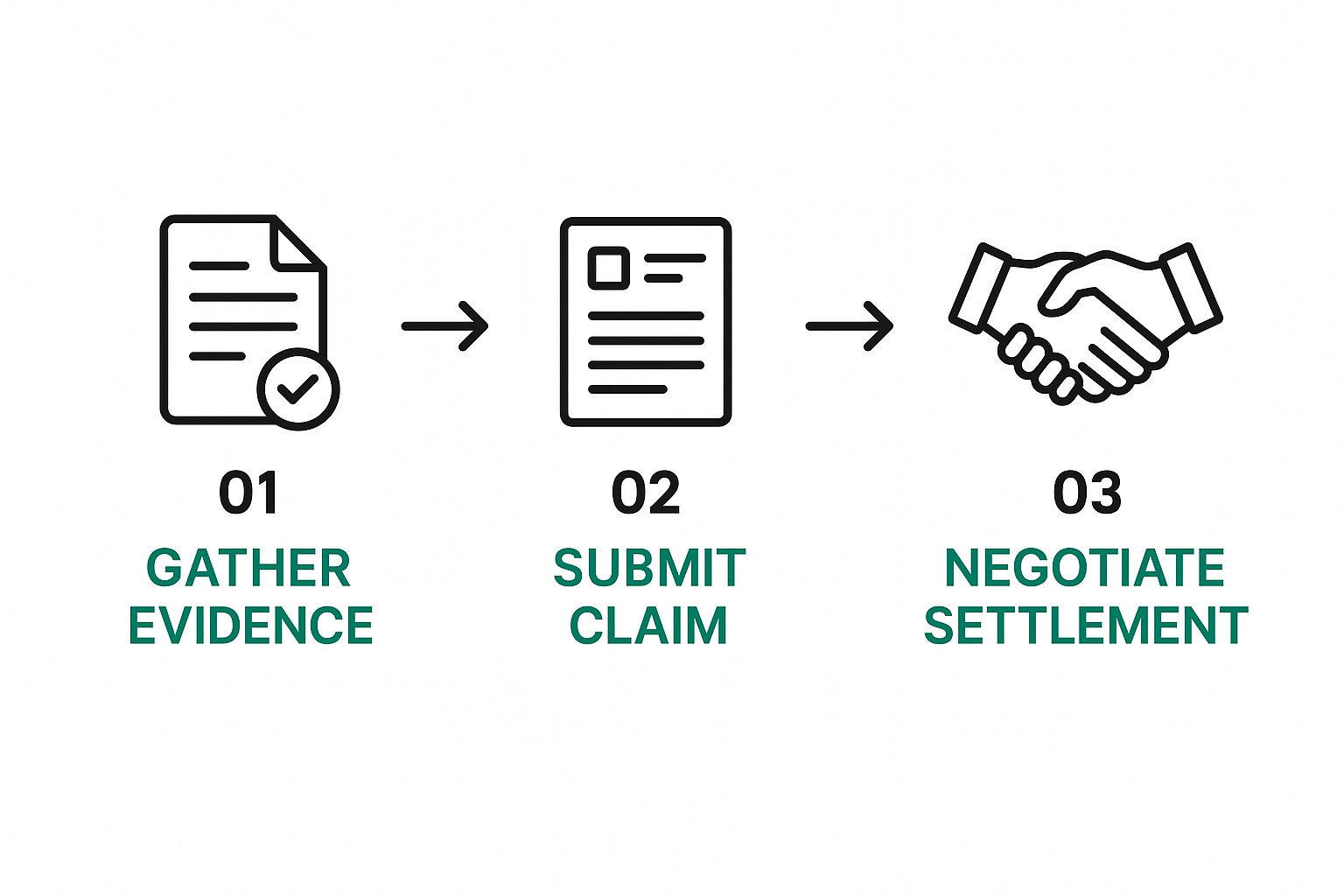

Your Step-by-Step Guide to Filing a Successful Claim

Once your vehicle repairs are complete, it’s time to file your claim for its diminished value after an accident. While it can seem intimidating, a structured approach and solid evidence will empower you to navigate the process confidently. Following these steps will help you build a strong case that insurance companies can’t easily dismiss.

Think of this as your roadmap to getting paid fairly.

Let’s break down the three key phases: gathering your proof, submitting the claim, and negotiating a fair settlement.

Step 1: Assemble Your Evidence

Before you contact the insurance company, gather all the necessary documents. An organized file demonstrates that you are serious and prepared. This proactive step helps streamline the process and strengthens your claim from the start.

Your Diminished Value Claim Checklist:

- Police Accident Report: Establishes fault and provides an official record of the incident.

- Final Repair Invoice: Details the full extent of the damage and the cost of repairs.

- Pre- and Post-Repair Photos: Visually documents the damage and the quality of the completed work.

- Certified DV Appraisal Report: This is your expert evidence proving the exact amount of value your vehicle has lost. A SnapClaim appraisal report provides the professional documentation you need.

- Proof of Pre-Accident Value: Maintenance records or other documents can help establish your vehicle’s excellent condition before the crash.

Step 2: Submit Your Claim and Demand Letter

With your documents ready, it’s time to formally submit your claim to the at-fault driver’s insurance company. Do this in writing with a “demand letter.” Keep your letter professional, clear, and to the point.

Your demand letter should include:

- Your contact information and the insurance claim number.

- A clear statement that you are seeking compensation for your vehicle’s inherent diminished value.

- The specific dollar amount you are demanding, which should match your certified appraisal.

- A list of the enclosed documents supporting your claim (repair invoice, appraisal report, etc.).

Your SnapClaim appraisal report is the cornerstone of this package. It grounds your demand in an expert’s analysis and makes your claim credible and difficult to dispute.

Step 3: Navigate the Negotiations

After you submit your claim, the adjuster will review it and contact you. Don’t be surprised if their initial response is a lowball offer or one of the common objections we discussed earlier. This is a standard negotiation tactic.

Stay calm and firm. When the adjuster questions your demanded amount, refer them back to your appraisal report. The report does the talking for you.

Your appraisal report shifts the focus from their self-serving formula to your vehicle’s actual, documented loss in market value.

Politely explain that your claim is based on a professional, third-party assessment. If they mention the 17c formula, you can confidently state that your certified appraisal provides a more accurate and specific valuation. Persistence is key, and with professional evidence on your side, you are in a strong position to achieve a fair settlement.

The Broader Economic Impact of Car Accidents

When you’re fighting for diminished value after an accident, it’s easy to feel like your problem is an isolated one. However, your financial loss is part of a much larger economic picture that federal agencies like the National Highway Traffic Safety Administration (NHTSA) track every year.

Understanding this context validates your claim. Your loss isn’t just a minor inconvenience; it’s a recognized, quantifiable financial harm that contributes to the staggering national cost of motor vehicle crashes. You aren’t asking for a handout—you’re seeking fair compensation for a real economic injury.

Your Claim Is Part of a National Issue

The economic burden of car crashes in the United States is enormous. According to the NHTSA, the total economic cost of motor vehicle crashes in 2019 was $340 billion. Property damage, which includes diminished value, accounted for a significant portion of this cost. You can Learn more about the societal costs of motor vehicle crashes on NHTSA.gov.

This data proves that your loss is not imaginary. It is a legitimate financial damage recognized within a broad framework of economic losses caused by collisions nationwide.

When an insurance adjuster tries to downplay your claim, remember that the very concept of your loss is supported by extensive, government-level economic data. This knowledge, combined with a certified SnapClaim appraisal, gives you the confidence to stand your ground and demand the compensation you are rightfully owed.

Frequently Asked Questions (FAQ)

Understanding a diminished value after accident claim often raises numerous inquiries. Below are detailed responses to some of the most frequent questions from vehicle owners.

Can I file a diminished value claim with my own insurance?

In most cases, the answer is no. Diminished value claims are considered “third-party” claims, which means they are filed against the insurance policy of the at-fault driver. Your collision coverage typically covers repair costs, not the loss in market value due to another party’s negligence. However, this can vary based on state regulations and your specific insurance policy, so it’s advisable to review your policy details. Our guide to diminished value in North Carolina provides further insight into this.

How long do I have to file my claim?

The timeframe for filing a property damage claim is governed by the “statute of limitations” in each state, usually ranging from two to five years from the accident date. Despite this window, it is advisable to file your claim as soon as possible after repairs are completed. Prompt action demonstrates your commitment to the claim and ensures all evidence remains current. Read here more about the appraisal cost.

Do I need a lawyer to file a diminished value claim?

In most scenarios, a lawyer is not required to file a diminished value claim. A well-prepared, certified appraisal report from a professional, such as SnapClaim, provides the necessary evidence and support to negotiate a fair settlement independently. However, if you own a high-value exotic or classic vehicle, or if the insurance company is not negotiating fairly, seeking legal advice may be beneficial.

What evidence is needed to support a diminished value claim?

To support a diminished value claim, you will generally need a certified appraisal report that details the vehicle’s loss in market value. This report should be prepared by a qualified expert and include information about the car’s condition before and after the accident, repair details, and comparable sales data.

Can I still file a claim if the repairs are minor?

Yes, you can file a diminished value claim even if the repairs are minor. Any accident can potentially reduce a vehicle’s value, and the extent of the repairs does not necessarily correlate with the loss in market value. It is important to document all repairs and obtain a professional appraisal to determine the actual diminished value.

Ready to recover the money your vehicle has lost? A SnapClaim certified appraisal report provides the proof you need to strengthen your claim and support your negotiations with insurers. Our service is backed by a risk-free, money-back guarantee. Get your free estimate today

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This article was reviewed by SnapClaim’s team of certified auto appraisers and claim specialists with years of experience preparing court-ready reports for attorneys and accident victims. Our content is regularly updated to reflect the latest industry practices and insurer guidelines.

Get Started Today

Ready to prove your claim? Generate a free diminished value estimate in minutes and see how much you may be owed.

Get your free estimate today