Car value depreciation after accident is a hidden financial loss many drivers overlook. Even if your car is perfectly repaired, your vehicle’s history report now has a permanent blemish that makes it worth less to any future buyer. This is car value depreciation after an accident, often called diminished value, and you have the right to be compensated for it.

Understanding car value depreciation after accident

Imagine two identical used cars on a lot—same make, model, year, and mileage. One has a clean history, while the other has a collision on its record. Even if the repaired car looks flawless, which one would a buyer pay more for? The answer is obvious, and that difference in price is your financial loss.

Your insurance payout covers the repair bill, but it doesn’t address this automatic drop in market value. This means that even after your car is fixed, you haven’t been made financially whole. Understanding this concept is the first step toward getting the fair compensation you deserve.

Three Types of Value Loss

The drop in your car’s worth isn’t just one big concept; it actually breaks down into a few specific categories. Knowing the difference helps you build a stronger claim and understand what you’re owed. Here’s a simple breakdown of the three main types of diminished value.

Quick Overview of Diminished Value Types

| Type of Diminished Value | Simple Explanation |

|---|---|

| Inherent Diminished Value | This is the automatic, unavoidable loss in value that happens just because a car now has an accident history. It’s the most common type of claim and assumes the repairs were done perfectly. |

| Repair-Related Diminished Value | This loss comes from a bad repair job. Think mismatched paint, cheap aftermarket parts instead of factory originals, or lingering frame issues. The poor quality of the work itself makes the car worth even less. |

| Immediate Diminished Value | This is the loss in value right after the accident, but before any repairs are made. It’s not used as often in claims but represents the car’s worth in its damaged state. |

For most claims, the focus is on inherent diminished value—the loss that exists even when the body shop does an amazing job. It’s all about the stigma attached to that accident report.

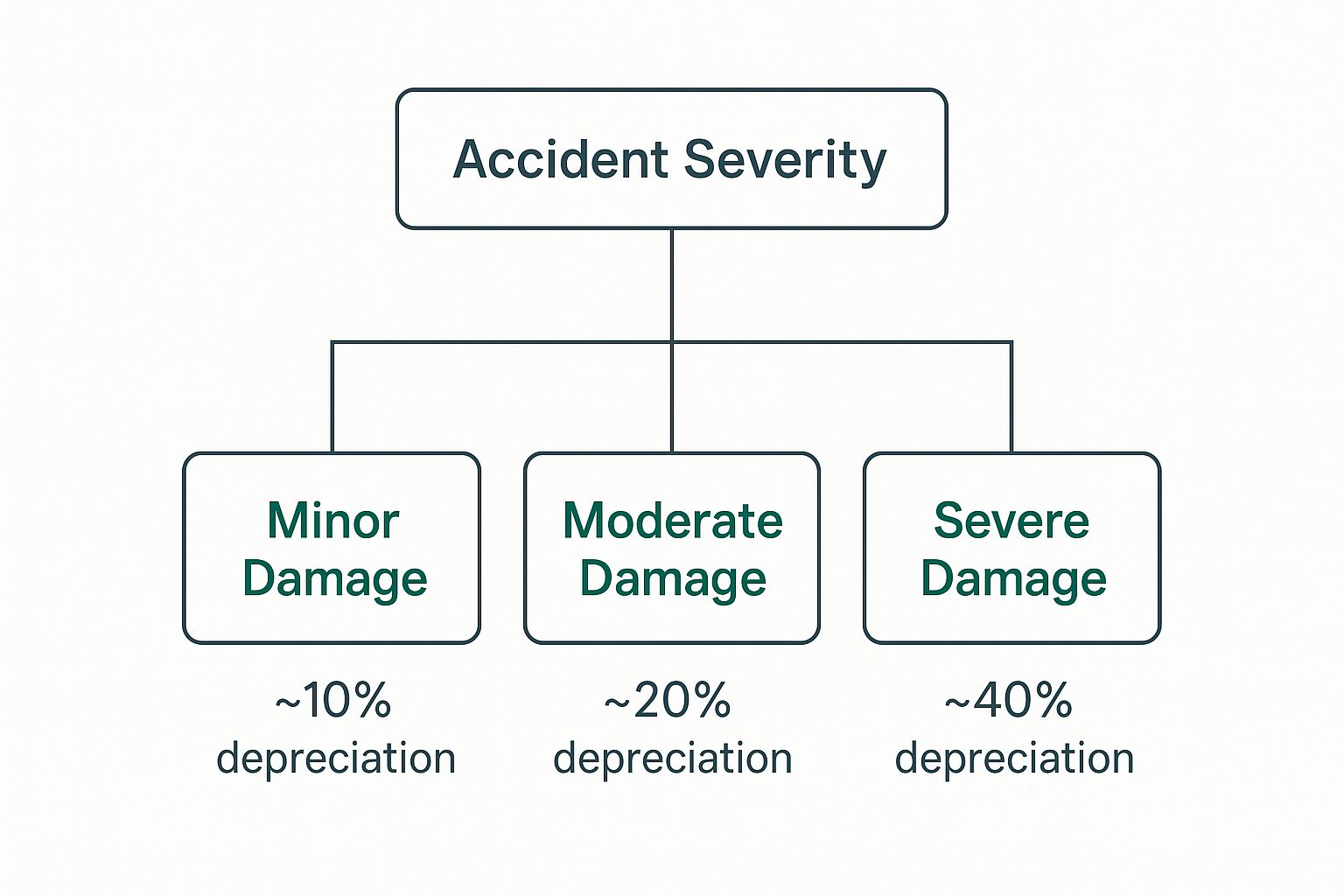

This infographic shows just how much the severity of an accident can impact your car’s value.

As you can see, even a minor fender-bender can cause a 10% drop in value. A severe collision could result in a loss of 40% or more.

For a more detailed explanation, check out our guide on what vehicle diminished value is.

How Much Value Does a Car Lose After an Accident?

Pinpointing the exact dollar amount a car loses after a wreck is tricky because there’s no single formula. The loss depends on several key factors unique to your vehicle and the accident. Learn more about how much a car’s value depreciates after an accident at Zimmerman Law Firm.

An accident dramatically speeds up the natural depreciation process. As a rough guide, a minor fender-bender might reduce a car’s value by 5-10%, while a more serious collision could easily cause a 15% drop or more. However, these percentages are just estimates. The real financial hit depends on your car’s specific situation.

Key Factors That Determine Depreciation

Several critical elements determine your vehicle’s diminished value. Understanding them makes it clear why a professional appraisal is necessary to capture the true loss.

- Vehicle Age and Mileage: A newer car with low mileage will lose a much larger percentage of its value than an older vehicle with 150,000 miles. A newer car simply has more value to lose from the stigma of an accident.

- Pre-Accident Condition and Value: Was your car in pristine condition, or did it already have some wear and tear? A vehicle with a higher fair market value before the crash will naturally experience a more significant dollar-amount loss.

- Severity of the Damage: This is often the biggest factor. A minor cosmetic scrape is very different from a collision that causes frame damage. Any structural damage is a massive red flag for future buyers and leads to the highest levels of depreciation.

- Quality of Repairs and Parts Used: How the car was fixed matters. Using Original Equipment Manufacturer (OEM) parts—the same ones your car was built with—helps retain far more value than using cheaper, aftermarket alternatives.

Key Takeaway: You can’t just plug numbers into a simple formula. The combination of your car’s age, the accident’s severity, and the quality of repairs creates a unique financial impact that demands a detailed, expert analysis.

Why Every Accident Is Different

Let’s imagine two identical cars. One is involved in a minor sideswipe that damages a door panel. The other is in a front-end collision requiring the replacement of the bumper, radiator, and a section of the frame.

Even if both are repaired to look perfect, the second car will have a much greater diminished value. The vehicle history report will show the severity of the repairs, and any informed buyer will pay significantly less for a car with a history of structural damage.

This is why generic online calculators fall short. You can get a rough idea with our free diminished value claim calculator, but only a certified appraisal provides the detailed, undeniable proof you need to negotiate with an insurance company. Our experts dig into all these factors to create a report that supports your claim for your true financial loss.

Why Your Insurance Company’s First Offer Is Often Too Low

After an accident, you trust the insurance company to make you financially whole again. However, their primary goal is to protect their bottom line by minimizing claim payouts. That first settlement offer for your car’s diminished value is almost never their best one; think of it as an opening bid in a negotiation.

Insurance companies are skilled at calculating car value depreciation after an accident in a way that serves their interests, not yours. They often use specific tools and methods designed to produce the smallest number possible.

Common Tactics Insurers Use

That lowball offer isn’t random. It’s the result of a systematic approach designed to justify a low payout and put the burden of proof on you.

- Proprietary Software: Many large insurance carriers use in-house software built to undervalue claims. These programs are a “black box”—you never see the calculations, but the result is predictably low.

- Flawed Formulas: The most infamous tactic is the “17c formula.” It’s an outdated and widely criticized calculation that starts with your car’s pre-accident value and then applies arbitrary caps and modifiers to drastically reduce the final diminished value amount.

- Biased Appraisals: Sometimes, an insurer will use an “independent” appraiser who has a long-standing relationship with them. Unsurprisingly, these appraisals often favor the insurer, overlooking key factors that would increase your claim.

An insurer’s first offer is a starting point, not the finish line. Arriving prepared with your own independent proof is the only way to level the playing field.

Once you understand these tactics, you can shift from being a passive recipient to a prepared negotiator. The insurance adjuster has their evidence—now it’s time for you to bring yours. If you’re dealing with an uncooperative adjuster, our guide on handling an unfair insurance offer on a totaled vehicle offers additional strategies.

A certified, independent appraisal report is the single most powerful tool you have. It replaces their flawed formulas with a data-backed, market-driven analysis of your vehicle’s true loss in value. SnapClaim provides exactly that kind of proof, and our money-back guarantee makes it a risk-free decision. If our report doesn’t help you recover at least $1,000, we refund the appraisal fee.

How to Prove Your Car’s Actual Diminished Value

You don’t have to accept the insurance company’s valuation of your car. To counter a lowball offer, you need to arm yourself with facts, not opinions. This is how you build a rock-solid case for your car’s true diminished value.

Proving your car value depreciation after an accident isn’t about arguing; it’s about presenting such complete and undeniable documentation that the insurance adjuster has no choice but to negotiate fairly.

Building Your Evidence File

A strong diminished value claim starts with solid paperwork. Each document tells part of your car’s story and helps paint a clear picture of the accident’s financial impact. Your first job is to gather all the relevant records.

Use this checklist to gather the essential proof you’ll need to build a compelling case.

Evidence Checklist for Your Diminished Value Claim

| Evidence Item | Why It’s Important |

|---|---|

| Police Report | This official record establishes fault, which is crucial for proving your right to file a third-party claim. |

| Photos of Damage | Before any repairs are made, take photos from every angle. This visual proof shows the true extent of the damage, which directly relates to the loss in value. |

| Repair Invoices | A detailed invoice is critical. It lists every part and hour of labor, and shows whether genuine OEM or cheaper aftermarket parts were used—all proof of the accident’s severity. |

| Vehicle History Report | A clean Carfax or AutoCheck report is a thing of the past. This report proves the accident is now a permanent part of your car’s record, creating the stigma that drives down its value. |

This collection of documents lays the foundation for your claim. But one final piece of evidence ties it all together and makes your case undeniable.

The Power of an Independent Appraisal

The single most powerful tool in your arsenal is a certified, independent appraisal. While your other documents show what happened, an appraisal report provides the expert analysis that translates that story into a specific, defensible dollar amount.

An independent appraisal isn’t just a second opinion; it’s an expert valuation that provides the data-backed proof needed to level the playing field and force a fair negotiation with the insurance company.

A professional appraiser dives into market data, analyzes the severity of the damage, assesses the quality of the repairs, and looks at comparable sales to pinpoint the exact loss in value. This report acts as your expert witness, replacing the insurer’s self-serving formula with a real-world valuation. Our guide on the importance of a car appraisal after an accident explains this process in more detail.

To make this step an easy decision, SnapClaim offers a money-back guarantee. If our certified appraisal report doesn’t help you recover at least $1,000 more from the insurance company, we’ll refund your appraisal fee in full. This allows you to fight for what you’re owed with complete confidence.

Understanding Your Rights and State Laws

Navigating the legal side of a claim for car value depreciation after an accident can feel overwhelming, but you have more rights than you might think. Understanding these rights is the first step toward ensuring the insurance company treats you fairly.

Your ability to file a successful claim depends on two key things: your state’s laws and who was at fault for the accident. While legal details vary, some basic principles apply almost everywhere.

Third-Party vs. First-Party Claims

The most important concept to understand is the difference between a third-party and a first-party claim. This distinction often determines your ability to get paid for diminished value.

- Third-Party Claim: This is when you file against the at-fault driver’s insurance company. In nearly every state, you have a strong legal right to be compensated for all your losses—including diminished value—by the person who caused the damage.

- First-Party Claim: This is when you file a claim with your own insurance company, typically under your collision coverage. Unfortunately, many insurance policies are written to exclude diminished value in first-party situations, making these claims much harder to win.

The bottom line is that if someone else hit you, the law in most states is on your side. You are legally entitled to be made “whole” again, and that includes compensation for the financial hit your car took from the accident.

Know Your State Specifics

While the “third-party” rule is a solid starting point, every state has its own specific rules and, crucially, a statute of limitations—the deadline you have to file a claim. Knowing the laws where you live is critical for building a successful case.

Key Insight: You are not an insurance expert, and you don’t have to be. Your right to fair compensation is based on established legal principles, not the insurance company’s internal policies.

Because these regulations can be complex, it pays to be informed. We’ve compiled a resource that breaks down the specifics for you. You can learn more by checking out our detailed guide on diminished value state laws to see exactly what rules apply in your area.

It’s Time to Recover Your Car’s Lost Value

Realizing your car has lost value after an accident is the first step. The next is understanding that the insurance company’s initial offer isn’t the final word—it’s just their opening bid. You now know you have the right to fight for the compensation you are truly owed.

To win that negotiation, you need to replace the insurer’s lowball opinion with undeniable, expert proof. That’s where a certified appraisal report from SnapClaim comes in. It provides the powerful, data-driven evidence needed to strengthen your claim and demand a fair settlement.

Don’t Settle for Less

A vehicle’s value drops quickly enough on its own. For example, some luxury sedans can lose over half their value in five years without an accident. A collision only makes that financial loss worse. You can explore these car value depreciation after accident trends to see how significant the impact can be. This is your money, and you’re entitled to recover it.

Your vehicle’s accident history is permanent, but the financial loss doesn’t have to be. Arming yourself with a professional appraisal is the most effective way to recover what you are rightfully owed.

Don’t leave that money on the table. We make the process risk-free with our money-back guarantee: if our report doesn’t help you recover at least $1,000, we’ll refund the appraisal fee completely.

Ready to take the next step? Get a free estimate to see what your claim could be worth, or order your certified appraisal report to start the recovery process today.

You can read more about car value depreciation after an accident here.

Frequently Asked Questions

The aftermath of an accident can be confusing. Here are clear, straightforward answers to common questions about car value depreciation after an accident.

How Long Do I Have to File a Diminished Value Claim?

This depends on your state’s statute of limitations for property damage, which is the legal deadline for filing a claim. Most states give you between two to five years, but this varies. It’s crucial to act quickly and check your specific state’s laws so you don’t miss the deadline.

Will Filing a Diminished Value Claim Raise My Insurance Rates?

If you were not at fault for the accident, the answer is no. When you file a third-party claim against the at-fault driver’s insurance, it should not affect your own rates. Your premiums should not increase when an accident is not your fault.

Can I Claim Diminished Value on a Leased Car?

Yes, you absolutely can—and you should. Your lease agreement holds you responsible for the car’s condition and value. If you don’t recover that lost value from the insurance company now, the leasing company will likely charge you for that exact amount when you turn the car in at the end of the lease.

Is an Appraisal Report Really Worth the Cost?

Yes, an independent appraisal provides the professional proof needed to challenge an insurer’s lowball offer and negotiate a fair settlement. The compensation recovered is almost always many times the cost of the report, making it a smart investment. Plus, our money-back guarantee makes it totally risk-free. If a SnapClaim report doesn’t help you recover at least $1,000 more than the insurance company’s offer, we’ll refund the appraisal fee.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This article was reviewed by SnapClaim’s team of certified auto appraisers and claim specialists with years of experience preparing court-ready reports for attorneys and accident victims. Our content is regularly updated to reflect the latest industry practices and insurer guidelines.

Get Started Today

Ready to prove your claim? Generate a free diminished value estimate in minutes and see how much you may be owed.

Get your free estimate today