Surprise Diminished Value Appraisal

Get Your Free Estimate in a Minute!

Recover the lost value of your car after an accident with an Surprise diminished value appraisal. Our reports are fast, accurate, and court-ready—trusted throughout Arizona.

No credit card required [Takes less than 30 second]

Surprise Diminished Value Appraisal — Get the True Value of Your Car After an Accident

Even after professional repairs, your vehicle can lose resale value once its accident history appears on Carfax or AutoCheck. If your accident happened in Phoenix, Tucson, or Mesa, a Surprise diminished value appraisal helps document that loss — often worth $2,000–$7,000 depending on vehicle type and damage severity. SnapClaim delivers data-driven, court-ready appraisal reports used by Surprise insurers, attorneys, and small-claims courts.Why Diminished Value Matters in Arizona

Surprise allows recovery for diminished value when you are not at fault in an accident. Even when repairs are performed properly, the market often discounts vehicles with an accident history.Why Surprise Vehicle Owners Are Affected Most

- Surprise’s dry desert climate and intense sun exposure can impact paint and materials, making accident history even more critical to resale value.

- High demand for trucks, SUVs, and sedans (Toyota, Ford, Chevrolet, Honda) increases DV potential.

- Insurance offers in Surprise often undervalue vehicles compared to actual retail listings.

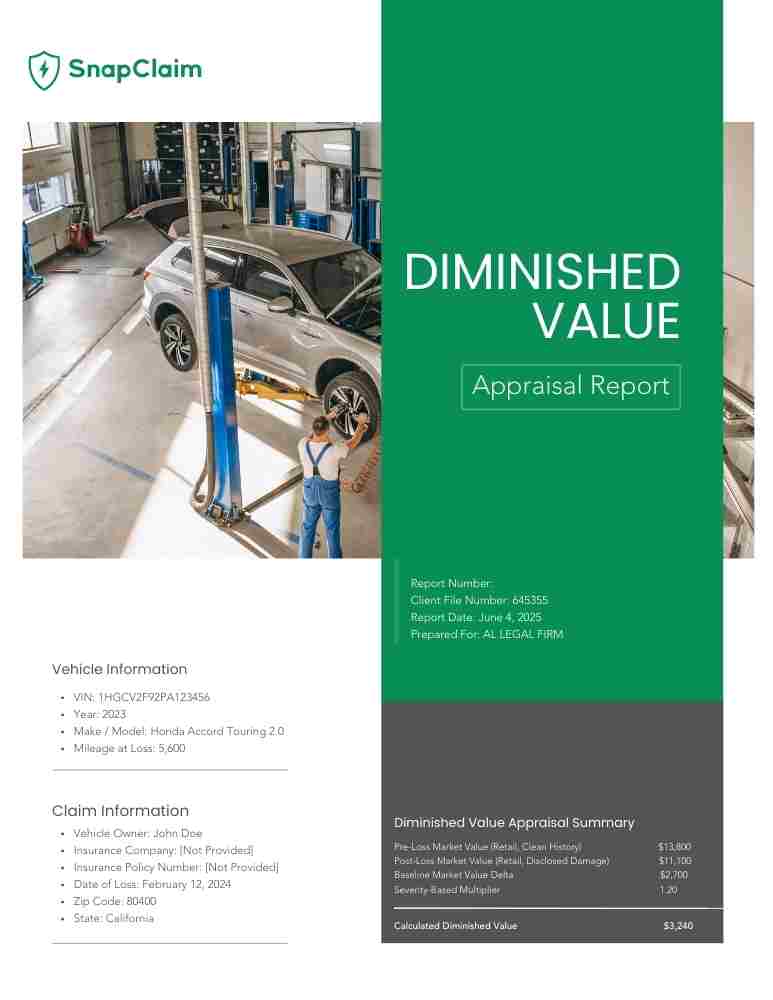

What Your Surprise Diminished Value Appraisal Report Includes

- Vehicle details (year, make, model, trim, mileage, options)

- Comparable listings pulled from Phoenix, Tucson, Mesa, and nearby areas

- Pre- and post-accident market value estimates using verified Surprise market data

- Surprise DV calculation incorporating repair severity and dealer feedback

- Transparent methodology aligned with appraisal best practices (USPAP-aware)

- Optional expert-witness support for court or arbitration in Surprise

Surprise and Surrounding Areas We Serve

- Phoenix

- Tucson

- Mesa

- Chandler

- Scottsdale

- Gilbert

- Glendale

- Tempe

- Peoria

- Surprise

- Yuma

- Prescott

- Flagstaff

- Avondale

How to File a Surprise Diminished Value Claim

- Order your Surprise appraisal to document the loss with clear market evidence.

- Submit a DV demand letter to the at-fault driver’s insurer.

- Negotiate or escalate — our Surprise reports are formatted for attorney and arbitration review.

- Recover compensation — many Surprise clients recover between $3,000 and $6,500.

Local Insight: Common Surprise Insurance Practices

- Listings pulled from AutoTrader, CarGurus, and Cars.com within the Surprise market

- Dealer quotes within ~50 miles of Phoenix metro area

- Localized adjustments for mileage, color, options, and regional demand across Surprise

Example Surprise Case Study

Vehicle: 2020 Ford F-150 Lariat Repair Cost: $7,100 (rear-end collision) Initial Insurer Offer: $1,500 (formula-based) SnapClaim DV Result: $5,200 Final Settlement: $5,000 after submitting our Arizona report and demand letterHelpful Surprise Resources

- Arizona Department of Insurance

- Arizona Attorney General — Consumer Protection

- Arizona State Courts — Small Claims

Ready to Get Your Surprise Diminished Value Appraisal?

- No credit card required

- Delivery in about 1 hour

- Includes appraisal and demand-letter template

Related Arizona Locations

Order Your Diminished Value Appraisal

Get Your Appraisal Report and Demand Letter Now!

Free Estimate, no credit card required.

Recover Diminished Value After an Accident in Surprise

How SnapClaim Helps Surprise Drivers

- Eligibility Check: See if your accident qualifies for a claim in just seconds.

- Free Estimate: View your potential payout based on i market data — no cost, no obligation Surprise .

- Detailed Appraisal Report: Get a data-backed valuation that reflects actual resale prices across Metro Surprise.

- Demand Letter: Submit your claim easily using our pre-filled Arizona demand letter template.

- Money-Back Guarantee: If your recovery is under $1,000 using our report, we’ll refund your appraisal cost.

Start your Surprise diminished value appraisal today to see how much your car lost in resale value — and take the first step toward getting it back.

“I was hit on Grand Ave in Surprise. Repairs were done quickly, but my SUV’s value took a hit. SnapClaim delivered a thorough diminished value appraisal and the insurer finally matched the evidence.”

— Andre G., Surprise, AZ

Frequently Asked Questions :

- What is a diminished value appraisal in Surprise

A Surprise diminished value appraisal determines how much value your vehicle lost after an accident, even after quality repairs. It compares pre-accident and post-repair market values using local Arizona sales data to support your insurance claim.

- Who qualifies for a diminished value claim in Arizona?

You qualify if: You were not at fault for the accident, Your vehicle was repaired, and You still own the vehicle. Arizona law recognizes the right to recover loss in value after repairs, as confirmed in Oliver v. Henry (2011).

- How much can I recover for diminished value in Surprise?

Most Surprise drivers recover between $2,000 and $7,000, depending on vehicle type, age, repair quality, and local market demand in the Surprise area.

- How long does it take to get my Surprise diminished value report?

Most reports are completed within about one hour after your vehicle and repair information is submitted. Each report includes an insurer-ready demand letter for faster claim processing in Surprise.

- What areas around Surprise do you serve?

SnapClaim serves the entire East Valley and Greater Phoenix area, including Mesa, Gilbert, Chandler, Tempe, Queen Creek, Apache Junction, and Scottsdale.

- Do insurance companies in Arizona accept SnapClaim reports?

Yes. SnapClaim reports are widely accepted by insurers and attorneys across Arizona because they use standardized, USPAP-aligned valuation methods backed by real Phoenix market data.

- Can I file a diminished value claim myself, or do I need an attorney?

You can file your claim directly using your SnapClaim appraisal and demand letter. If your insurer disputes the claim, an attorney can use our court-ready report to support negotiation or arbitration.

- Where can I order an Arizona diminished value appraisal?

You can order online through the SnapClaim free estimate tool. Select your Arizona city — such as Phoenix, Tucson, or Scottsdale — and get your certified appraisal report today.

- What documents do I need to get a diminished value appraisal?

You’ll need: Your repair invoice or estimate, Vehicle details (VIN, mileage, year, make, and model), and Photos of the damage or repair area (optional but helpful). SnapClaim’s appraiser team uses this information to calculate accurate pre- and post-accident market value.

Diminished Value & Total Loss Appraisal Reports

Instant Free Estimate

Instant diminished value and total loss appraisals — no guesswork, no delays, backed by a 100% money-back guarantee.

Free Estimate, no credit card required.