Diminished Value : Even after the best body shop works its magic, your car is worth less simply because it has an accident on its record. This hidden financial loss is called diminished value—the real-world drop in your vehicle’s market price after a collision. If you were choosing between two identical used cars, would you pay the same for the one that’s been in a wreck? Of course not, and that price gap is the value you’ve lost.

What Is Diminished Value and Why Does It Matter?

After an accident, your first thought is getting the car repaired. The insurance company pays the body shop, the dents disappear, and the new paint job looks great. But that repair bill only covers the cosmetic and mechanical damage—it does nothing to restore your car’s lost market value.

The moment a collision is reported, your vehicle’s history is permanently stained. Future buyers will pull a CARFAX or AutoCheck report, see the accident, and immediately offer you less money. This isn’t a hypothetical problem; it’s a real, tangible financial hit you’ll take when you decide to sell or trade in your car.

The Real Financial Impact of an Accident Record

Most people are shocked when they learn how much an accident record costs them. A vehicle can lose a significant portion of its worth right after a collision, no matter how flawless the repairs are. Why? Because the market sees a previously damaged car as a bigger risk.

A vehicle typically loses between 10% and 30% of its pre-accident value. For a $30,000 car, that’s a $3,000 to $9,000 loss just for having an accident on its record.

This loss is the difference between what your car was worth moments before the crash and what it’s worth after repairs are complete.

Why You Are Owed Compensation

Here’s the bottom line: if another driver caused the accident, their insurance company is required to make you “whole” again. That doesn’t just mean paying for repairs. It means compensating you for all your losses, which absolutely includes the diminished value of your car.

You shouldn’t be stuck with a lower resale value because of someone else’s mistake. Filing a diminished value claim is how you recover this loss, but don’t expect the insurance adjuster to bring it up—they won’t offer this money voluntarily. It’s up to you to demand it and provide proof to strengthen your claim.

You can learn more about the specifics in our complete guide on what a diminished value claim is.

The Three Types of Diminished Value Explained

When you hear “diminished value,” it’s easy to think of it as one single issue. But this financial loss actually breaks down into three different categories. Knowing which one applies to your car is the first step toward building a strong claim and getting the compensation you’re owed.

Inherent Diminished Value

This is the most common and unavoidable loss you’ll face. Inherent Diminished Value is the automatic drop in your car’s resale value simply because it now has an accident on its record.

Even with perfect repairs, the stigma of that accident is permanent. When it’s time to sell or trade it in, potential buyers will see the collision on a vehicle history report and won’t pay as much as they would for an identical car with a clean past. This is the core loss most diminished value claims aim to recover.

Repair-Related Diminished Value

While inherent diminished value occurs even with flawless repairs, that’s not always what you get. Repair-Related Diminished Value is the extra loss in value caused by a poor or incomplete repair job. Common examples include:

- Mismatched paint that doesn’t blend with the original color.

- The use of cheaper, non-original parts that don’t fit or perform correctly.

- Lingering frame damage that affects how the car drives.

- Noticeable gaps around doors, the hood, or the trunk.

This is the financial penalty for a bad repair, and it gets stacked right on top of the inherent value drop. To learn more, check out our guide on how much an accident will devalue a car.

Immediate Stigma Diminished Value

This is the loss in value that occurs immediately after the accident, before any repairs have been made. It’s the difference between your car’s pre-accident value and its value in a damaged state. While less common in claims, it’s a real part of the overall value loss picture.

Why Insurance Companies Fight Diminished Value Claims

If you’ve ever tried to file a diminished value after car accident claim, you’ve probably felt like you’re in for a fight. Insurance companies, despite their friendly commercials, are businesses. Their goal is to protect their bottom line, which means paying out as little as possible.

Adjusters are trained to minimize, dispute, or deny these claims, hoping you’ll get tired and accept the repair costs as the final word.

Common Tactics Insurers Use

Insurance companies have a playbook for shutting down diminished value claims. Understanding their common moves helps you prepare a much stronger case.

Here are a few tactics you might encounter:

- Outright Denial: The adjuster might claim, “We don’t pay for diminished value in your state,” or that your policy doesn’t cover it. This is often a bluff to see if you’ll go away.

- The Lowball Offer: They might quickly offer a few hundred dollars, hoping you’ll take the easy money without realizing you could be owed thousands more.

- Delay and Confuse: By dragging their feet and using complicated jargon, they try to frustrate you into giving up.

- Unfair Formulas: Almost every insurer uses an internal, biased formula to “calculate” your loss. The most infamous of these is the “17c formula.”

The Problem with the 17c Formula

The 17c formula is a calculation method that came out of a single court case. Insurers adopted it because it’s designed to produce ridiculously low diminished value figures. The formula uses arbitrary caps and modifiers that almost guarantee it will undervalue your real-world loss. Recent insurance claim trends and their impact show that insurers are under pressure to manage costs, making tools like the 17c formula very appealing to them.

An adjuster will present their 17c calculation as an objective assessment, but it’s a tool designed to serve their interests, not yours. This is why you need your own independent proof to show what your car is actually worth.

This is where a certified appraisal from SnapClaim changes the dynamic. It replaces their biased formula with a credible, market-based valuation backed by real-world data, providing the proof you need to negotiate effectively.

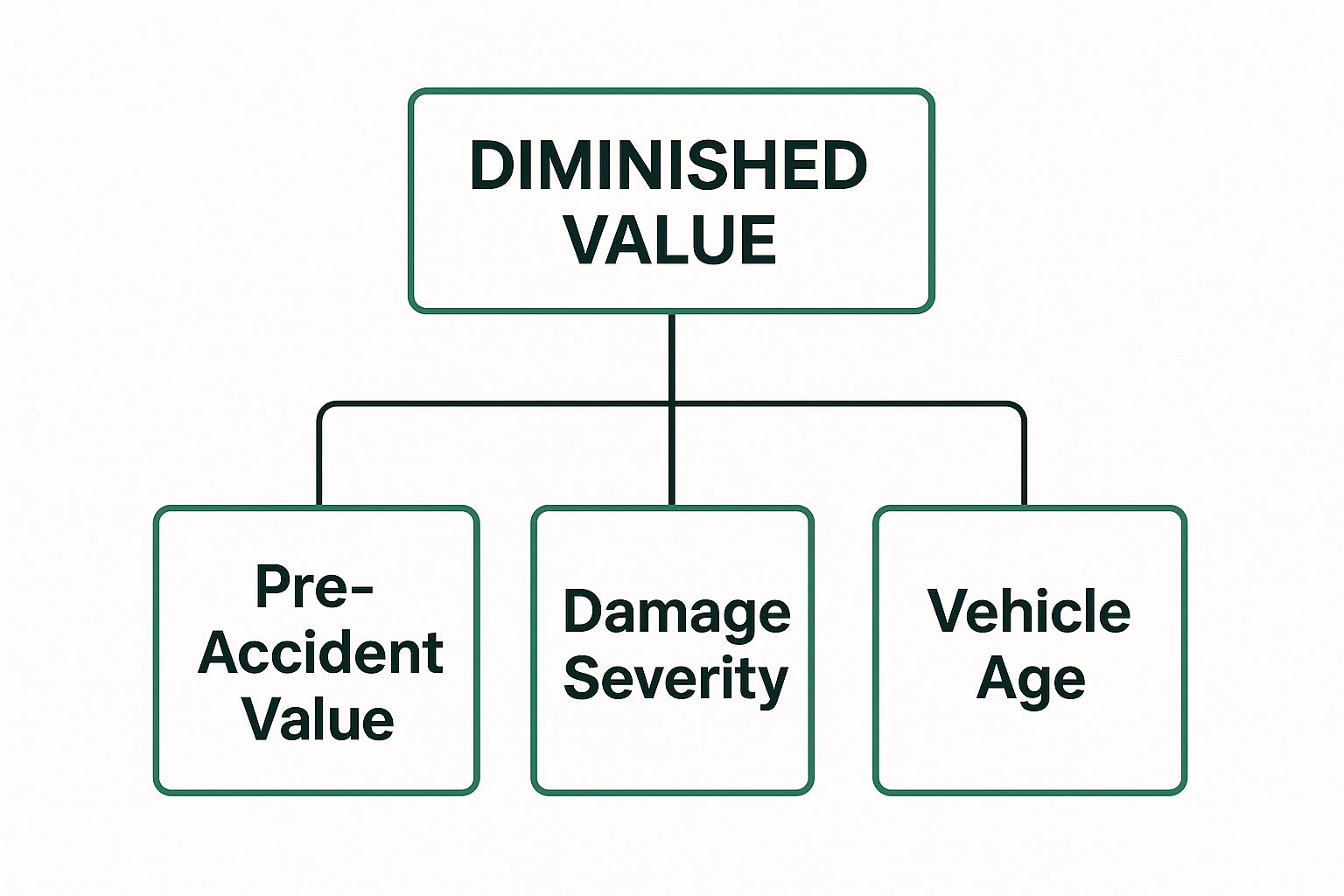

How to Calculate Your Car’s Diminished Value

Figuring out the true financial hit your vehicle took is the most important part of your claim. Insurers use methods designed to protect their bottom line, not make you whole again. Understanding the difference between their lowball math and a real, market-based analysis is key to getting a fair settlement.

The 17c Formula Insurers Love

Insurance companies almost always default to the “17c formula.” It came from a single court case and was adopted by the industry because it consistently produces tiny payout figures.

The formula works against you in two ways:

- It starts with a hard cap. The calculation begins by limiting the maximum possible loss to just 10% of your car’s pre-accident value, regardless of what the real-world market says.

- It applies penalties. From there, it shrinks that number by applying “modifiers” for things like damage severity and mileage, slicing away even more of your compensation.

An adjuster will often present this as the final word, hoping you won’t dig deeper.

The Right Way: A Professional Market-Based Analysis

A professional appraiser uses a market-based approach—the only way to determine your true financial loss. This isn’t about a made-up formula; it’s about analyzing real-world data and applying expert knowledge. A certified appraiser dives deep into a few key areas to build an undeniable case.

- Step 1: Determine Pre-Accident Fair Market Value: An appraiser establishes exactly what your vehicle was worth moments before the crash by evaluating its specific trim, options, mileage, and overall condition.

- Step 2: Analyze Post-Repair Market Value: Instead of a flawed formula, the appraiser analyzes real sales data for similar wrecked-and-repaired vehicles. They contact dealership managers to get on-the-ground intel on how much less a car like yours sells for with an accident on its record.

The difference between the pre-accident value and this new, lower value is your true, inherent diminished value.

The Power of an Independent Appraisal Report

An independent, certified appraisal report from SnapClaim takes your claim from a simple request and turns it into a formal, evidence-backed demand. It throws out the insurer’s self-serving 17c formula and replaces it with a credible valuation based on hard market facts. It’s your single most powerful negotiating tool.

To see the entire process, check out our guide on how to file a diminished value claim.

We make getting this crucial proof easy and risk-free. Our certified reports provide the documentation needed to fight lowball offers. Better yet, with our money-back guarantee, if the insurance recovery from your claim is less than $1,000, we’ll refund your appraisal fee in full. You have nothing to lose.

A Step-by-Step Guide to Filing Your Claim

Ready to get back the money you’re owed? Filing a claim for diminished value after a car accident is a manageable process when you break it down. This guide gives you a simple roadmap to build a solid case that an insurance adjuster can’t just brush aside.

Step 1: Confirm You Weren’t at Fault

First, you can almost always only file a diminished value claim against the at-fault driver’s insurance. Double-check the police report to confirm the other party was cited for causing the accident.

Step 2: Gather All Your Key Documents

Think of yourself as building a case. Your evidence is the paperwork, so having meticulous records is essential. Start collecting every document related to the accident and repairs.

You’ll need:

- The official police report.

- The final itemized repair bill from the body shop.

- Photos of the damage.

- Copies of all correspondence with the insurance adjuster.

Step 3: Get a Certified Appraisal Report

This is the most critical step. Your opinion on your car’s lost value won’t sway an insurer, but an expert’s report will. A certified, independent appraisal provides unbiased, data-driven proof of your vehicle’s diminished value. It replaces the insurance company’s lowball formula with a credible valuation and strengthens your negotiating position.

Step 4: Submit a Formal Demand Letter

With your appraisal and documents ready, it’s time to submit your claim. Send a professional demand letter to the at-fault driver’s insurance adjuster. It should clearly state that you are making a diminished value claim and specify the amount you are seeking, supported by your appraisal report.

Step 5: Negotiate the Settlement

The insurance adjuster will likely come back with a low counteroffer. Don’t be discouraged—this is part of the process. Stay professional, refer back to the evidence in your appraisal report, and be prepared to negotiate firmly. Remember, you have the facts on your side.

Getting started is easy and completely risk-free. You can get your free diminished value estimate from SnapClaim today to see what your claim could be worth.

FAQ: Your Top Diminished Value Questions Answered

Let’s wrap up by tackling some of the most common questions we hear from drivers dealing with a diminished value after car accident claim.

How do I prove diminished value?

The most effective way to prove your diminished value claim is with an independent, certified appraisal report. A report from a company like SnapClaim provides a detailed market analysis showing exactly how much value your car has lost. This expert documentation gives you the leverage you need to counter the insurer’s lowball offer and supports your negotiations. A similar appraisal process is just as critical if your vehicle is declared a total loss. You can see how that works in our guide on what to do when your car is a total loss.

Can I claim diminished value if I was at fault?

Generally, no. A diminished value claim is almost always filed against the at-fault driver’s insurance company. Your own collision policy is designed to cover the cost of repairs, not the drop in your car’s market value. However, insurance rules can vary by state, so it’s always a good idea to check the specifics where you live. Your local DMV or state insurance commissioner’s website is a great resource.

How long do I have to file a claim?

Every state sets a deadline for filing property damage claims, known as the statute of limitations. This window can be as short as one year or as long as several years after the accident. If you miss this deadline, you lose your right to pursue compensation. Acting quickly is critical.

Why is an appraisal report necessary?

While not legally required, a certified appraisal report is the single most powerful tool for a successful claim. An insurance adjuster has no reason to accept a number you came up with yourself. A professional report from SnapClaim provides unbiased, data-driven proof that your claim is credible and fair. It’s a risk-free way to strengthen your case, thanks to our money-back guarantee: if you recover less than $1,000 from your claim using our report, we’ll fully refund your appraisal fee.

Ready to stop the insurance company’s games and get the compensation you deserve? SnapClaim provides the certified, data-driven appraisal report you need to strengthen your claim. Get your free estimate in minutes and order a court-ready report in under an hour. Visit us at https://www.snapclaim.com to start your claim today.

About SnapClaim

SnapClaim is a premier provider of expert diminished value appraisals. Our core mission is to equip vehicle owners with the data-driven evidence necessary to recover the full financial loss incurred after an accident. We utilize cutting-edge technology and extensive industry expertise to produce accurate, defensible reports that empower you to negotiate confidently with insurance companies. With a steadfast commitment to transparency and customer satisfaction, SnapClaim streamlines the intricate process of claiming diminished value, ensuring you receive the compensation you rightfully deserve.

Ready to move beyond guesswork and start proving your claim? The dedicated team at SnapClaim is prepared to provide the certified, data-driven appraisal report essential for confident negotiation. Our reports offer the proof needed to strengthen your claim, and with our money-back guarantee, you can begin the process risk-free.