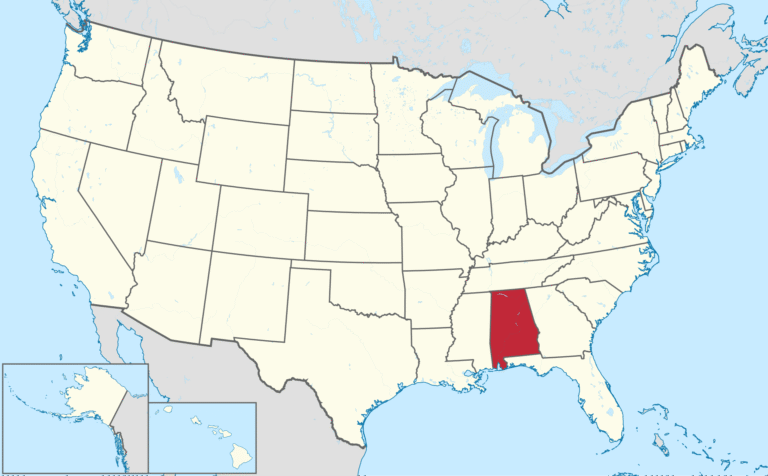

Total Loss Appraisal in

Alabama

Get Your Free Estimate in a Minute!

If your car was declared a total loss and you’re not happy with the insurance payout, you have the right to request a Alabama total loss appraisal. SnapClaim helps you dispute unfair insurance valuations with certified, data-backed reports that show your vehicle’s true fair market value.

No credit card required [Takes less than 30 second]

Total Loss Appraisal in Alabama: What You Need to Know

Alabama Total Loss Appraisal — Get the True Value of Your Totaled Vehicle

If your vehicle was declared a total loss and the insurance company’s payout seems too low, you have the right to request an independent Alabama total loss appraisal. Whether your accident happened in Birmingham, Montgomery, Mobile, Huntsville, or anywhere across the state, SnapClaim helps you determine your car’s fair market value (ACV) before the crash and recover the amount you truly deserve. Our certified total loss appraisal reports are data-driven, USPAP-aware, and court-ready — trusted by insurance adjusters, attorneys, and small-claims courts throughout Alabama.Why Get a Total Loss Appraisal in Alabama?

When a vehicle is declared totaled, insurers must pay its actual cash value. Initial valuations based on CCC or Mitchell reports often undervalue Alabama markets, especially in regions with strong used-car demand like Birmingham and Mobile. An independent appraisal helps ensure a fair settlement.Common Reasons to Dispute a Total Loss Offer

- Incorrect vehicle trim, options, or mileage listed in the insurer’s report

- Comparables from out-of-state or low-cost markets

- Condition deductions not supported by evidence

- Local market demand or upgrades (e.g., towing, safety, technology) ignored

What’s Included in Your Alabama Total Loss Appraisal Report

- Full vehicle details (VIN, make, model, trim, mileage, options)

- Verified comparable listings from Alabama markets (Birmingham, Huntsville, Mobile, Montgomery, Tuscaloosa)

- Fair-market-value analysis immediately before the loss

- Transparent adjustment matrix for mileage, features, and regional trends

- Documentation to invoke your appraisal clause or present in court

- Optional expert-witness support for arbitration or litigation

Alabama Total Loss Laws & Appraisal Rights

Under Alabama law, insurers must provide fair and prompt settlement of total loss claims. If you disagree with their valuation, you can invoke your policy’s appraisal clause — each side hires an appraiser, and if they disagree, a neutral umpire decides the value.- Ala. Code §32-8-87 — Total Loss Vehicle Provisions

- Alabama Department of Insurance — Fair Claims Practices

- Alabama Small Claims Court (limit $6,000)

How to Dispute a Total Loss Offer in Alabama

- Request the insurer’s valuation report and review it carefully.

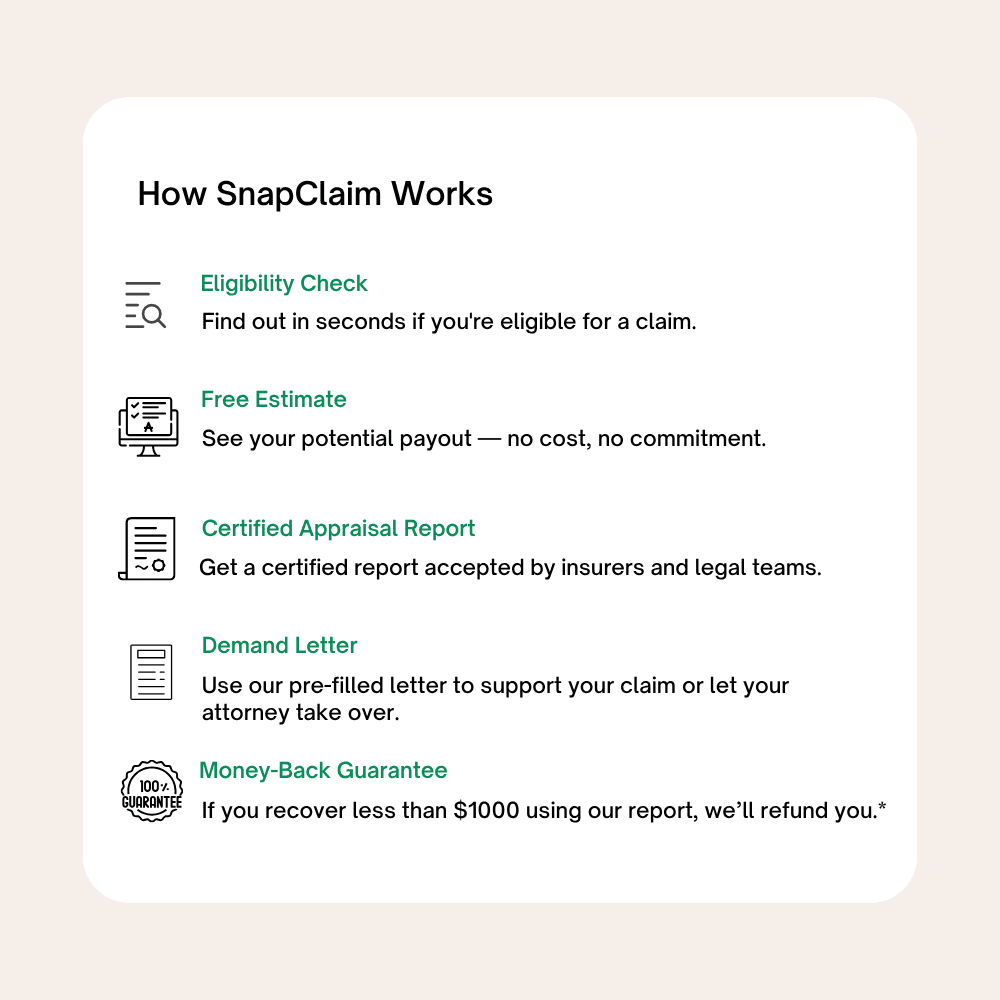

- Order your independent appraisal through SnapClaim to establish accurate pre-loss market value.

- Invoke the appraisal clause in writing if your valuation differs.

- Submit SnapClaim’s report to your adjuster or attorney.

- Negotiate or escalate—most Alabama clients recover thousands more with proper documentation.

Local Insight: Alabama Total Loss Trends

- Birmingham, Huntsville, and Mobile have the state’s highest resale values due to demand and inventory shortages.

- Trucks and SUVs (Ford, Toyota, Chevrolet) maintain above-average value in Alabama markets.

- Post-2021 inflation in used-vehicle prices continues to widen insurer valuation gaps.

Example Alabama Case Study

Vehicle: 2019 Toyota Highlander XLEInsurance Offer (CCC): $24,600

SnapClaim Appraisal: $28,200

Final Settlement: $27,800 after invoking the appraisal clause

Helpful Alabama Resources

- Ala. Code §32-8-87 — Total Loss Vehicle Provisions

- Alabama Department of Insurance — File a Complaint

- Small Claims Court — Filing Guidance

- NHTSA — Vehicle History & VIN Lookup

Ready to Get Your Alabama Total Loss Appraisal?

- No upfront payment required

- Report delivered in about 1 hour

- Fair-market-value and insurer-ready documentation included

Related Alabama Locations

Click a pin to open the city’s total loss page.

Find your Alabama city below to order your Total Loss Appraisal.

Order Your Total Loss Appraisal

Get Your Appraisal Report and Demand Letter Now!

Free Estimate, no credit card required.

Dispute an Unfair Total Loss Offer in Alabama

If your car was declared a total loss in Colorado but the insurance payout seems too low, you don’t have to accept it. Under your policy’s appraisal clause, you can request an independent Alabama total loss appraisal to verify your vehicle’s true fair market value. SnapClaim makes it simple — get a certified total loss report, invoke your appraisal rights, and negotiate a higher settlement — all within minutes.

“After my SUV was totaled outside Birmingham, my insurance payout didn’t even come close to local market value. SnapClaim stepped in fast — their Alabama total loss appraisal showed what my car was really worth, and I ended up getting nearly $4,000 more from the insurer.”

Chris S.

Birmingham, AL

Frequently Asked Questions:

- What qualifies a vehicle as a total loss in Alabama?

In Alabama, a vehicle is considered a total loss when the cost of repairs equals or exceeds 75% of its fair retail value before the accident. Once this threshold is reached, the vehicle must be branded with a salvage title.

- What does “actual cash value” (ACV) mean in a total loss claim?

The Actual Cash Value (ACV) is your vehicle’s fair market value immediately before the crash, based on its make, model, mileage, condition, and Alabama market pricing in areas like Birmingham, Huntsville, and Mobile. See how we calculate fair value: Fair Market Value Appraisals.

- How much does insurance pay if my car is totaled in Alabama?

Your insurance company must pay the vehicle’s fair market value at the time of loss, minus your deductible if you file under your own policy. If the other driver is at fault, their insurer pays the full ACV with no deductible.

- Can I challenge the insurer’s total loss valuation?

Yes. You have the right to request the insurer’s valuation report and present your own comparables. You can also order an independent Alabama total loss appraisal to support your claim or invoke your appraisal clause for a formal dispute.

- What happens to my car title after a total loss?

Once declared a total loss, the title becomes branded as Salvage. After repairs and inspection by the Alabama Department of Revenue, you can apply for a rebuilt title to legally drive it again.

- Can I keep my totaled vehicle?

Yes. You can retain the vehicle, but your payout will be reduced by its salvage value. You’ll need to follow Alabama’s salvage and rebuilt title process before registering or driving it again.

- Are taxes and fees included in my settlement?

Alabama insurers often include sales tax, title fees, and registration costs in total loss settlements. Ask for a detailed breakdown to ensure these are itemized in your payout. For more guidance, see Fair Market Value Appraisals.

- What if my insurance offer seems too low?

Request the insurer’s full valuation report and double-check comparable listings. If the payout doesn’t reflect Alabama market prices, order a certified independent appraisal to document your car’s true value.

- How long do I have to file a total loss claim?

In Alabama, you generally have six years from the accident date to file a property damage or total loss claim (Ala. Code §6-2-34). Acting early helps preserve evidence and market data.

- Why does Alabama market data matter for my claim?

Vehicle prices vary across Alabama — cars in Huntsville or Mobile often sell for more than in smaller towns. Using local market data ensures your ACV reflects real resale conditions, not national averages. See more about how market value is calculated.

- What is an appraisal clause and how does it protect me?

Most Alabama auto policies include an appraisal clause that allows you to dispute a payout. Each side selects an appraiser, and an umpire makes the final decision — a fair and faster way to resolve value disagreements.

- Can I use an independent appraisal in court or arbitration?

Yes. A certified appraisal from SnapClaim can be used in small claims or arbitration to show evidence of your vehicle’s true pre-loss value if the insurer won’t adjust the offer.

- How long does it take to get a total loss appraisal?

Most SnapClaim Alabama total loss reports are completed within 24 hours — often the same day — giving you documentation to negotiate quickly and effectively.

- What if I still owe more than my car’s value?

If your loan balance is higher than your insurance payout, you’ll owe the difference to your lender. GAP insurance can cover this shortfall if it’s included in your auto policy or financing agreement.

- How does SnapClaim help Alabama drivers?

SnapClaim provides fast, court-ready total loss appraisals using Alabama-specific market data. Our reports help drivers recover thousands more than low insurer estimates — often within hours, not days.

Diminished Value & Total Loss Appraisal Reports

Instant Free Estimate

Instant diminished value and total loss appraisals — no guesswork, no delays, backed by a 100% money-back guarantee.

Free Estimate, no credit card required.